How to Enable Mobile Billing: Complete Setup Guide

Learn how to enable mobile billing with your carrier. Step-by-step guide to set up carrier billing for app purchases, in-app transactions, and digital services ...

Mobile billing enables users to pay for products or services via their mobile devices, with charges added directly to their phone bills. It’s especially useful for digital goods and affiliate marketing.

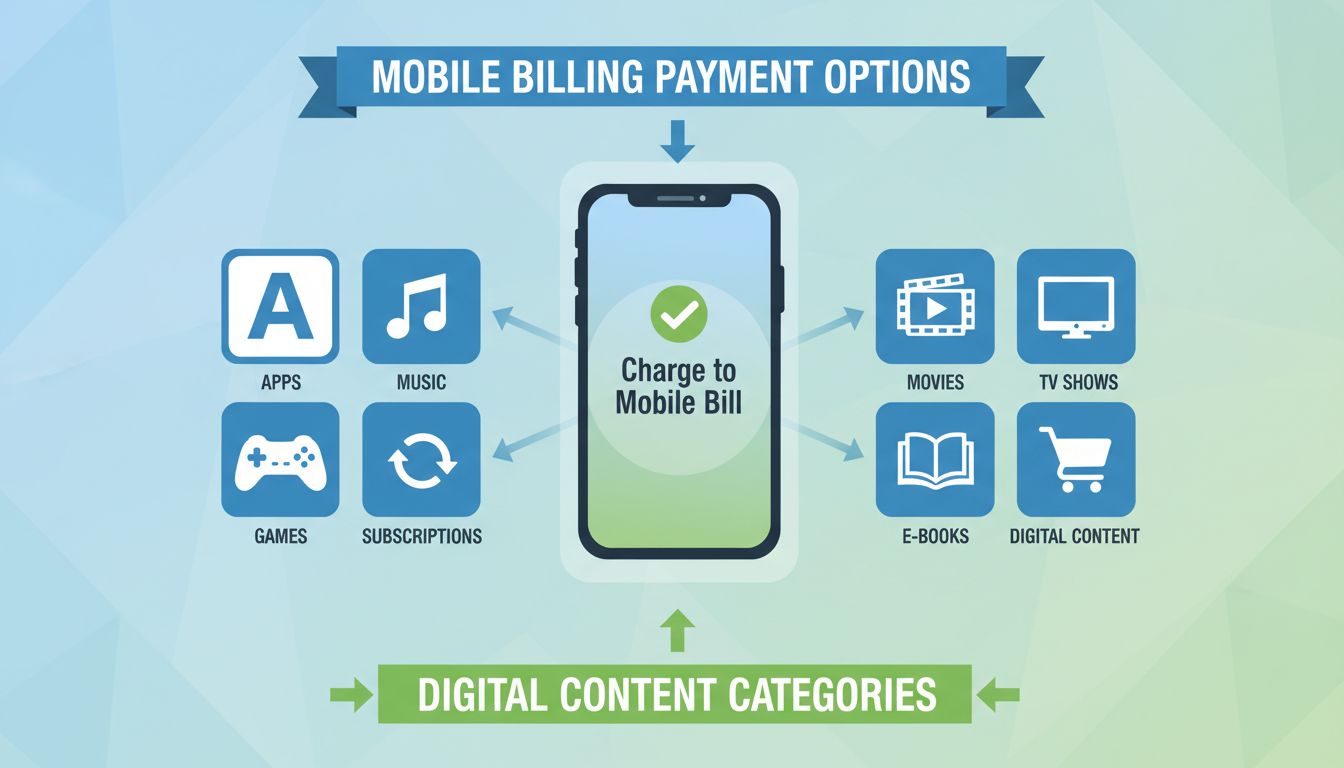

Mobile billing, also known as mobile carrier billing, is a payment method that allows consumers to charge purchases directly to their mobile phone bills. This bypasses the need for credit cards, bank transfers, or cash payments. The process is straightforward: users are exposed to an ad, decide to subscribe or purchase, and the cost is added to their phone bill. This method is especially advantageous for digital goods and services, including apps, games, music, and subscriptions.

Direct Carrier Billing is a simple payment method where users can make purchases that are billed to their mobile phone or deducted from their prepaid balance. It involves minimal steps and often only requires a phone number to complete a transaction. Digital merchants highly favor this method due to its high conversion rates and ease of use.

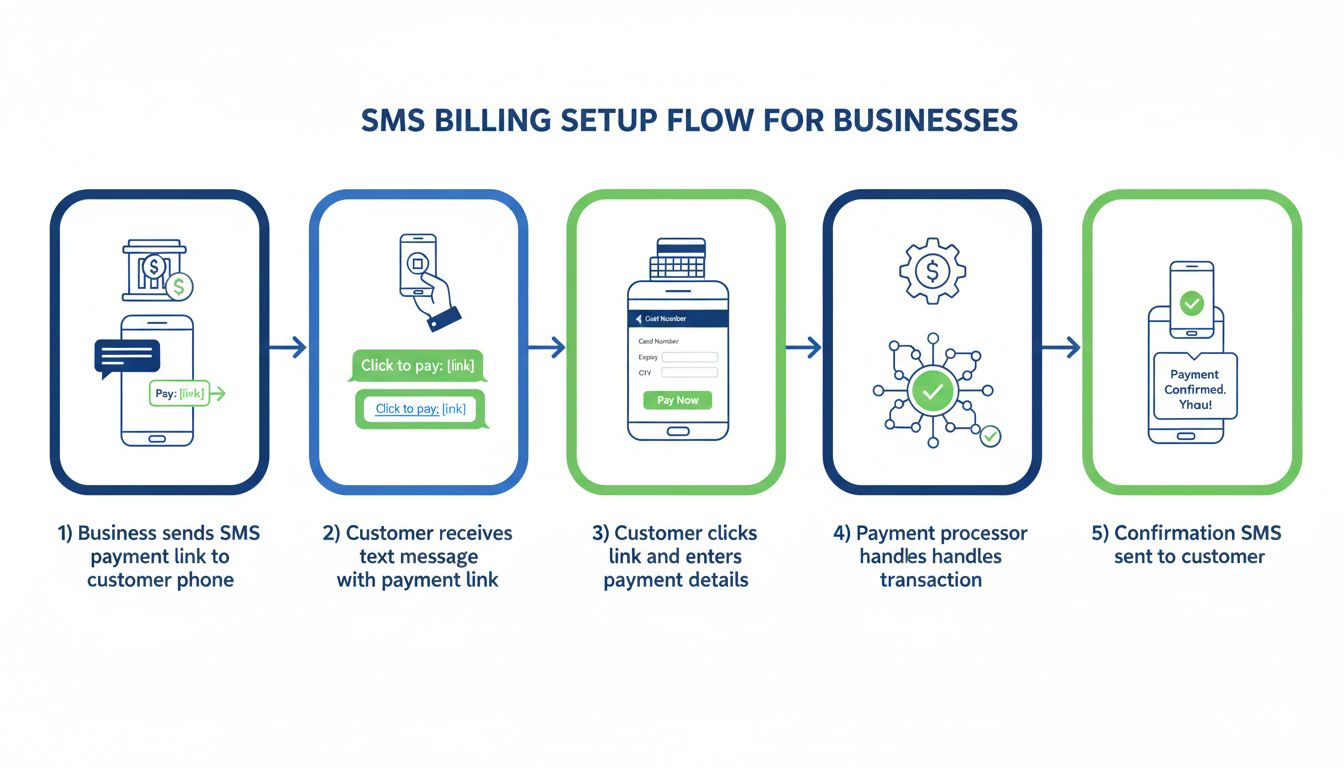

Premium SMS billing involves transactions conducted via text messages. Customers can either be charged upon receiving a text from a merchant (Mobile Terminated SMS) or by sending a premium SMS (Mobile Originated SMS). This method is commonly used for subscription-based services and digital content delivery.

WAP billing enables “one-click” purchases from mobile devices using a WAP browser or application. It automatically detects the device’s MSISDN (Mobile Subscriber Integrated Services Digital Network Number) for streamlined billing, making it an efficient choice for mobile content downloads and subscriptions.

In areas with limited banking infrastructure, mobile airtime transfer provides a viable mobile billing option. Users can transfer credits to one another, facilitating a peer-to-peer payment system that extends the reach of mobile billing beyond traditional channels.

In affiliate marketing , mobile billing serves as a critical tool for enhancing user acquisition and retention. By integrating mobile billing into affiliate software, marketers can streamline the purchasing process, reduce cart abandonment, and boost conversion rates. Affiliates can track transactions more efficiently, ensuring they receive appropriate commissions for driving sales.

Traditional payment methods like credit/debit cards and bank transfers require extensive user information, while mobile billing simplifies this to just a phone number. This ease of use is particularly appealing in regions where mobile penetration is high, but banking services are less accessible.

Mobile billing is gaining traction worldwide, with significant adoption in regions with high mobile penetration and limited banking access. Countries in Africa, Southeast Asia, and parts of Europe and Latin America are experiencing rapid growth in mobile billing usage. Global corporations like Microsoft and Apple are supporting mobile billing in various regions, highlighting its widespread acceptance.

While mobile billing offers numerous advantages, it also presents challenges that need to be addressed for optimal implementation in affiliate marketing .

Carriers often require approval from central banks to offer direct carrier billing services, which can limit availability in certain countries. Affiliates must ensure compliance with local regulations to avoid legal complications.

While mobile billing reduces the need for sharing financial details, safeguarding user data remains crucial. Affiliates and merchants must implement robust security measures to protect consumer information.

As mobile technology continues to evolve, so will mobile billing systems. The integration of advanced technologies like blockchain and AI is expected to enhance security and streamline processes further. Affiliate marketers who leverage these innovations will likely see increased efficiency and profitability.

Integration with IoT Devices: Expands the use of mobile billing beyond traditional mobile devices.

Blockchain Technology: Offers enhanced security and transparency in transactions.

AI and Machine Learning: Facilitate personalized user experiences and reduce fraud.

With mobile billing you can usually buy apps, music, movies, and TV shows.

You will need to create an account with your carrier's billing system, and then add your mobile phone number to the account. Once your phone number is added, you will need to set up a payment method, by credit card or from a bank account.

You first need to make sure mobile billing is available in your country and for your carrier. After that, you can add mobile billing through the Payment & Shipping settings.

Learn how integrating mobile billing can boost your affiliate marketing conversions and reach new audiences.

Learn how to enable mobile billing with your carrier. Step-by-step guide to set up carrier billing for app purchases, in-app transactions, and digital services ...

Discover what you can purchase with mobile billing in 2025. Learn about apps, subscriptions, digital content, and how mobile carrier billing works for seamless ...

Complete guide to setting up SMS billing for your business. Learn about SMS payment providers, integration steps, security compliance, and best practices for te...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.