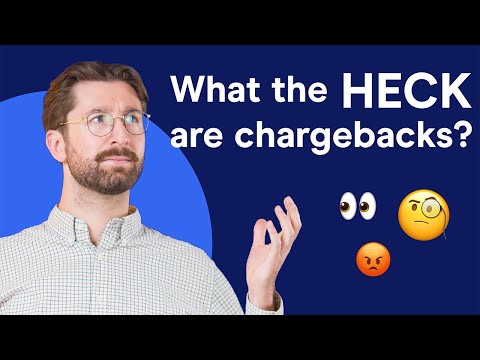

What is chargeback?

A chargeback is a reversal of a credit card transaction initiated by the cardholder’s bank. This process typically begins when a customer disputes a charge on their credit card statement, leading the issuing bank to investigate the claim. If the dispute is found valid, the bank reverses the transaction, returning the funds to the customer. Chargebacks can arise from several reasons, such as unauthorized transactions, non-receipt of goods or services, or dissatisfaction with a purchase.

Chargeback Process

- Transaction Dispute: The customer disputes a charge with their bank, citing reasons such as fraud or dissatisfaction.

- Investigation: The bank temporarily credits the customer’s account and initiates an investigation into the dispute.

- Notification: The merchant is notified of the chargeback and given an opportunity to contest it by providing evidence.

- Resolution: The bank decides the outcome, either returning the funds to the customer or rejecting the chargeback if the merchant provides sufficient evidence.

Chargebacks can be costly for merchants due to associated fees, which can range from $15 to $100 per transaction, depending on the payment processor and the industry risk involved.

Chargebacks in Affiliate Marketing

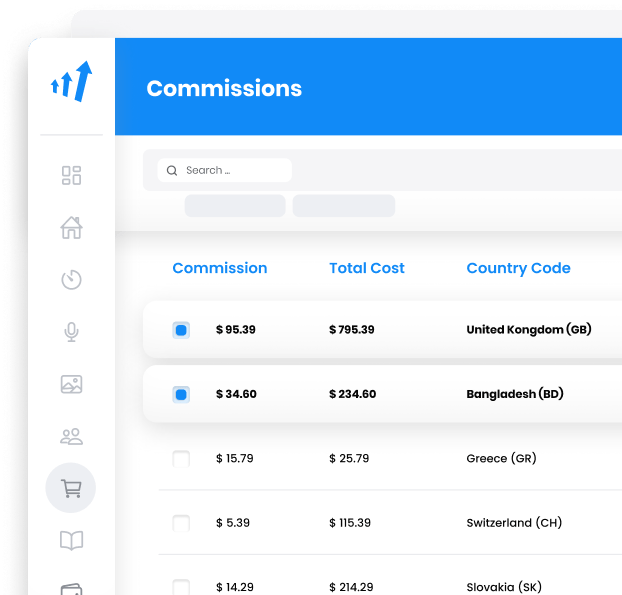

In the context of affiliate marketing, chargebacks can disrupt revenue streams and affect affiliate commissions. Affiliates earn commissions based on successful transactions, but when a chargeback occurs, the commission is often deducted from their earnings. This situation places a financial burden on both merchants and affiliates, who may be innocent parties in the transaction dispute.

Impact on Affiliate Programs

- Commission Reversal: Affiliates lose earnings from disputed sales, affecting their overall income.

- Program Reputation: High chargeback rates can damage the reputation of an affiliate program, making it less attractive to potential affiliates.

- Increased Fees: Merchants may face higher transaction fees if classified as high risk due to frequent chargebacks, impacting profitability.

Preventing Chargebacks in Affiliate Marketing

Preventing chargebacks requires a proactive approach from both merchants and affiliates. Here are some strategies to consider:

- Clear Policies: Establish transparent return and refund policies to minimize disputes and set clear expectations for customers.

- Fraud Prevention: Implement fraud detection software to identify and address suspicious activities early in the transaction process.

- Affiliate Screening: Carefully vet affiliates to ensure they adhere to ethical marketing practices and do not engage in misleading promotions.

- Customer Service: Provide exceptional customer service to address complaints promptly before they escalate to chargebacks.

- Payment Verification: Use secure payment gateways and require additional verification methods, such as CVV codes, for online transactions.

Chargeback vs. Refund

Understanding the distinction between chargebacks and refunds is essential:

- Initiation: Chargebacks are initiated by the customer through their bank, whereas refunds are processed directly by the merchant in response to a customer request.

- Process: Chargebacks involve the issuing bank and can take months to resolve, while refunds are typically quicker, direct transactions between the customer and merchant.

- Fees: Chargebacks incur additional fees for merchants, whereas refunds generally do not, making them a less costly option for resolving disputes.

Understanding Chargebacks in Affiliate Marketing

For affiliate marketers, managing chargebacks is essential to maintaining a healthy relationship with their partners and ensuring the sustainability of their programs. High chargeback rates can lead to increased scrutiny from banks and payment processors, possibly affecting the merchant's ability to process payments.

FAQs

Q: How can affiliate marketers reduce chargebacks?

A: By ensuring clear communication with customers, providing accurate product descriptions, and maintaining transparent billing practices.

Q: What should an affiliate do if a chargeback occurs?

A: Gather all relevant transaction evidence and communicate with the acquirer to contest the chargeback if it's unwarranted.

Q: Can high chargeback rates affect affiliate partnerships?

A: Yes, high chargeback rates can damage relationships with partners, leading to potential termination of agreements.

Understanding chargebacks is crucial for affiliate marketers to protect their business and maintain trust with customers and partners. By adopting best practices, affiliates can minimize the risk and impact of chargebacks on their operations.

Frequently Asked Questions

How does a chargeback work?

A chargeback is a transaction that is returned to the cardholder by their issuing bank. This usually happens when the cardholder disputes a charge with their bank. The bank will then investigate the claim and determine whether or not to refund the cardholder.

How long does a chargeback take?

A chargeback generally takes about 30 days.

How to keep your affiliates happy with split commissions

Discover how Post Affiliate Pro's SplitCommission™ feature can boost affiliate motivation and engagement by fairly distributing commissions among all contributors to a sale. Learn how to implement this innovative model to enhance your affiliate program's success.

A guide to different types of affiliate tracking

Explore the comprehensive guide on affiliate tracking methods like cookie, postback URL, and IP tracking to optimize your affiliate marketing strategy. Learn how Post Affiliate Pro's advanced software ensures precise tracking, maximizes sales, and provides exceptional support for seamless affiliate cooperation. Unlock your brand's potential with cutting-edge tracking solutions today!

Explore Post Affiliate Pro's comprehensive Affiliate Marketing Glossary to enhance your industry knowledge with easy-to-understand definitions of essential terms. Perfect for marketers seeking to understand the fundamentals and advanced concepts, this glossary helps you master the language of affiliate marketing. Visit now to boost your expertise!