Chargebacks & Refunds

Post Affiliate Pro automatically handles refunds and chargebacks by adjusting affiliate commissions accordingly. Protect your business from paying commissions o...

Learn how PostAffiliatePro’s new refund processing feature gives you flexibility to handle refunds using negative commissions or commission decline methods. Discover which approach works best for your affiliate program.

Refund processing is one of the most critical yet often overlooked aspects of running a successful affiliate program. When customers return products, dispute charges, or cancel subscriptions, merchants face a complex challenge: how to fairly adjust affiliate commissions without damaging relationships or creating accounting nightmares. PostAffiliatePro’s new refund processing feature addresses this challenge head-on by offering merchants two flexible methods to handle refunds—the traditional negative commission approach and the innovative commission decline method. This flexibility empowers program managers to choose the approach that best aligns with their business model, affiliate relationships, and operational preferences.

Refunds are an inevitable part of any business. Industry data shows that e-commerce businesses experience refund rates between 5-30% depending on the product category, with fashion and electronics at the higher end of that spectrum. When a customer returns a product or disputes a charge, the original sale that generated an affiliate commission is no longer valid. This creates a fundamental problem: should the affiliate keep the commission for a sale that was reversed? Most ethical affiliate programs say no, but the method of handling this adjustment significantly impacts both your accounting and your affiliate relationships.

The challenge becomes even more complex when you consider the timing of refunds. Some refunds happen immediately after purchase, while others occur weeks or months later—potentially after the affiliate commission has already been paid. Additionally, partial refunds complicate matters further, requiring proportional commission adjustments rather than complete reversals. Without a systematic approach to refund processing, merchants risk overpaying affiliates, creating disputes, damaging affiliate relationships, and facing compliance issues with payment processors and tax authorities.

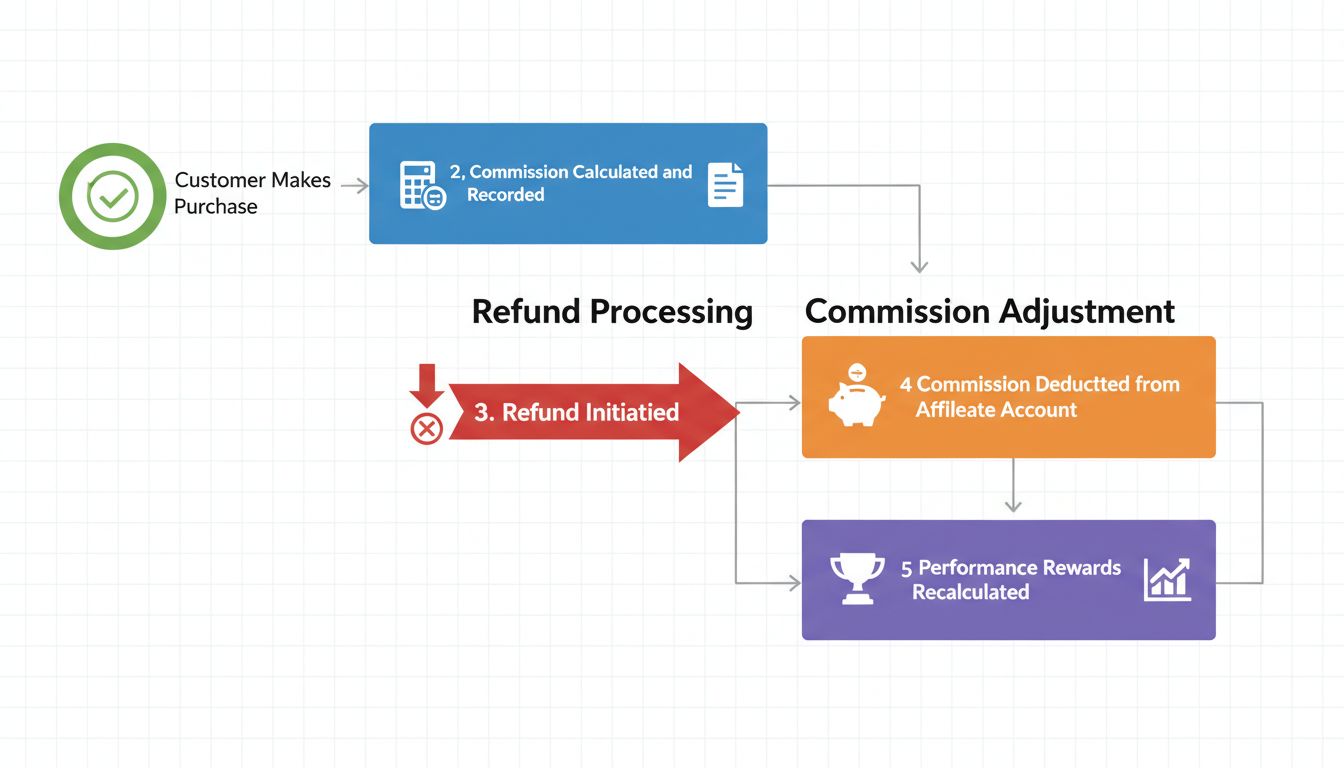

Negative commissions have been the standard approach in affiliate marketing for decades. When a refund is processed, the system creates a negative commission entry that offsets the original positive commission. For example, if an affiliate earned a $100 commission on a sale that is later refunded, the system records a -$100 commission. This negative commission is then deducted from the affiliate’s account balance, either immediately or during the next payout cycle.

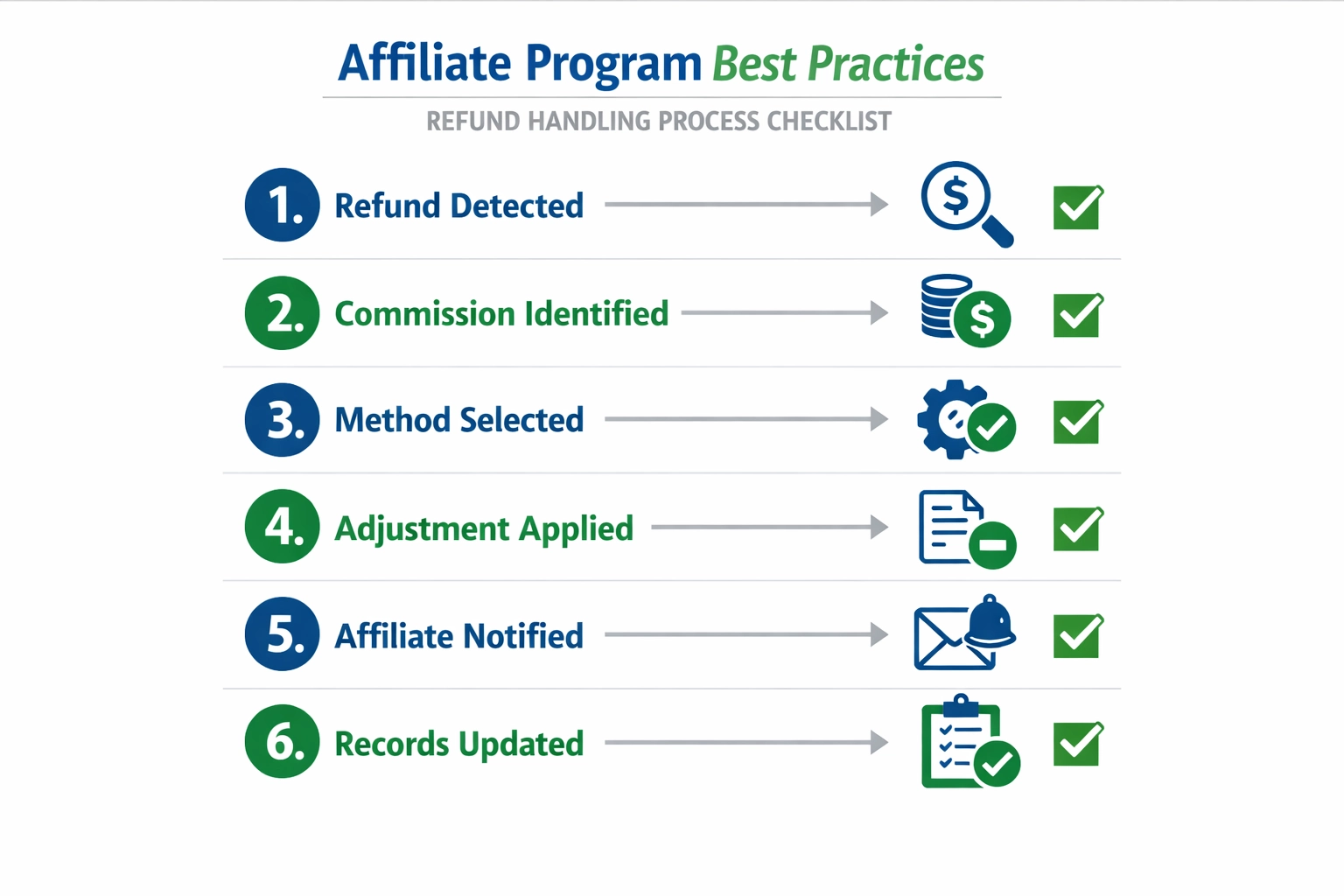

How Negative Commissions Work: The mechanics are straightforward. When a refund is detected (either manually entered or automatically synced from your payment processor), the affiliate tracking system creates a negative commission record. This negative entry appears in the affiliate’s commission history and reduces their total earnings. If the affiliate has already been paid, the negative commission creates a debt that must be recovered in future payouts or written off. If the commission is still pending, the negative entry simply reduces the amount owed.

Advantages of Negative Commissions:

Disadvantages of Negative Commissions:

PostAffiliatePro’s new commission decline feature offers an alternative approach that addresses many of the limitations of negative commissions. Rather than creating negative entries, this method simply declines to approve or pay the commission in the first place. When a refund is detected, the system marks the associated commission as “declined” rather than creating a negative balance.

How Commission Decline Works: When you enable the commission decline method, refunds trigger a different workflow. Instead of generating a negative commission, the system identifies the original commission and changes its status to “declined.” This can happen automatically if you’ve configured the system to detect refunds from your payment processor, or manually if you review refunds and decline commissions accordingly. The key difference is that the affiliate’s account balance never goes negative—the commission simply never becomes payable.

Advantages of Commission Decline:

Disadvantages of Commission Decline:

| Aspect | Negative Commissions | Commission Decline |

|---|---|---|

| Accounting Impact | Creates negative entries, complicates records | Cleaner financial statements |

| Affiliate Experience | May feel punitive or confusing | More transparent and professional |

| Implementation | Automatic and systematic | Requires more manual oversight |

| Timing Flexibility | Works at any point in the process | Best before payment |

| Partial Refunds | Handles easily with proportional amounts | Requires careful calculation |

| Already-Paid Commissions | Creates debt to recover | Avoids collection issues |

| Audit Trail | Detailed history of all adjustments | Clear declined status records |

| Affiliate Relationships | Can strain relationships | Maintains professional relationships |

| Compliance Documentation | Excellent for tax purposes | Good but less detailed |

| Scalability | Works well for high-volume programs | Better for smaller, managed programs |

| Best For | High-refund industries, automated systems | Relationship-focused programs |

The choice between these methods depends on several factors. If you operate in an industry with high refund rates (fashion, electronics, returns-heavy products), negative commissions provide systematic handling of volume. If you prioritize affiliate relationships and have the capacity to review refunds before payment, commission decline offers a cleaner, more professional approach. Many sophisticated affiliate programs use a hybrid approach: commission decline for most refunds, with negative commissions reserved for edge cases or already-paid situations.

Regardless of which method you choose, successful refund processing requires careful planning and clear policies. Here are the essential best practices:

Understanding how these methods work in practice helps clarify which approach suits your business. Consider these common scenarios:

Scenario 1: E-Commerce Return (Negative Commission) An affiliate generates a $500 sale with a $50 commission. The customer returns the product within 14 days. Using negative commissions, the system automatically creates a -$50 entry. If the commission was still pending, it’s simply cancelled. If already paid, the affiliate owes $50 on their next payout. This method works well for high-volume e-commerce where returns are frequent and expected.

Scenario 2: SaaS Cancellation (Commission Decline) An affiliate refers a customer who signs up for a $99/month SaaS subscription with a $10 monthly commission. After two months, the customer cancels. Using commission decline, the system marks the third month’s commission as “declined” before it’s approved for payment. The affiliate sees a clear record of why the commission wasn’t paid, maintaining transparency and trust.

Scenario 3: Partial Refund (Negative Commission) A customer purchases $1,000 worth of products with a $100 affiliate commission. They return $300 worth of items. The system creates a -$30 negative commission (proportional to the refund). This proportional adjustment is easier to manage with negative commissions than with decline methods.

Scenario 4: Already-Paid Commission (Commission Decline) An affiliate’s commission was paid 45 days ago. A customer now disputes the charge and receives a refund. With commission decline, you simply document the refund and note that the commission was already paid. With negative commissions, you’d need to recover the $50 from the affiliate, creating friction. This scenario favors the decline method.

PostAffiliatePro’s new refund processing feature recognizes that one size doesn’t fit all in affiliate marketing. By offering both negative commissions and commission decline methods, the platform empowers merchants to implement refund handling that aligns with their business model, industry norms, and affiliate relationships. Whether you prioritize systematic automation or relationship-focused transparency, you now have the flexibility to choose the approach that works best for your program.

The key to successful refund processing isn’t which method you choose—it’s implementing it consistently, communicating clearly with affiliates, and maintaining detailed records. Start by evaluating your refund rates, industry standards, and affiliate relationships. Then configure PostAffiliatePro to match your chosen approach. Your affiliates will appreciate the transparency, your accounting team will appreciate the clarity, and your program will benefit from reduced disputes and stronger partnerships.

Ready to implement professional refund processing in your affiliate program? PostAffiliatePro makes it simple with flexible options, automated detection, and comprehensive reporting. Start your free trial today and discover how the right refund processing approach can strengthen your affiliate program.

Negative commissions create a negative balance in the affiliate's account that offsets previous earnings, while declining commissions simply mark a commission as not payable without creating a negative entry. Negative commissions work well for high-volume refunds, while declining commissions maintain cleaner accounting and better affiliate relationships.

PostAffiliatePro integrates with your payment processor to automatically detect refunds. When a refund is identified, the system can either create a negative commission or decline the associated commission based on your chosen method. You can also manually process refunds through the dashboard.

Yes, many sophisticated affiliate programs use a hybrid approach. You can use commission decline for most refunds detected before payment, and negative commissions for edge cases or refunds that occur after payment has been made to the affiliate.

With negative commissions, the affiliate's balance decreases by the refund amount. With commission decline, the commission simply never becomes payable. In both cases, the affiliate's total earnings are reduced to reflect the refunded sale.

Industry best practice is to hold commissions for 30-90 days, matching your business's refund policy. This ensures that most refunds are detected before commissions are paid, reducing the need to recover money from affiliates.

No, declined commissions are a normal part of affiliate program operations. When communicated transparently, affiliates understand that declined commissions reflect customer refunds, not performance issues. Clear communication prevents misunderstandings.

Yes, affiliates can request clarification or dispute declined commissions. PostAffiliatePro provides detailed records showing why commissions were declined, making it easy to explain the reason and resolve disputes professionally.

PostAffiliatePro integrates with major payment processors like Stripe, PayPal, and others to automatically sync refund data. When a refund is processed in your payment system, PostAffiliatePro detects it and triggers the appropriate commission adjustment based on your settings.

Implement professional refund handling that protects your program profitability while maintaining strong affiliate relationships. Choose between negative commissions and commission decline methods based on your business needs.

Post Affiliate Pro automatically handles refunds and chargebacks by adjusting affiliate commissions accordingly. Protect your business from paying commissions o...

Learn about the latest bug fixes in Post Affiliate Pro including refunded commission counting in performance rewards and plugin integrations for Memberful, SamC...

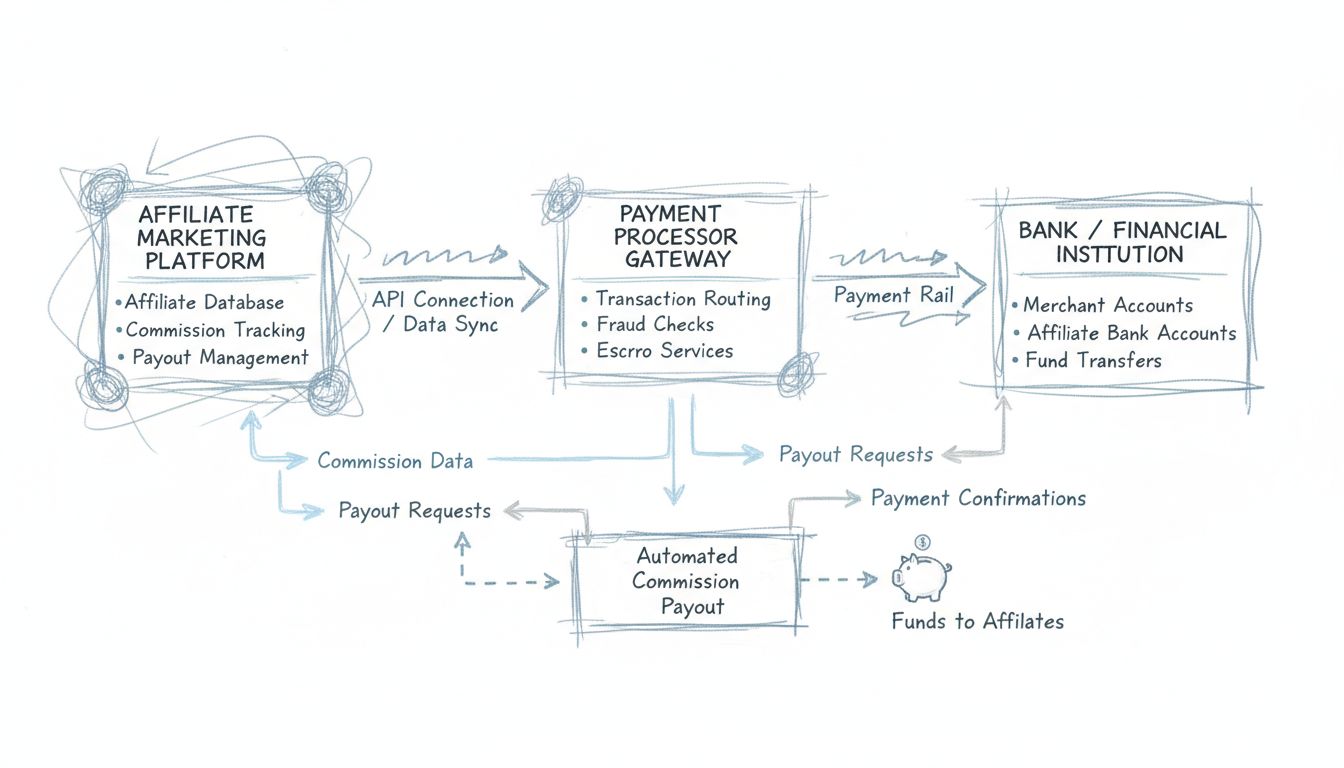

Learn how to integrate payment processors with affiliate marketing software for automated commission payouts. Discover APIs, built-in integrations, and best pra...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.