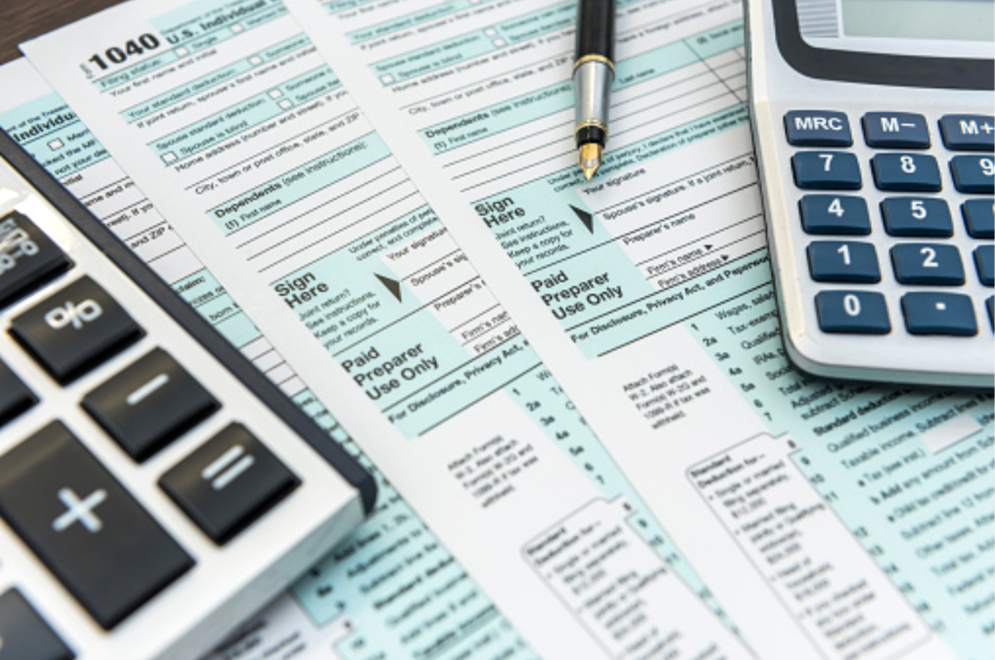

Affiliate marketing can be a lucrative opportunity for anyone looking to make money online. It’s important that you understand the tax implications of affiliate marketing before you start your business, and we’re here to help. In this blog post, we’ll discuss what taxes are involved with running an affiliate website and how they will affect your revenue, as well as the way you do business.

Bear in mind that how much tax you pay and the way in which you pay them will greatly depend on where you live and work. While this article is a great starting point, we strongly recommend talking to a professional tax advisor or an accountant before starting a new affiliate business.

Affiliate marketing taxes: step by step

Why do you need to pay taxes on your earnings as an affiliate marketer?

Almost all countries have a system of taxing businesses, including affiliates who sell products online. This means that if you plan to make money with affiliate marketing then you have to ensure that you don’t forget about taxes!

The income tax system is designed to make sure that everyone pays their fair share. This means that unless you live in one of the many countries around the world which are designated as ‘tax havens’ for online business owners, then you will need to pay your taxes and abide by all other relevant laws related to running an affiliate website or online business.

Why are taxes important when running your own business, including the self-employment tax for sole proprietorships?

Many countries around the world have different tax models that allow self-employment. As a registered business owner who works for themselves, you still have an obligation to pay taxes at different tax rates. Whilst this may be different from the traditional tax model, you still have to pay some taxes on the affiliate marketing income that you make.

Just because you’re not working as a business with many employees, this does not minimize your obligation to pay taxes. In fact, as a small business owner, you may be an even bigger target for a tax audit.

However, not everything is bad. You can apply for a tax return, which can actually free up some money you would have otherwise spent.

What kind of taxes should you pay as an affiliate marketer?

Let’s get one thing out of the way first. As an affiliate marketer, you are working for yourself, so you are not employed in the traditional sense. There is no company that you work for. Instead, you must set up your own company and due to that, you’re responsible for paying your own taxes on time, as well as paying into your pension and for any other related fees.

Most countries around the world have some sort of framework that allows you to work on your own and for yourself. This is otherwise known as a sole proprietorship and in the age of working online, it’s a pretty common business model.

For example, in the United States, you won’t pay any sales taxes as an affiliate marketer, since technically, you’re not the one selling anything; it’s the company whose products you are selling. Moreover, you probably won’t have to pay any local taxes, since you are once again, technically not selling anything.

However, you will have to pay state income taxes, self-employment taxes and in some cases, federal income taxes.

Different countries have different rules and tax rates, so once again, it’s best to consult a professional before getting knee-deep in affiliate marketing. Once you get started, it’s always a good idea to hire an accountant to help you out.

The difference between gross income and net income

- Gross income is the total amount of money made from affiliate marketing, while net income is gross income minus expenses.

- Gross profit is the amount remaining after you deduct the cost of goods from your revenue. The net profit is what’s remaining after you remove all business expenses from your revenue.

- Gross markups are also known as “gross earnings” or just “earnings.” The sale price charged by an online merchant plus any fees that you’re paid for each sale (also called referral fees), less what you’re charged for each item sold.

Deducting expenses from your earnings as an affiliate marketer

Only costs that are directly related to the affiliate marketing business are considered ‘expenses’.

For example, if you own a retail store and purchase items for your storefront using money made from affiliate marketing, then these purchases would be considered valid business expenses. Likewise, any labor costs associated with employees who worked specifically on your affiliate site should be counted as a business expense.

As an affiliate marketer, you cannot deduct personal expenses, such as clothing or jewelry that was purchased for your own use and not resold on the site. Likewise, any money spent on travel to network at conferences would count as a personal expense because it wouldn’t directly lead to sales of products unless you state otherwise and can prove it.

Some of the most common deductions for affiliate marketers include web hosting, software subscriptions and online research. You can also count your hourly wage as a business entity, or what you pay an employee to work on your site as expenses.

When filing taxes related to affiliate marketing income, all expenses must be deducted from gross earnings in order to determine taxable income.

In other words, you need to pay close attention to everything that you earn, as well as the things you spend money on. Maintaining this focus every month not only makes sure you don’t lose money but also makes it much easier to do business according to the law.

What are the tax implications for international affiliates?

Tax implications for your business, including how to report any income or expenses on your affiliate marketing taxes are different, depending on the region or country.

Affiliate tax in the US

The USA was one of the countries that caught up with the need for an affiliate tax model most urgently. In 2008, a new ‘affiliate nexus law’ emerged, as a way to collect tax without the need for the seller of the goods to be physically present in the state where the goods are being sold.

In essence, a nexus is a connection between the business that produces goods or services and the entity selling them. If there is a nexus between the two different states, one of them has the ability to tax remote sales.

There aren’t nexus laws in every state in the USA; but there are in 30 of them. Depending on where the company is located and where you are located, you’ll have different tax obligations and tax rates.

For example, if you’re located in Alabama and selling to a customer in California or Colorado, the nexus laws won’t be the same.

Sounds complex? We agree, which is why we suggest reading this document first. After that, you should pay a visit to a tax professional.

Affiliate tax in the EU

If you’re selling any kind of digital product in the European Union, you fall under the so-called MOSS legislation for VAT payments. Short for Mini One Stop Shop, this legislation was introduced in 2015, as a quick way to collect tax on selling digital goods in the European Union.

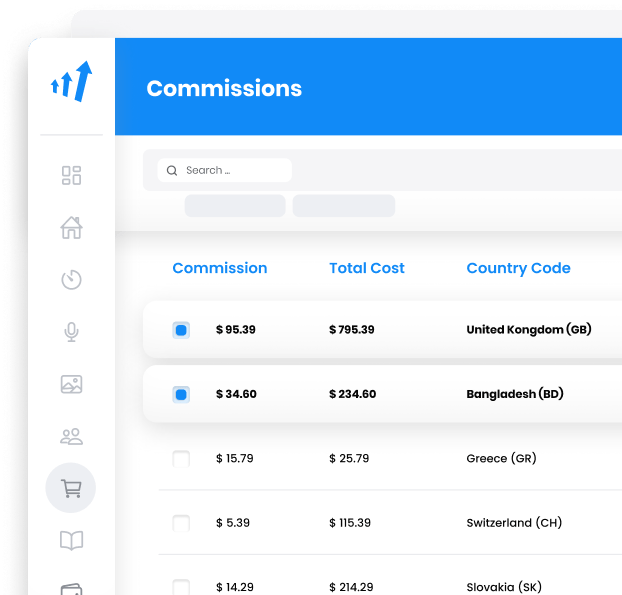

To make it easier for you to coordinate affiliate marketing taxes, you don’t have to claim them in your own country. Instead, you should manually submit a quarterly MOSS report for VAT detailing all the sales you make across different EU countries. That way, you get to report and pay everything in one go, and to one entity.

If you sell exclusively in the EU, this is a neat way to handle taxes in one go for all member countries.

Tax tips for those who are new to the world of affiliate marketing

Know your tax obligations as an affiliate marketer

It’s important to know what your tax obligations are in the area where you live. Knowing what taxes you need to pay and report on is crucial!

If you’re not sure about your local laws, it might be best to consult with an accountant or a lawyer who specializes in tax law in that specific region.

If you’re based in the European Union, for example, there are specific rules about what taxes you need to pay and how much money can be deducted from your affiliate earnings for these purposes. It’s important that you know exactly what processes and procedures will affect your personal situation.

There is often a lot of confusion about what taxes are involved in affiliate marketing, especially when considering the types of commissions you make. This can lead to mistakes being made at tax time that could be avoided if people knew more about their obligations and how they might affect them personally.

Understand the difference between a hobby and a business

Affiliate marketing can be fun, but you need to remember that it’s taxable fun as you’re generating money that you need to then report.

There are some common dilemmas that often affect those working in affiliate marketing.

A lot of affiliate marketers don’t earn enough money to file with the government or pay taxes on what they make through their websites. In almost all countries, income tax is calculated once you hit a certain % threshold, and it could be true that based on your affiliate efforts, you are simply not making enough to enter the first tax bracket.

On the flip side, if you’re lucky enough that affiliate marketing provides a more significant % of your yearly marketing income, make sure what you do with it is tracked carefully so you don’t end up in a tax predicament!

This is why it’s important to know what your obligations are and not rely on others for guidance, unless they are a professional in the field (as we mentioned earlier). In any

Study the basics and tax regulations in your area

Depending on the region/form of your company, make sure you’re aware of all of the dos & don’ts.

For example, if you’re a sole trader, or run a service business that is taxed as an individual entity, (as opposed to a limited company) then the process of filing your affiliate marketing taxes will be different from those who have their own companies.

The rules and regulations around affiliate marketing are often not well understood by people who are new to the industry. This leads to problems that could be avoided if you’re well-informed about what your obligations are ahead of time, not after the fact when it might already be too late!

Educate yourself about what’s taxable and what isn’t

When you set out to launch an affiliate marketing business, it’s important to get informed about what you’re selling and who you’re selling it to.

For example, re-selling physical products may have different tax rates than selling software products. You need to make the appropriate calculations when (re)selling these products; you can use a tax calculator for this procedure. That way, you ensure that you don’t lose any money and that you delegate the right amount of your profit for taxes.

If you sell a variety of products and services and to a large number of countries and regions, make sure to do your research first. Before you add a new product or start working with a new partner, research the implications of this partnership first to ensure that the product is actually taxable and how much of a percentage you would need to pay.

How to avoid income tax issues when you’re making money online

Have a separate bank account for your online income

If you have a separate bank account that isn’t attached to your day-to-day finances, it will make it easier for you to track the money that comes in from your online work.

Another helpful factor is that since these accounts are not connected directly with any other funds or transactions found on household bills etc, it makes tax time much easier to manage.

This way, you can keep track of both what you need to pay, and when it’s due, without any problems arising in the future!

Keep accurate records of your income, contracts and expenses

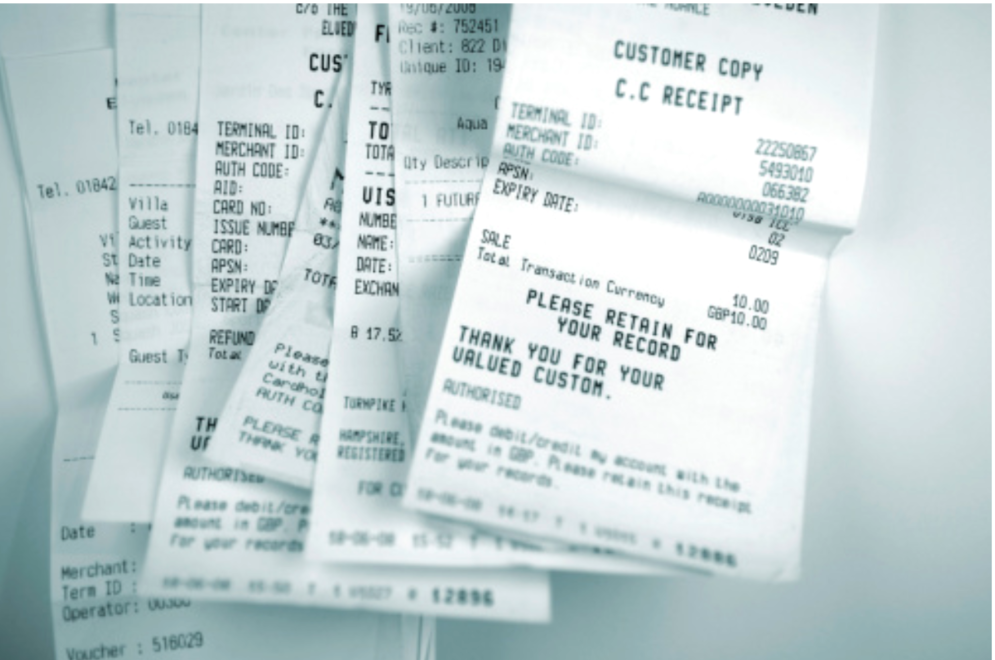

It’s important to keep all receipts and maintain an accurate record of your business income and expenses.

This can make it easier for you during tax time, as well as help if something ever comes up in the future where you might need proof of your earnings, what was spent on certain things, or if you’re audited.

Set up a system to file your taxes every year (invoices, receipts, etc.)

Every year, you should set up a system that will make filing affiliate marketing taxes much easier.

This could be as simple as organizing your receipts and invoices in an easy-to-find folder or binder where they can easily be found later when it’s time to file.

Having an organized system to keep track of everything that you’ve earned can help simplify filing, regardless if your business is run as a sole trader or through a limited company.

Consider getting an accountant or tax lawyer who specializes in this type of work so they can help ensure everything goes smoothly when filing

If you’re having trouble filing your taxes due to specific regulations and rules around the types of income or business that you have, then it might be time to consider getting help from a professional.

When looking for someone who specializes in this type of work, make sure they can provide references or case studies; examples of other cases where they’ve helped people with their taxes in the past.

An accountant or tax lawyer can help you file safely and securely without any problems, regardless of your business type (sole trader/limited company).

Create a business plan for your affiliate marketing and stick to it

It’s important that this is created, regardless of what type of affiliate marketing business you’re running, as having a plan in place will make everything much easier down the line!

If done correctly, an affiliate marketing business can be very rewarding and lucrative.

Understanding the key components of a business plan is necessary in this process, as it provides a roadmap that covers all aspects of your business. Having a good business plan in place can help you stay organized as well as ensure that your income remains steady throughout the year.

Make sure that your online work is legal in the country where you live or are working

It’s important that everything is done legally, otherwise, this could lead to major issues later on.

There are many countries around the world where it’s illegal to run an online business without paying taxes and complying with all related laws/regulations.

For some people who live in places with these regulations, or work remotely for companies outside of their country, it may be difficult to keep track of all the legalities involved.

This is why it’s important that you do as much research as possible so that everything works out in the end!

Consider getting insurance to cover any potential losses from doing affiliate marketing

If you’re concerned that your affiliate marketing business might not yield the desired outcome, then it’s important to consider getting some type of insurance.

This can be in place at any time throughout the year (not just when filing affiliate taxes) and additionally, it can provide peace of mind knowing that if anything ever does come up, it’ll be covered by the insurance in place.

As touched upon earlier, having a good plan in place can help affiliate marketers make sure that they’re ready for anything, which is why it’s important to look into insurance, regardless of what type of business you have!

Frequently Asked Questions

Do I need an accountant or tax preparer to file my affiliate marketing taxes?

While it is definitely a good idea to consider hiring one, especially if you have no absolutely no knowledge on taxes, you do not definitively need an accountant or tax preparer to file your affiliate marketing taxes. You can use online resources such as tax calculators that are available for free. Alternatively, you can use a program (such as Turbotax) or a spreadsheet that will automatically calculate everything for you. Just make sure to keep track of all income and expenses!

Are there any other ways that I can save money on my own when it comes to affiliate marketing taxes?

There are many different tax breaks that can be applied when it comes to affiliate marketing. For example, if you use your blog to generate income then this might qualify for a home office deduction (if certain requirements apply). You will need to speak with an accountant or find some online resources that talk about how these deductions work and what is required to be eligible.

How to handle taxes for your blog?

If you have a blog, then the best thing to do is keep track of all income that has been made. If possible try and use a tax calculator or spreadsheet that will automatically calculate everything for you. This way it will be easy to determine what needs to be paid.

What are affiliate marketing taxes and why do I have to pay them?

Affiliate marketing, like any other business, involves making money. As it is counted as income and you need to pay expenses, you also need to pay taxes. You need to consider all the money you make and pay taxes accordingly.

How do I know if my income is taxable or not?

When you receive money from the affiliate company, it is taxable. This means that you have to pay taxes on this income! The bottom line here is: if your bank account has more money after a month than before, then tax will be applied.

How to calculate your estimated quarterly taxes?

In the US, if your income is more than $600 per month, the IRS will require you to make estimated quarterly tax payments. You can do this by filling in Form T (quarterly taxes). When filling in this form, it is important to keep track of the total income that has been received for that quarter. You can then deduct specific eligible expenses (like business use of home) from your taxable gross income before working out how much tax you should pay. If you are not required to make quarterly tax payments (because your monthly affiliate income is too low) then simply pay the total amount due for that year on or before April 15th of the following year.

Why is it important not to forget about taxes when using a company like Amazon Associates or Google Adsense?

If you are using a company like Amazon Associates or Google Adsense, they will send money to your bank account every now and then. If you do not declare these amounts as taxable income for the right tax year (based on when it was received) then you could face some hefty penalties! The best thing to do is keep track of all affiliate income from companies like these and declare it as income for the tax year that you received it in.

When will my taxes be due and what can happen if they're not paid on time?

The best time to declare your income is when you receive it. If you are looking for a quick resolution, then the easiest thing to do is pay estimated quarterly taxes within each quarter that require payment (if this applies) This means, estimating how much tax you should pay each quarter, based on previous values, and paying that amount. If you end up overpaying, you’ll just get a rebate.

9 affiliate marketing tools that’ll help you run your affiliate program

Discover 9 essential tools to supercharge your affiliate marketing program! From visual content creation with Visme to comprehensive management with Post Affiliate Pro and audience insights via Smartlook, these tools will boost your sales and refine your strategy. Dive in to maximize your affiliate success!

How to keep your affiliates happy with split commissions

Discover how Post Affiliate Pro's SplitCommission™ feature can boost affiliate motivation and engagement by fairly distributing commissions among all contributors to a sale. Learn how to implement this innovative model to enhance your affiliate program's success.

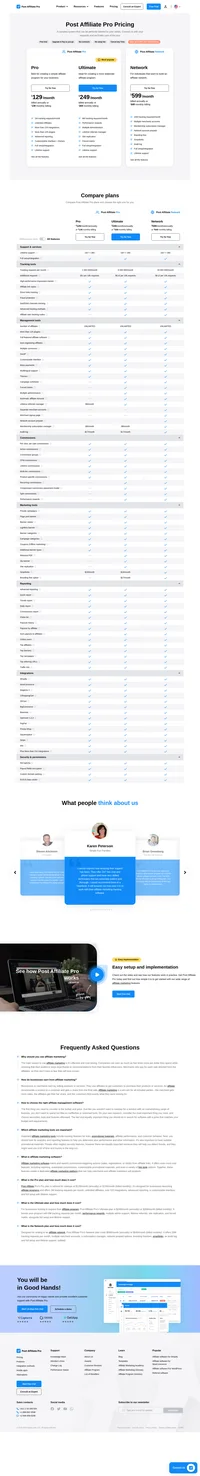

Discover Post Affiliate Pro's flexible pricing plans tailored to fit your business needs, with options for Pro, Ultimate, and Network packages. Enjoy a free trial with no credit card required, no setup fees, and the freedom to cancel anytime. Benefit from features like unlimited affiliates, advanced reporting, customizable interfaces, and lifetime support. Save up to 20% with annual billing and take advantage of more than 220 integrations. Perfect for businesses seeking to enhance their affiliate marketing efforts. Visit now to find the ideal plan for you!

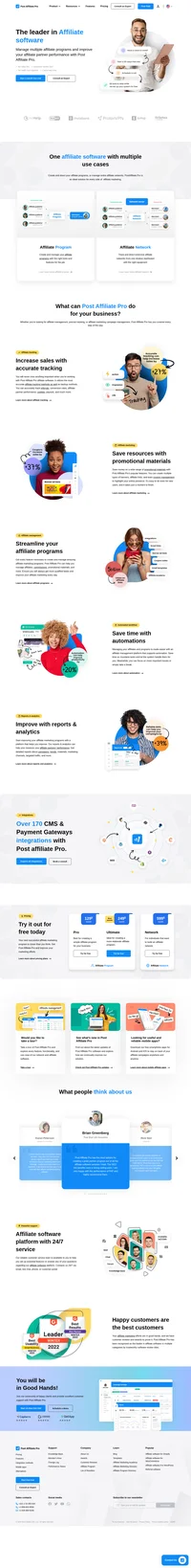

The leader in Affiliate software

Post Affiliate Pro offers a comprehensive affiliate software platform to manage multiple affiliate programs with ease. Enjoy no setup fees, 24/7 customer support, and a free 1-month trial. Ideal for small and large businesses, it features precise tracking, automated workflows, and customizable tools to boost your affiliate marketing success. Try it now and streamline your affiliate operations effortlessly!

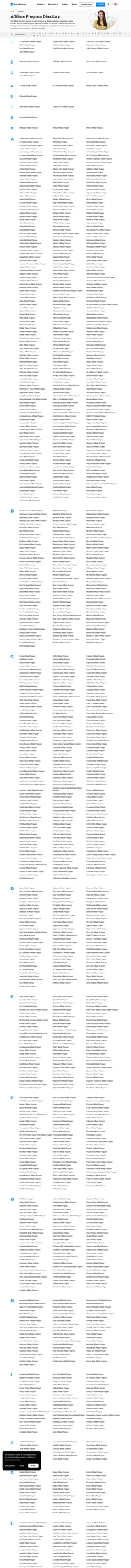

Explore Post Affiliate Pro's comprehensive Affiliate Program Directory, featuring diverse opportunities with competitive commissions and flexible payout options. Discover programs across various industries, accept worldwide traffic, and elevate your affiliate marketing game. Join today and maximize your earnings!