Affiliate Program ROI Calculator

Calculate the return on investment for your affiliate program. Evaluate cost-effectiveness, compare with other marketing channels, and understand your break-even point. Includes advanced metrics like customer lifetime value and channel comparison.

Calculate Your Affiliate Program ROI

📊 Understanding Affiliate Program Profitability

Return on Investment (ROI) measures how much profit your affiliate program generates relative to costs. An ROI of 100% means you’re doubling your money—earning $2 for every $1 spent. Higher ROI indicates more efficient marketing spend.

Cost Per Acquisition (CPA) is your total cost to acquire one customer through affiliates, including commissions and program overhead. Compare your affiliate CPA to PPC, social ads, and other channels to identify your most cost-effective customer acquisition method.

Break-Even Point shows the minimum sales volume needed to cover fixed program costs (platform, staff, creative). Understanding this helps you set realistic targets and evaluate program viability during launch phase.

💡 Maximizing Your Program ROI

Use this calculator before launching your affiliate program to model different commission structures and cost scenarios. Test the impact of increasing commission rates to attract top affiliates—sometimes higher commissions yield better ROI by driving more volume at lower CPA than paid ads.

Compare your affiliate CPA to other channels. If PPC costs $75 per customer and affiliates cost $40, redirecting budget to affiliate recruitment and higher commissions may deliver better overall returns. Factor in customer lifetime value for subscription or repeat-purchase businesses—a $50 CPA is excellent if customers generate $500 lifetime revenue.

Monitor break-even monthly. As your program grows and you recruit more affiliates, economies of scale improve—fixed costs (platform, staff time) get distributed across more sales, lowering per-customer costs and improving ROI. Programs that appear marginal at 20 sales/month often become highly profitable at 200 sales/month.

🎯 When to Invest in Affiliate Marketing

Affiliate marketing typically delivers better ROI than paid advertising for:

- E-commerce businesses with strong product-market fit and 30%+ margins

- SaaS companies seeking predictable customer acquisition costs

- Digital product sellers with affiliate-friendly content and high AOV

- Subscription businesses where CLV justifies higher upfront acquisition costs

- B2B services leveraging partner networks for warm referrals

Poor candidates for affiliate marketing: ultra-low-margin products (unless commission-based pricing works), heavily regulated industries with complex compliance, businesses without proper tracking infrastructure, or programs unable to provide competitive commissions vs. alternatives.

Frequently asked questions

- How is affiliate program ROI calculated?

ROI is calculated as (Net Profit / Total Costs) × 100. Net profit = revenue from affiliate sales minus all program costs (commissions, platform fees, staff time, creative costs). For example, if you spend $1,000/month on your program and generate $2,500 in profit, your ROI is 150%. This means you're earning $1.50 for every dollar spent.

- What costs should I include in affiliate program ROI?

Include all program-related costs: affiliate commissions (percentage or fixed per sale), tracking software/platform fees, staff time spent managing affiliates and reviewing applications, creative assets (banners, landing pages, promotional materials), affiliate bonuses or incentives, and training resources. Don't forget indirect costs like legal review of terms or payment processing fees.

- What is a good ROI for affiliate marketing?

ROI over 100% is profitable (earning more than you spend). 50-100% ROI is acceptable for new programs building momentum. 100-200% ROI is good for established programs. 200%+ ROI is excellent. However, context matters: low-margin businesses may accept lower ROI if affiliate marketing has better ROI than alternatives like PPC. High-ticket B2B programs often achieve 300%+ ROI.

- How does affiliate marketing ROI compare to PPC?

Affiliate marketing typically offers better ROI than PPC for several reasons: you pay only for results (not clicks), affiliates provide content and SEO value beyond the sale, customer acquisition costs are predictable, and top affiliates have established audiences with higher trust. PPC CPA ranges from $50-$200+ in competitive niches, while affiliate CPA often runs $20-$80 depending on commission structure.

- What is Cost Per Acquisition (CPA) in affiliate marketing?

CPA is the total cost to acquire one customer through your affiliate program. It includes commissions paid to the affiliate plus your share of fixed costs (platform, staff, creative) divided by sales volume. Lower CPA means more efficient spending. Compare your affiliate CPA to other channels (PPC, social ads, content marketing) to determine which delivers customers most cost-effectively.

- How do I calculate break-even for my affiliate program?

Break-even point is the minimum sales needed to cover fixed costs (platform, staff, creative) after accounting for variable costs (commissions). Formula: Break-even sales = Fixed Monthly Costs / (Average Order Value - Commission Per Sale). For example, with $500 fixed costs, $100 AOV, and $10 commission, you need $500 / ($100 - $10) = 6 sales to break even. Sales beyond this generate profit.

- Should I include customer lifetime value in ROI calculations?

Yes, especially for subscription businesses or products with repeat purchases. Standard ROI only measures first-sale profit, but CLV shows long-term value. If a customer acquired for $50 generates $500 lifetime revenue, your true ROI is much higher than first-sale ROI suggests. This justifies higher initial acquisition costs and more competitive commission rates to attract top affiliates.

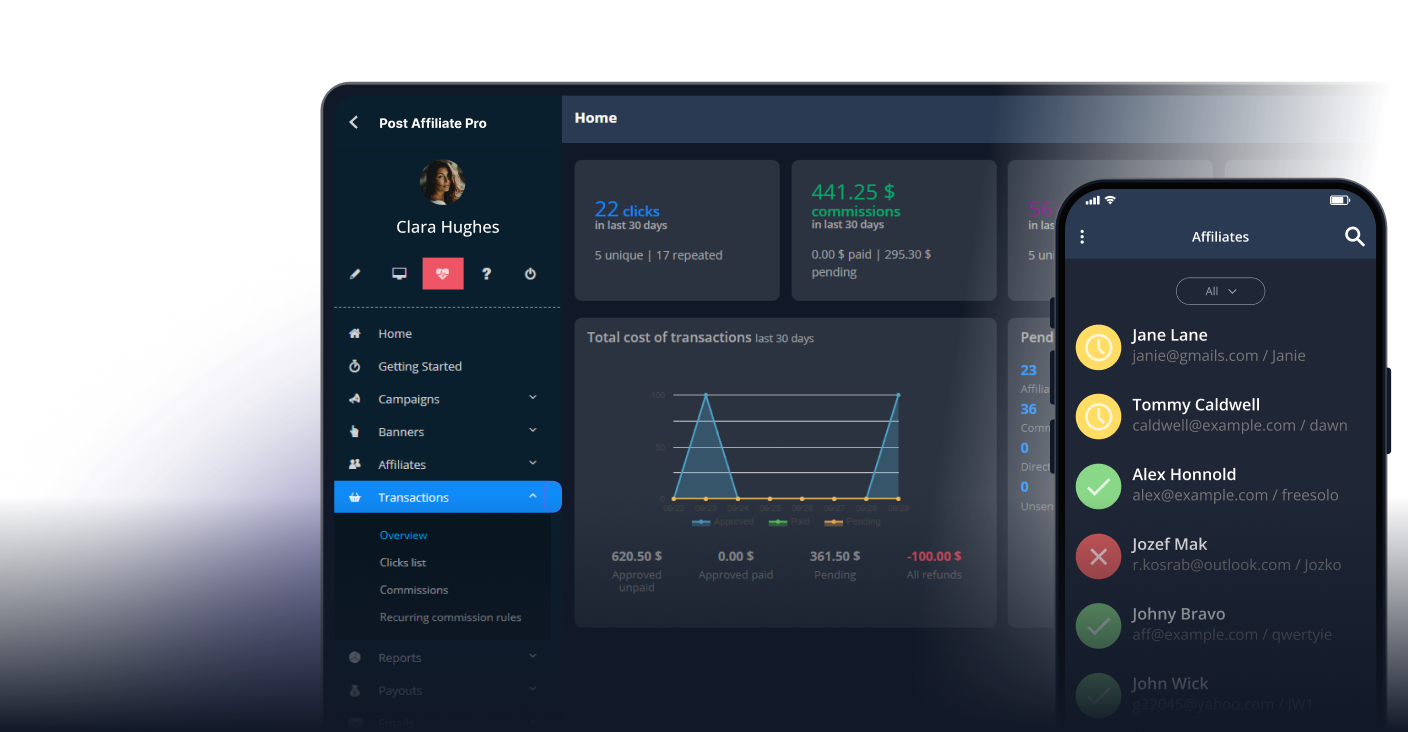

The leader in Affiliate software

Manage multiple affiliate programs and improve your affiliate partner performance with Post Affiliate Pro.