Why Are Reviews Critical in Affiliate Marketing?

Discover why reviews are essential for affiliate marketing success. Learn how reviews influence purchase decisions, build trust, boost conversions by 370%, and ...

why regularly reviewing and adjusting affiliate payments is crucial for program success. strategies to maintain competitiveness, align with business goals

In today’s competitive affiliate marketing landscape, where 81% of brands are running affiliate programs and the industry is projected to exceed $37 billion globally, the stakes for getting your payment strategy right have never been higher. Regularly reviewing and adjusting affiliate payments isn’t a one-time task—it’s an ongoing strategic practice that directly impacts your program’s ability to attract quality partners, maintain profitability, and drive sustainable revenue growth. When you establish a systematic approach to payment reviews, you create a framework that allows your program to evolve alongside your business, market conditions, and affiliate expectations.

The affiliate marketing landscape is highly competitive, with top-performing affiliates often juggling multiple programs simultaneously. If your commission rates lag behind industry standards or competitor offerings, your best partners will inevitably migrate to more lucrative opportunities. Regular payment reviews allow you to benchmark your rates against competitors and industry standards, ensuring you remain an attractive option for quality affiliates. According to industry data, SaaS companies typically offer 15-30% recurring commissions, while ecommerce programs range from 5-20% per sale. By conducting quarterly or semi-annual reviews, you can identify gaps in your compensation structure and make timely adjustments before losing valuable partners.

The competitive advantage extends beyond just matching rates—it’s about understanding what motivates your specific affiliate base. Some affiliates prioritize higher commission percentages, while others value performance bonuses, exclusive product access, or tiered incentive structures. Regular reviews provide opportunities to gather feedback from your affiliates about what would make your program more attractive compared to alternatives they might be considering. This intelligence-driven approach to payment adjustments demonstrates that you value your affiliate relationships and are committed to their success.

| Product Category | Typical Commission Rate | Cookie Duration | Best For |

|---|---|---|---|

| Physical Products (Low-Margin) | 5-10% | 30-90 days | E-commerce, retail |

| Physical Products (High-Margin) | 10-15% | 30-90 days | Premium goods, specialty items |

| Digital Products | 20-50% | 30-90 days | Software, courses, ebooks |

| SaaS Subscriptions | 15-30% (recurring) | 30-90 days | Cloud services, tools |

| High-Ticket Items | 1-5% (flat rate) | 30-90 days | Real estate, luxury goods |

| Financial Services | 5-20% or flat fee | 30-90 days | Banking, insurance, fintech |

| Fashion & Apparel | 8-15% | 30-90 days | Clothing, accessories |

| Health & Wellness | 8-15% | 30-90 days | Supplements, fitness |

| Beauty & Personal Care | 10-18% | 30-90 days | Cosmetics, skincare |

| Hosting & Web Services | $50-$200+ flat | 30-90 days | Web hosting, domains |

Your business objectives change over time. You might be launching new product lines, entering new markets, shifting focus to higher-margin products, or adjusting your overall growth strategy. Your affiliate payment structure should evolve in tandem with these changes. Regular reviews ensure that your commission rates and payment models directly support your current business priorities rather than perpetuating outdated structures designed for previous objectives.

For example, if you’re transitioning from a broad product portfolio to focusing on premium, high-margin offerings, you might implement tiered commissions that reward affiliates more generously for promoting these premium products. Conversely, if you’re in a growth phase where customer acquisition is paramount, you might temporarily increase commission rates or introduce performance bonuses to accelerate affiliate recruitment and activation. Without regular reviews, these strategic opportunities are missed, and your affiliate program becomes disconnected from your business strategy.

| Business Scenario | Recommended Payment Adjustment | Expected Impact |

|---|---|---|

| Launching new product line | Offer 5-10% higher commission for new products during first 90 days | Accelerates affiliate awareness and promotion of new offerings |

| Entering new geographic market | Implement location-based commission tiers with higher rates for target regions | Incentivizes affiliates to focus on high-priority markets |

| Shifting to premium products | Create tiered structure: standard products 5%, premium products 15% | Drives revenue growth from higher-margin offerings |

| Scaling customer acquisition | Increase base commission by 2-3% or add performance bonuses | Motivates affiliates to increase promotional efforts |

| Managing profitability concerns | Reduce commission by 1-2% while adding performance bonuses | Maintains affiliate motivation while protecting margins |

The market environment is characterized by rapid shifts in consumer behavior, technological advancement, and economic conditions. Affiliate marketing trends evolve continuously—what worked last year may not be as effective today. Regular payment reviews allow you to adapt your compensation structure to reflect these market realities. If you notice that certain affiliate channels (such as content creators or niche bloggers) are generating significantly higher-quality leads than others, you can adjust their commission rates upward to encourage continued focus on these high-performing channels.

Economic conditions also impact the viability of your affiliate program. During periods of economic uncertainty, you might need to adjust commission structures to maintain profitability while still keeping affiliates engaged. Conversely, during growth periods, you have more flexibility to offer competitive rates that attract top-tier affiliates. Additionally, seasonal variations in consumer spending patterns should inform your payment strategy. Many businesses implement temporary commission increases during peak seasons (Black Friday, holiday shopping, back-to-school) to capitalize on heightened consumer activity and affiliate motivation.

One of the most critical aspects of regular payment reviews is ensuring that your affiliate program maintains a healthy return on investment. While you want to offer competitive commissions to attract and retain quality affiliates, you must also ensure that the program remains financially sustainable. Regular reviews allow you to analyze the relationship between commission costs and revenue generated, identifying which affiliates and channels deliver the best ROI.

Advanced analytics capabilities enable you to track detailed performance metrics for each affiliate, allowing you to make data-driven decisions about commission adjustments. By analyzing metrics such as conversion rates, average order value, customer lifetime value, and return rates, you can identify which affiliates are generating the most profitable sales. This insight allows you to implement performance-based commission structures where top performers earn higher rates, creating a system that rewards quality over quantity. The industry benchmark for affiliate program ROI typically ranges from 200% to 1,400%, depending on your business model and affiliate quality. Regular reviews help you move toward the higher end of this range by optimizing your payment structure to attract and retain only the most effective affiliates. You might discover that paying 15% commission to your top 20% of affiliates generates more revenue than paying 5% to a larger group of underperforming partners.

Affiliate motivation is directly tied to compensation. When affiliates feel that their efforts are fairly rewarded and that their compensation is competitive, they’re more likely to invest time and resources into promoting your products. Regular payment reviews demonstrate to your affiliates that you’re actively monitoring the market and committed to keeping them fairly compensated. This proactive approach builds trust and loyalty, transforming transactional relationships into genuine partnerships.

Beyond base commission rates, regular reviews provide opportunities to introduce performance-based incentives that motivate specific behaviors. For example, you might implement bonus structures that reward affiliates for achieving specific milestones (first 100 sales, 500 clicks, new customer acquisition), introducing new promotional channels, or maintaining consistent performance over extended periods. These incentive structures keep your program fresh and engaging, preventing affiliate fatigue and maintaining enthusiasm for your brand. Additionally, regular communication about payment adjustments—when done transparently and with clear rationale—reinforces that you value your affiliate relationships. Affiliates appreciate understanding why changes are being made and how these changes benefit both parties. This transparency builds stronger relationships and reduces the likelihood of affiliates feeling undervalued or seeking opportunities elsewhere.

To maximize the benefits of regular payment reviews, establish a structured process that occurs at predictable intervals. Most successful affiliate programs conduct comprehensive reviews quarterly or semi-annually, with informal check-ins monthly. Your review process should include analyzing performance data, benchmarking against competitors, gathering affiliate feedback, and assessing your business objectives. Document your findings and decisions, creating a clear audit trail that demonstrates your commitment to fair and strategic compensation management.

Your systematic review process should follow these key steps:

Effective payment reviews require tracking specific performance indicators that reveal program health and optimization opportunities. Affiliate recruitment rate shows how successfully you’re attracting new partners, while retention rate indicates whether existing affiliates remain engaged and motivated. Average commission per affiliate helps you understand your cost structure, and program ROI reveals whether your affiliate spending generates positive returns. Additionally, monitor conversion rates to identify which affiliates drive the highest-quality traffic, average order value to understand customer quality, and customer lifetime value to assess long-term profitability. These metrics collectively provide a comprehensive view of your program’s performance and guide strategic payment adjustments.

Many businesses make critical errors when reviewing and adjusting affiliate payments. Paying too little is the most common mistake—rates below industry standards make it nearly impossible to attract quality affiliates. Conversely, paying unsustainably high rates can quickly destroy profitability. Another mistake is setting rates without considering your profit margins, leading to situations where you lose money on affiliate sales. Failing to adjust rates based on performance data is also problematic; regularly review your affiliate program’s ROI and adjust rates if needed.

Don’t neglect the importance of clear communication about commission structures. Complicated or unclear commission terms confuse affiliates and lead to disputes. Avoid changing commission rates without notice or failing to grandfather existing affiliates—sudden rate cuts damage trust and cause affiliates to leave. Finally, don’t ignore the importance of affiliate support. Even competitive rates won’t retain affiliates if they feel unsupported or undervalued.

Modern affiliate program management requires sophisticated tools that streamline the review process and enable quick implementation of payment adjustments. Automation platforms provide real-time visibility into affiliate performance, allowing you to track metrics continuously rather than waiting for quarterly reviews. Automated reporting features generate comprehensive performance summaries, eliminating manual data compilation and reducing errors.

Flexible commission structures are essential for implementing sophisticated payment strategies. The ability to set tiered commissions, performance bonuses, and product-specific rates means you can execute complex payment strategies without manual complexity. Automated payment processing ensures affiliates receive accurate, timely compensation, building trust and reducing administrative overhead. PostAffiliatePro’s commission management features streamline this entire process by providing real-time visibility into affiliate performance, automated reporting, and flexible commission structures that can be adjusted quickly when needed. The platform’s ability to implement tiered commissions, performance bonuses, and product-specific rates means you can execute sophisticated payment strategies without manual complexity, enabling you to focus on strategic decision-making rather than administrative tasks.

Most successful programs conduct comprehensive reviews quarterly or semi-annually, with informal check-ins monthly. The frequency depends on your business volatility and market conditions, but regular reviews ensure your program stays competitive and aligned with business goals.

Key metrics include affiliate recruitment rate, retention rate, average commission per affiliate, program ROI, conversion rates, average order value, and customer lifetime value. These metrics help you understand program health and identify optimization opportunities.

The decision depends on your program's performance and business goals. Increase commissions if you're struggling to recruit quality affiliates or if your profit margins allow. Decrease commissions only if your program is unprofitable, but consider adding performance bonuses instead to maintain motivation.

Communicate changes transparently with clear rationale. Explain why changes are being made and how they benefit both parties. Provide advance notice when possible, and consider grandfathering existing affiliates at old rates to maintain trust and loyalty.

The ideal rate depends on your product type, profit margins, and industry standards. Physical products typically offer 5-15%, digital products 20-50%, and SaaS 15-30%. Calculate your maximum sustainable rate by ensuring commissions don't exceed 30-40% of your profit margin.

Offer performance-based bonuses, provide exceptional support and marketing materials, create exclusive promotions, implement referral bonuses for recruiting new affiliates, and ensure timely, accurate payments. Many affiliates value support and resources as much as commission rates.

Industry benchmarks show affiliate program ROI typically ranges from 200% to 1,400%, depending on your business model and affiliate quality. Regular reviews help you move toward the higher end of this range by optimizing your payment structure.

PostAffiliatePro provides real-time analytics, automated reporting, flexible commission structures including tiered commissions and performance bonuses, and automated payment processing. These features streamline your review process and enable quick implementation of payment adjustments.

PostAffiliatePro's advanced commission management tools help you set competitive rates, implement tiered structures, and automate payment adjustments based on performance metrics. Keep your affiliates motivated and your program profitable.

Discover why reviews are essential for affiliate marketing success. Learn how reviews influence purchase decisions, build trust, boost conversions by 370%, and ...

Discover how real-time affiliate payment notifications improve retention, build trust, and reduce support costs. Learn best practices for transparency.

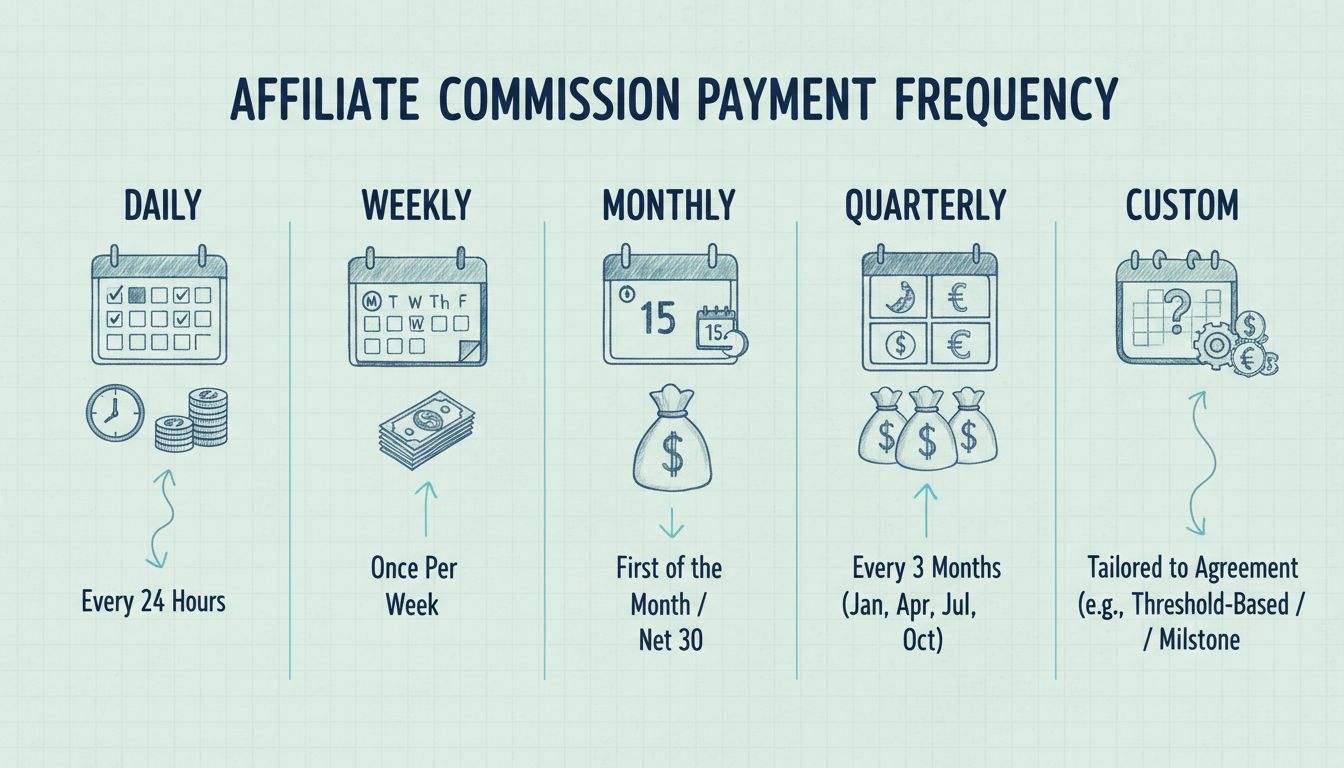

Learn about affiliate commission payment frequencies: daily, weekly, monthly, and custom intervals. Discover how Post Affiliate Pro automates recurring commissi...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.