Managing International Betting Affiliate Programs Across

Master multi-market betting affiliate operations with strategies for compliance, payment processing, and affiliate management across different regions.

Discover proven affiliate marketing strategies for Mexico’s booming online gambling market. Learn about regulations, payment methods, and growth opportunities.

Mexico’s online gambling market represents one of Latin America’s most compelling opportunities for affiliate marketers, with the industry valued at $0.97 billion in 2025 and projected to reach $1.96 billion by 2030, reflecting a robust 15.11% compound annual growth rate (CAGR). This explosive expansion is driven by Mexico’s large population of 128 million, increasing internet penetration, and a cultural passion for gaming and sports betting that shows no signs of slowing. The market’s rapid digitalization has created a perfect storm for affiliate marketers: established operators are aggressively seeking customer acquisition channels, regulatory frameworks are becoming clearer, and consumer demand continues to surge across all demographics. For affiliates, Mexico offers the rare combination of high market growth, substantial commission opportunities, and a relatively untapped audience compared to more saturated North American markets. The convergence of these factors makes Mexico an essential market for any serious affiliate marketer looking to diversify revenue streams and capitalize on emerging opportunities in the Latin American gaming sector.

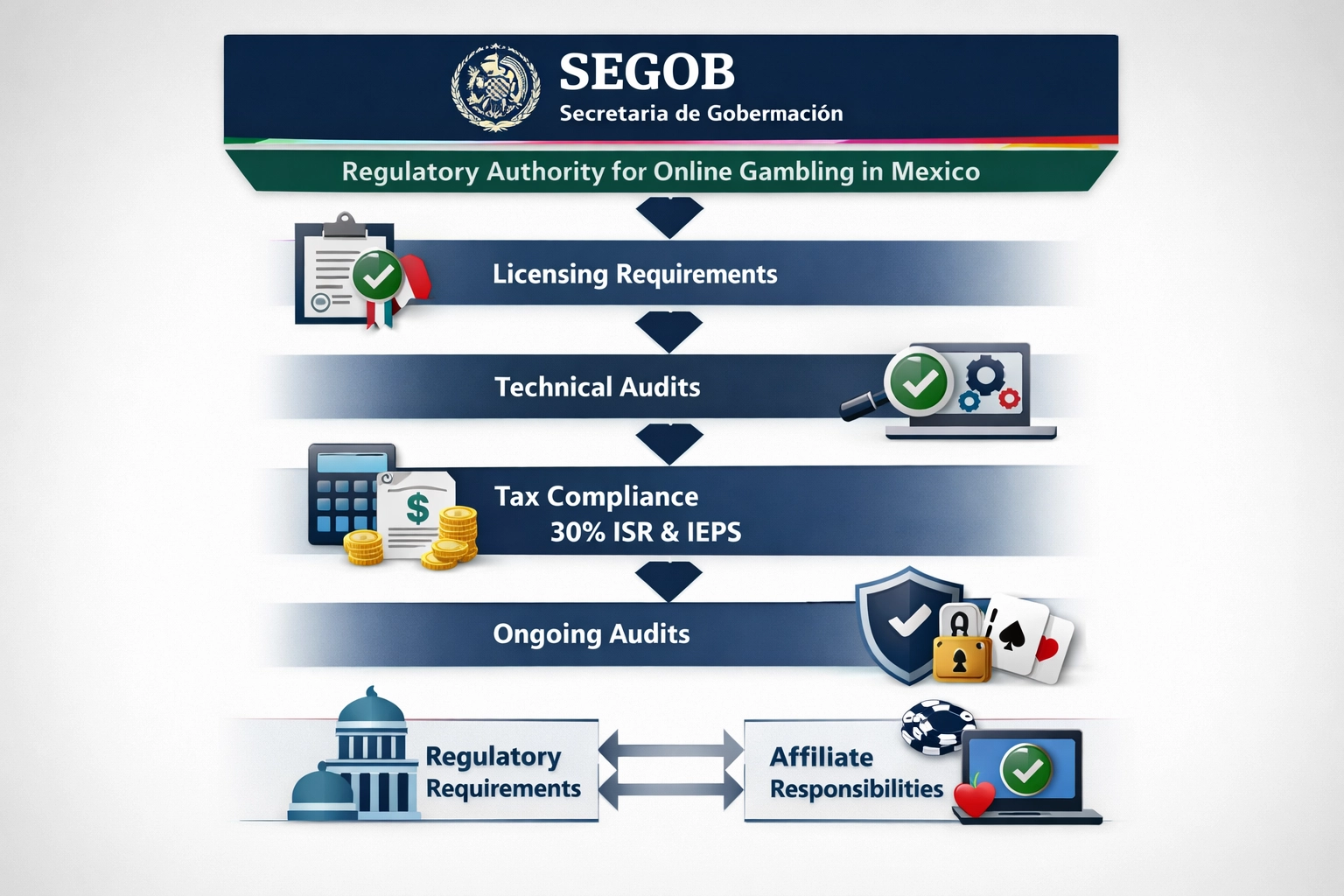

Mexico’s online gambling industry operates under the oversight of SEGOB (Secretaría de Gobernación), which enforces the Federal Law of Gaming and Sweepstakes to ensure consumer protection and market integrity. All operators offering online gambling services must obtain explicit licensing from SEGOB, a process that requires substantial documentation, financial reserves, and compliance infrastructure—requirements that directly impact affiliate partnerships and promotional activities. Affiliates must understand that their partner operators are subject to a 30% Income Tax (ISR) on gaming revenues, plus an additional IEPS (Special Tax on Production and Services) that varies based on the type of gaming activity, creating a complex tax environment that affects commission structures and profitability. Compliance audits are conducted regularly by SEGOB, and any affiliate promoting unlicensed operators or engaging in prohibited marketing practices faces legal liability and potential financial penalties. The regulatory framework requires transparent player protection measures, responsible gambling disclosures, and strict data privacy compliance under Mexican law, meaning affiliates must ensure all promotional materials and landing pages meet these standards. Additionally, affiliates operating in Mexico must maintain detailed records of player referrals, commissions earned, and marketing activities for potential tax and regulatory audits.

| Requirement | Details | Impact on Affiliates |

|---|---|---|

| Licensing | Operators must obtain SEGOB approval; only licensed operators can legally offer services | Affiliates can only promote licensed operators; partnerships with unlicensed sites carry legal risk |

| Corporate Tax (ISR) | 30% tax on gaming operator revenues | Affects operator profitability and commission budgets; may influence commission rates offered to affiliates |

| IEPS Tax | Variable tax on gaming activities (typically 1-5% depending on game type) | Additional cost burden on operators that may be passed to affiliates through lower commissions |

| Compliance Audits | Regular SEGOB inspections and player protection audits | Affiliates must maintain compliant marketing materials and documentation; non-compliance can result in partnership termination |

Mexico’s online gambling audience is predominantly composed of adults aged 25-40, representing 49.44% of the market, with this demographic showing strong purchasing power and consistent engagement with gaming platforms. However, the fastest-growing segment is Gen Z (18-24), expanding at an impressive 16.73% CAGR, indicating that younger players are rapidly adopting online gambling as a mainstream entertainment option and representing significant long-term value for affiliates. The market is distinctly mobile-first, with 63.92% of all gambling activity occurring on smartphones and tablets, meaning affiliates must prioritize mobile-optimized content, apps, and promotional strategies to effectively reach their audience. Sports betting dominates player preferences with 56.41% of the market share, driven largely by Mexico’s passionate fan base and the immense popularity of Liga MX (Mexican soccer league), which creates natural seasonal peaks in betting activity and affiliate commission opportunities. Beyond soccer, Mexican players also engage heavily with international football leagues, basketball, and boxing, providing affiliates with diverse content angles and promotional opportunities throughout the year. The combination of high mobile adoption, sports betting preference, and cultural passion for Liga MX creates a uniquely engaged audience that responds well to targeted, sports-focused affiliate campaigns and real-time betting promotions.

The success of any online gambling affiliate program in Mexico hinges on offering payment methods that resonate with local players, and this is where understanding regional preferences becomes absolutely critical. Mexican players expect seamless, secure transactions using methods they use daily, which is why integrating local payment solutions has become non-negotiable for operators seeking market penetration. The Mexican financial ecosystem has evolved significantly, with digital payment adoption accelerating across all demographics, making it essential for affiliates to promote platforms that support these local options. Beyond traditional methods, international payment gateways provide flexibility for players who prefer established global solutions, while cryptocurrency options appeal to tech-savvy younger demographics. The most successful affiliate campaigns in Mexico highlight the diversity of payment options available, as this directly addresses one of the primary concerns Mexican players have when choosing an online gambling platform. Here are the primary payment methods that should be featured in your affiliate marketing materials:

• SPEI (Sistema de Pagos Electrónicos Interbancarios) - The fastest domestic bank transfer system, allowing instant transfers between Mexican banks • CoDi (Cobro Digital) - QR-based payment system enabling quick transfers via mobile banking apps • DiMo (Dinero Móvil) - Mobile money transfer service integrated with major Mexican banks • OXXO Pay - Retail payment option allowing deposits at OXXO convenience stores nationwide • Neteller - International e-wallet popular among Mexican players for its security and speed • Skrill - Global payment platform offering competitive exchange rates for Mexican users • PayPal - Widely recognized international option providing buyer protection and ease of use • Cryptocurrency (Bitcoin, Ethereum) - Emerging option for privacy-conscious and tech-forward players

Affiliates who emphasize local payment integration in their marketing materials see significantly higher conversion rates, as players feel more confident depositing through familiar channels. The ability to withdraw winnings quickly through preferred local methods is a major selling point that should be prominently featured in all promotional content and comparison guides.

Creating content in Spanish is merely the baseline for success in Mexico’s gambling affiliate market; true localization requires deep cultural understanding and relevance that goes far beyond simple translation. Mexican players are passionate about Liga MX football, and affiliates who build their content strategy around this obsession—featuring betting guides for El Clásico Tapatío, analysis of Chivas vs. América matchups, and exclusive promotions tied to league events—will naturally attract engaged audiences. Seasonal promotions aligned with Mexican cultural moments create powerful marketing opportunities: Día de Muertos campaigns can feature special bonuses with thematic branding, Cinco de Mayo promotions resonate with national pride, and the upcoming FIFA 2026 tournament (co-hosted by Mexico) presents an unprecedented opportunity for football-focused affiliate content. Incorporating términos locales (local terminology) and cultural references that Mexican players recognize and appreciate builds trust and authenticity that generic, globally-translated content simply cannot achieve. Equally important is weaving responsible gambling messaging throughout all localized content, emphasizing player protection and healthy gaming habits in ways that respect Mexican cultural values around family and community. Affiliates who balance promotional enthusiasm with genuine concern for player welfare establish themselves as trusted guides rather than mere sales channels, ultimately building longer-term audience loyalty and sustainable commission streams.

With over 80% of Mexican online gambling traffic originating from mobile devices, any affiliate marketing strategy that doesn’t prioritize mobile optimization is essentially leaving money on the table. Mobile-first design isn’t optional—it’s the foundation upon which all successful affiliate campaigns in Mexico must be built, from responsive website layouts to fast-loading comparison tables and review pages optimized for thumb navigation. The proliferation of dedicated gambling apps has created new affiliate opportunities, as players increasingly prefer native applications over mobile browsers for their superior performance, security features, and push notification capabilities. Push notifications and SMS marketing represent underutilized channels for Mexican affiliates, allowing you to send timely alerts about new promotions, major sporting events, and exclusive bonuses directly to engaged audiences who have opted in. The rollout of 5G networks across Mexico’s major metropolitan areas is accelerating mobile adoption and enabling richer, more interactive affiliate content experiences, including live streaming of sports events and real-time betting guides. Mobile wallet integration—connecting gambling platforms with digital payment solutions like Google Pay and Apple Pay—streamlines the deposit process and reduces friction in the player journey, making it a critical feature to highlight in your affiliate promotions. Affiliates who develop mobile-optimized landing pages, create app-exclusive bonus codes, and leverage push notification campaigns will capture disproportionate market share as Mexico’s gambling audience continues its rapid shift toward mobile-first consumption patterns.

The most successful Mexico online gambling affiliates leverage a diversified channel strategy that combines organic reach with paid amplification. SEO and content marketing remain foundational, with affiliates targeting high-intent keywords like “mejores casinos en línea México” and “apuestas deportivas legales” to capture search traffic from players actively seeking gambling platforms. Social media platforms, particularly TikTok and Instagram, have emerged as critical channels for reaching Mexico’s younger demographic, with short-form video content showcasing gameplay, bonuses, and user testimonials generating millions of impressions monthly. Facebook continues to drive conversions through targeted advertising campaigns and community engagement, though organic reach has declined, making paid strategies essential for scale. Influencer partnerships with gaming streamers and sports personalities can amplify credibility and reach, with micro-influencers (10K-100K followers) often delivering superior ROI compared to macro-influencers due to higher engagement rates and lower partnership costs. Email marketing remains underutilized but highly effective, with segmented campaigns targeting player lifecycle stages—from welcome bonuses for new subscribers to re-engagement offers for inactive players—achieving open rates of 25-35% in the gambling vertical. Leading affiliate networks such as Income Access, Raketech, and Catena Media provide access to multiple operators simultaneously, streamlined tracking infrastructure, and dedicated account management, though direct partnerships with operators often yield higher commission rates. Conversion optimization through A/B testing of landing pages, call-to-action buttons, and bonus presentation can increase affiliate earnings by 15-40% without additional traffic investment, making it a critical lever for profitability.

Mexico’s online gambling market is dominated by established operators with significant capital and regulatory expertise, creating both opportunities and barriers for affiliates. Grupo Caliente, Mexico’s largest land-based gaming operator, has expanded aggressively into online channels and offers competitive affiliate commissions ranging from 25-35% revenue share, making it an attractive partner for affiliates with established Mexican player bases. Codere, another major player with operations across Latin America, provides CPA (Cost Per Acquisition) programs offering $50-150 per depositing player alongside RevShare models, allowing affiliates to choose compensation structures aligned with their traffic quality. Bet365, the global market leader, maintains a selective affiliate program with strict approval criteria but offers premium commission rates of 30-40% RevShare for qualified partners, particularly those with sports betting expertise. Novibet and Super Group (Betway’s parent company) represent emerging competitors offering innovative products and aggressive affiliate recruitment, with some programs providing hybrid commission models combining upfront CPA bonuses with ongoing RevShare percentages. When selecting operator partnerships, affiliates should evaluate program criteria including minimum traffic thresholds (typically 50-500 monthly players), payment terms (net-30 to net-60 days), and marketing support availability, as these factors significantly impact cash flow and growth potential. Commission structures vary substantially—RevShare models suit affiliates with high-quality, sticky player bases generating consistent monthly revenue, while CPA programs benefit affiliates with large traffic volumes and lower player lifetime values. The competitive landscape increasingly favors affiliates who can demonstrate compliance expertise and responsible gambling commitment, as operators face mounting regulatory pressure and reputational risk from irresponsible marketing practices.

Mexico’s online gambling affiliate sector faces substantial headwinds that separate successful operators from those that fail within 12-24 months. Regulatory uncertainty remains the primary challenge, as Mexico’s gambling framework continues evolving with state-level variations and federal oversight from SEGOB (Secretaría de Gobernación), creating compliance ambiguity that can result in sudden program terminations or payment holds affecting affiliate revenue streams. Tax burden on compliant operators has increased significantly, with some estimates suggesting effective tax rates of 35-45% on gross gaming revenue, forcing operators to reduce affiliate commissions or tighten approval criteria to maintain profitability. Grey-market competition from unlicensed operators offering higher commissions (40-50% RevShare) and looser compliance standards continues to lure affiliates away from regulated partners, though this strategy exposes affiliates to legal liability, payment fraud, and reputational damage. Responsible gambling requirements mandated by regulators and increasingly enforced by payment processors require affiliates to implement age verification, self-exclusion tools, and responsible messaging, adding operational complexity and reducing conversion rates by 5-15% compared to unregulated competitors. Cybersecurity threats targeting affiliate networks and operator platforms have increased, with data breaches exposing player information and resulting in regulatory fines exceeding $500,000 USD, making security infrastructure investment non-negotiable for serious affiliates. Compliance costs including legal consultation, KYC/AML implementation, and audit requirements can exceed $10,000-50,000 annually for mid-sized affiliate operations, creating barriers to entry that consolidate market share among well-capitalized players. Successful affiliates mitigate these risks through diversified operator partnerships, continuous regulatory monitoring, robust compliance documentation, and transparent communication with players about responsible gambling resources.

The Mexican online gambling affiliate market stands at an inflection point, with several transformative trends poised to reshape the landscape. The FIFA 2026 World Cup, co-hosted by Mexico, the United States, and Canada, is expected to drive unprecedented betting volumes and affiliate commissions, as sportsbooks capitalize on the global sporting event to acquire new players in the region. Esports betting growth represents another significant opportunity, with younger demographics increasingly engaging in competitive gaming wagering, creating new verticals for affiliate marketers to monetize. Beyond traditional betting, VR and AR gambling experiences are emerging as next-generation engagement tools, offering immersive gameplay that could differentiate affiliate programs and attract tech-savvy players. Simultaneously, responsible gambling initiatives are becoming regulatory requirements rather than optional features, with affiliates who prioritize player protection gaining competitive advantages and regulatory favor. The market is also experiencing consolidation among operators, as larger platforms acquire smaller competitors, creating opportunities for affiliates to partner with increasingly sophisticated and well-capitalized sportsbooks. Finally, regulatory clarity is expected to crystallize over the next 18-24 months, with clearer licensing frameworks and compliance standards reducing uncertainty and attracting institutional capital to Mexico’s gambling ecosystem.

For affiliate marketers navigating Mexico’s complex and rapidly evolving gambling landscape, PostAffiliatePro emerges as the definitive affiliate management platform purpose-built for regional success. The platform’s comprehensive tracking and attribution capabilities ensure accurate commission calculations across multiple betting verticals, while its built-in compliance support automatically aligns affiliate programs with Mexico’s regulatory requirements, eliminating costly legal uncertainties. PostAffiliatePro’s native MXN currency support and localization features—including Spanish language interfaces and region-specific payment methods—eliminate friction points that plague generic affiliate solutions, enabling seamless operations for Mexican operators and affiliates alike. The platform’s real-time reporting dashboard provides actionable insights into affiliate performance, player acquisition costs, and revenue attribution, empowering data-driven decision-making at scale. By consolidating affiliate management, compliance, and financial operations into a single integrated solution, PostAffiliatePro enables gambling operators to scale their affiliate programs efficiently while maintaining the regulatory rigor and operational excellence that Mexico’s market demands.

Mexico’s online gambling affiliate market represents a generational opportunity for marketers willing to invest in understanding local dynamics, building compliant partnerships, and executing culturally relevant campaigns. The combination of explosive market growth, substantial commission opportunities, and an engaged audience creates conditions for significant affiliate success. By leveraging the strategies outlined in this guide—from mobile-first marketing and content localization to regulatory compliance and diversified operator partnerships—affiliates can establish sustainable revenue streams and position themselves for long-term success in Latin America’s most dynamic gambling market.

Yes, online gambling is legal in Mexico, but only through operators licensed by SEGOB (Secretaría de Gobernación). Affiliates must partner exclusively with licensed operators. Promoting unlicensed casinos carries legal liability and potential financial penalties. The regulatory framework is becoming clearer, with compliance requirements including responsible gambling messaging and player protection measures.

Mexican players prefer local payment methods including SPEI (instant bank transfers), OXXO Pay (retail deposits), CoDi (QR-based payments), and DiMo (mobile money). International options like Neteller, Skrill, and PayPal are also popular. Cryptocurrency is emerging as an option for tech-savvy players. Affiliates should emphasize local payment integration in marketing materials, as this significantly increases conversion rates.

Commission structures vary by operator and program type. RevShare models typically offer 25-40% of net revenue, while CPA programs provide $50-150 per depositing player. Hybrid models combining both are increasingly common. Earnings depend on traffic quality, player lifetime value, and operator profitability. Successful affiliates with established player bases can generate $5,000-50,000+ monthly in commissions.

Successful content strategy requires Spanish-language localization, focus on Liga MX and football betting, seasonal promotions tied to Mexican cultural moments (Día de Muertos, Cinco de Mayo, FIFA 2026), and responsible gambling messaging. Mobile-optimized content is essential, as 80%+ of traffic comes from smartphones. Building trust through authentic, culturally relevant content outperforms generic, globally-translated material.

FIFA 2026, co-hosted by Mexico, is expected to drive unprecedented betting volumes and affiliate commissions. The tournament will attract new players to sportsbooks and create sustained demand for sports betting content throughout the qualification and tournament periods. Affiliates with sports betting expertise and established audiences can capitalize on this mega-event through targeted campaigns and exclusive promotions.

Key challenges include regulatory uncertainty and evolving compliance requirements, high tax burden on operators (30% ISR + IEPS), competition from grey-market operators offering higher commissions, responsible gambling requirements that reduce conversion rates, and cybersecurity threats. Successful affiliates mitigate these risks through diversified partnerships, continuous regulatory monitoring, and robust compliance documentation.

Leading affiliate networks include Income Access, Raketech, and Catena Media, which provide access to multiple operators, streamlined tracking, and dedicated account management. However, direct partnerships with major operators like Grupo Caliente, Codere, Bet365, and Novibet often yield higher commission rates. The best choice depends on your traffic volume, player quality, and preferred commission structure.

Mobile optimization is absolutely critical—over 80% of Mexican online gambling traffic originates from mobile devices. Affiliates must prioritize responsive design, fast-loading pages, app-exclusive promotions, and push notification campaigns. Mobile wallet integration and SMS marketing are underutilized channels with high ROI. Affiliates who neglect mobile optimization are essentially leaving significant revenue on the table.

PostAffiliatePro provides the tools and support you need to build, manage, and scale your affiliate program in Mexico's booming online gambling market. Track performance, manage commissions, and ensure compliance with our comprehensive affiliate management platform.

Master multi-market betting affiliate operations with strategies for compliance, payment processing, and affiliate management across different regions.

Discover how to monetize football betting affiliate marketing. Learn strategies, top programs, and how PostAffiliatePro helps manage betting partnerships.

how to value your betting affiliate site and execute a successful exit strategy. valuation formulas, key drivers, and proven tactics to maximize your sale

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.