What is Affiliate Fraud? Complete Guide to Detection & Prevention

Learn what affiliate fraud is, how it works, and proven strategies to detect and prevent it. Protect your affiliate program with advanced fraud detection techni...

how to prevent affiliate fraud with built-in fraud detection platforms, real-time monitoring, and geographic restrictions.

Affiliate fraud is costing businesses billions annually, with estimates suggesting that 25-30% of all digital marketing activities involve some form of fraudulent activity. In extreme cases, fraud can consume up to 51.8% of an advertising budget, according to recent industry research. For SaaS companies specifically, this translates to paying commissions for fake clicks, fabricated leads, and non-existent conversions that never result in actual customers. The global affiliate fraud losses reached $84 billion in 2023 alone, and the problem continues to accelerate as fraudsters develop more sophisticated tactics. Without proper fraud detection and prevention measures in place, your SaaS affiliate program becomes an easy target for scammers looking to exploit performance-based commission structures.

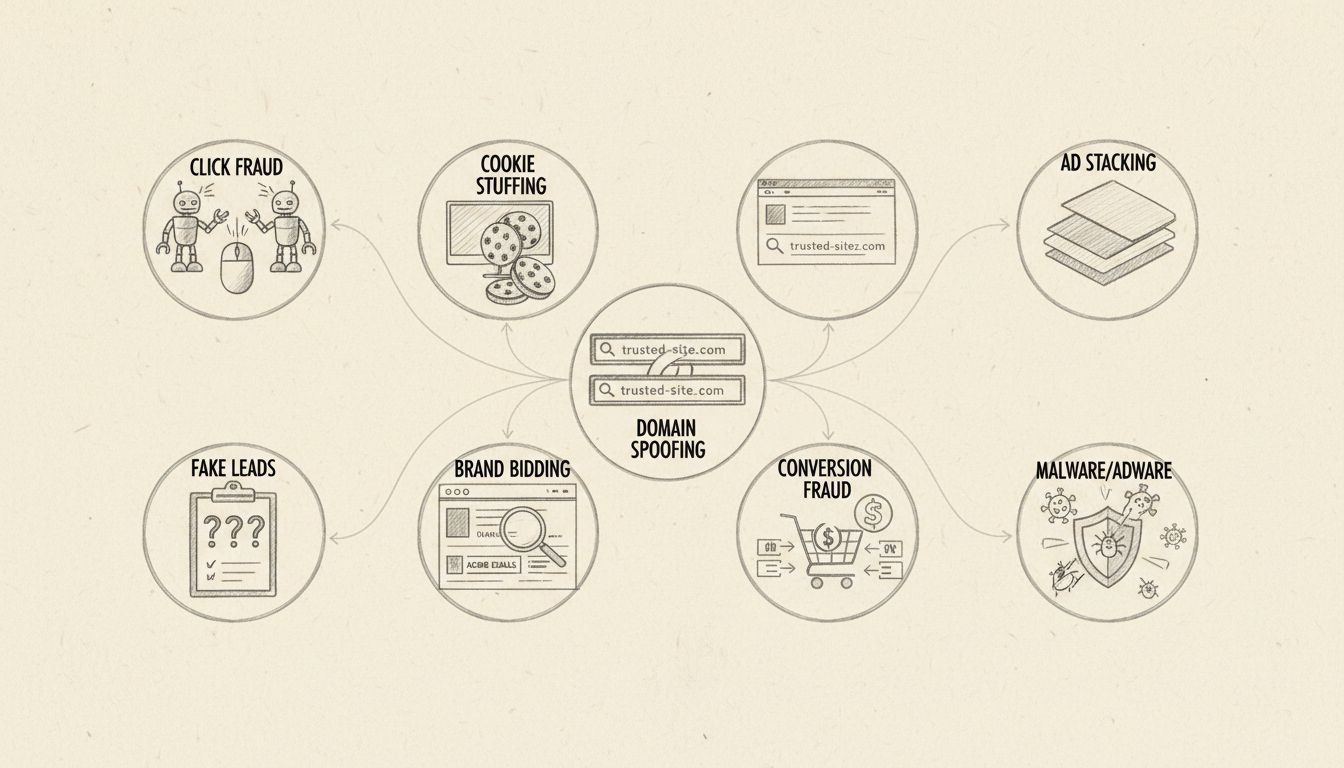

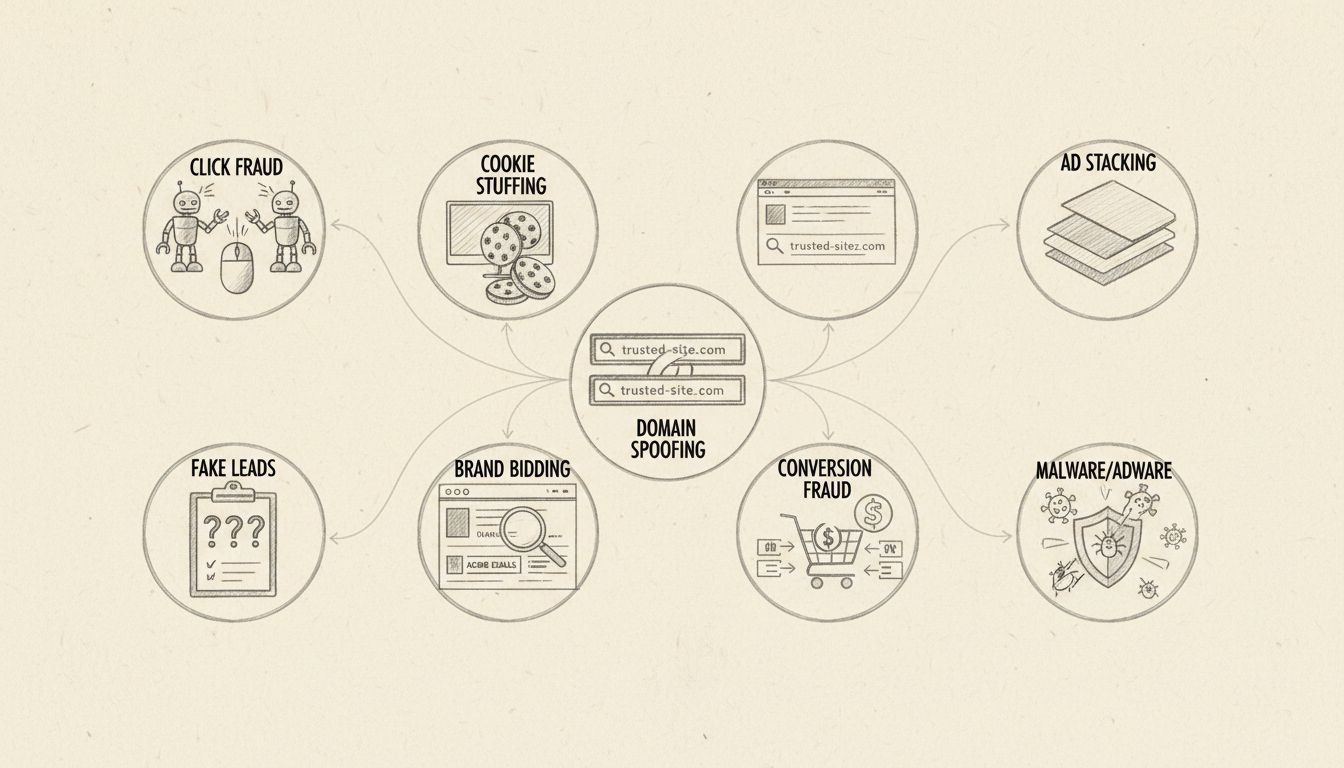

Fraudsters employ a diverse arsenal of tactics to exploit affiliate programs, each designed to bypass traditional detection methods and claim unearned commissions. Understanding these fraud types is essential for building an effective defense strategy. Here are the most prevalent forms of affiliate fraud you need to watch for:

| Fraud Type | How It Works |

|---|---|

| Click Fraud | Automated bots or click farms generate thousands of fake clicks without real user engagement, inflating click volumes while conversions remain flat |

| Cookie Stuffing | Fraudsters secretly place tracking cookies on user browsers through scripts or pop-ups, claiming credit for sales they didn’t actually drive |

| Fake Leads/Conversions | Scammers submit fabricated or stolen personal data to generate false sign-ups and conversions, often using bot automation to scale these activities |

| Click Injection | Mobile apps inject fake clicks just before legitimate app installs occur, stealing attribution and commission credit from legitimate sources |

| URL Hijacking | Scammers use lookalike domains (typosquatting) or redirect chains to intercept users and claim commissions for traffic they didn’t generate |

| Malware & Malvertising | Malicious software automatically injects affiliate codes when infected users make purchases, or fraudsters purchase ad space to serve infected code |

Each of these tactics exploits different vulnerabilities in affiliate tracking systems, which is why a multi-layered fraud prevention approach is essential for protecting your program.

Detecting affiliate fraud early requires vigilance and understanding what suspicious activity looks like in your data. Several warning signs should immediately trigger investigation and heightened monitoring. Unusual conversion spikes without corresponding increases in traffic or engagement often indicate bot-driven fraud or cookie stuffing schemes. High bounce rates following affiliate clicks suggest that traffic sources are generating fake visitors rather than genuine users interested in your product. Duplicate IP addresses generating multiple conversions in short timeframes is a classic indicator of click farms or bot networks operating from centralized locations. Geographic mismatches—where traffic originates from unexpected countries or regions where you don’t actively market—frequently signal VPN-masked fraud or traffic from data centers rather than real users. Abnormally low session durations, where users click through but spend only milliseconds on your site, indicate automated traffic rather than genuine user behavior. Additionally, conversion rates that dramatically deviate from your historical benchmarks or industry standards warrant immediate investigation and potential affiliate suspension pending review.

Manual monitoring of affiliate activity becomes impossible as your program scales beyond a handful of partners, which is why automated fraud detection technology is essential for modern SaaS companies. Machine learning and artificial intelligence have revolutionized fraud detection by analyzing patterns across millions of transactions in real-time, identifying suspicious behavior that human auditors would miss. Advanced platforms use device fingerprinting to track unique devices across multiple transactions, IP reputation scoring to identify traffic from known fraud sources, and behavioral analytics to distinguish between legitimate user actions and bot-generated activity. Real-time monitoring enables automatic blocking or flagging of high-risk events before fraudulent commissions are paid, preventing losses before they occur. Several platforms offer fraud detection capabilities, including Anura, Forensiq by Impact, SEON, Bluepear, and BrandVerity, each with different strengths and price points. However, PostAffiliatePro stands out as the top choice for SaaS companies, offering comprehensive built-in fraud detection that integrates seamlessly with your affiliate management workflow. PostAffiliatePro’s advantage lies in its combination of real-time fraud scoring, automated response mechanisms, machine learning models that improve continuously, and transparent reporting that helps you understand exactly why conversions are flagged or blocked—all without requiring separate third-party integrations.

Effective fraud prevention requires establishing systematic monitoring processes that track affiliate performance across multiple dimensions simultaneously. Traffic source analysis involves regularly reviewing where affiliate traffic originates, identifying unexpected sources, and investigating any sudden shifts in traffic patterns or quality. Conversion rate monitoring compares each affiliate’s conversion rates against your program average and historical benchmarks, flagging partners whose rates deviate significantly in either direction. Cookie behavior audits examine the duration and frequency of affiliate cookies, looking for unusually long cookie windows or evidence of cookie stuffing through excessive cookie placements. Integration with Google Analytics and your native tracking platform provides additional validation of user journeys, allowing you to cross-reference affiliate claims against actual user behavior data. Setting up automated alerts for specific thresholds—such as more than 10 clicks from the same IP address, conversion rates below 0.1%, or traffic from known data center IP ranges—enables your team to respond immediately to suspicious activity. Regular performance audits conducted quarterly or monthly, depending on program size, help identify emerging fraud patterns before they cause significant financial damage. The combination of automated alerts and periodic manual reviews creates a comprehensive monitoring system that catches both obvious and sophisticated fraud attempts.

Geographic considerations play an important role in affiliate fraud prevention, as certain regions experience significantly higher fraud rates due to varying levels of regulatory oversight and fraud sophistication. High-risk regions for affiliate fraud include parts of Eastern Europe, Southeast Asia, and certain developing markets where fraud operations are more prevalent and organized. However, implementing blanket geographic bans eliminates legitimate international partnerships and limits your market expansion opportunities. Instead, use IP geolocation verification to confirm that traffic actually originates from the claimed geographic location, and implement VPN and proxy detection to identify fraudsters masking their true location. For high-risk regions, consider implementing additional verification requirements such as identity confirmation, business license verification, or higher approval thresholds before partners gain full program access. You can also use graduated commission structures where new partners from higher-risk regions start with lower commission rates and tighter monitoring before earning access to standard rates. This balanced approach allows you to expand into new markets while maintaining fraud protection, rather than losing legitimate opportunities due to overly restrictive geographic policies. Regular review of fraud patterns by region helps you adjust your risk tolerance and restrictions as the threat landscape evolves.

The first line of defense against affiliate fraud is preventing fraudulent actors from entering your program in the first place through comprehensive vetting and onboarding procedures. Implement a multi-layered vetting process that includes manual review of every application, not auto-approval, since fraudsters specifically target programs with lenient acceptance criteria. Verify the quality of applicant websites by checking domain age (new domains are higher risk), content quality and relevance to your product, and traffic sources through tools like SimilarWeb or SEMrush. Review social media presence to confirm that applicants have legitimate marketing channels and established audiences, rather than newly created accounts with no history. Require clear disclosure of exactly how applicants plan to promote your products, including specific channels, audience demographics, and promotional methods. For mid-market and enterprise programs, implement identity verification requirements such as tax IDs, business licenses, or corporate documentation before approving payouts. Use a graduated approval process where new partners start with lower commission rates and tighter monitoring before gaining full program access, allowing you to validate their legitimacy before exposing your program to higher risk. This vetting approach significantly reduces the number of fraudulent actors who successfully infiltrate your program while maintaining a welcoming environment for legitimate partners.

Establishing and enforcing clear compliance rules creates accountability and deters fraudsters who know you’re actively monitoring and enforcing policies. Your affiliate agreement should explicitly define what constitutes fraud, provide specific examples of prohibited tactics, and clearly state the consequences: immediate commission reversal, program termination, and potential legal action. Require affiliates to disclose exact placements—specific URLs and pages where they promote your offers—either during application or in monthly performance reports, creating transparency that makes unauthorized placements immediately visible. Implement strict promotional code restrictions by assigning unique, trackable codes to specific partners or channels, making unauthorized sharing immediately detectable when codes appear on coupon aggregation sites. Establish clear placement requirements that prohibit hidden landing pages, non-compliant ad placements, and traffic from spam email lists or misleading advertisements. Create a tiered warning system where first offenses receive education and warnings, second offenses trigger commission holds or review, and third offenses result in termination, demonstrating fair enforcement while building a clear violation history. Send periodic compliance reminders to all partners highlighting your fraud detection capabilities and recent enforcement actions (without naming specific partners), creating a deterrent effect that discourages fraud attempts. Document all violations, investigations, and enforcement actions meticulously to build a clear history that protects you legally and demonstrates consistent, fair enforcement across your entire partner network.

Modern fraud prevention requires real-time monitoring and automated response capabilities that can identify and block fraudulent activity before commissions are paid. Real-time fraud scoring analyzes dozens of parameters for every click, install, and conversion—including device fingerprints, IP reputation scores, user journey completeness, and behavioral signals—assigning a risk score that determines whether the event should be approved, flagged for review, or automatically blocked. Automated blocking of high-risk events prevents fraudulent payouts without manual intervention, protecting your budget while maintaining program efficiency. Machine learning models continuously improve detection accuracy by learning from new fraud patterns and adapting to evolving fraudster tactics, ensuring your fraud detection stays ahead of emerging threats. Device fingerprinting creates unique identifiers for each device based on hardware characteristics, browser settings, and other parameters, allowing you to identify when the same device generates multiple suspicious conversions. IP reputation analysis checks every conversion’s IP address against databases of known fraud sources, data centers, VPN providers, and proxy services, flagging traffic from suspicious origins. Conversion validation before payout implements post-conversion checks such as flagging bulk purchases of single low-value items, multiple orders from the same IP in short timeframes, or shipping/billing address mismatches in different countries. Implementing a holding period for commissions from new partners—paying out after 30-60 days once you can verify transactions aren’t chargebacks or returns—provides additional protection while building confidence in partner legitimacy.

Choosing an appropriate fraud detection solution depends on your program size, budget, and fraud sophistication level, with three distinct tiers of solutions available. Tier 1: Platform-Native Tools work best for small programs with fewer than 50 active affiliates and limited budgets, using built-in tracking dashboards, free tools like Google Alerts, manual spreadsheet analysis, and custom conversion rules. These solutions are labor-intensive and reactive rather than proactive, but they’re cost-effective for programs just starting their fraud prevention journey. Tier 2: Integrated Partnership Automation Solutions like PostAffiliatePro serve mid-market programs with 50-500+ active affiliates, combining affiliate tracking with built-in fraud prevention including real-time fraud scoring, automated promo code monitoring, paid search compliance tracking, device fingerprinting, and machine learning models. These platforms deliver the best value for SaaS companies by automating detection, providing real-time monitoring, and integrating directly into your existing partnership workflows without disconnected tools or manual data transfers. Tier 3: Specialized Third-Party Fraud Detection solutions like CHEQ and Spider AF serve enterprise brands with massive programs or exceptionally high fraud rates, offering advanced bot detection, cross-platform fraud identification, predictive fraud modeling, and dedicated fraud analyst support. For most SaaS companies, PostAffiliatePro represents the optimal balance of comprehensive fraud detection capabilities, ease of implementation, and cost-effectiveness, providing enterprise-grade protection without the complexity and expense of specialized third-party solutions. The platform’s transparent reporting and integrated approach make it significantly easier to manage fraud prevention as part of your overall affiliate program rather than as a separate function requiring dedicated resources.

The financial impact of implementing comprehensive fraud detection is substantial and measurable, with most SaaS companies seeing significant ROI within 2-3 months of deployment. Consider a typical SaaS company running a $500,000 monthly affiliate program with an average fraud rate of 15%—that’s $75,000 in fraudulent commissions paid monthly, or $900,000 annually. After implementing PostAffiliatePro’s fraud detection, the same company reduced their fraud rate to 2%, eliminating $65,000 in monthly fraudulent payouts while maintaining legitimate partner relationships and program growth. Beyond direct cost savings, fraud prevention improves data integrity by ensuring that your conversion data accurately reflects real customer acquisition, enabling better decision-making for marketing optimization and budget allocation. Legitimate affiliates benefit from fraud prevention as well, as they’re no longer competing against fraudsters for commissions and recognition, leading to stronger partner relationships and higher-quality traffic from ethical sources. The reduction in chargebacks and payment disputes from fraudulent transactions decreases operational overhead and improves cash flow predictability. Additionally, protecting your program’s integrity preserves your brand reputation and customer trust, preventing the damage that occurs when fraudulent traffic leads to poor customer quality or negative user experiences. These combined benefits—direct cost savings, improved data quality, stronger partner relationships, reduced operational overhead, and brand protection—demonstrate that fraud prevention isn’t an expense but a strategic investment that pays dividends across your entire business.

Affiliate fraud occurs when scammers use deceptive tactics to earn undeserved commissions. For SaaS companies, this means paying for fake clicks, leads, or conversions that never result in real customers, directly impacting customer acquisition cost (CAC) and return on investment (ROI). Fraudsters exploit performance-based commission structures to generate revenue without delivering genuine value.

Watch for red flags like unusual conversion spikes without increased traffic, high bounce rates after affiliate clicks, duplicate IP addresses generating multiple conversions, geographic mismatches, and abnormally low session durations. Use fraud detection platforms with real-time monitoring and machine learning to identify suspicious patterns automatically before fraudulent commissions are paid.

Common types include click fraud (bot-generated clicks), cookie stuffing (unauthorized tracking), fake leads, click injection (mobile fraud), URL hijacking, and malware. Each requires different detection and prevention strategies. Understanding these tactics helps you implement targeted defenses that address your program's specific vulnerabilities.

PostAffiliatePro includes built-in fraud detection with real-time monitoring, device fingerprinting, IP reputation analysis, behavioral analytics, and automated blocking of high-risk events. It uses machine learning to continuously improve detection accuracy and integrates seamlessly with your affiliate management workflow without requiring separate third-party tools.

Yes, geographic restrictions can reduce fraud risk, but balance this with market expansion goals. Use IP geolocation verification and VPN detection rather than blanket bans to maintain legitimate international partnerships. Implement graduated approval processes for high-risk regions with additional verification requirements before partners gain full program access.

Fraud prevention typically saves 5-30% of affiliate spend by eliminating fraudulent payouts, improving data integrity, and reducing chargebacks. Most SaaS companies see ROI within 2-3 months of deployment. Beyond direct cost savings, fraud prevention improves decision-making accuracy and strengthens relationships with legitimate partners.

Implement continuous real-time monitoring with automated alerts for suspicious activity. Conduct manual audits quarterly for new fraud patterns, review high-risk partners monthly, and investigate any anomalies immediately. The combination of automated detection and periodic manual reviews creates a comprehensive system that catches both obvious and sophisticated fraud attempts.

Include clear definitions of fraud, consequences (commission reversal, termination, legal action), placement requirements, promotional code restrictions, and data validation rules. Require affiliates to disclose exact promotional methods and traffic sources. Create a tiered warning system and document all violations to demonstrate fair, consistent enforcement across your partner network.

PostAffiliatePro's built-in fraud detection identifies and blocks suspicious activity in real-time, protecting your budget and ensuring only legitimate partners earn commissions.

Learn what affiliate fraud is, how it works, and proven strategies to detect and prevent it. Protect your affiliate program with advanced fraud detection techni...

How affiliate management systems detect and prevent fraud in real-time. Fraud detection tools, prevention strategies, and PostAffiliatePro protection.

Learn proven strategies to prevent affiliate fraud in 2025. Discover monitoring techniques, fraud detection tools, and best practices to protect your affiliate ...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.