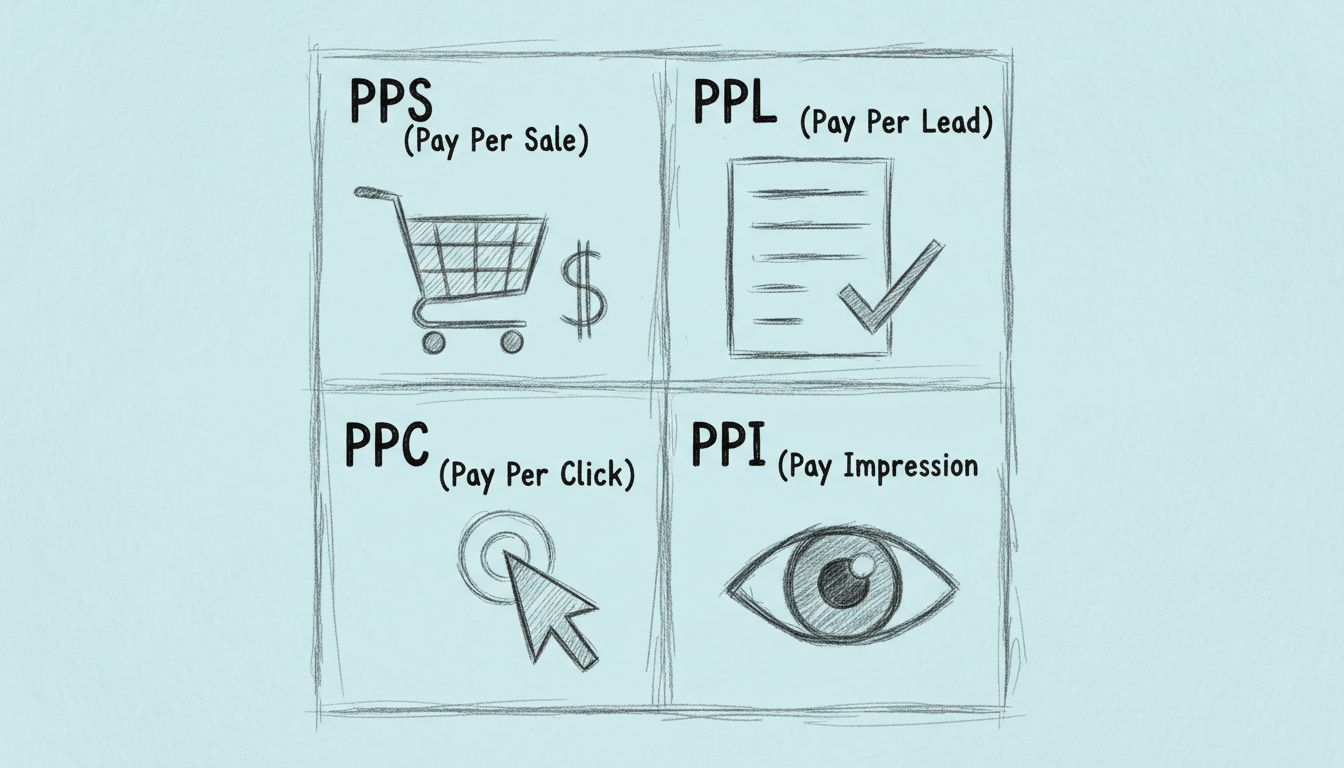

Common Affiliate Payout Models: PPS, PPC, PPL Explained

Learn about the most common affiliate payout models including Pay Per Sale, Pay Per Click, and Pay Per Lead. Choose the best model for your business.

Discover the most common affiliate payment agreements including PPS, PPL, and PPC. Learn how each model works and which is best for you.

The foundation of any successful affiliate program lies in choosing the right payment model—the mechanism that determines how and when your affiliates earn commissions. This decision directly impacts your program’s attractiveness to potential partners, your bottom line, and ultimately, your business growth. Three primary models dominate the affiliate landscape: Pay Per Sale (PPS), Pay Per Lead (PPL), and Pay Per Click (PPC)—each with distinct advantages and trade-offs that can make or break your program’s success.

Pay Per Sale remains the gold standard of affiliate marketing, accounting for approximately 70% of all affiliate programs globally. In this model, affiliates earn a commission only when their referred customer completes a purchase—typically ranging from 5% to 30% of the transaction value, depending on your industry and profit margins. PPS is the preferred choice for e-commerce giants like Amazon (which offers 1-10% commissions depending on product category) and digital product platforms because it directly ties affiliate earnings to actual revenue generation. The primary advantage is merchant safety: you only pay when money actually enters your business, making it virtually risk-free from a financial perspective. Affiliates appreciate the unlimited earning potential—top performers can generate substantial income by driving high-volume sales or promoting high-ticket items. However, PPS presents a significant barrier to entry for new affiliates who lack established audiences, and it typically requires higher conversion rates to be profitable for partners. This model works exceptionally well for SaaS platforms, online retailers, and subscription services where customer lifetime value justifies the commission investment.

| Payment Model | How It Works | Best For | Typical Commission |

|---|---|---|---|

| Pay Per Sale (PPS) | Affiliates earn commission on completed purchases | E-commerce, digital products, SaaS | 5-30% of sale value |

| Pay Per Lead (PPL) | Affiliates earn for qualified leads (signups, forms) | B2B, financial services, insurance | $5-$50 per lead |

| Pay Per Click (PPC) | Affiliates earn for each click on their link | Brand awareness, traffic generation | $0.10-$2.00 per click |

| Recurring Commissions | Ongoing payments for subscription renewals | SaaS, memberships, subscriptions | 20-70% per billing cycle |

| Tiered Commissions | Commission rates increase with performance | High-incentive sales programs | Varies by tier |

Pay Per Lead compensates affiliates for delivering qualified prospects rather than completed sales, with typical payouts ranging from $5 to $50 per lead depending on industry and lead quality requirements. A “lead” might be a completed contact form, email signup, insurance quote request, or loan application—essentially any action that indicates genuine buyer interest. Industries like financial services, insurance, B2B software, and real estate heavily rely on PPL because their sales cycles are lengthy and require nurturing before conversion. The model’s greatest strength is its lower barrier to entry: affiliates can start earning immediately without needing to drive sales, making it attractive for newer partners building their audience. PPL also enables rapid pipeline building, allowing your sales team to focus on conversion rather than lead generation. The critical challenge is lead quality assurance—not all leads are created equal, and you must establish clear qualification criteria to prevent affiliates from submitting low-intent prospects. Fraud prevention becomes essential, as some affiliates may attempt to game the system with fake submissions or bot-generated leads, requiring robust verification systems.

Pay Per Click compensates affiliates simply for directing traffic to your website, regardless of whether visitors take any action, with rates typically ranging from $0.10 to $2.00 per click depending on your niche and traffic quality. This model prioritizes volume and visibility over conversion, making it ideal for building brand awareness and increasing overall website traffic. PPC’s primary appeal is its simplicity and accessibility—affiliates need only drive traffic, making it the easiest model for beginners to understand and participate in. However, PPC suffers from significant drawbacks: it’s highly vulnerable to click fraud, where bad actors artificially inflate clicks without genuine traffic, and the low commission rates mean affiliates must drive enormous volumes to earn meaningful income. Most importantly, PPC disconnects earnings from actual business outcomes, meaning you’re paying for traffic that may never convert into customers or leads. While PPC can serve as a complementary model to boost traffic alongside PPS or PPL programs, it rarely works as a standalone strategy for serious affiliate programs. Smart program managers use PPC strategically for brand-building campaigns rather than as their primary monetization mechanism.

Beyond the three primary models, sophisticated affiliate programs leverage specialized payment structures to maximize performance and partner motivation:

Recurring Commissions: Affiliates earn ongoing commissions for the lifetime of a customer subscription or membership. Perfect for SaaS, membership sites, and subscription boxes—imagine earning 20% monthly on every customer you refer for as long as they remain subscribed. This model creates long-term income streams and incentivizes affiliates to promote quality products that customers will retain.

Tiered Commissions: Commission rates increase as affiliates hit performance milestones (e.g., 5% on first 10 sales, 7% on sales 11-50, 10% on 50+ sales). This structure rewards top performers and encourages affiliates to scale their efforts, creating a win-win dynamic that benefits high-volume partners.

Two-Tier Programs: Affiliates earn commissions not only on their direct referrals but also on sales generated by affiliates they recruit. This creates a network effect and is particularly effective for building large affiliate communities, though it requires careful fraud monitoring to prevent pyramid scheme concerns.

Flat-Rate Commissions: Affiliates receive a fixed amount per sale or lead ($25 per sale, $10 per lead) rather than a percentage. This model works well when your product price varies significantly or when you want predictable affiliate costs, providing clarity and simplicity for both parties.

Selecting your payment model requires analyzing several critical business factors. Start by examining your profit margins—if you operate on thin margins (5-10%), a 20% PPS commission may be unsustainable, making PPL or PPC more appropriate. Consider your customer lifetime value (CLV); if customers spend an average of $500 over their relationship with you, a higher PPS commission becomes justified and attractive to affiliates. Evaluate your market competition—if competitors offer 15% PPS commissions, you’ll need to match or exceed that to attract quality affiliates. Your business model type matters significantly: B2B companies with long sales cycles benefit from PPL, while e-commerce retailers thrive with PPS. Finally, assess affiliate motivation—experienced, established partners want higher-earning potential (favoring PPS), while newer affiliates prefer lower-risk models (favoring PPL or PPC). The best approach involves analyzing your historical customer acquisition costs and comparing them against potential affiliate commission structures to ensure profitability.

Successful affiliate payment programs demand clear communication and robust operational systems. Transparency is non-negotiable: publish your commission structure prominently, explain exactly what qualifies for payment, and provide real-time tracking so affiliates can monitor their earnings and conversions. Establish clear payment terms including minimum payout thresholds (typically $50-$100), payment frequency (monthly or bi-weekly), and accepted payment methods (direct deposit, PayPal, wire transfer). Implement fraud prevention measures such as IP monitoring, duplicate detection, and manual review of suspicious activity patterns—this protects your program’s integrity and ensures legitimate affiliates aren’t competing against fraudsters. Provide exceptional affiliate support through dedicated account managers, regular communication, and educational resources about your products and promotional best practices. Consider offering non-monetary incentives like exclusive promotional materials, early access to new products, or recognition in affiliate leaderboards to boost motivation beyond commission rates. Finally, regularly audit your payment model’s performance against your acquisition cost targets and adjust rates if necessary to remain competitive while maintaining profitability.

PostAffiliatePro stands as the industry-leading affiliate management platform, offering unmatched flexibility to implement any payment model your business requires. The platform’s intelligent commission engine allows you to configure PPS, PPL, PPC, recurring commissions, tiered structures, and two-tier programs without technical limitations, adapting seamlessly as your business evolves. Real-time tracking and automated payout systems eliminate manual processing errors and ensure affiliates receive accurate, timely payments—building trust and program loyalty. Comprehensive reporting dashboards provide complete visibility into program performance, affiliate productivity, and ROI metrics, enabling data-driven optimization of your commission structure. With built-in fraud detection, customizable approval workflows, and multi-currency support, PostAffiliatePro handles the operational complexity so you can focus on program strategy and growth.

Your affiliate payment model is far more than an administrative detail—it’s a strategic lever that determines your program’s competitiveness, profitability, and growth trajectory. The right model aligns your business economics with affiliate motivation, creating a sustainable partnership that drives mutual success. Whether you’re launching your first affiliate program or optimizing an existing one, PostAffiliatePro provides the sophisticated tools and flexibility needed to implement any payment structure and scale your program with confidence.

Pay Per Sale (PPS) is by far the most common affiliate payment model, accounting for approximately 70% of all affiliate programs globally. In PPS, affiliates earn a commission only when their referred customer completes a purchase, typically ranging from 5% to 30% of the transaction value. This model is popular because it directly ties affiliate earnings to actual revenue generation, making it safe for merchants and rewarding for high-performing affiliates.

The key difference is what triggers payment. PPS (Pay Per Sale) pays affiliates only when a customer completes a purchase, while PPL (Pay Per Lead) pays for qualified actions like form submissions, email signups, or demo requests—regardless of whether they convert to sales. PPL has a lower barrier to entry for affiliates but requires careful lead quality management, while PPS is riskier for affiliates but safer for merchants.

PPC (Pay Per Click) is vulnerable to click fraud, where bad actors artificially inflate clicks without genuine traffic. While PostAffiliatePro includes advanced fraud detection with IP monitoring and duplicate detection, PPC requires careful monitoring and is best used as a complementary model alongside PPS or PPL rather than as a standalone strategy.

Absolutely! Many successful programs combine multiple payment models to maximize effectiveness. A typical hybrid approach might use PPS for direct sales, PPL for lead generation, and recurring commissions for subscription renewals. PostAffiliatePro's unified platform manages all these models seamlessly, providing comprehensive tracking and automated payouts across all commission types.

Commission rates vary by industry and product type. E-commerce typically ranges from 5-15%, digital products from 20-50%, and SaaS subscriptions from 20-40%. The key is ensuring your commission rate is sustainable based on your profit margins while remaining competitive to attract quality affiliates. Most successful programs leave room to increase rates over time as their program matures.

Most affiliate programs use monthly or bi-weekly payment cycles with minimum payout thresholds of $50-$100 to reduce processing overhead while maintaining frequent payouts. The payment frequency should balance administrative efficiency with affiliate satisfaction. PostAffiliatePro supports flexible payment schedules and multiple payment methods including direct deposit, PayPal, and wire transfers.

Tiered commissions increase as affiliates hit performance milestones (e.g., 5% on first 10 sales, 7% on sales 11-50, 10% on 50+ sales), rewarding top performers and encouraging scaling. Flat-rate commissions pay a fixed amount per sale or lead regardless of volume, providing simplicity and predictability. Tiered structures are more motivating for high-volume affiliates, while flat-rate works better for businesses with variable product pricing.

Implement robust fraud prevention measures including IP monitoring to detect suspicious patterns, duplicate detection to catch repeated submissions, and manual review of unusual activity. Establish clear lead quality standards and verification processes. PostAffiliatePro includes advanced fraud detection features and customizable approval workflows to help maintain program integrity while protecting legitimate affiliates from competing against fraudsters.

PostAffiliatePro supports all major payment models with advanced tracking, automated payouts, and comprehensive reporting. Start managing your affiliate program with the industry's leading platform.

Learn about the most common affiliate payout models including Pay Per Sale, Pay Per Click, and Pay Per Lead. Choose the best model for your business.

Discover the most common affiliate payout models including PPS, PPL, PPC, and PPI. Learn how each model works, their advantages, and which is best for your affi...

Learn how pay per sale (PPS) affiliate marketing works in 2025. Discover commission structures, tracking mechanisms, earning potential, and best practices for m...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.