What is an Example of an Affiliate Network? Top Platforms Explained

Discover the best affiliate network examples including Amazon Associates, ShareASale, and ClickBank. Learn how affiliate networks work and compare top platforms...

how affiliate networks earn revenue through commissions, fees, and premium services. Understand the complete payment ecosystem and network profitability models.

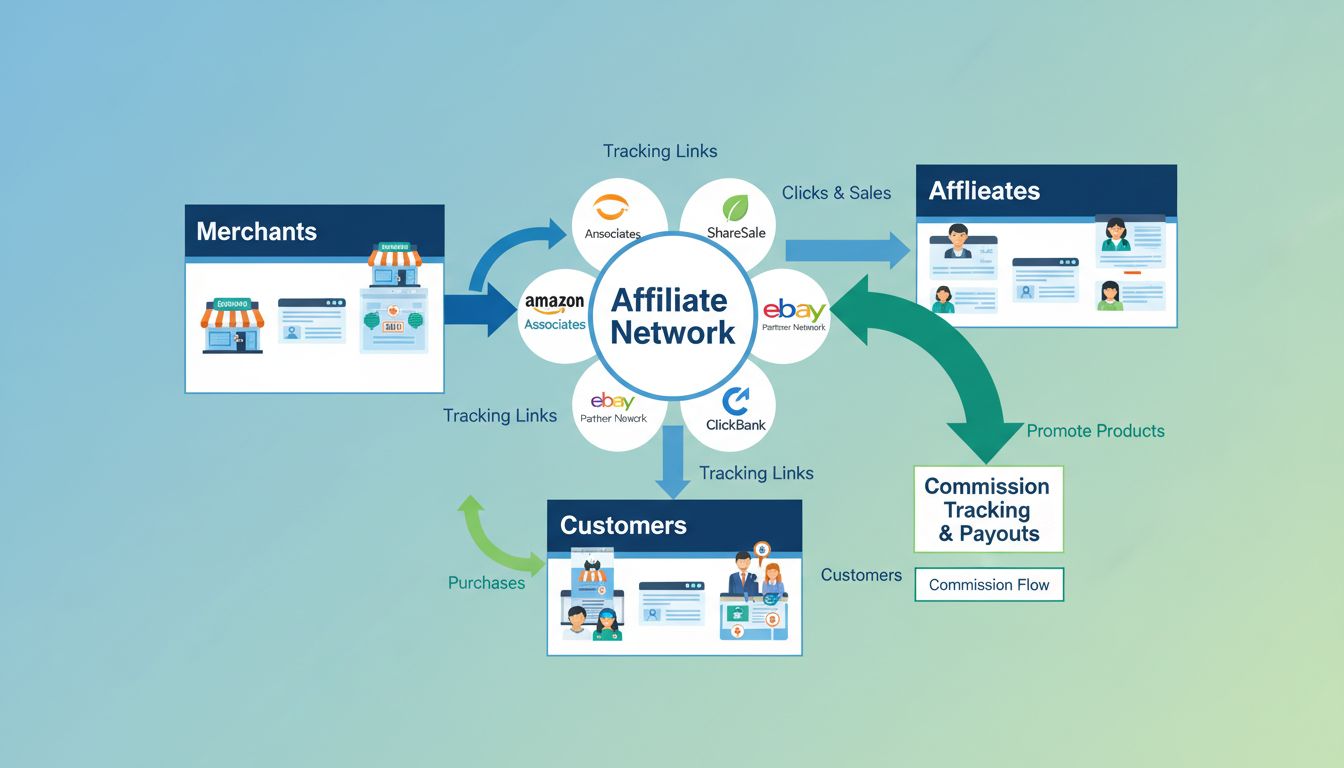

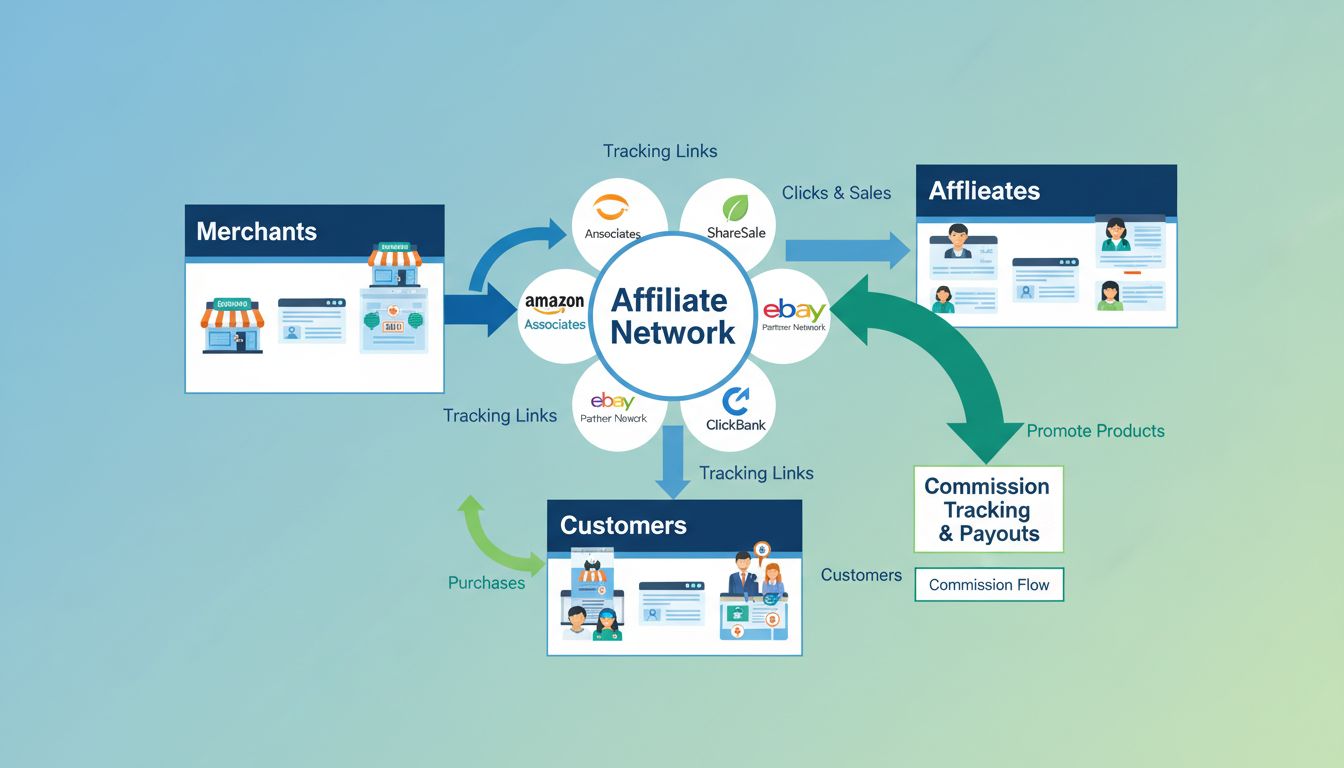

Affiliate networks operate as sophisticated intermediaries that connect three essential parties: merchants seeking customer acquisition, affiliates looking to earn commissions, and consumers making purchases. These networks generate revenue through multiple streams, with their primary income derived from commission-based earnings on transactions facilitated through their platforms. Understanding how affiliate networks monetize their operations is crucial for merchants and affiliates alike, as it directly impacts commission rates, payment structures, and overall program profitability. The three-party system creates a mutually beneficial ecosystem where networks earn by taking a percentage of merchant fees while ensuring affiliates receive fair compensation for their promotional efforts.

The most significant revenue stream for affiliate networks comes from merchant fees, which typically represent 20-40% of the total transaction value or a flat percentage of sales generated through affiliate channels. Networks charge merchants in several ways: percentage-based fees (commonly 20-30% of affiliate payouts), transaction fees (a fixed amount per sale), or flat fees for premium services and account management. The sophistication lies in how networks implement tracking technology to ensure accurate attribution—every click, impression, and conversion is recorded through advanced tracking pixels, cookies, and server-to-server integrations that verify which affiliate drove the sale. This fraud prevention infrastructure is critical because it protects merchants from invalid traffic while ensuring proper attribution; networks employ machine learning algorithms, behavioral analysis, and cross-reference systems to detect suspicious patterns and prevent commission fraud. By maintaining transparent tracking systems, networks build trust with merchants who can confidently invest in affiliate marketing knowing their costs are directly tied to verified results.

| Commission Type | Description | Example | Typical Range |

|---|---|---|---|

| Percentage of Sales | Network takes % of each sale | 10-30% per transaction | 10-30% |

| Flat Fee Per Sale | Fixed amount per conversion | $5-$50 per sale | Varies by industry |

| Transaction Fees | Fee on payment processing | 2-5% of payout | 2-5% |

| Setup/Subscription Fees | Recurring platform fees | Monthly/annual charges | $500-$5,000+ |

| Premium Services | Advanced features and support | Dedicated account management | Custom pricing |

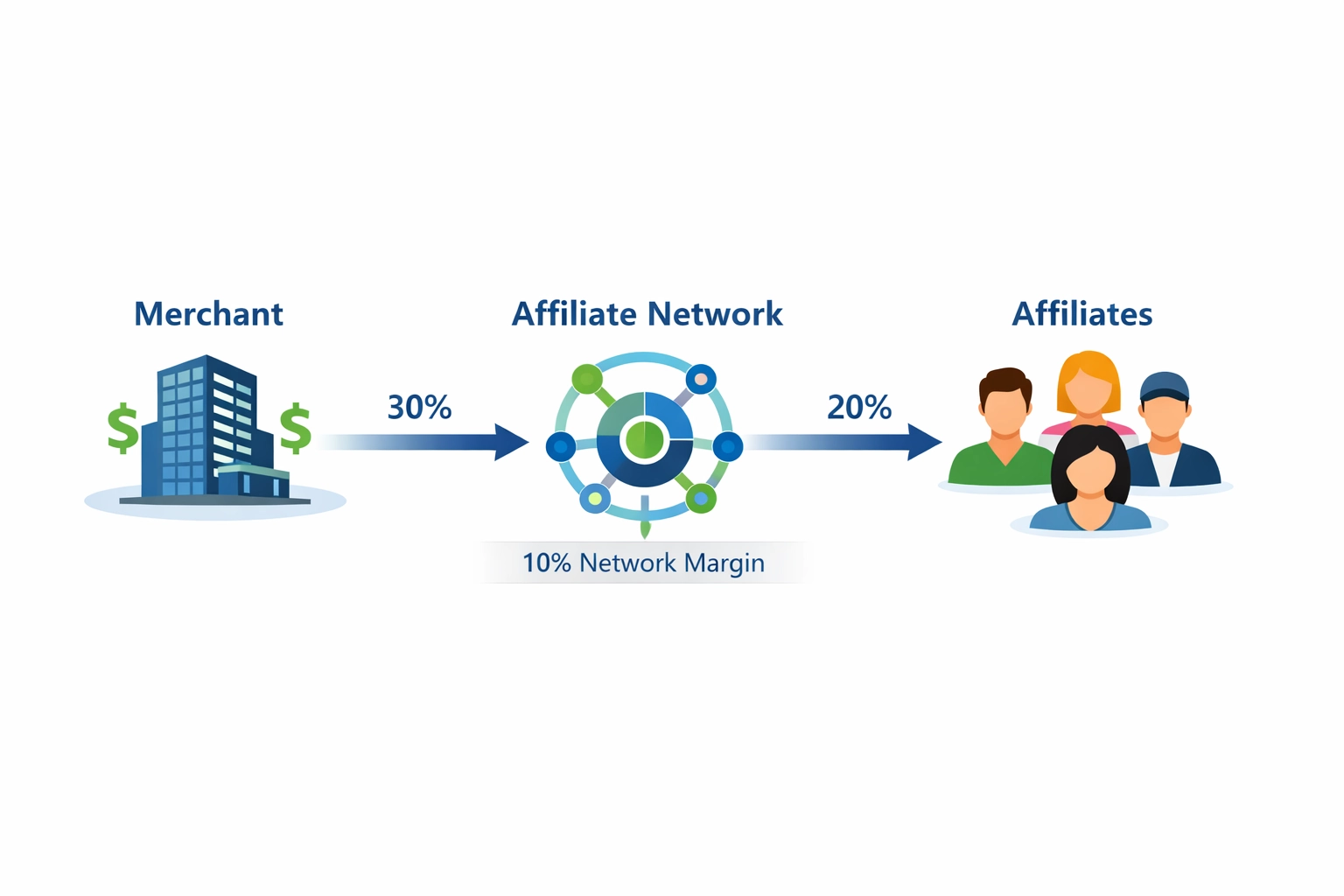

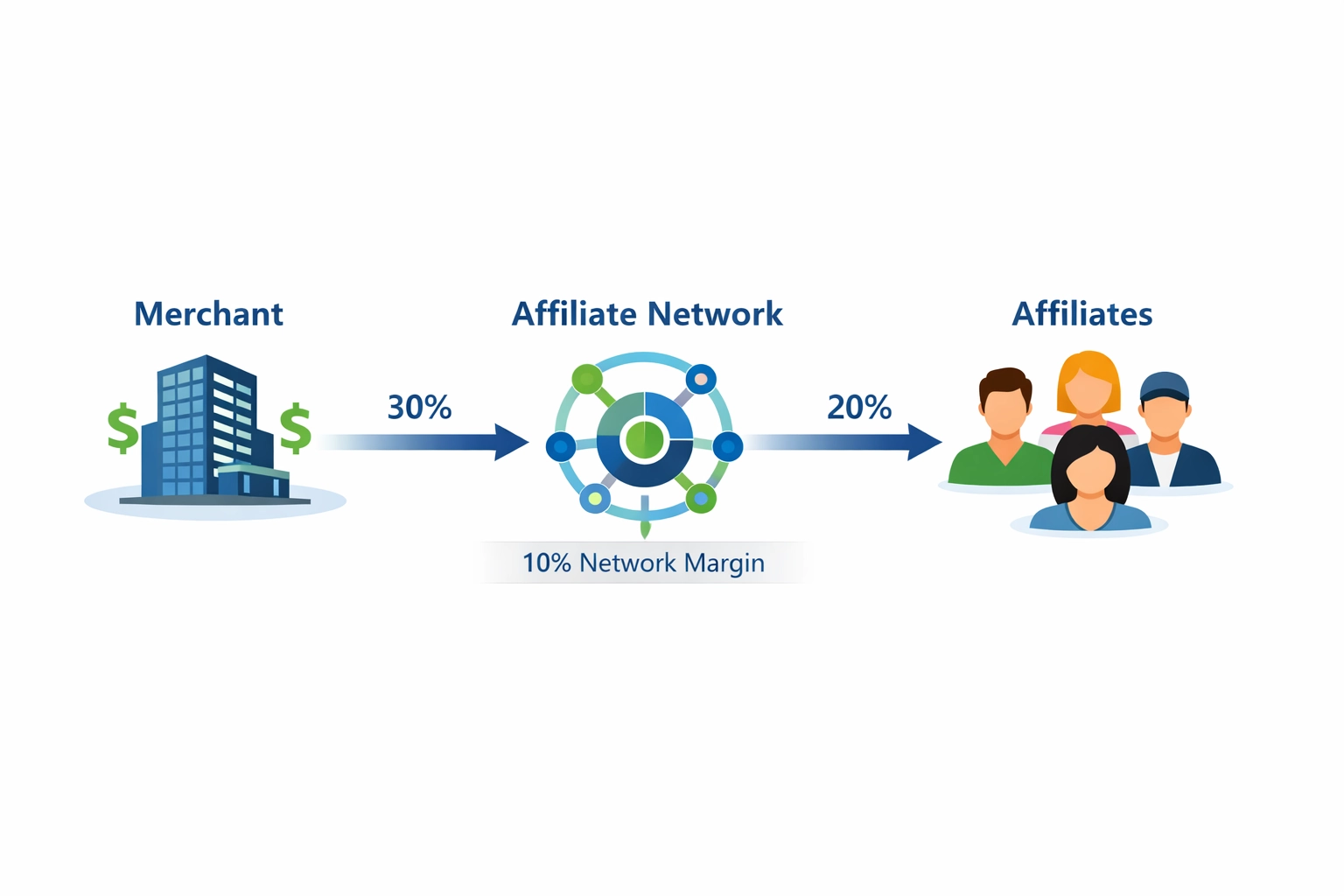

Affiliate networks distribute earnings to their partners through various payment models, each designed to align incentives with business objectives. The most common structures include pay-per-sale (PPS), where affiliates earn a percentage of each completed purchase; pay-per-click (PPC), compensating for traffic regardless of conversion; pay-per-lead (PPL), rewarding qualified lead generation; and cost-per-action (CPA), paying for specific user actions like signups or downloads. The financial split between what merchants pay and what affiliates receive creates the network’s margin—for example, if a merchant pays 30% commission and the affiliate receives 20%, the network retains 10% as its operational fee. Commission rates typically range from 5-50% depending on the model and industry, with SaaS companies averaging 20-25% recurring commissions while e-commerce products often offer 5-15% due to lower profit margins. This tiered approach allows networks to remain profitable while offering competitive affiliate compensation that attracts quality partners and motivates performance.

While commission-based earnings form the foundation of network revenue, sophisticated platforms diversify income through multiple value-added services and premium services. These additional revenue sources include:

These premium services create recurring revenue streams that reduce dependence on transaction-based income and improve overall profitability, particularly during market downturns when affiliate activity may decline.

Behind every successful affiliate network lies a robust technology infrastructure that handles complex payment processing and real-time transaction management. Networks invest heavily in tracking technology systems that capture data across multiple touchpoints—web browsers, mobile apps, server-to-server connections—ensuring no valid conversion is missed. The automated systems calculate commissions instantly, reconcile transactions with merchant records, and flag discrepancies for investigation, all while maintaining security measures that protect sensitive financial and personal data. Fraud detection mechanisms operate continuously, analyzing transaction patterns, IP addresses, device fingerprints, and user behavior to identify suspicious activity before payments are issued. Real-time tracking capabilities allow merchants and affiliates to monitor performance dashboards instantly, while automated commission calculations eliminate manual errors and accelerate payment cycles. The technology stack required includes payment gateways, fraud detection APIs, data warehouses, and reporting engines—representing significant capital investment that networks must maintain to stay competitive and compliant with financial regulations.

Network margins typically range from 20-40% of the total merchant fees collected, though this varies significantly based on network size, service level, and market positioning. For example, if a merchant pays a 30% commission on a $100 sale ($30 total), and the affiliate receives 25%, the network retains $5 (approximately 17% of the merchant fee). Larger networks with established merchant relationships and high affiliate volumes can operate on tighter margins (15-20%) due to economies of scale, while smaller or specialized networks may require higher margins (35-40%) to cover operational costs. Profit margins depend heavily on operational efficiency—networks with automated systems, minimal fraud, and high transaction volumes achieve better profitability than those requiring extensive manual management. Understanding these revenue splits is essential for merchants evaluating network partnerships; networks that invest heavily in fraud prevention, affiliate support, and technology infrastructure often justify higher fees through superior performance and lower risk.

Affiliate networks operate under different business models, each with distinct revenue implications. Horizontal networks like ShareASale and CJ Affiliate serve merchants across all industries, generating revenue through high transaction volumes and diverse merchant bases that spread risk. Vertical networks focus on specific industries (fashion, finance, technology), allowing them to command premium fees by offering specialized expertise and highly targeted affiliate audiences. Self-hosted networks enable merchants to manage their own affiliate programs directly, eliminating network intermediaries but requiring significant internal investment in technology and management. Managed networks provide white-label solutions where merchants outsource all affiliate operations, paying premium fees for comprehensive management, recruitment, and optimization services. Each model generates revenue differently: horizontal networks profit from scale, vertical networks from specialization, self-hosted programs from direct merchant investment, and managed networks from service fees. Understanding these distinctions helps merchants and affiliates choose platforms aligned with their revenue goals and operational capabilities.

Operating globally introduces complexity and opportunity for affiliate networks managing international payments across multiple currencies and jurisdictions. Networks must navigate cross-border transactions, currency conversion fees, local payment regulations, and varying tax requirements—each adding operational costs but also enabling access to global merchant and affiliate pools. Multi-currency support allows networks to serve merchants and affiliates worldwide, though currency fluctuations create accounting challenges and potential margin compression. Regional payment methods vary significantly; while credit cards dominate in North America and Europe, digital wallets, bank transfers, and local payment systems are preferred in Asia and emerging markets. Networks that efficiently handle international payments gain competitive advantage by reducing friction for global partners, though they must invest in compliance infrastructure, payment processor relationships, and currency management systems. The complexity of global operations increases operational costs but also enables networks to capture higher transaction volumes and command premium positioning in international markets.

Affiliate networks face significant operational challenges that directly impact revenue and profitability. Affiliate fraud remains a persistent threat, with bad actors using click injection, cookie stuffing, incentivized traffic, and fake conversions to claim unearned commissions—forcing networks to invest heavily in detection systems that increase operational costs. Chargebacks and payment disputes occur when customers dispute transactions or merchants claim invalid traffic, requiring networks to investigate, mediate, and sometimes refund commissions, creating revenue volatility. Operational costs for fraud prevention, customer support, technology maintenance, and compliance can consume 30-50% of gross revenue, leaving limited margin for profit and reinvestment. The cost of acquiring and retaining quality affiliates continues rising as competition intensifies, requiring networks to offer better support, training, and promotional resources. Additionally, regulatory changes around data privacy (GDPR, CCPA), payment processing, and consumer protection create compliance burdens that increase expenses and limit revenue flexibility. Networks that fail to manage these challenges effectively face declining merchant confidence, affiliate attrition, and margin compression.

PostAffiliatePro stands as the leading affiliate software solution for merchants and networks seeking to maximize revenue optimization while maintaining operational efficiency and partner satisfaction. The platform’s advanced tracking capabilities utilize multiple verification methods to ensure accurate attribution and minimize fraud, protecting both merchant investments and network credibility. Automated payments streamline commission distribution across thousands of affiliates simultaneously, reducing administrative overhead and accelerating cash flow cycles that improve partner satisfaction and retention. Multi-currency support enables networks to serve global merchants and affiliates seamlessly, expanding addressable markets and transaction volumes without proportional cost increases. Comprehensive reporting and analytics provide real-time visibility into network performance, affiliate quality, and revenue trends, enabling data-driven optimization decisions. Fraud prevention features protect network integrity by identifying suspicious patterns before commissions are paid, reducing chargebacks and disputes that erode profitability. By consolidating these critical functions into a single platform, PostAffiliatePro enables networks to operate more efficiently, scale faster, and maintain higher profit margins while delivering superior service to merchants and affiliates.

The affiliate network landscape is evolving rapidly, driven by technological innovation and changing market dynamics. Blockchain payments and cryptocurrency adoption are emerging as alternatives to traditional payment methods, offering faster settlement times, lower transaction fees, and access to unbanked populations—potentially transforming how networks handle international payments and reducing operational costs. AI-powered fraud detection systems are becoming increasingly sophisticated, using machine learning to identify fraud patterns with greater accuracy than rule-based systems, reducing losses and improving network profitability. Real-time payouts are shifting from monthly or quarterly cycles to daily or even hourly settlements, improving affiliate satisfaction and retention while requiring networks to maintain larger cash reserves and more sophisticated payment infrastructure. Subscription models are gaining traction as networks move beyond transaction-based revenue to recurring fees for premium features, providing more predictable income and reducing dependence on volatile affiliate activity. Emerging technologies like voice commerce, IoT tracking, and metaverse integrations are creating new affiliate channels and revenue opportunities for forward-thinking networks. Networks that embrace these trends while maintaining robust fraud prevention and compliance infrastructure will capture disproportionate market share and command premium positioning in the evolving affiliate ecosystem.

Affiliate networks generate revenue through a sophisticated ecosystem of commission-based earnings, merchant fees, and premium services. The most successful networks balance profitability with fair compensation for merchants and affiliates, investing heavily in fraud prevention, tracking technology, and automated payment systems. Understanding these revenue models helps merchants make informed decisions about affiliate program partnerships and enables affiliates to recognize the value networks provide. As the affiliate marketing industry continues to grow—with the global market expected to exceed $17 billion by 2026—networks that optimize their revenue models while maintaining transparency and trust will thrive in an increasingly competitive landscape.

Affiliate networks typically take 20-40% of the merchant's affiliate program budget, with the remainder going to affiliates. The exact percentage varies based on network type, services provided, and negotiated agreements. Some networks charge flat fees instead of percentages, which can range from $500 to $5,000+ monthly depending on service level and transaction volume.

The difference is the network's revenue and operational margin. If a merchant pays 30% commission on a $100 sale, the network might keep 10% ($10) and pay the affiliate 20% ($20). This spread covers the network's operational costs, technology infrastructure, fraud prevention systems, customer support, and profit margin.

Most legitimate affiliate networks don't charge affiliates to join their basic programs. However, some networks offer premium tiers with additional features, tools, and exclusive offers that require subscription fees. Networks primarily earn from merchants, not affiliates, making free affiliate membership the industry standard.

Networks implement sophisticated fraud detection systems including click capping, conversion validation, hold periods for chargebacks, and AI-powered anomaly detection. These measures protect both the network's revenue and merchant trust by preventing fraudulent commissions. Advanced systems analyze IP addresses, device fingerprints, and user behavior patterns to identify suspicious activity before payments are issued.

Common payment methods include PayPal, bank transfers, Stripe, cryptocurrency, and digital wallets like Skrill and Payoneer. Networks offer multiple options to accommodate affiliates worldwide. Payment frequency typically ranges from weekly to monthly, with minimum payout thresholds of $30-$100 to manage processing costs.

Networks earn through currency conversion fees, international payment processing fees, and premium services for global operations. They also benefit from increased merchant spending on international affiliate programs, which generates higher commission revenue. Multi-currency support and cross-border payment infrastructure enable networks to serve global markets and capture additional transaction volumes.

Yes, successful affiliate networks are highly profitable. With proper fraud prevention, efficient operations, and a large affiliate base, networks can achieve 30-50% profit margins. However, profitability depends on network size, operational efficiency, ability to attract quality merchants and affiliates, and effectiveness of fraud prevention systems.

PostAffiliatePro provides comprehensive tools for automated tracking, fraud prevention, multi-currency payments, and detailed reporting. These features reduce operational costs, minimize fraud losses, and enable networks to scale efficiently while maintaining affiliate satisfaction and merchant trust. The platform's automation capabilities process thousands of commissions with minimal manual intervention.

PostAffiliatePro makes it easy to manage affiliate payments, track commissions, and scale your network globally with automated payouts and comprehensive reporting.

Discover the best affiliate network examples including Amazon Associates, ShareASale, and ClickBank. Learn how affiliate networks work and compare top platforms...

Discover what network affiliates are, how they work, and their role in affiliate marketing. Learn about commission structures, types of affiliates, and best pra...

An affiliate network is a connection between merchants and affiliates. Members of affiliate networks are rewarded for provided sales or leads.

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.