Profit Margin Calculator - Calculate Gross, Net & Operating Margins

Free profit margin calculator to analyze gross, net, and operating margins. Calculate profitability, optimize pricing strategies, and compare against industry b...

Understand the true financial impact of discounts on your profitability. Calculate margin erosion, required volume increases, and break-even scenarios to make smart promotional decisions that protect your bottom line.

Margin Erosion - Discounts reduce profit margins far more than they reduce prices. A 20% discount doesn’t mean 20% less profit - it often eliminates 50-70% of profit margins depending on your cost structure. This happens because discounts come entirely from profit, not from costs. If you have 30% margins and offer 15% discount, your margin drops to 15% - a 50% margin reduction. Understanding this relationship is critical before implementing any discount strategy.

Revenue vs. Profit - A common mistake is celebrating revenue increases from discounts while ignoring profit decreases. Selling 50% more units at 20% discount might increase revenue by 20% but could decrease profit by 40% or more. Track profit dollars, not just revenue dollars. Many businesses have grown revenue through aggressive discounting only to find themselves less profitable or even unprofitable despite higher sales volume.

Competitive Pressure - Once you establish a discount pattern, customers expect it and competitors may match or exceed it. This creates a race to the bottom where everyone discounts but no one gains lasting market share. Premium positioning and value communication often generate better long-term profitability than competing on price. Use discounts strategically and sparingly rather than as a default marketing tool.

Inventory Management - Use discounts to clear slow-moving, seasonal, or excess inventory. These tactical discounts serve a clear purpose: converting inventory to cash and freeing warehouse space. Calculate the cost of holding inventory (storage, insurance, obsolescence) versus margin erosion from discounts. Often, aggressive discounting to clear old inventory is more profitable than holding it while it depreciates or becomes obsolete.

Customer Acquisition - First-purchase discounts can be profitable when customer lifetime value exceeds acquisition cost. Calculate: if 30% of discounted first-time customers make repeat purchases at full price, and average customer generates $500 profit over lifetime, you can afford significant acquisition discounts. Track cohort profitability to ensure first-purchase discounts actually create profitable long-term customers rather than one-time bargain hunters.

Market Penetration - When entering new markets or launching new products, temporary discounts can accelerate trial and word-of-mouth. These growth-stage discounts are investments in market position, not pure profit activities. Set clear goals (number of customers, market share targets) and timelines for these strategic discounts. Plan the transition to full pricing carefully to avoid shocking customers with sudden price increases.

Segmentation and Targeting - Not all customers need discounts. Segment your audience and offer discounts only to price-sensitive segments while maintaining full pricing for value-oriented customers. Use targeted channels (email lists, retargeting) rather than public discounts visible to everyone. Offer different discount types to different segments: students, first-time buyers, bulk purchasers, loyalty members. Precision targeting improves ROI and protects margin.

Psychological Framing - How you present discounts affects perception and effectiveness. Percentage discounts (20% off) work better on lower-priced items. Dollar discounts ($50 off) work better on high-priced items. “Buy One Get One” feels more generous than 50% off despite being mathematically identical. “Limited time” and “While supplies last” create urgency. Frame discounts as special opportunities rather than standard practice to maintain value perception.

Instead of reducing price, add value: free shipping, free gift with purchase, extended warranty, free installation, or bonus products. These alternatives preserve price integrity while providing tangible benefits. Value-adds often cost you less than equivalent discounts (especially if using excess inventory as gifts) while being perceived as more valuable by customers. They also differentiate your offer from simple price-cutting competitors.

Offer discounts on product bundles rather than individual items. Bundles increase average order value, move slower inventory, and make price comparison with competitors difficult. A 15% bundle discount feels generous while maintaining better margins than 15% off individual products. Structure bundles to pair high-margin with lower-margin items, ensuring overall profitability even with the bundle discount applied.

Offer increasing discounts at higher volume thresholds: 5% off $100, 10% off $250, 15% off $500. This encourages larger purchases, increasing average order value while giving customers control over their discount level. Many customers will buy more to reach the next discount tier, improving both revenue and total profit. Set tiers based on your margin structure to ensure profitability at each level.

Short-duration flash sales (4-24 hours) create urgency and limit the total discounted volume. This generates excitement and quick action while preventing the extended margin erosion of week-long or month-long sales. Flash sales also give you frequent touchpoints with customers without training them to expect constant discounts. Vary the timing and products to maintain unpredictability and effectiveness.

Reward repeat customers with points, cashback, or tiered benefits rather than upfront discounts. This builds customer lifetime value, encourages repeat purchases, and gives you control over reward redemption timing. Loyalty programs also provide valuable customer data and segmentation opportunities. The deferred nature of rewards helps cash flow versus immediate discounts.

Require actions that provide value to you: email signup (builds list), social share (generates awareness), referral (acquires customers), review submission (builds social proof), or survey completion (provides insights). These “discounts with purpose” generate marketing assets that justify the margin sacrifice. The customer earns the discount rather than receiving it freely.

Sometimes the best discount strategy is not discounting at all. Raising base prices allows you to offer “discounts” that actually represent your original desired price. This maintains margin while giving customers the psychological benefit of a deal. Many successful brands maintain high list prices with regular “sales” that bring products to target price points while creating perception of value and urgency.

Distinguish between true clearance (never returning inventory) and promotional pricing (regular product on temporary discount). Clearance can justify deeper discounts because it’s one-time inventory liquidation. Promotional pricing requires more caution because it sets customer expectations. Clearly mark clearance items and communicate they’re final sale to prevent training customers to wait for discounts on regular inventory.

Consider offering price adjustment policies (refund difference if price drops within 30 days) instead of frequent sales. This reduces customer incentive to wait for discounts while maintaining pricing integrity. You control when prices change and limit the window of retroactive discounts. Most customers never claim price adjustments even when eligible, making this less costly than broad-based promotional discounts.

Provide affiliates with exclusive discount codes that create urgency and track attribution. These codes make affiliates feel valued and give them unique selling propositions. You can adjust affiliate discount levels based on partner tier, giving top performers better offers. This targeted approach ensures discounts go to qualified traffic rather than being publicly available, protecting margins while incentivizing promotion.

Discounts reduce profit margins far more dramatically than most businesses realize. A 20% discount doesn't reduce profit by 20% - it can eliminate 50% or more of your margin depending on your starting margin. Example: Product costs $60, sells for $100 (40% margin, $40 profit). A 20% discount ($80 sale price) leaves only $20 profit - a 50% margin reduction. Lower-margin businesses are hit even harder. This calculator shows exactly how discounts impact your specific margins.

Break-even volume increase is how many more units you must sell at the discounted price to match your original profit. Example: 40% margin product with 10% discount requires 33% more sales volume just to break even on profit. A 20% discount requires 100% more sales (double your volume). These volume increases are often unrealistic, meaning many discounts destroy profitability despite increasing revenue. Calculate break-even volume before offering discounts to ensure the promotion is financially viable.

Offer discounts when: you need to clear excess inventory, stimulate demand during slow periods, respond to competitive pressure, or acquire new customers (calculated customer lifetime value justifies acquisition cost). Avoid discounts when: margins are already thin, you're capacity-constrained (sell out anyway), brand positioning is premium, or customers don't have budget constraints. Alternative promotions: value-adds (free shipping, bonuses), bundles, loyalty rewards, or financing options. These alternatives preserve price integrity better than direct discounts.

The math is counterintuitive because discounts reduce per-unit profit, not just per-unit revenue. Example: 30% margin product with 10% discount sees margin drop to 16.7% (nearly halved). To maintain total profit, you must sell enough units at lower margin to compensate. The formula: Break-even volume increase = Discount % / (Original Margin % - Discount %). Lower margins and higher discounts create exponentially larger volume requirements, often making discounts unprofitable.

Strategies to discount profitably: 1) Discount high-margin products only (80%+ margins can support meaningful discounts), 2) Require minimum purchase amounts (preserve average order value), 3) Time-limited flash sales (create urgency, limit volume impact), 4) Tiered discounts (bigger discounts at higher volumes), 5) First-purchase discounts (justify by customer lifetime value), 6) Bundle discounts (move slower inventory, increase basket size), 7) Conditional discounts (email signup, social share - gain marketing value).

Safe discount percentage depends on your margin structure. High-margin businesses (70%+ margins like SaaS, digital products) can offer 20-50% discounts and remain profitable. Mid-margin businesses (40-60% margins) should limit discounts to 10-20%. Low-margin businesses (under 30% margins like retail, grocery) can rarely afford more than 5-10% discounts. Use this calculator with your actual numbers to find your safe discount range. Also consider whether realistic volume increases justify the discount.

Affiliates and discounts create complex dynamics: 1) Discounts increase conversion rates, benefiting affiliates (often more important than commission rate), 2) Exclusive affiliate discount codes drive attribution and increase affiliate promotion, 3) Deep discounts may squeeze margins, forcing commission rate reductions, 4) Regular discounts train customers to wait for sales, reducing full-price affiliate sales, 5) Premium positioning with rare discounts maintains higher commissions and stronger brand. Balance affiliate interests with margin protection.

Discounts are always calculated from price (the customer's perspective), not cost. A $100 product with 20% discount sells for $80, regardless of cost. However, profitability analysis must consider cost. If cost is $70, the $20 discount takes your profit from $30 to $10 - a 67% profit reduction. Many businesses make this mistake, thinking in terms of revenue impact rather than profit impact. Always calculate both the discount amount (from price) and profit impact (from margin) to understand true financial consequences.

Frequency depends on your positioning and goals. Premium brands: 1-2 major sales annually (Black Friday, end-of-season clearance). Mid-market brands: monthly or bi-weekly promotions with varying offers. Value brands: weekly deals or everyday low pricing. Risks of frequent discounts: customers delay purchases waiting for sales, erode perceived value, create discount dependency, attract only price-sensitive customers. Use scarcity (limited time, limited inventory) and variation (different products, different discount types) to maintain effectiveness without training customers to expect constant discounts.

Margin recovery strategies: 1) Upsell and cross-sell higher-margin products during checkout, 2) Offer post-purchase complementary products at full price, 3) Build customer lifetime value (first purchase discount justified by repeat purchases), 4) Capture email for future full-price marketing, 5) Establish subscriptions or recurring revenue, 6) Reduce acquisition costs (organic traffic, referrals) to improve net margin, 7) Gradually increase prices for new customers while honoring discount for existing customers. View discounted customer acquisition as investment in long-term profitability.

Manage multiple affiliate programs and improve your affiliate partner performance with Post Affiliate Pro.

Free profit margin calculator to analyze gross, net, and operating margins. Calculate profitability, optimize pricing strategies, and compare against industry b...

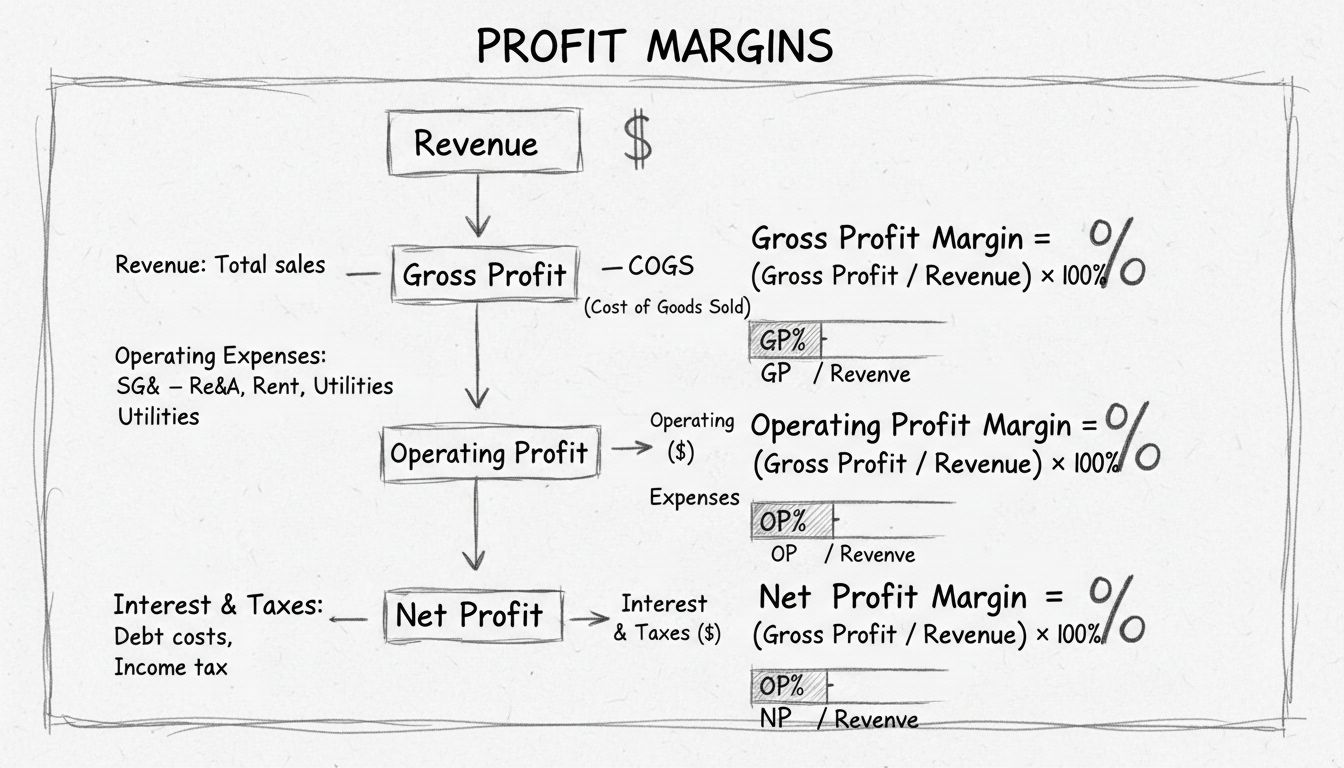

Discover the three main types of profit margins: gross, operating, and net. Learn how to calculate each, understand industry benchmarks, and optimize your busin...

Free break-even calculator to determine sales volume needed to cover costs. Plan pricing strategies, analyze profitability, and make informed business decisions...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.