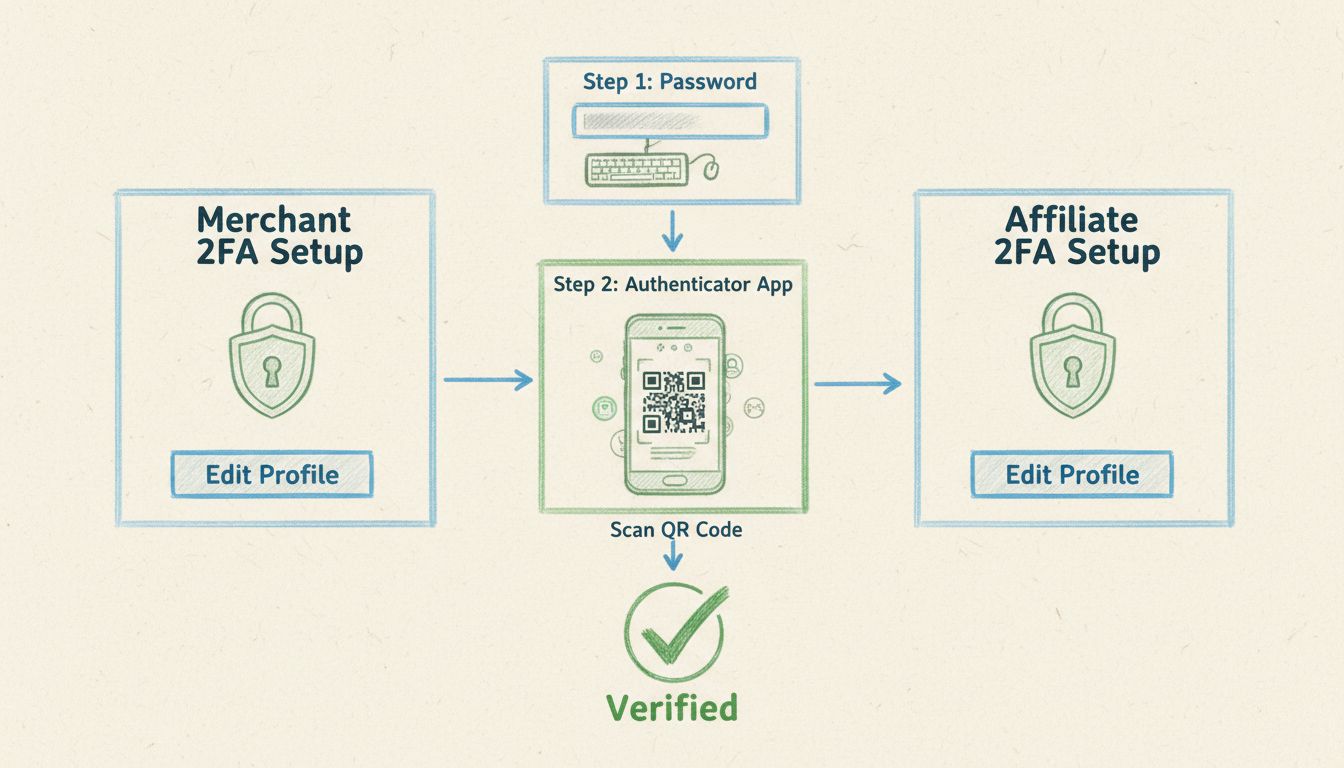

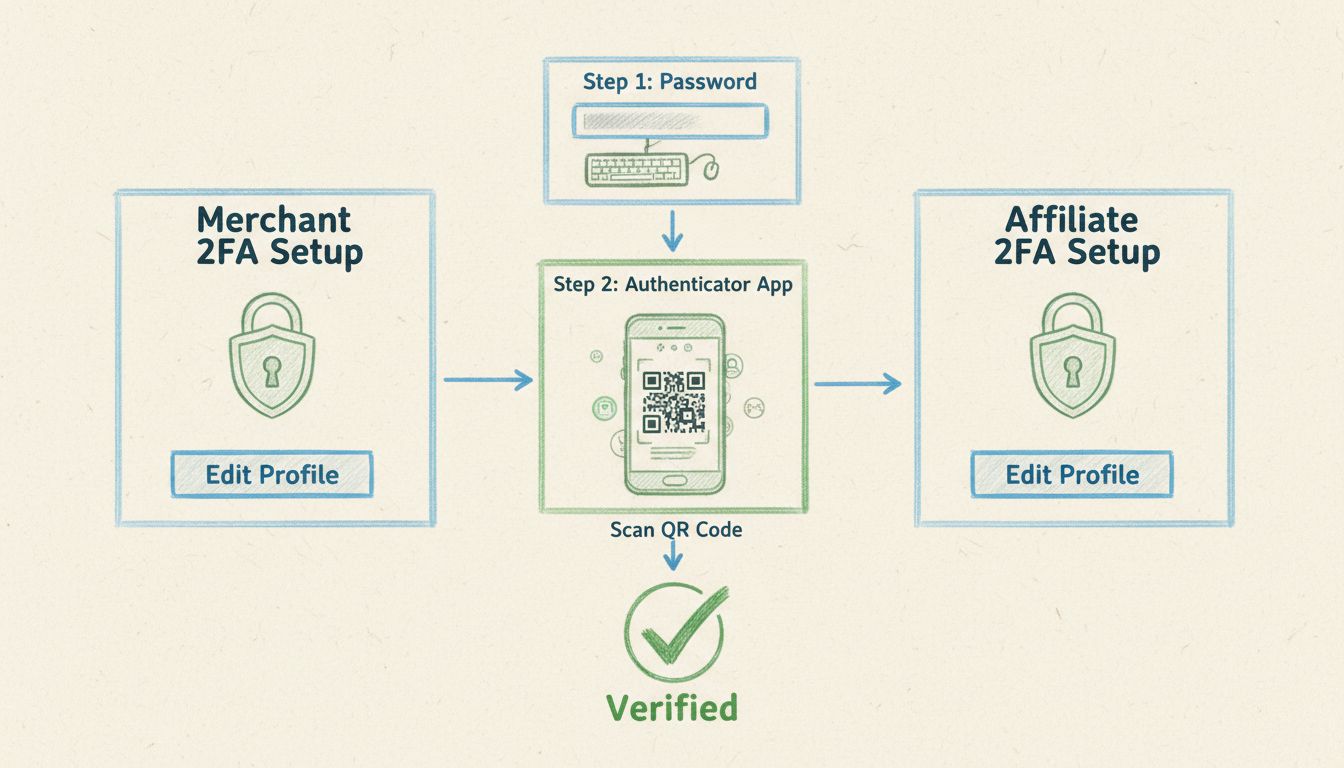

2-Step Verification for Merchants and Affiliates: Complete Setup Guide

Learn how to enable 2-step verification (2FA) for both merchants and affiliates in Post Affiliate Pro. Secure your account with authentication apps, understand ...

Complete guide to documents needed when applying to affiliate networks. Learn about identity verification, tax documentation, and website verification.

Government-issued identification forms the cornerstone of affiliate network verification, serving as the primary proof that you are who you claim to be. Most affiliate networks require a valid passport, driver’s license, or national identification card that clearly displays your full legal name, date of birth, and photograph. Beyond government ID, networks also mandate proof of your current residential address, which can be satisfied through recent utility bills, bank statements, or official government letters dated within the last three months. These identity verification requirements exist for critical reasons: they prevent fraudulent applications, protect the network from liability, ensure regulatory compliance with anti-money laundering (AML) regulations, and maintain the integrity of the entire affiliate ecosystem. The timeline for document validity is strict—most networks require government-issued IDs to be valid for at least six months beyond your application date, and address proof must be current within 90 days. Submitting expired or outdated documents will result in automatic rejection and may require reapplication.

Accepted Identity Documents by Type:

| Document Type | Accepted | Validity Period | Requirements |

|---|---|---|---|

| Passport | Yes | 6+ months remaining | Must show full name, DOB, photo |

| Driver’s License | Yes | 6+ months remaining | Must be government-issued, not expired |

| National ID Card | Yes | 6+ months remaining | Government-issued, clear photo required |

| Utility Bill | Yes | Within 90 days | Must show name and current address |

| Bank Statement | Yes | Within 90 days | Must display account holder name and address |

| Government Letter | Yes | Within 90 days | Tax notice, voter registration, or official correspondence |

| Voter Registration | Yes | Within 90 days | Must show current address and full name |

| Lease Agreement | No | N/A | Not accepted as primary address proof |

| Credit Card Statement | No | N/A | Too easily falsified, not accepted |

| Handwritten Documents | No | N/A | Must be official, printed documents |

Tax documentation represents one of the most critical components of your affiliate network application, particularly if you’re operating from the United States or earning income from U.S.-based networks. U.S. citizens and permanent residents must complete a W-9 form (Request for Taxpayer Identification Number and Certification), which requires either your Social Security Number (SSN) if you’re a sole proprietor or your Employer Identification Number (EIN) if you’ve established a business entity such as an LLC or corporation. The distinction between SSN and EIN is important: an SSN is assigned to individuals, while an EIN is a nine-digit number issued by the IRS to business entities and provides additional liability protection. International applicants must submit a W-8BEN form instead, which certifies your foreign tax status and prevents unnecessary U.S. tax withholding on your affiliate commissions. Your tax identification information must match exactly with your legal name and address as they appear on your government-issued identification documents—any discrepancies will trigger manual review and potentially delay your approval by 5-10 business days. Accuracy in tax documentation is non-negotiable because networks are legally required to report affiliate earnings to the IRS, and mismatched information creates compliance issues for both you and the network.

Tax Documentation Requirements by Country/Region:

| Country/Region | Tax Form Required | Tax ID Type | Additional Requirements |

|---|---|---|---|

| United States | W-9 | SSN or EIN | Must match legal name exactly |

| Canada | W-8BEN | Social Insurance Number (SIN) | Proof of Canadian residency |

| United Kingdom | W-8BEN | Unique Taxpayer Reference (UTR) | Self-Assessment Tax Reference |

| Australia | W-8BEN | Tax File Number (TFN) | ABN for business entities |

| European Union | W-8BEN | VAT Number (if applicable) | Country-specific tax ID |

| India | W-8BEN | PAN (Permanent Account Number) | Aadhaar card as backup |

| Japan | W-8BEN | My Number (Individual Number) | Resident registration certificate |

| Mexico | W-8BEN | RFC (Federal Taxpayer Registry) | CURP identification number |

| Brazil | W-8BEN | CPF (Individual) or CNPJ (Business) | Proof of Brazilian residency |

| Singapore | W-8BEN | NRIC or FIN | Tax residency certificate |

Affiliate networks require verified bank account information to process your commission payments accurately and securely, making this documentation essential for successful fund transfers. You’ll need to provide your complete bank account number, routing number (for U.S. banks), SWIFT code (for international transfers), and the exact name of the account holder, which must match your legal name precisely as it appears on your government-issued identification. Many networks, particularly Awin and Impact.com, implement a micro-deposit verification system where they deposit a small amount (typically £1, €1, or $1 USD) into your account, which you must confirm within a specified timeframe to verify account ownership and prevent fraudulent payment claims. This verification process adds a critical security layer that protects both you and the network from unauthorized access or account takeover attempts. All bank account information is encrypted using SSL/TLS encryption standards and stored securely according to PCI DSS (Payment Card Industry Data Security Standard) compliance requirements, ensuring your sensitive financial data remains protected from unauthorized access. Accuracy in payment information is absolutely critical because even minor discrepancies—such as a middle initial missing or a hyphenated name formatted differently—can cause payment processing failures, resulting in delayed commissions and potential account suspension until the issue is resolved.

If you’re applying as a content creator, blogger, or website owner, affiliate networks will conduct thorough evaluations of your website’s quality, traffic volume, content originality, and overall professionalism before approving your application. Minimum traffic requirements vary significantly across networks—some networks like ClickBank accept new sites with minimal traffic, while others like Rakuten require 10,000+ monthly visitors, and most mainstream networks fall somewhere in between with 1,000-5,000 monthly visitor requirements. Your website must feature original, high-quality content that demonstrates genuine expertise in your niche, with networks using automated plagiarism detection tools to identify copied content, thin pages with minimal value, or AI-generated material that lacks authenticity. Networks evaluate SSL certification (HTTPS), mobile responsiveness, and page load speed as fundamental technical requirements—websites without HTTPS encryption or that fail to display properly on mobile devices face automatic rejection regardless of content quality. The content quality assessment process involves both automated scanning and manual review by affiliate managers who assess whether your content aligns with advertiser brands, maintains professional standards, and demonstrates the ability to promote products authentically without misleading your audience. For example, a fitness blog with 50+ original articles about workout routines, nutrition science, and equipment reviews will receive faster approval than a newly created site with 5 generic pages, even if both receive similar monthly traffic.

For influencers and social media creators, affiliate networks implement sophisticated verification processes that go far beyond simply checking follower counts, examining engagement metrics, account authenticity, and audience demographics to ensure you can deliver genuine promotional value. Networks analyze your follower count, engagement rate (likes, comments, shares relative to follower count), posting frequency, and account age across platforms like Instagram, TikTok, YouTube, and Twitter to establish a baseline of legitimacy and audience interaction. Your audience demographics are carefully analyzed to ensure alignment with advertiser brands—a fashion influencer with 50,000 highly engaged followers in your target market is far more valuable than someone with 500,000 followers from unrelated demographics. Networks employ sophisticated fake follower detection algorithms that identify accounts with suspicious engagement patterns, such as sudden follower spikes, engagement from bot accounts, or engagement rates that don’t align with follower count (a red flag for purchased engagement). Platform-specific requirements vary significantly—YouTube requires channels to have at least 1,000 subscribers and 4,000 watch hours in the past 12 months, TikTok typically requires 5,000+ followers with consistent engagement, and Instagram focuses on engagement rate rather than absolute follower count. Your social media accounts should demonstrate consistent activity with professional bios, clear niche focus, and authentic audience interaction through meaningful comments and shares rather than generic emoji responses, as networks recognize that authentic engagement drives actual conversions and sales.

If you’re operating as a formal business entity rather than a sole proprietor, affiliate networks require comprehensive business registration and compliance documentation to verify your legitimacy and ensure you’re operating within legal frameworks. Business license requirements vary by jurisdiction—you’ll need to provide your current business license issued by your local or state government, which must be active and in good standing. Articles of incorporation (for corporations) or articles of organization (for LLCs) serve as proof that your business entity is legally established and registered with your state’s Secretary of State office. For business entities, you must provide your Employer Identification Number (EIN) documentation from the IRS, which establishes your business as a separate tax entity and is required for payroll and tax reporting purposes. Business address proof must be provided, which can be a commercial lease, utility bill in the business name, or official government correspondence addressed to your business location. Networks also require compliance declarations where you confirm your understanding and commitment to FTC (Federal Trade Commission) disclosure requirements, which mandate that you clearly disclose affiliate relationships to your audience using language such as “This post contains affiliate links” or “I earn commissions from qualifying purchases.” These compliance declarations are non-negotiable because FTC violations can result in significant penalties affecting both individual affiliates and the entire network, making networks extremely cautious about ensuring all affiliates understand their legal obligations before approval.

Key Compliance Requirements:

Understanding how different affiliate networks compare in their documentation requirements, approval timelines, and minimum thresholds helps you strategically target applications to networks most likely to approve your profile. The following comprehensive comparison demonstrates the significant variations in requirements across the industry’s leading platforms:

| Network Name | Approval Timeline | Minimum Traffic | Tax Documentation | Identity Verification | Website Required |

|---|---|---|---|---|---|

| PostAffiliatePro | 3-5 days | Flexible/None | W-9/W-8BEN | Government ID + Address | Optional |

| Awin | 5-10 days | 1,000+ visitors/month | W-9/W-8BEN | Government ID + Address + Micro-deposit | Required |

| CJ Affiliate | 3-7 days | Varies by program | W-9/W-8BEN | Government ID + Address | Required |

| ClickBank | 1-3 days | Minimal/None | W-9/W-8BEN | Government ID only | Optional |

| Impact.com | 5-10 days | 5,000+ visitors/month | W-9/W-8BEN | Government ID + Address + Verification | Required |

| Rakuten | 7-14 days | 10,000+ visitors/month | W-9/W-8BEN | Government ID + Address + Detailed review | Required |

PostAffiliatePro stands out as the most flexible and fastest-approving platform, offering streamlined verification processes that typically complete within 3-5 business days while maintaining rigorous security standards. The platform’s advanced compliance tools help both networks and affiliates maintain regulatory adherence without unnecessary friction, making it the preferred choice for affiliates seeking quick approval without compromising on security. PostAffiliatePro’s flexible approach to minimum traffic requirements makes it ideal for new content creators and emerging influencers who haven’t yet built substantial audiences but demonstrate genuine commitment to affiliate marketing. The platform’s sophisticated verification system balances speed with security, using automated checks for basic compliance while reserving manual review for edge cases, resulting in faster approvals without sacrificing fraud prevention.

Understanding why affiliate network applications get rejected allows you to proactively address potential issues before submission, significantly improving your approval chances. Incomplete or inconsistent information represents the most common rejection reason—if your name differs between documents (such as “John Smith” on your ID but “J. Smith” on your tax form), your contact details don’t match across fields, or you leave required fields blank, your application will be flagged for manual review and likely rejected. Low-quality or copied website content triggers automatic rejection because networks want to ensure affiliates will create authentic, valuable content that reflects positively on advertiser brands; plagiarism detection tools identify copied content, and thin pages with minimal original material are immediately rejected. Suspicious activity patterns such as multiple applications from the same person using different email addresses, unusually high traffic spikes that don’t align with your account history, or engagement patterns that suggest bot activity trigger fraud detection systems and result in rejection. Prohibited content categories including adult material, illegal products, weapons, counterfeit goods, or hate speech result in immediate rejection regardless of application quality. Unverified payment methods or mismatched bank account holder names cause payment-related rejections because networks cannot process commissions to accounts that don’t match your verified identity. Failure to respond to verification requests within the specified timeframe (typically 7-14 days) results in automatic application denial, as networks interpret non-response as lack of genuine interest or inability to meet basic communication requirements.

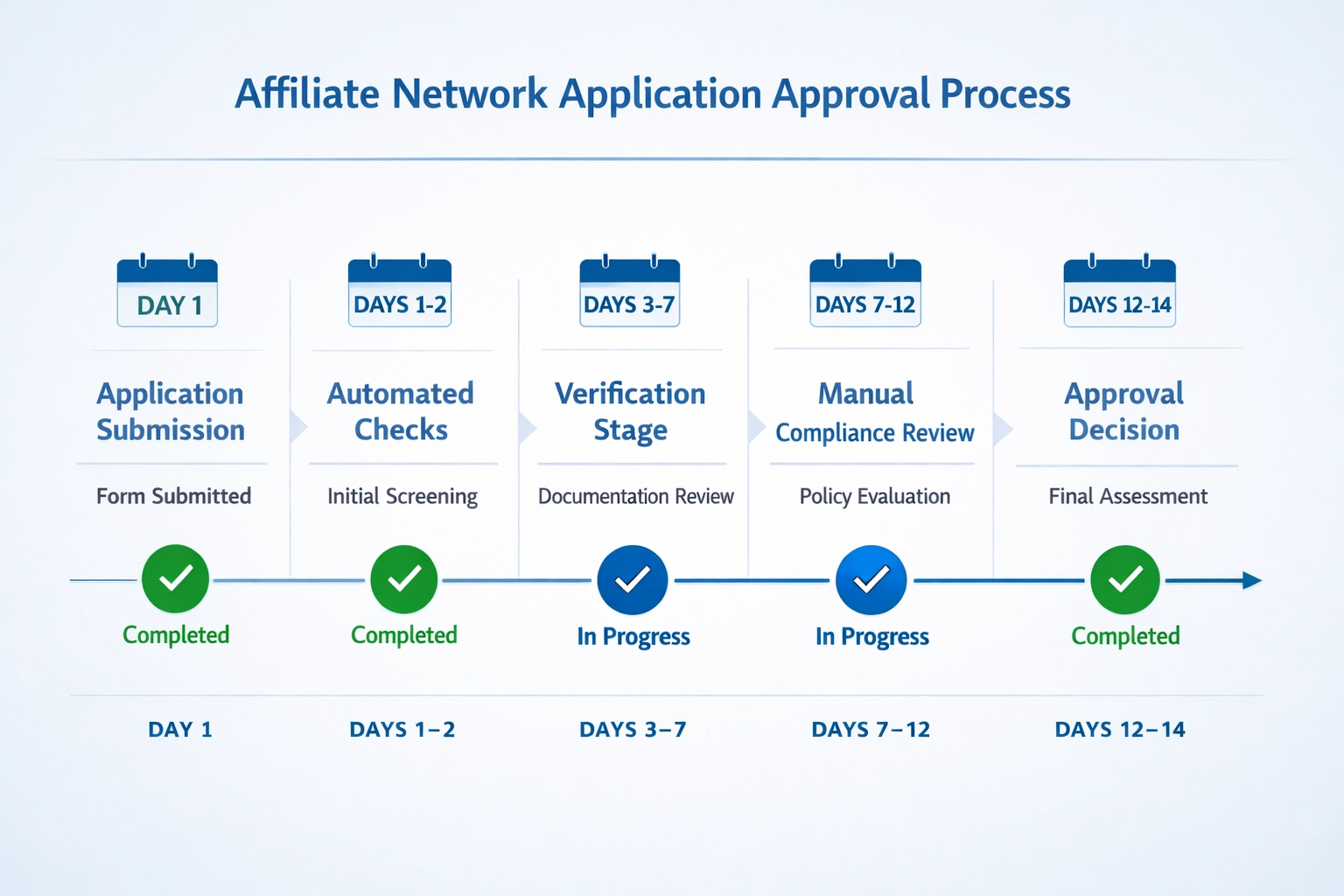

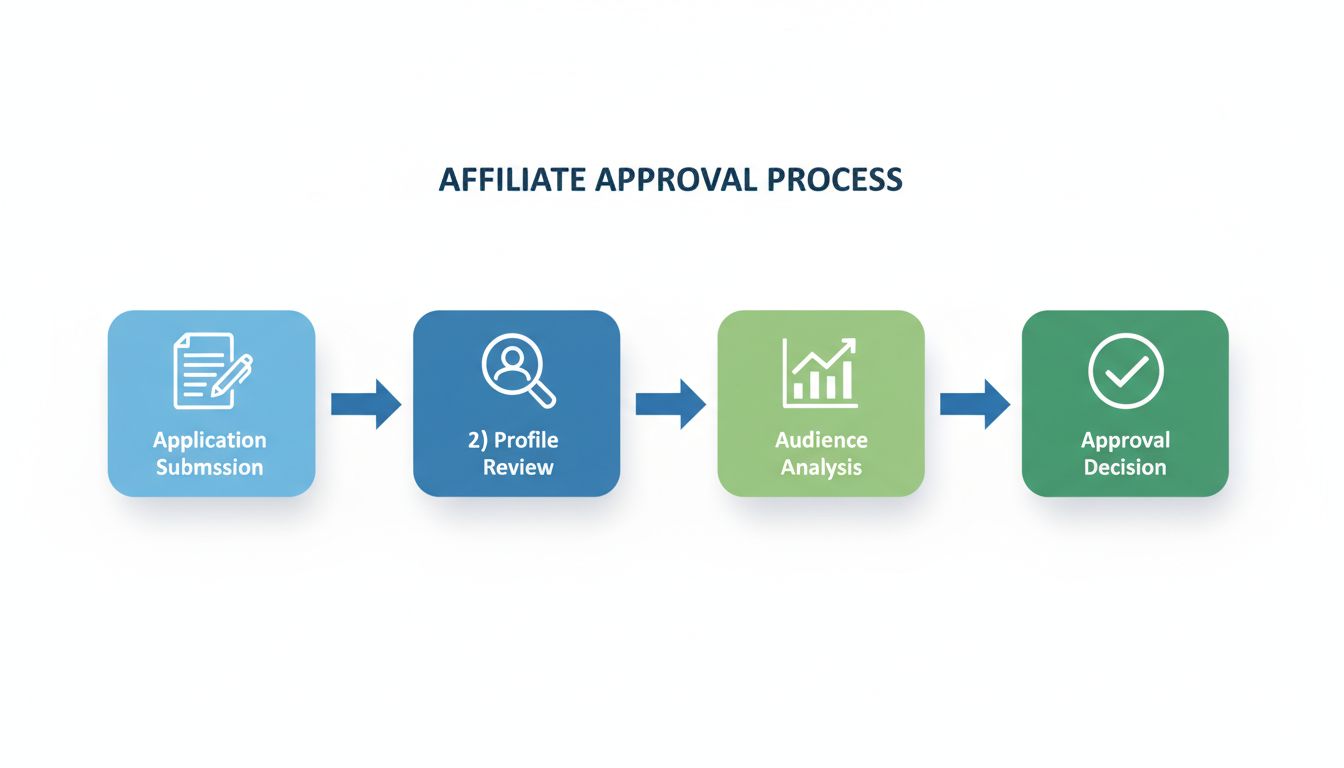

The typical affiliate network application process takes between 5 to 14 business days from submission to final approval decision, though this timeline varies significantly based on network policies, application complexity, and how quickly you respond to verification requests. Your application first undergoes automated checks for completeness and basic compliance, which typically completes within 1-2 business days and screens for missing information, obviously fraudulent details, or prohibited content categories. The verification stage, lasting 3-7 business days, involves identity confirmation through document review, website quality assessment, traffic verification through analytics tools, and social media account authentication. Manual compliance review by the network’s dedicated team takes an additional 2-5 business days, during which affiliate managers assess your promotional methods, evaluate niche alignment with available programs, and make the final approval decision. Factors that accelerate approval include complete and accurate information with no discrepancies, an established website with consistent traffic history spanning 6+ months, clear niche focus that aligns with multiple advertiser brands, and quick responses to any verification requests or additional information requests. Factors that delay approval include newer websites with limited traffic history, incomplete information requiring follow-up requests, additional verification needs due to flagged patterns, or slow response times to network inquiries. Some networks like ClickBank approve applications within 1-3 days due to minimal requirements, while others like Rakuten may take up to 14 days due to rigorous traffic verification and compliance review. PostAffiliatePro’s streamlined verification system typically processes applications within 3-5 business days, making it one of the fastest platforms available while maintaining enterprise-grade security standards.

Preparing your application thoroughly before submission maximizes your approval chances and demonstrates professionalism to affiliate managers. Here are the essential best practices for successful affiliate network applications:

Prepare documents in advance: Gather all required documents at least one week before applying, ensuring government-issued ID is valid for at least six months and address proof is dated within three months.

Use consistent legal names: Ensure your legal name appears identically across all documents—government ID, tax forms, bank account information, and application fields; even minor variations like middle initials or hyphenated names formatted differently will trigger manual review.

Complete all required fields: Never leave blank spaces in application forms; incomplete submissions are immediately rejected as they suggest lack of seriousness or inability to follow basic instructions.

Write a professional application description: Craft a compelling 150-300 word description of your niche, target audience, promotional methods, and why you’re interested in specific programs; this demonstrates you’ve researched the network and have genuine promotional plans.

Prepare your website thoroughly: If applying as a content creator, ensure your website has at least 10-20 high-quality, original articles before submission; a professional design with clear navigation, proper SSL certification, and mobile responsiveness is essential.

Build consistent traffic: Establish 3-6 months of consistent traffic history before applying; networks view established traffic patterns as proof of legitimacy, while sudden traffic spikes appear suspicious.

Respond promptly to requests: When networks request additional information or verification, respond within 24-48 hours; slow responses suggest disinterest and may result in application denial.

Verify payment information accuracy: Double-check that your bank account number, routing number, and account holder name are 100% accurate; even single-digit errors prevent payment processing.

Ensure FTC compliance: Review your website and promotional materials to confirm they include clear affiliate disclosures; networks verify compliance before approval.

Research program alignment: Apply only to programs whose products genuinely align with your content and audience; misaligned applications are rejected even if your profile is otherwise strong.

International affiliates face slightly different documentation requirements depending on their country of residence, tax status, and the specific networks they’re applying to, making it essential to understand your jurisdiction’s unique requirements. Non-U.S. applicants must complete a W-8BEN form instead of a W-9, which certifies your foreign tax status and prevents unnecessary U.S. tax withholding on your affiliate commissions—this form is required by U.S. tax law and must be submitted before you can receive payments from U.S.-based networks. Different countries have varying tax identification requirements that networks must collect for compliance purposes: the United Kingdom requires a UTR (Unique Taxpayer Reference), Canada requires a Social Insurance Number (SIN), Australia requires a Tax File Number (TFN), India requires a PAN (Permanent Account Number), and EU countries may require VAT numbers if you’re operating as a business entity. Some networks have geographic restrictions and may not accept applications from certain countries due to regulatory complexity, payment processing limitations, or sanctions considerations—always verify that your chosen network accepts applicants from your country before investing time in the application. Currency and payment method options vary significantly by network and country—some networks offer payments in multiple currencies while others only pay in USD, and payment methods range from bank transfers to PayPal to local payment processors depending on your location. Language requirements typically mandate English proficiency for communication and compliance purposes, as networks need to ensure you can understand terms of service, compliance requirements, and communication from affiliate managers. International applicants should verify their country’s specific requirements with the network’s support team before applying to prevent delays caused by missing country-specific documentation.

When submitting sensitive documents and personal information to affiliate networks, protecting your data security must be a top priority, requiring careful attention to encryption standards, document handling, and fraud prevention. Reputable networks use SSL/TLS encryption for all data transmission, indicated by the “https://” prefix in the URL and a padlock icon in your browser, ensuring that your information is encrypted during transmission and cannot be intercepted by unauthorized parties. Never submit original documents—always provide high-quality scans or photocopies of your government-issued ID, tax forms, and address proof; original documents can be lost, damaged, or misused, and networks only need copies for verification purposes. Be extremely cautious about sharing your Social Security Number or tax identification; legitimate networks only request this information through secure channels on their official website, never via email or unsecured forms. Verify that you’re submitting to the official network website by carefully checking the URL and bookmarking the official site to prevent accidental submission to phishing sites—scammers create fake affiliate network websites to steal personal information. Use strong, unique passwords for your affiliate account that include uppercase letters, lowercase letters, numbers, and special characters, and never reuse passwords across multiple accounts. Enable two-factor authentication if the network offers it, adding an extra security layer that prevents unauthorized access even if your password is compromised. Be wary of phishing emails claiming to be from affiliate networks requesting document resubmission or password verification; legitimate networks will never ask for sensitive information via email, and you should always navigate directly to the network’s website rather than clicking email links. PostAffiliatePro implements enterprise-grade security measures including advanced encryption, regular security audits, compliance with international data protection standards, and dedicated security teams that monitor for threats, ensuring your information remains confidential and secure throughout the verification process and beyond.

Government-issued identification is the foundation of any affiliate application. It serves as primary proof of identity and is required by all legitimate affiliate networks for fraud prevention and regulatory compliance. Without valid government ID, your application will be rejected regardless of other qualifications.

Most affiliate networks take 5-14 business days to approve applications, though this varies by network. PostAffiliatePro typically approves applications within 3-5 business days. The timeline includes automated checks (1-2 days), verification stage (3-7 days), and manual compliance review (2-5 days).

It depends on the network. Some networks like ClickBank and PostAffiliatePro don't require a website, while others like Rakuten and Impact.com require 5,000-10,000+ monthly visitors. Social media influencers can often apply without a website if they have sufficient followers and engagement.

International affiliates must complete a W-8BEN form instead of a W-9. Additionally, you'll need country-specific tax identification such as UTR (UK), SIN (Canada), TFN (Australia), PAN (India), or VAT numbers (EU). Requirements vary by country, so verify your jurisdiction's specific needs.

Networks require verified bank account information to process commission payments accurately and securely. Many networks use micro-deposit verification where they deposit a small amount into your account that you must confirm. This prevents fraudulent payment claims and ensures funds reach the correct account holder.

Common rejection reasons include incomplete or inconsistent information, low-quality or copied website content, suspicious activity patterns, prohibited content categories, unverified payment methods, and failure to respond to verification requests within the specified timeframe.

Prepare documents in advance, use consistent legal names across all documents, complete all required fields, write a professional application description, ensure your website has quality original content, build consistent traffic for 3-6 months, respond promptly to verification requests, and verify payment information accuracy.

Yes, PostAffiliatePro typically approves applications within 3-5 business days, making it one of the fastest platforms available. It also offers more flexible requirements than competitors like Awin (5-10 days), Impact.com (5-10 days), and Rakuten (7-14 days), while maintaining enterprise-grade security standards.

PostAffiliatePro makes it easy to manage your affiliate network with built-in verification tools, automated compliance checks, and streamlined onboarding. Start building your affiliate program today with the industry's leading platform.

Learn how to enable 2-step verification (2FA) for both merchants and affiliates in Post Affiliate Pro. Secure your account with authentication apps, understand ...

Make your account more secure with 2-step verification and prevent anyone from obtaining your sensitive information.

Learn how affiliates get approval for programs. Discover the complete approval process, requirements, best practices, and strategies to increase acceptance rate...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.