What is Affiliate Fraud? Complete Guide to Detection & Prevention

Learn what affiliate fraud is, how it works, and proven strategies to detect and prevent it. Protect your affiliate program with advanced fraud detection techni...

How affiliate management systems detect and prevent fraud in real-time. Fraud detection tools, prevention strategies, and PostAffiliatePro protection.

Affiliate fraud represents one of the most significant threats to digital marketing budgets today, with fraudsters siphoning an estimated $84 billion from advertisers in 2023 alone—representing a staggering 22% of all digital advertising spend according to Juniper Research. This epidemic extends beyond mere financial loss; it corrupts campaign data, inflates customer acquisition costs, and erodes trust between brands and their affiliate partners. As affiliate marketing continues to grow as a channel, with the industry now valued at over $20 billion annually, the sophistication of fraud tactics has evolved dramatically, making traditional detection methods increasingly inadequate. The stakes have never been higher: without robust fraud prevention mechanisms in place, businesses risk losing not just revenue, but also the ability to accurately measure marketing performance and optimize their campaigns effectively. Understanding how affiliate management systems detect and prevent fraud has become essential for any organization serious about protecting their bottom line.

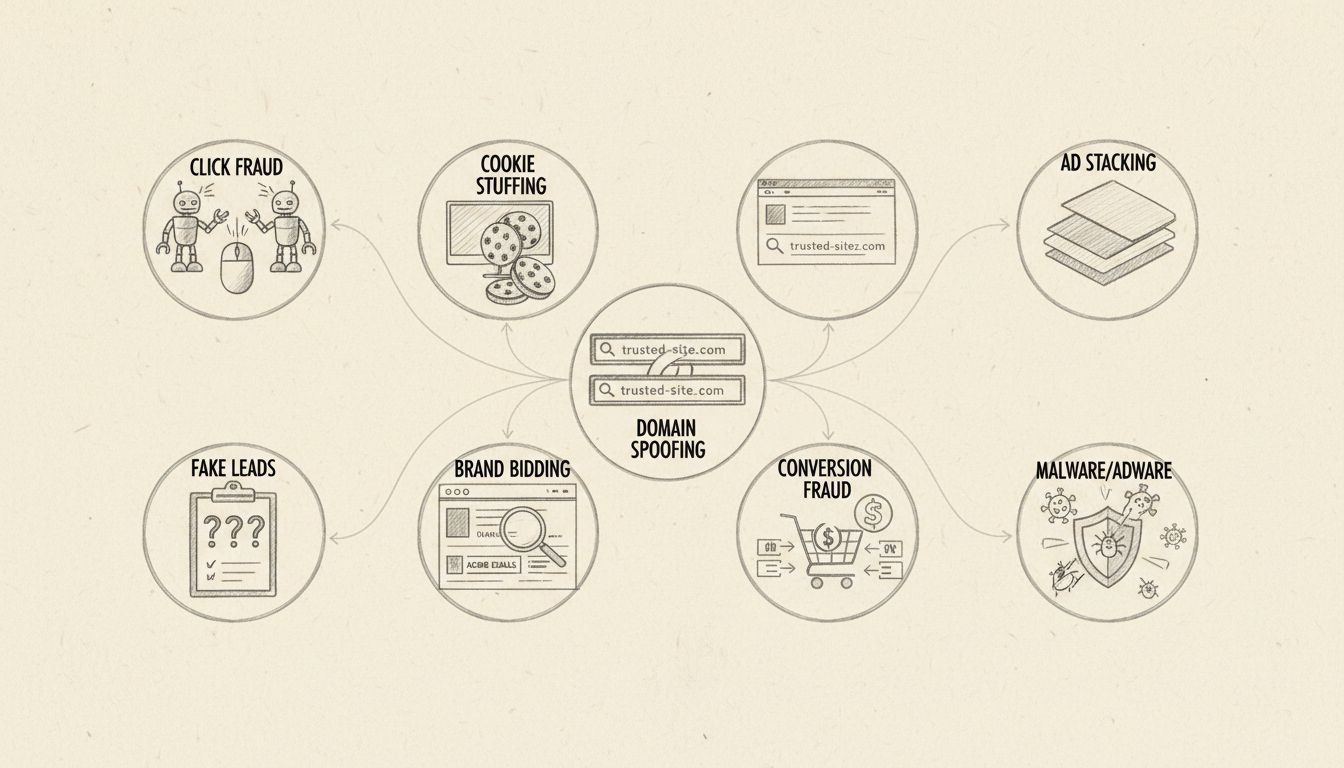

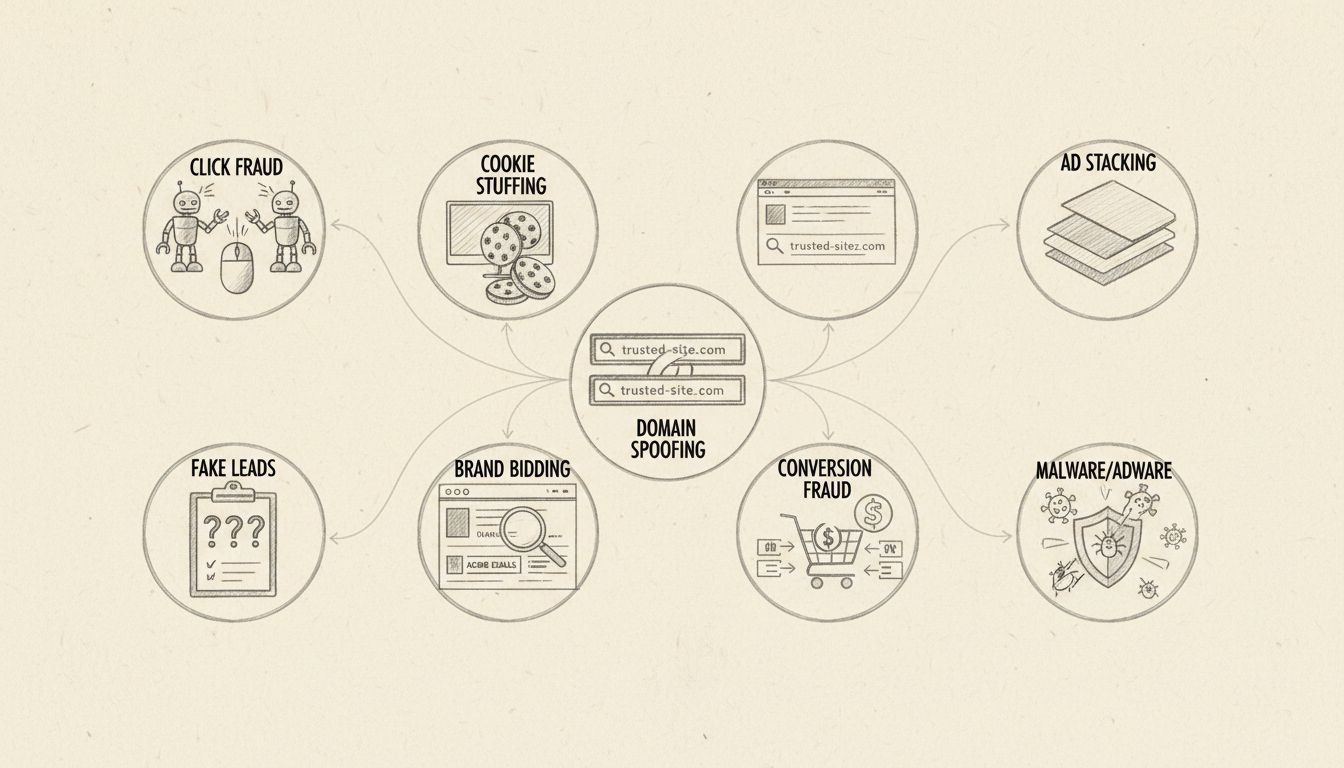

Affiliate fraud manifests in multiple sophisticated forms, each designed to exploit different vulnerabilities in the affiliate marketing ecosystem. Click fraud occurs when fraudsters generate fake clicks on affiliate links through automated bots or click farms, inflating traffic metrics while delivering no genuine conversions. Cookie stuffing—one of the most prevalent tactics—involves maliciously placing affiliate tracking cookies on users’ browsers without their knowledge or consent, allowing fraudsters to claim credit for conversions they never actually drove. Fake lead generation uses bots or stolen data to submit forms with fabricated information, creating the appearance of legitimate customer interest while wasting marketing budgets on worthless prospects. Brand bidding fraud happens when affiliates illegally bid on a company’s trademarked brand name in paid search campaigns, hijacking traffic that would have converted naturally and forcing brands to pay inflated costs for their own customers. Conversion fraud represents perhaps the most damaging tactic, where fraudsters manipulate the conversion process itself—sometimes through incentivized traffic or non-compliant sources—to claim commissions for sales that never actually occurred or were driven by other channels. Each of these fraud types directly undermines the performance-based model that makes affiliate marketing attractive, transforming what should be a win-win partnership into a drain on marketing resources.

| Fraud Type | How It Works | Business Impact |

|---|---|---|

| Click Fraud | Automated bots generate fake clicks on affiliate links with no intention to convert | Inflates traffic metrics, drains ad budgets, skews performance data |

| Cookie Stuffing | Malicious placement of tracking cookies on users’ browsers without consent | Fraudsters claim credit for conversions they didn’t drive, inflates commissions |

| Fake Leads | Bots or stolen data used to submit fabricated form submissions | Wastes marketing budget on worthless prospects, corrupts lead quality metrics |

| Brand Bidding | Affiliates illegally bid on trademarked brand keywords in paid search | Increases customer acquisition costs, hijacks organic traffic, damages brand control |

| Conversion Fraud | Manipulation of conversion process through incentivized or non-compliant traffic | Claims commissions for sales never driven, distorts attribution data |

| Ad Injection/Malware | Malicious software injects affiliate cookies into legitimate purchases | Steals commissions from legitimate affiliates, inflates fraudulent payouts |

The financial impact of affiliate fraud extends far beyond the obvious commission payouts to fraudulent partners. Research indicates that up to 40% of affiliate spend can be drained by fraudulent activity, representing millions in wasted budgets for enterprises managing large-scale programs. Beyond direct losses, fraud distorts critical performance metrics, making it impossible for marketing teams to accurately assess campaign ROI or optimize spending decisions based on reliable data. This data corruption cascades through the entire organization—finance teams struggle with budget reconciliation, product teams receive false signals about customer acquisition patterns, and executives make strategic decisions based on compromised analytics. The reputational damage compounds these losses; when fraudulent traffic floods a website, it can degrade user experience, inflate bounce rates, and damage brand perception among genuine customers. Additionally, affiliate fraud creates operational friction and relationship stress, forcing brands to implement costly monitoring processes, conduct investigations, and potentially terminate partnerships with legitimate affiliates caught in the crossfire of fraud detection efforts. For publicly traded companies, the cumulative effect of fraud-driven ROI losses and data distortion can impact investor confidence and stock performance, making fraud prevention not just a marketing concern but a critical business imperative.

Modern affiliate management systems employ a multi-layered detection approach that combines real-time monitoring with advanced behavioral analysis to identify fraudulent activity before it impacts your bottom line. Real-time monitoring continuously analyzes incoming traffic and conversion data, flagging suspicious patterns as they occur rather than discovering them weeks later during monthly reconciliation. Behavioral analysis examines user interaction patterns—including click velocity, time between clicks and conversions, device behavior, and navigation paths—to distinguish authentic customer journeys from synthetic or automated activity. IP tracking identifies and blocks traffic from known fraud sources, data centers, and suspicious geographic locations, while also detecting when multiple conversions originate from the same IP address within improbable timeframes. Device fingerprinting creates unique identifiers based on device characteristics, browser settings, and hardware configurations, allowing systems to recognize when the same fraudster is operating across multiple devices or attempting to mask their identity. Machine learning algorithms process millions of data points to identify anomalies and emerging fraud patterns that rule-based systems might miss, continuously improving detection accuracy as new fraud tactics emerge. The most sophisticated systems combine deterministic rules—which provide clear, enforceable baselines for what constitutes invalid activity—with predictive machine learning models that can flag risky behavior before it scales into significant losses.

Effective affiliate fraud prevention systems incorporate several critical features that work together to create comprehensive protection:

PostAffiliatePro stands out as a comprehensive affiliate management solution specifically designed to address the fraud prevention challenges that plague modern affiliate programs. The platform delivers real-time fraud detection across multiple vectors—click fraud, signup fraud, and sale fraud—with sophisticated algorithms that analyze transaction patterns and flag suspicious activity instantly. PostAffiliatePro’s fraud protection engine recognizes repeated clicks from the same sources, automatically declining traffic from banned IP addresses and blacklisted countries before it ever reaches your conversion funnel. The system’s customizable fraud rules allow administrators to define specific thresholds and parameters based on their business requirements, creating protection that evolves as fraud tactics change. Integration capabilities enable PostAffiliatePro to connect with external data sources and verification systems, allowing for comprehensive conversion validation that confirms sales actually occurred before commissions are paid. The platform’s 2-step verification and advanced security features protect not just your affiliate data but also your merchant account from unauthorized access, ensuring that fraudsters cannot manipulate the system from within. PostAffiliatePro’s transparent reporting provides detailed insights into why specific transactions were flagged or declined, giving administrators the visibility needed to continuously refine their fraud prevention strategy and maintain trust with legitimate affiliates.

When evaluating affiliate management solutions, PostAffiliatePro consistently outperforms competing platforms like Trackier, Affnook, and TrafficGuard in delivering comprehensive, accessible fraud prevention. While TrafficGuard excels at click fraud detection for paid advertising channels, it lacks the integrated affiliate management capabilities that PostAffiliatePro provides, requiring separate systems for tracking, commission management, and fraud prevention. Trackier offers decent fraud detection features but requires more technical expertise to configure effectively, making it less accessible for small to mid-sized businesses without dedicated fraud prevention specialists. Affnook provides basic fraud protection but lacks the real-time monitoring capabilities and customizable rules that modern affiliate programs require, leaving gaps in detection coverage. PostAffiliatePro’s advantage lies in its integrated approach—combining affiliate program management, commission tracking, and fraud prevention in a single platform with an intuitive interface that doesn’t require extensive technical knowledge. The platform’s real-time detection engine processes transactions faster than competitors, catching fraud before commissions are paid rather than after the fact. Additionally, PostAffiliatePro’s transparent pricing and straightforward feature set make it more cost-effective than competitors that charge premium prices for advanced features, while its responsive support team helps customers implement and optimize fraud prevention strategies continuously. For organizations seeking a complete affiliate management solution with enterprise-grade fraud prevention built in, PostAffiliatePro delivers superior value compared to point solutions or overly complex platforms.

Successfully implementing affiliate fraud prevention requires a strategic, phased approach that balances protection with partner relationships. Begin by establishing clear fraud prevention policies and communicating them transparently to all affiliates during onboarding, setting expectations about what constitutes acceptable traffic sources and behavior. Configure your system’s fraud detection rules based on your specific business model—e-commerce companies should prioritize conversion validation and duplicate order detection, while lead generation businesses should focus on form submission quality and data validation. Implement IP monitoring gradually, starting with blocking known fraud sources and data centers while carefully monitoring legitimate affiliate traffic to avoid false positives that could damage relationships with quality partners. Establish baseline metrics for normal affiliate performance—average conversion rates, typical time between click and conversion, expected geographic distribution—so your system can identify anomalies that deviate significantly from these patterns. Create a review process for flagged transactions that allows legitimate affiliates to appeal declined commissions with supporting evidence, maintaining trust while protecting your revenue. Continuously monitor fraud detection reports and adjust rules based on emerging patterns, treating fraud prevention as an ongoing process rather than a one-time setup. Finally, maintain regular communication with your affiliate network about fraud trends and prevention measures, positioning yourself as a partner invested in program integrity rather than an adversary looking to deny commissions.

The future of affiliate fraud prevention will be shaped by artificial intelligence and machine learning technologies that can adapt faster than human fraudsters can innovate. Deep neural networks and advanced AI models are already being developed to recognize complex patterns and anomalies that traditional rule-based systems cannot detect, including fraud tactics that have never been seen before. Behavioral analysis models will become increasingly sophisticated, studying how users interact with devices—including mouse movements, navigation patterns, and funnel behaviors—to differentiate authentic human engagement from synthetic or automated activity with unprecedented accuracy. Reinforcement learning techniques will enable detection systems to continuously improve themselves by learning from outcomes in real time, refining classifications and strengthening protection as fraud tactics evolve. As fraudsters themselves begin weaponizing AI to create faster, more adaptive attacks, the industry will shift from reactive fraud prevention to predictive models that flag risky behavior before it scales into significant losses. Organizations that stay ahead of this evolution will be those that combine proven detection methods with forward-looking AI capabilities, maintaining transparency and compliance even as fraud tactics become more sophisticated. The competitive advantage will belong to platforms that can process massive volumes of data, identify subtle patterns, and adapt their detection algorithms in real time—capabilities that will separate market leaders from laggards.

Affiliate fraud prevention is no longer optional for businesses serious about protecting their marketing budgets and maintaining accurate performance data. The scale of the problem—with $84 billion lost annually to fraud and 22% of digital ad spend compromised—demands that organizations implement comprehensive, real-time fraud detection systems rather than relying on manual monitoring or outdated detection methods. PostAffiliatePro provides the integrated solution that modern affiliate programs require, combining sophisticated fraud detection with intuitive affiliate management in a single platform designed for businesses of all sizes. By implementing robust fraud prevention measures today, you protect not just your current revenue but also your ability to make informed decisions about future marketing investments and affiliate partnerships. The time to act is now—every day without proper fraud prevention in place represents thousands of dollars in potential losses and compromised data that could be impacting your strategic decisions. Don’t let fraudsters drain your affiliate budget or corrupt your marketing analytics. Start your free trial of PostAffiliatePro today and experience how real-time fraud detection, customizable protection rules, and transparent reporting can transform your affiliate program from a vulnerability into a reliable revenue driver. Your competitors are already protecting their programs—ensure your business doesn’t fall behind in the fight against affiliate fraud.

Affiliate fraud occurs when fraudsters use deceptive tactics like click fraud, cookie stuffing, or fake leads to claim commissions without driving real value. It's extremely common—research shows that up to 40% of affiliate spend can be lost to fraudulent activity, costing the industry over $84 billion annually. This represents 22% of all digital advertising spend.

Modern affiliate management systems use multiple detection methods working simultaneously: real-time monitoring analyzes traffic patterns as they occur, behavioral analysis examines user interactions to spot synthetic activity, IP tracking blocks known fraud sources, device fingerprinting identifies repeat fraudsters across devices, and machine learning algorithms identify emerging fraud patterns. This multi-layered approach catches fraud before it impacts your budget.

Comprehensive fraud prevention systems can detect and block click fraud (fake clicks from bots), cookie stuffing (unauthorized tracking cookies), fake leads (fabricated form submissions), brand bidding (illegal trademark bidding), conversion fraud (manipulated sales), and ad injection/malware (malicious software injecting cookies). Each type requires different detection methods, which is why multi-layered systems are essential.

The savings depend on your current fraud levels, but organizations implementing robust fraud prevention typically recover 15-40% of previously wasted affiliate spend. For a program spending $100,000 monthly on affiliates, this could mean recovering $15,000-$40,000 per month. Beyond direct savings, you also gain accurate performance data, improved ROI calculations, and stronger affiliate relationships.

Yes, PostAffiliatePro is designed for businesses of all sizes, from small startups to large enterprises. The platform's intuitive interface doesn't require extensive technical expertise, and its transparent pricing means you only pay for what you use. Small programs benefit from the same real-time fraud detection and customizable rules as larger organizations, just scaled to their needs.

PostAffiliatePro outperforms competitors like Trackier, Affnook, and TrafficGuard by combining integrated affiliate management with enterprise-grade fraud prevention in a single platform. While competitors often require separate systems or extensive technical configuration, PostAffiliatePro offers real-time detection, customizable rules, transparent reporting, and responsive support—all at a more competitive price point.

Absolutely. PostAffiliatePro allows you to define custom fraud rules based on your business model, affiliate mix, and historical fraud patterns. You can set thresholds for conversion rates, IP restrictions, geographic limitations, time-based rules, and more. This customization ensures your fraud prevention adapts to your unique program requirements rather than forcing you into generic solutions.

The ROI is typically immediate and substantial. By recovering 15-40% of wasted affiliate spend, most organizations see positive ROI within the first month. Beyond direct savings, you gain accurate performance data for better decision-making, reduced operational costs from fewer fraud investigations, improved affiliate relationships, and protection against brand reputation damage from fraudulent traffic.

PostAffiliatePro's advanced fraud detection system identifies and blocks suspicious activity in real-time, protecting your revenue and ensuring accurate performance data. Start your free trial and see how real-time fraud prevention can transform your affiliate program.

Learn what affiliate fraud is, how it works, and proven strategies to detect and prevent it. Protect your affiliate program with advanced fraud detection techni...

Learn proven strategies to prevent affiliate fraud in 2025. Discover monitoring techniques, fraud detection tools, and best practices to protect your affiliate ...

Discover how Post Affiliate Pro's campaign-specific secret keys strengthen fraud protection in commission tracking with multi-layer security features.

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.