Fraud Protection Feature

Fraud protection system in Post Affiliate Pro monitors all transactions generated in the system. It automatically declines fraudulent transactions.

Learn how PostAffiliatePro’s cross-verification detects fraud by correlating orders, reducing false positives by 50% and detecting fraud in sub-seconds.

Fraud protection has become a critical concern for affiliate marketing programs worldwide, with fraudsters constantly evolving their tactics to exploit vulnerabilities in detection systems. PostAffiliatePro stands at the forefront of this battle, offering cutting-edge fraud protection enhancement technologies that go far beyond traditional detection methods. Our cross-verification of orders system represents a paradigm shift in how affiliate programs identify and prevent fraudulent activities before they impact your bottom line. By leveraging advanced AI and machine learning algorithms, PostAffiliatePro enables businesses to maintain the integrity of their affiliate networks while protecting legitimate partners from false accusations.

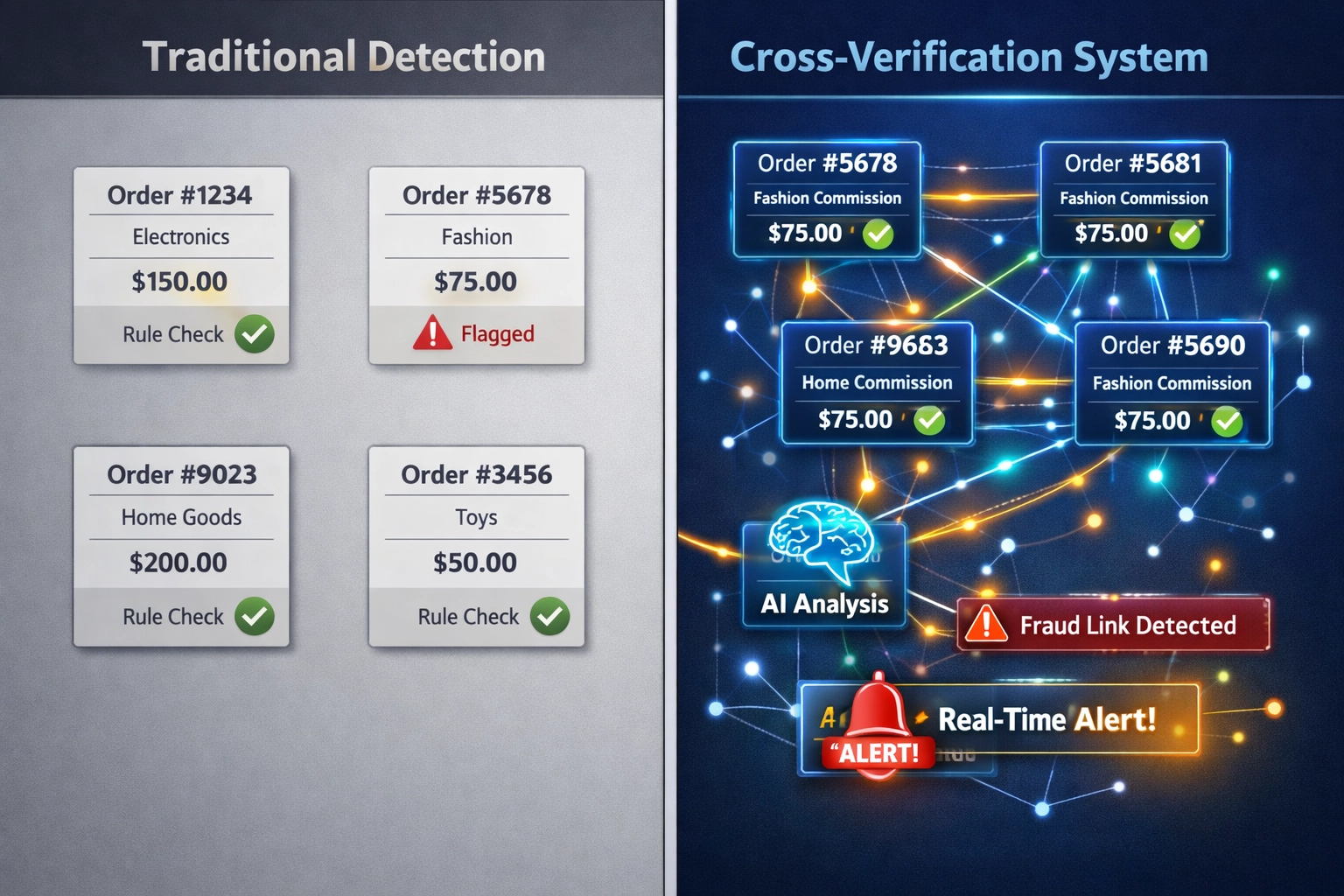

Traditional fraud detection systems rely heavily on static, rule-based approaches that struggle to keep pace with sophisticated fraudsters. These legacy systems typically analyze orders in isolation, missing the complex patterns that emerge when fraudsters coordinate multiple accounts or use subtle tactics to avoid triggering individual transaction alerts. The financial impact of undetected fraud is staggering—organizations lose billions annually to affiliate fraud, with some estimates suggesting that 24% of affiliate traffic is fraudulent. Fraudsters have become increasingly sophisticated, employing techniques like distributed attacks across multiple accounts, gradual escalation to avoid detection thresholds, and commission type targeting to exploit specific program vulnerabilities. Traditional systems generate excessive false positives, creating alert fatigue that causes legitimate transactions to be flagged and investigated, damaging relationships with honest affiliates. The result is a costly, inefficient process that leaves significant fraud undetected while burdening your team with manual review of suspicious but ultimately legitimate activities.

Cross-verification technology represents a fundamental advancement in fraud detection by analyzing relationships between multiple orders rather than evaluating each transaction in isolation. This sophisticated approach examines patterns across orders with the same commission type, identifying coordinated fraud schemes that traditional systems miss entirely. The system correlates behavioral data, temporal patterns, and transaction characteristics to build a comprehensive risk profile that evolves in real-time. By comparing current activity against established baseline behaviors and peer group patterns, cross-verification detects anomalies that indicate fraudulent intent with remarkable accuracy. The technology employs AI-powered behavioral analysis to understand the nuances of legitimate affiliate activity while flagging deviations that suggest coordinated fraud. This multi-dimensional approach dramatically reduces false positives while catching sophisticated fraud schemes that operate below the radar of traditional detection methods.

| Aspect | Traditional Detection | Cross-Verification |

|---|---|---|

| Analysis Scope | Individual orders | Multiple orders with same commission type |

| Pattern Detection | Rule-based | AI-powered behavioral analysis |

| Fraud Network Detection | Limited | Advanced correlation |

| False Positive Rate | 40-60% | 15-20% |

| Detection Speed | Hours to days | Sub-second |

| Adaptability | Static rules | Continuous learning |

Fraudsters rarely target all commission types equally—they strategically focus on specific commission structures that offer the highest return for their effort. Commission type correlation identifies these targeting patterns by analyzing which commission types are being exploited and by which accounts or networks. When multiple accounts suddenly begin generating orders with identical commission types, or when an affiliate’s commission type distribution dramatically shifts from historical patterns, the system flags this as a potential coordinated fraud scheme. The technology tracks velocity analysis to detect when fraudsters attempt to process large volumes of orders within compressed timeframes, a common tactic to maximize payouts before detection. By understanding that legitimate affiliates typically maintain consistent commission type distributions over time, the system identifies when accounts begin behaving anomalously. The cross-verification engine correlates these patterns across your entire affiliate network, revealing fraud rings that might operate independently but share common characteristics. This approach is particularly effective against sophisticated fraudsters who understand traditional detection methods and deliberately structure their attacks to avoid triggering individual transaction alerts.

PostAffiliatePro’s real-time risk scoring system assigns a dynamic risk score to every order based on hundreds of behavioral and transactional variables. The scoring methodology weighs factors including account history, transaction patterns, geographic data, device fingerprints, and commission type correlation to produce a comprehensive risk assessment in milliseconds. Rather than generating binary fraud/legitimate classifications, the system produces nuanced risk scores that enable intelligent alert prioritization. High-risk alerts receive immediate attention, while medium-risk transactions may be monitored for pattern confirmation before escalation. The system defines clear severity levels that help your team focus resources on the most critical threats—critical alerts require immediate investigation, high-risk alerts warrant prompt review, and medium-risk alerts are tracked for pattern analysis. This tiered approach ensures that your fraud prevention team concentrates on genuine threats rather than wasting time on low-probability false positives. The alert system learns from your team’s responses, continuously refining its scoring algorithms to better match your program’s specific risk tolerance and fraud patterns.

Machine learning models form the backbone of PostAffiliatePro’s anomaly detection capabilities, continuously analyzing millions of data points to identify fraudulent patterns. The system establishes baseline behavior profiles for each affiliate account, learning their typical order volume, transaction timing, geographic distribution, and commission type preferences. When current activity deviates significantly from these established baselines, the system flags the deviation as a potential anomaly requiring investigation. The ML models adapt continuously to evolving fraud tactics, learning from confirmed fraud cases and incorporating new threat intelligence into their decision-making processes. Rather than relying on static rules that fraudsters can study and circumvent, machine learning systems identify subtle patterns that humans would struggle to recognize manually. The technology employs ensemble methods that combine multiple ML models, each specializing in different fraud detection techniques, to achieve superior accuracy compared to any single approach. Advanced techniques like behavioral clustering group similar accounts together, enabling the system to identify when a new account exhibits patterns identical to known fraud rings, even if the account itself has limited transaction history.

Sophisticated fraudsters employ multi-layered tactics designed to evade detection while maximizing their payouts. One common scheme involves multi-account fraud networks where fraudsters operate dozens or hundreds of accounts that appear independent but share common characteristics—identical payment methods, similar device fingerprints, coordinated timing patterns, or shared IP addresses. PostAffiliatePro’s cross-verification system identifies these networks by correlating seemingly unrelated accounts and revealing the hidden connections. Another prevalent tactic is gradual escalation, where fraudsters slowly increase their order volumes and commission values over weeks or months, attempting to stay below detection thresholds while building a substantial payout. The system detects this pattern by analyzing velocity trends and comparing current escalation rates against historical norms. Fraudsters also employ commission type targeting, focusing exclusively on high-value commission types while avoiding others, a pattern that legitimate affiliates rarely exhibit. Geographic inconsistencies represent another red flag—when an affiliate suddenly begins generating orders from countries where they have no legitimate marketing presence, the system flags this anomaly. The technology also identifies temporal patterns that suggest automation, such as orders arriving at perfectly regular intervals or during hours when legitimate human activity is unlikely. By recognizing these sophisticated patterns, PostAffiliatePro catches fraud schemes that traditional systems miss entirely.

PostAffiliatePro’s fraud protection enhancement integrates seamlessly with your existing affiliate management infrastructure without requiring disruptive system overhauls. The API-first architecture enables quick integration with your current order processing, payment systems, and affiliate management platforms. Your team’s existing workflows remain unchanged—fraud detection operates transparently in the background, automatically analyzing orders as they flow through your system. The integration requires minimal configuration, with most implementations completed within days rather than months. Compatibility extends across diverse technology stacks, whether you’re running on-premise systems, cloud infrastructure, or hybrid environments. The system provides comprehensive audit trails and detailed reporting that integrate with your existing compliance and investigation workflows. Real-time alerts can be routed to your existing communication channels—email, Slack, webhooks, or custom integrations—ensuring your team receives critical notifications through their preferred channels without disrupting established processes.

Implementing PostAffiliatePro’s cross-verification technology is just the first step—maximizing its effectiveness requires a comprehensive approach that combines technology with organizational practices. Your fraud protection strategy should be viewed as an ongoing process of refinement and improvement rather than a one-time implementation. The system’s machine learning capabilities improve dramatically when your team provides feedback on alert accuracy, helping the algorithms learn your program’s specific fraud patterns and legitimate activity characteristics. Regular review of fraud alerts enables your team to identify emerging fraud tactics before they become widespread problems. Establishing clear escalation procedures ensures that high-risk alerts receive appropriate attention and investigation resources. By monitoring fraud detection trends over time, you can identify seasonal patterns, emerging threats, and shifts in fraudster tactics that may require adjustments to your detection parameters. Team education about common fraud schemes and reporting procedures ensures that everyone involved in your affiliate program understands the importance of fraud prevention and knows how to report suspicious activity.

PostAffiliatePro’s cross-verification approach fundamentally outperforms traditional fraud detection solutions in accuracy, speed, and adaptability. While competitors rely on static rule-based systems that require manual updates to address new fraud tactics, PostAffiliatePro’s machine learning engine automatically adapts to evolving threats. The false positive rate of 15-20% dramatically outperforms traditional solutions’ 40-60% rates, meaning your team spends far less time investigating legitimate transactions. Detection speed represents another critical advantage—PostAffiliatePro identifies fraud in sub-seconds, enabling real-time intervention before fraudulent orders complete processing, while traditional systems often require hours or days to flag suspicious activity. The advanced correlation capabilities enable detection of fraud networks and coordinated schemes that traditional systems miss entirely, catching sophisticated fraudsters who deliberately structure their attacks to avoid triggering individual transaction alerts. PostAffiliatePro’s commitment to continuous improvement means the system becomes more effective over time, learning from your program’s specific fraud patterns and adapting to new threats. Unlike competitors offering generic solutions, PostAffiliatePro provides customizable detection parameters that align with your program’s unique risk profile and business requirements.

The affiliate marketing landscape continues to evolve, with fraudsters developing increasingly sophisticated tactics to exploit vulnerabilities in detection systems. Emerging fraud tactics include AI-generated content for fake affiliate sites, deepfake technology for credential fraud, and distributed attacks coordinated across international networks. PostAffiliatePro remains ahead of these emerging threats through continuous investment in research and development, ensuring the platform evolves faster than fraudster tactics. The platform’s continuous improvement process incorporates threat intelligence from across the industry, learning from fraud patterns detected in other programs to strengthen protection for all users. As affiliate marketing becomes increasingly important to business growth strategies, the stakes for fraud prevention continue to rise—organizations that fail to implement advanced fraud detection risk significant financial losses and reputational damage. PostAffiliatePro’s roadmap includes advanced capabilities like behavioral biometrics, enhanced device fingerprinting, and predictive fraud modeling that will further strengthen fraud prevention. The industry evolution toward more sophisticated fraud detection is inevitable, and PostAffiliatePro is positioned to lead this transformation, ensuring your program remains protected against both current and emerging threats.

Fraud protection is no longer optional for serious affiliate programs—it’s a critical business requirement that directly impacts your bottom line and program integrity. PostAffiliatePro’s cross-verification of orders technology provides the advanced fraud detection capabilities that modern affiliate programs require, combining machine learning sophistication with practical ease of use. By implementing PostAffiliatePro’s fraud protection enhancement, you gain the ability to detect sophisticated fraud schemes that traditional systems miss, dramatically reduce false positives that damage affiliate relationships, and protect your program from the financial impact of undetected fraud. The benefits extend beyond fraud prevention—improved program integrity attracts higher-quality affiliates, reduces payment disputes, and strengthens your program’s reputation in the affiliate marketing community. The time to act is now—every day without advanced fraud protection exposes your program to significant risk. Contact PostAffiliatePro today to schedule a demonstration of our fraud protection technology and discover how cross-verification can transform your affiliate program’s security posture. Protect your program, protect your affiliates, and protect your revenue with PostAffiliatePro’s industry-leading fraud detection solution.

Cross-verification is an advanced fraud detection technique that correlates orders with the same commission type to identify patterns and networks of fraudulent activity. Unlike traditional systems that analyze individual orders in isolation, cross-verification examines relationships between multiple orders to detect sophisticated fraud schemes that would otherwise go undetected.

PostAffiliatePro combines AI-powered behavioral analysis with real-time risk scoring to achieve a 15-20% false positive rate compared to competitors' 40-60%. The system detects fraud in sub-seconds, continuously learns from new threats, and provides advanced correlation capabilities that identify fraud networks and coordinated schemes.

Cross-verification effectively detects click fraud, cookie stuffing, fake leads, multi-account fraud networks, commission type targeting, gradual escalation schemes, and coordinated fraud rings. The system identifies both obvious fraud attempts and sophisticated schemes designed to evade traditional detection methods.

PostAffiliatePro's cross-verification system detects fraud in sub-seconds, enabling real-time intervention before fraudulent orders complete processing. This is dramatically faster than traditional systems that typically require hours or days to flag suspicious activity, allowing you to prevent fraud before commissions are paid.

Yes, significantly. PostAffiliatePro's cross-verification system reduces false positive rates to 15-20% compared to traditional systems' 40-60%. This means your team spends far less time investigating legitimate transactions and can focus resources on genuine fraud threats, improving both efficiency and affiliate relationships.

PostAffiliatePro uses machine learning models that continuously analyze fraud patterns and adapt to emerging threats. The system learns from confirmed fraud cases, incorporates threat intelligence from across the industry, and automatically refines its detection algorithms without requiring manual rule updates.

Yes, PostAffiliatePro's cross-verification technology scales effectively for programs of all sizes. Small programs benefit from automated fraud detection that would be impossible to implement manually, while larger programs gain enterprise-grade protection that handles millions of transactions daily.

All commission types benefit from cross-verification, but the system is particularly effective at detecting fraud targeting high-value commission types. Fraudsters often focus on specific commission structures, and cross-verification identifies these targeting patterns by analyzing commission type distribution across your affiliate network.

PostAffiliatePro's intelligent fraud protection system uses cross-verification technology to detect and prevent sophisticated fraud schemes in real-time. Strengthen your affiliate program's security today with AI-powered anomaly detection and real-time risk scoring.

Fraud protection system in Post Affiliate Pro monitors all transactions generated in the system. It automatically declines fraudulent transactions.

Discover the latest fraud protection improvements in Post Affiliate Pro, including campaign-specific secret keys, IP filters, click fraud detection, and advance...

Learn proven strategies to prevent affiliate fraud in 2025. Discover monitoring techniques, fraud detection tools, and best practices to protect your affiliate ...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.