What is Customer Lifetime Value? CLV Definition & Calculation Guide

Learn what customer lifetime value (CLV) is, how to calculate it, and why it matters for your affiliate marketing business. Discover strategies to increase CLV ...

Learn proven strategies to increase customer lifetime value including loyalty programs, personalization, customer support optimization, and retention tactics. Discover how PostAffiliatePro helps maximize CLV.

Increase customer lifetime value by developing strong customer relationships, providing exceptional customer service, implementing loyalty programs, personalizing customer experiences, collecting customer feedback, and using data-driven strategies to optimize retention and upselling opportunities.

Customer Lifetime Value (CLV), also known as Customer Lifetime Value or LTV, represents the total monetary worth a customer brings to your business throughout their entire relationship with your company. This metric is fundamentally different from one-time transaction value because it captures the complete picture of customer profitability over time. For example, a customer who makes an initial $200 purchase but returns quarterly for five years generates $4,000 in lifetime value—far exceeding their first transaction. Understanding CLV is essential for modern businesses because it directly influences how you allocate marketing budgets, structure customer retention programs, and make strategic business decisions. Unlike short-term metrics that only show immediate revenue, CLV provides insight into long-term business sustainability and helps identify which customer segments are most valuable to your organization.

The importance of CLV extends beyond simple revenue calculation. It serves as a strategic compass for your entire business operation, guiding decisions about customer acquisition costs, retention investments, and product development priorities. Companies that prioritize CLV typically enjoy higher profitability, stronger customer loyalty, and more predictable revenue streams. By understanding the true value of each customer relationship, you can make informed decisions about how much to spend acquiring new customers and how much to invest in keeping existing ones satisfied.

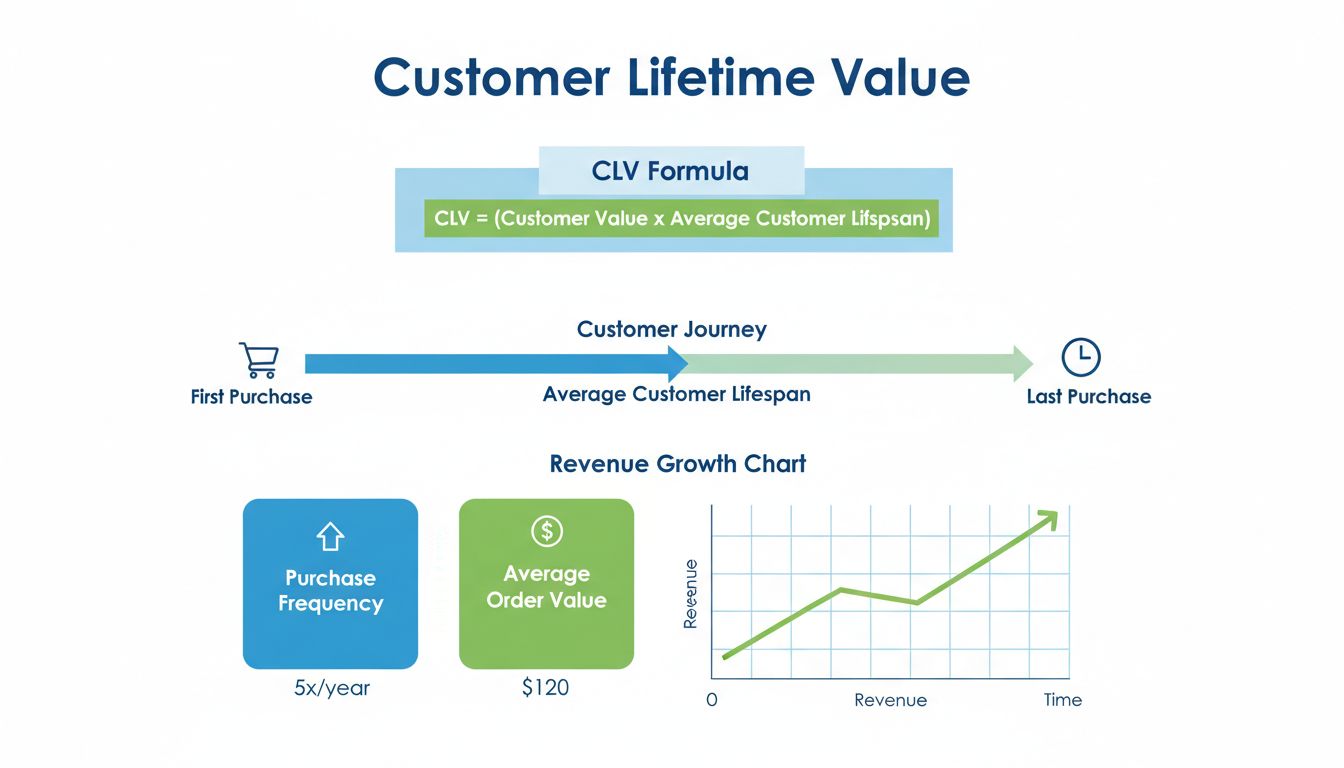

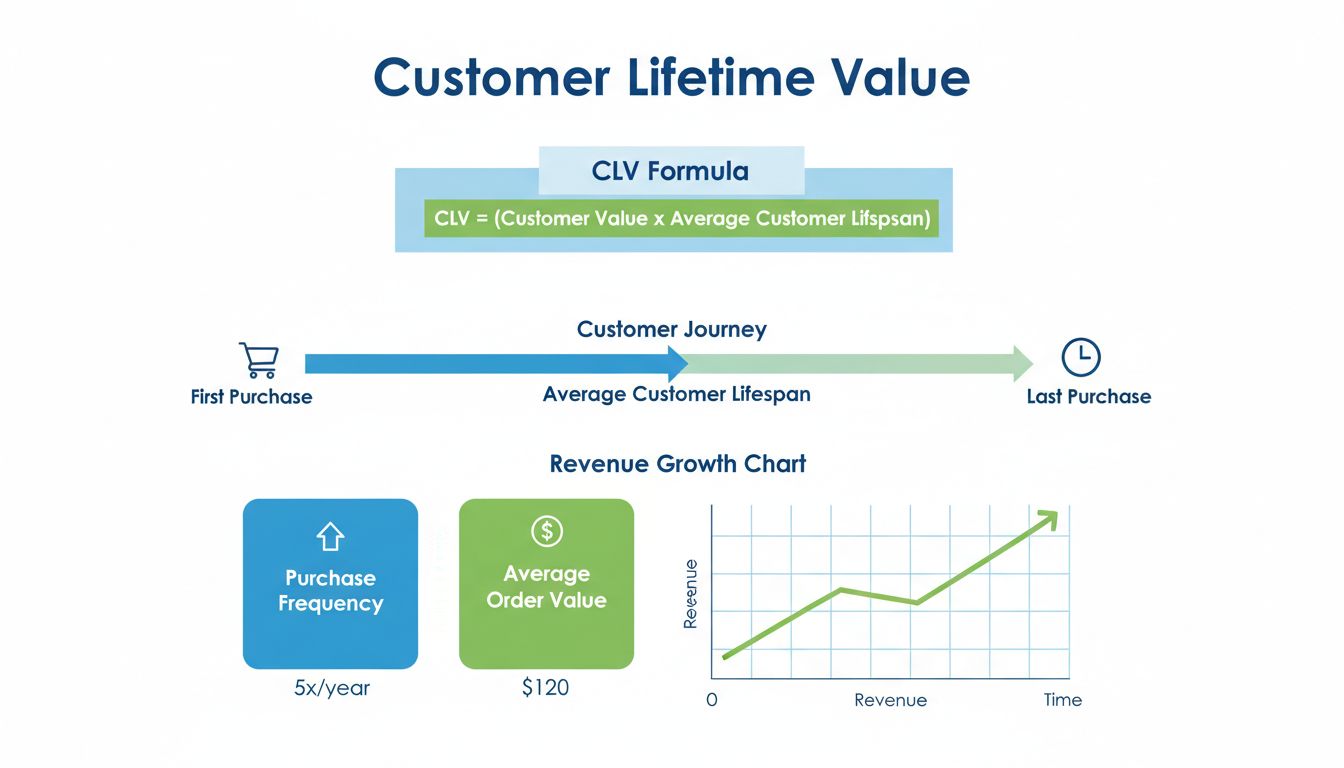

There are several established formulas for calculating customer lifetime value, each suited to different business models and data availability. The most straightforward approach is the Average Customer Lifespan Method: CLV = Average Customer Lifespan × Customer Value, where customer value equals average purchase value multiplied by purchase frequency. This method works well for businesses with consistent purchasing patterns and clear customer lifecycles. Another popular formula is the Revenue-Based Method: CLV = (Total Customer Revenue × Customer Margin) ÷ Churn Rate, which incorporates profitability and customer retention rates into the calculation. For more sophisticated analysis, the Comprehensive Method combines multiple factors: CLV = Average Value of Sale × Retention Period × Number of Transactions × Profit Margin. This approach provides the most detailed picture but requires more granular data collection.

| Calculation Method | Formula | Best For | Data Requirements |

|---|---|---|---|

| Average Lifespan | Lifespan × Customer Value | Simple businesses | Purchase history, frequency |

| Revenue-Based | (Revenue × Margin) ÷ Churn Rate | Subscription models | Revenue, margins, churn data |

| Comprehensive | Sale Value × Retention × Transactions × Margin | Complex businesses | Complete transaction data |

| Predictive | Historical data + AI modeling | Growth companies | Large datasets, analytics tools |

Building genuine, lasting relationships with customers is the foundation of increasing CLV. Strong relationships create emotional connections that go beyond transactional interactions, making customers more likely to remain loyal and spend more over time. This requires consistent, personalized communication that demonstrates you understand and value each customer as an individual. Companies that excel at relationship building invest time in understanding customer preferences, anticipating their needs, and proactively reaching out with relevant solutions. The key is to move beyond generic mass communications and create touchpoints that feel personal and meaningful. When customers feel genuinely valued and understood, they’re significantly more likely to increase their spending, recommend your business to others, and remain loyal even when competitors offer lower prices.

Implementing relationship-building strategies requires a systematic approach. Start by creating detailed customer profiles that capture not just purchase history but also preferences, communication preferences, and life events. Use this information to personalize interactions at every touchpoint—from welcome emails to post-purchase follow-ups. Celebrate customer milestones like anniversaries or birthdays with personalized offers. Implement a customer success program that proactively helps customers achieve their goals with your product or service. Train your team to view every interaction as an opportunity to strengthen the relationship rather than simply complete a transaction. When customers experience consistent, genuine care from your organization, they naturally increase their lifetime value through higher purchase frequency, larger order values, and increased advocacy.

Customer support quality directly impacts CLV because it influences customer satisfaction, retention, and willingness to spend more. Exceptional support means being responsive, knowledgeable, and genuinely helpful across all customer touchpoints. Research shows that customers who receive excellent support are significantly more likely to make repeat purchases and recommend your business to others. The modern customer expects support across multiple channels—email, chat, phone, social media—and expects quick, effective resolutions. Companies that fail to meet these expectations lose customers to competitors who do. Investing in customer support infrastructure and training is one of the highest-ROI investments you can make for increasing CLV because it directly prevents customer churn and increases satisfaction.

To optimize customer support for CLV growth, implement omnichannel support systems that allow customers to reach you through their preferred channels. Build a comprehensive knowledge base that enables customer self-service, reducing support burden while improving customer satisfaction. Train support staff to not just solve problems but to identify upselling and cross-selling opportunities during support interactions. Use support interactions as data collection points to understand customer needs and pain points. Implement support metrics that track not just resolution time but customer satisfaction and repeat purchase rates. Consider implementing proactive support that reaches out to customers before problems occur, such as sending tips for product optimization or alerting customers to relevant new features. When customers experience support that genuinely helps them succeed, they naturally increase their engagement and spending.

Loyalty programs are among the most effective tools for increasing CLV because they directly incentivize repeat purchases and increase customer engagement. Research shows that 80% of companies implementing loyalty programs report positive ROI, with an average of 4.9 times more revenue than expenses. Effective loyalty programs create a sense of exclusivity and reward customers for their continued business, making them feel valued and appreciated. The most successful programs go beyond simple point systems to create emotional connections and community among members. They offer tiered benefits that reward increasing levels of engagement, creating natural progression paths that encourage customers to spend more to reach higher tiers. Loyalty programs also provide valuable data about customer preferences and purchasing patterns that can inform other CLV-increasing strategies.

When designing a loyalty program, consider multiple reward types beyond discounts: exclusive access to new products, VIP customer service, birthday rewards, referral bonuses, and community recognition. Implement tiered structures that reward increasing engagement levels—customers who reach higher tiers should receive increasingly valuable benefits that justify their higher spending. Use the program to collect first-party data about customer preferences, which you can leverage for personalization. Make the program easy to understand and participate in; complex programs with unclear benefits fail to drive engagement. Integrate your loyalty program with your CRM and analytics systems so you can track its impact on CLV and continuously optimize based on data. The most successful loyalty programs feel like genuine appreciation for customer loyalty rather than manipulative marketing tactics.

Personalization is a critical driver of CLV because customers increasingly expect experiences tailored to their individual needs and preferences. Modern customers have access to countless alternatives, and they’re more likely to remain loyal to businesses that understand them and deliver relevant experiences. Personalization extends beyond using a customer’s name in emails—it encompasses tailored product recommendations, customized pricing, relevant content, and individualized communication preferences. Companies that excel at personalization see significantly higher engagement rates, conversion rates, and customer lifetime value. The key is using data strategically to understand each customer’s unique needs and preferences, then delivering experiences that feel natural and valuable rather than intrusive or manipulative.

Implement personalization across all customer touchpoints: website experiences that adapt based on browsing history and preferences, email campaigns that segment customers by behavior and interests, product recommendations based on purchase history and browsing patterns, and customer service interactions informed by complete customer context. Use behavioral data to predict customer needs and proactively offer relevant solutions. Implement dynamic pricing strategies that offer personalized discounts based on customer value and purchase patterns. Create personalized onboarding experiences that help new customers quickly realize value from your product or service. Use predictive analytics to identify which customers are at risk of churning and proactively reach out with personalized retention offers. When personalization is done well, customers feel understood and valued, which naturally increases their lifetime value through higher engagement and spending.

Customer feedback is invaluable for increasing CLV because it reveals what customers truly value and where your business is falling short. Systematic feedback collection and analysis helps you identify improvement opportunities, validate product decisions, and demonstrate to customers that you genuinely care about their opinions. Companies that actively collect and implement customer feedback see higher satisfaction rates, lower churn, and increased customer lifetime value. The key is not just collecting feedback but creating a systematic process for analyzing it, prioritizing improvements, and communicating back to customers about changes you’ve made based on their input. When customers see that their feedback leads to tangible improvements, they feel invested in your success and more likely to remain loyal.

Implement multiple feedback collection channels: surveys, customer interviews, focus groups, social media monitoring, and support ticket analysis. Create a centralized system for organizing and analyzing feedback so you can identify patterns and prioritize improvements. Establish a cross-functional team responsible for reviewing feedback and identifying actionable insights. Communicate back to customers about improvements you’ve made based on their feedback—this closes the loop and demonstrates that you value their input. Use feedback to inform product development, service improvements, and customer experience enhancements. Track how feedback-driven improvements impact customer satisfaction and CLV metrics. Create a culture where customer feedback is valued and acted upon at all levels of the organization. When customers see that their voice matters and leads to improvements, they become more engaged and loyal.

Upselling and cross-selling are direct methods for increasing customer lifetime value by encouraging customers to purchase higher-value products or complementary items. Upselling involves persuading customers to upgrade to a premium version of a product they’re already considering, while cross-selling recommends complementary products that enhance their primary purchase. When done strategically and customer-focused, these tactics increase average order value and customer satisfaction simultaneously. The key is recommending products that genuinely solve customer problems or enhance their experience, rather than pushing products for the sake of increasing revenue. Customers appreciate relevant recommendations that save them time and help them get more value from their purchases.

Implement upselling and cross-selling strategies by analyzing customer purchase history and behavior to identify relevant recommendations. Use product bundling to make it easy for customers to purchase complementary items together at a discount. Implement recommendation engines that suggest products based on browsing history, purchase patterns, and similar customer behavior. Train customer-facing teams to identify upselling and cross-selling opportunities during customer interactions. Time recommendations strategically—post-purchase is often ideal for cross-selling complementary products, while upgrade recommendations work well when customers are approaching usage limits. Use email marketing to recommend products based on customer segments and purchase history. Implement personalized product recommendations on your website and in your app. Track the impact of upselling and cross-selling efforts on CLV and continuously optimize based on results. When recommendations are relevant and valuable, customers appreciate them and are more likely to make additional purchases.

Customer churn—the rate at which customers stop doing business with you—is one of the most significant factors affecting CLV. Reducing churn is often more cost-effective than acquiring new customers, making it a critical focus area for CLV optimization. High churn rates indicate that customers aren’t receiving sufficient value or experiencing problems that drive them away. By identifying at-risk customers and implementing retention strategies, you can significantly increase CLV. Churn analysis reveals which customer segments are most likely to leave, what factors trigger churn, and what interventions are most effective at preventing it. Companies that excel at churn reduction typically implement proactive retention programs rather than waiting until customers have already decided to leave.

Implement churn reduction strategies by establishing clear metrics for tracking churn rates across customer segments. Use predictive analytics to identify customers at risk of churning before they leave. Implement proactive outreach programs that engage at-risk customers with personalized retention offers or support. Analyze churn reasons through exit surveys and support ticket analysis to identify systemic issues. Create win-back campaigns targeting recently churned customers with special offers or improvements addressing their original concerns. Implement customer success programs that proactively help customers achieve their goals and realize value from your product or service. Monitor customer engagement metrics and reach out when engagement drops below normal levels. Create tiered retention strategies that match intervention intensity to customer value—your highest-value customers warrant more intensive retention efforts. When you systematically reduce churn, you dramatically increase CLV because customers remain engaged and continue spending over longer periods.

Customer segmentation by lifetime value allows you to allocate resources strategically and tailor strategies to different customer groups. Not all customers are equally valuable, and treating them identically wastes resources on low-value customers while under-investing in high-value ones. Effective segmentation typically creates three to five customer tiers based on CLV: high-value customers who generate significant revenue, medium-value customers with growth potential, and low-value customers who may churn or require disproportionate support. By understanding these segments, you can create targeted strategies that maximize overall CLV. High-value customers warrant premium service levels and personalized attention, while medium-value customers represent growth opportunities through targeted upselling and engagement programs.

Implement customer segmentation by analyzing historical purchase data, transaction frequency, average order value, and customer lifetime value calculations. Create distinct customer personas for each segment that capture their characteristics, needs, and preferences. Develop segment-specific strategies: for high-value customers, implement VIP programs with premium service and exclusive benefits; for medium-value customers, focus on engagement and upselling opportunities; for low-value customers, implement efficient, scalable service models. Allocate marketing budgets proportionally to segment value—invest more in acquiring and retaining high-value customers. Use segment-specific messaging and offers that resonate with each group’s unique needs. Monitor segment migration over time—track which customers move between segments and understand what drives these transitions. Continuously refine your segmentation model based on new data and changing customer behavior. When you segment strategically, you can maximize CLV by focusing resources where they have the greatest impact.

Subscription and replenishment models create predictable, recurring revenue streams that significantly increase customer lifetime value. Rather than relying on one-time purchases, these models encourage customers to commit to ongoing relationships with your business. Subscription models work particularly well for products with regular consumption patterns—software, consumables, services—where customers benefit from convenience and often receive discounts for committing to recurring purchases. Replenishment reminders help customers remember to reorder products they regularly use, increasing purchase frequency without requiring active customer effort. These models increase CLV by creating multiple touchpoints throughout the customer lifecycle and making it easier for customers to continue doing business with you.

Implement subscription and replenishment strategies by analyzing customer purchase patterns to identify products suitable for recurring models. Create flexible subscription options with varying frequencies and price points to accommodate different customer needs. Implement automated replenishment reminders based on typical usage patterns—customers appreciate being reminded to reorder before they run out. Offer subscription discounts that incentivize customers to commit to recurring purchases. Make subscription management easy—customers should be able to pause, skip, or cancel subscriptions without friction. Use subscription data to predict customer needs and proactively offer relevant products or services. Implement tiered subscription options that allow customers to upgrade as their needs grow. Track subscription metrics like retention rate, churn rate, and expansion revenue to understand program performance. When subscription and replenishment models are implemented well, they create stable, predictable revenue while increasing customer convenience and satisfaction.

Exclusive community and VIP programs create emotional connections and sense of belonging that drive customer loyalty and increase CLV. Customers who feel part of an exclusive community are more likely to remain loyal, spend more, and advocate for your brand. VIP programs that offer exclusive benefits, early access to new products, and special recognition make high-value customers feel appreciated and valued. Community programs that connect like-minded customers create network effects that increase engagement and reduce churn. These programs work because they tap into fundamental human desires for belonging, recognition, and exclusivity. When customers feel they’re part of something special, they’re more likely to increase their engagement and spending.

Implement exclusive community and VIP programs by identifying your highest-value customers and creating special benefits that reward their loyalty. Offer exclusive access to new products, beta features, or special events. Provide dedicated customer success managers or concierge services for VIP customers. Create community forums or groups where customers can connect, share experiences, and learn from each other. Implement recognition programs that celebrate customer achievements and milestones. Offer exclusive discounts, early-bird pricing, or special promotions for community members. Create tiered membership levels that reward increasing engagement and spending. Host exclusive events—virtual or in-person—for community members. Use community feedback to inform product development and service improvements. Track community engagement metrics and their correlation with CLV. When you create genuine community and make customers feel valued, you build loyalty that translates directly into increased lifetime value.

Advanced data analytics and predictive modeling enable sophisticated CLV optimization strategies that would be impossible with manual analysis. Predictive analytics can identify which customers are most likely to churn, which are ready for upselling, and which have the highest growth potential. Machine learning models can predict optimal timing for marketing messages, ideal product recommendations, and personalized pricing strategies. By leveraging data strategically, you can make CLV-increasing decisions at scale, personalizing experiences for thousands or millions of customers simultaneously. The key is collecting quality data, implementing robust analytics infrastructure, and using insights to drive continuous optimization.

Implement data-driven CLV optimization by establishing comprehensive data collection across all customer touchpoints. Implement analytics platforms that can track customer behavior, engagement, and outcomes. Use cohort analysis to understand how different customer groups behave and what drives their CLV. Implement predictive models that identify at-risk customers, upsell opportunities, and churn risk. Use A/B testing to optimize messaging, offers, and experiences based on data rather than assumptions. Implement marketing automation that uses data to trigger personalized communications at optimal times. Use customer segmentation models that evolve based on new data and changing behavior patterns. Implement attribution modeling to understand which touchpoints and channels drive CLV. Create dashboards that track CLV metrics and key drivers in real-time. Continuously test and optimize based on data—what works for one segment may not work for another. When you embrace data-driven decision-making, you can systematically increase CLV through continuous optimization and personalization.

Effective CLV optimization requires continuous measurement, analysis, and refinement. CLV is not a static metric—it changes as customer behavior evolves, market conditions shift, and your business implements new strategies. By establishing clear CLV metrics and tracking them regularly, you can identify what’s working, what needs improvement, and where to focus resources. The most successful companies treat CLV optimization as an ongoing process rather than a one-time initiative. They establish baseline metrics, implement improvements, measure results, and iterate based on what they learn. This continuous improvement mindset ensures that CLV keeps increasing over time.

Implement continuous CLV measurement and optimization by establishing clear CLV metrics and tracking them monthly or quarterly. Calculate CLV using multiple methods to ensure accuracy and identify discrepancies. Segment CLV analysis by customer cohort, acquisition channel, product line, and other relevant dimensions. Track CLV trends over time to identify whether your strategies are working. Implement regular CLV reviews with cross-functional teams to discuss results and identify improvement opportunities. Use CLV data to inform budget allocation decisions—invest more in channels and strategies that drive higher CLV. Implement experimentation programs that test new CLV-increasing strategies and measure their impact. Create accountability for CLV improvement across the organization. Benchmark your CLV against industry standards and competitors where possible. Communicate CLV metrics and improvements throughout the organization to maintain focus on this critical metric. When you measure and optimize CLV continuously, you create a culture of improvement that drives sustainable business growth.

Many businesses make critical mistakes when attempting to increase CLV. One common error is using inaccurate CLV calculations that don’t account for all relevant costs and revenues, leading to flawed strategic decisions. Another mistake is setting unrealistic timeframes for CLV calculations—projecting customer value too far into the future introduces excessive uncertainty. Some companies calculate CLV infrequently, missing opportunities to respond to changing customer behavior and market conditions. Others focus exclusively on acquisition while neglecting retention, failing to realize that retaining existing customers is typically more cost-effective than acquiring new ones. Many businesses also fail to segment customers by value, treating all customers identically and wasting resources on low-value customers while under-investing in high-value ones. Finally, some companies implement CLV strategies without proper measurement and optimization, unable to determine whether their efforts are actually working. Avoiding these mistakes requires disciplined execution, accurate data, and continuous measurement and refinement.

PostAffiliatePro's advanced affiliate management platform helps you build stronger customer relationships, track customer value metrics, and implement retention strategies that drive sustainable revenue growth. Start optimizing your CLV today.

Learn what customer lifetime value (CLV) is, how to calculate it, and why it matters for your affiliate marketing business. Discover strategies to increase CLV ...

Learn what Lifetime Value (LTV), also known as Customer Lifetime Value (CLV), means in affiliate marketing. Discover how to calculate, use, and maximize LTV to ...

Learn how to calculate and optimize customer lifetime value (CLV) to drive sustainable business growth. Discover strategies to increase CLV.

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.