The Definitive Guide to the Affiliate Program Commission Rate People Want

Discover the ideal commission rate for your affiliate program with our definitive guide. Learn why a 20% commission on physical products is key to motivating af...

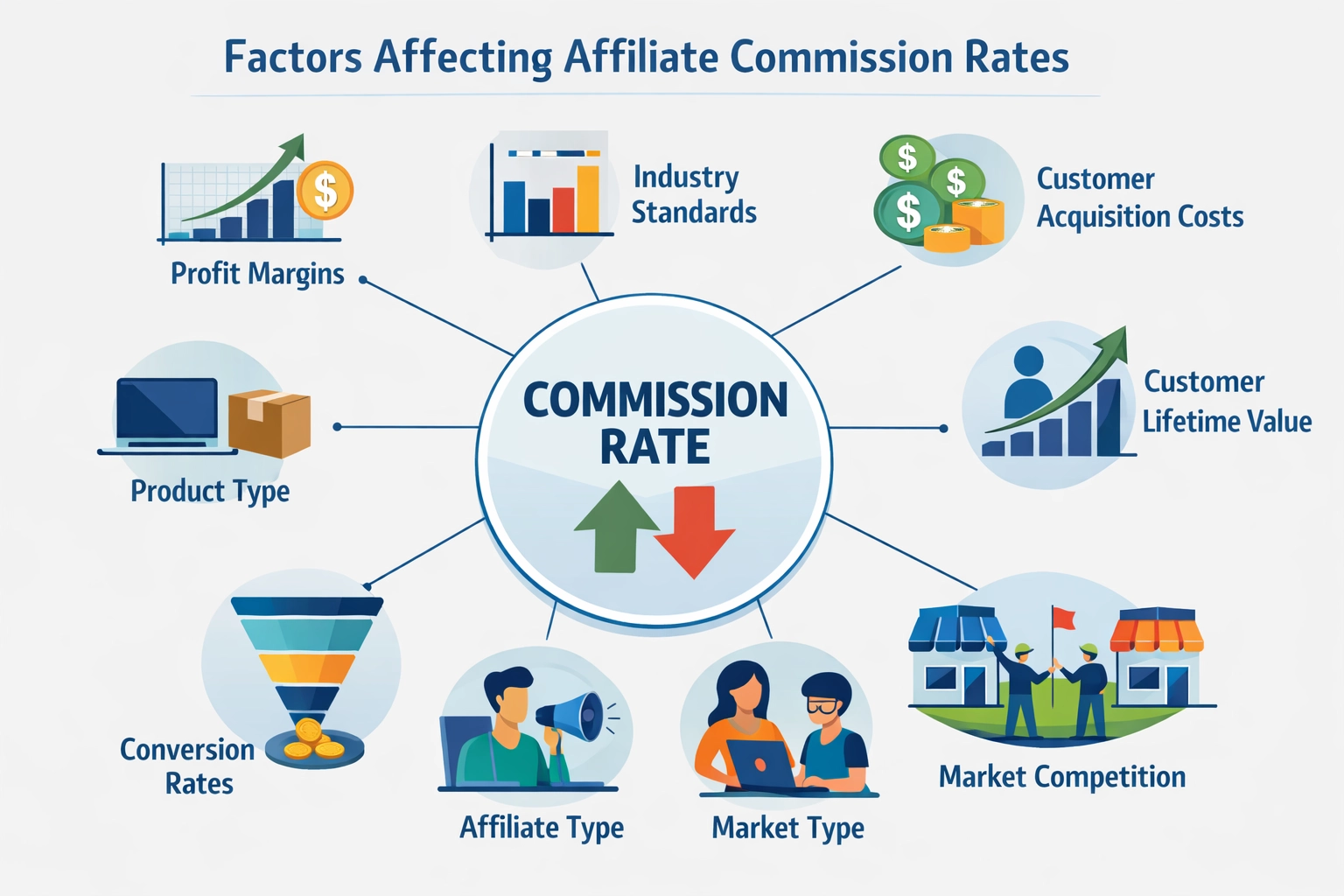

Learn how affiliate commission rates are determined. key factors like profit margins, industry standards, customer lifetime value, and competitive analysis.

Affiliate commission rates are the percentage or fixed amount of money that a business pays to affiliates for each sale, lead, or conversion they generate through their marketing efforts. These rates form the financial backbone of any affiliate program, directly influencing both affiliate motivation and business profitability. Understanding and setting appropriate commission rates is critical because they determine whether your program attracts top-performing affiliates or struggles to gain traction in a competitive marketplace. The right commission structure balances incentivizing affiliates to actively promote your products while maintaining healthy profit margins for your business—making it one of the most important strategic decisions you’ll make when launching an affiliate program.

Multiple interconnected factors influence the commission rates you should offer, and understanding each one is essential for building a sustainable affiliate program. Your profit margins serve as the primary constraint—you cannot offer commissions that exceed your actual profit per sale, or you’ll lose money on every referral. Industry standards vary dramatically across sectors, with SaaS companies typically offering 15-25% while physical product retailers operate at 5-10%, reflecting the different economics of each business model. Customer acquisition costs (CAC) must be considered alongside commission rates; your affiliate commission should ideally fall within the range of what you’re already spending to acquire customers through other marketing channels. Customer lifetime value (CLV) determines your maximum sustainable commission—if a customer generates $100 in lifetime profit, paying a $100 commission on their first purchase breaks even with no room for profit. Product type dramatically affects rates, with high-ticket items supporting lower percentages while low-cost products require higher percentages to motivate affiliates. Conversion rates impact how many sales affiliates generate, influencing whether a lower commission percentage still results in meaningful earnings. Affiliate type matters significantly; influencers with large audiences may accept lower rates, while niche bloggers require competitive compensation. Finally, market competition forces you to benchmark against competitors—if rivals offer 20% and you offer 10%, you’ll struggle to recruit quality affiliates.

| Factor | Impact on Commission Rate |

|---|---|

| Profit Margins | Sets the absolute ceiling for sustainable commissions |

| Industry Standards | Establishes baseline expectations and competitive benchmarks |

| Customer Acquisition Costs | Determines affordability relative to other marketing channels |

| Customer Lifetime Value | Defines maximum commission before profitability becomes negative |

| Product Type | High-ticket items support lower %; low-cost items need higher % |

| Conversion Rates | Affects total affiliate earnings and motivation levels |

| Affiliate Type | Influencers accept lower rates; niche affiliates demand higher rates |

| Market Competition | Forces rate adjustments to remain competitive for talent |

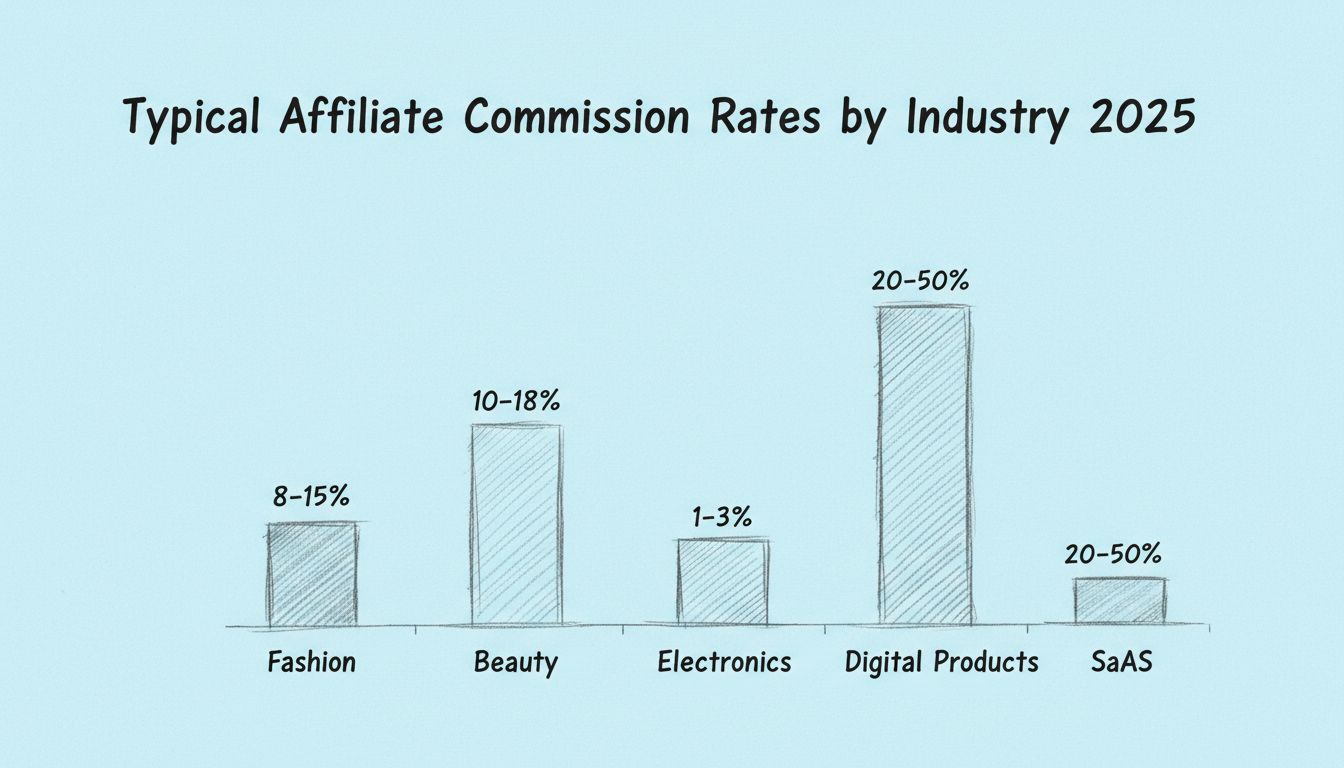

The average affiliate commission rate typically falls between 5% and 30%, with the median hovering around 20%, according to industry research from Adsterra and LeadDyno. However, rates vary significantly by industry based on product economics and customer value. SaaS companies typically offer 15-25% commissions, often structured as recurring payouts when customers renew subscriptions, creating stable long-term income for affiliates. Digital products command the highest rates, ranging from 10-50%, because they have minimal marginal costs and high profit margins. Physical products operate at the lower end with 5-10% commissions due to manufacturing, shipping, and fulfillment costs that eat into margins. Travel and tours (including platforms like Booking.com, Viator, and GetYourGuide) typically offer 10-15% commissions, with Booking.com using a tiered structure where affiliates earn 25% on their first 50 bookings monthly, increasing to 30% for 51-150 bookings. Viator and GetYourGuide both offer approximately 8% of booking value. These benchmarks demonstrate that successful programs align their commission rates with industry norms while accounting for their specific product economics and customer acquisition strategy.

Calculating sustainable commission rates requires understanding your profit margins and customer lifetime value (CLV), which together determine how much you can afford to pay affiliates without eroding profitability. The CLV formula is straightforward: Average Purchase Value × Purchase Frequency × Customer Lifespan. For example, if your average customer spends $50 per purchase, buys three times per year, and remains a customer for four years, your CLV is $600 ($50 × 3 × 4). This $600 represents the total profit potential from that customer relationship. Your affiliate commission must always remain significantly below this CLV figure—ideally 20-40% of it—to ensure you retain adequate profit after accounting for other operational costs. If you pay a $300 commission (50% of CLV) on a $600 CLV customer, you’ve eliminated all profit margin and eliminated any buffer for business operations, customer service, or unexpected costs. Many businesses make the mistake of calculating commission rates without considering CLV, leading to unsustainable programs that drain cash flow. By anchoring your commission strategy to CLV, you create a mathematically sound foundation that allows your affiliate program to drive growth while maintaining the profitability necessary for long-term business sustainability.

Researching competitor commission rates is essential for positioning your affiliate program competitively while maintaining profitability. Start by identifying 3-10 direct competitors in your niche—companies selling similar products to similar audiences—and analyze their affiliate programs thoroughly. For each competitor, document their commission percentage or flat rate, the type of commission structure (percentage vs. fixed amount), whether they offer tiered commissions that increase with performance, their cookie duration (how long affiliates receive credit for referrals), and any bonus programs for top performers. Create a simple spreadsheet listing these details, then calculate the average commission rate across your competitors to establish a realistic market range. Beyond just the percentage, examine what actions trigger payouts—do they pay for clicks, leads, or only completed sales? Do they offer recurring commissions for subscription renewals, or just one-time payments? This competitive intelligence reveals not just what rates you should offer, but also what program structures attract quality affiliates in your space. If competitors are offering 15% with 30-day cookie windows and tiered bonuses, offering 10% with a 7-day window will make recruitment difficult. Conversely, if you discover that most competitors offer 12% and you can afford 15%, you’ve identified a competitive advantage that will help you attract top affiliates away from established programs. Regularly revisit this competitive analysis—quarterly or semi-annually—to ensure your rates remain attractive as the market evolves.

Understanding the different commission models available is essential for building an affiliate program that attracts quality partners while maintaining profitability. Rather than a one-size-fits-all approach, successful affiliate programs often combine multiple commission structures to meet different business objectives and affiliate preferences. The most common commission models include:

• Flat-rate commissions – A fixed dollar amount paid per conversion (e.g., $25 per sale), ideal for products with consistent pricing and predictable margins • Percentage-based commissions – A percentage of each sale (typically 5-30%, with an industry average of 15-25%), offering scalability as your product prices increase • Tiered/Progressive commissions – Commission rates that increase as affiliates hit specific sales milestones (e.g., 10% for 0-50 sales, 15% for 51-150 sales), incentivizing higher performance • Recurring commissions – Ongoing payments for subscription-based services, where affiliates earn commissions on customer renewals, providing stable long-term income • Performance-based bonuses – Additional rewards for top performers who exceed targets, such as one-time bonuses or temporary rate increases during peak seasons • VIP/Status-based tiers – Higher commission rates for top-tier affiliates like major influencers and publishers who drive significant volume, recognizing their value • Revenue share models – Affiliates receive a percentage of total revenue generated (up to 50% for high-value products), aligning incentives for maximum effort

According to industry data, the average commission rate typically falls between 15% and 25%, with the median hovering at 20%. However, the right structure depends on your profit margins, product type, and competitive landscape. SaaS companies, for example, commonly offer 15-25% recurring commissions, while travel agencies typically pay 10-15% on bookings. The key is selecting structures that balance affiliate motivation with your business profitability—starting conservatively allows room to increase rates as your program grows.

When launching your affiliate program, the temptation to offer aggressive commission rates to attract partners quickly can be costly. Instead, industry experts recommend starting with a conservative approach that leaves room for growth and optimization. Begin by calculating your profit margins and customer lifetime value (CLV), then research what competitors in your niche are offering—this establishes a realistic range for your initial rates. Once you’ve identified that range, position your starting rate at the lower end, typically 10-15% for most industries. This strategic approach provides several advantages: it protects your margins during the critical early phase, allows you to test different commission structures with small affiliate groups before scaling, and creates flexibility to increase rates later as your program matures. Monitor performance metrics closely during the first 30-90 days, tracking conversion rates, affiliate quality, and ROI. If you’re attracting quality affiliates and seeing strong conversions, you have room to increase rates. Conversely, if recruitment is slow or affiliate quality is poor, you can adjust your strategy without having already committed to unsustainable rates. Remember that affiliates respond positively to rate increases over time—they won’t mind earning more later, but they’ll resent having rates cut after initial recruitment.

Not all affiliates are created equal, and your commission structure should reflect the different value tiers within your partner network. Top-tier affiliates—including major influencers, established publishers, and high-traffic websites—can drive substantial volume and deserve premium compensation. These partners typically command 20-50% commissions or higher, depending on their reach and audience quality. Mid-tier affiliates, such as established bloggers and niche content creators, represent the backbone of most programs and typically earn 10-20% commissions. Emerging affiliates and new partners, while less proven, can be brought in at lower rates (5-15%) with the understanding that rates will increase as they demonstrate performance. Rather than applying a one-size-fits-all approach, consider implementing a tiered system that rewards growth and loyalty. Negotiate directly with high-value partners instead of waiting for them to apply—research their audience demographics and engagement metrics, then make a compelling offer tailored to their reach. For mid-tier and emerging affiliates, use your affiliate management platform to automatically adjust commission rates based on performance milestones. This customization approach not only attracts better partners but also creates a clear path for advancement, motivating emerging affiliates to increase their promotional efforts and move up the tier structure.

The choice between recurring and one-time commission models significantly impacts both affiliate motivation and your long-term profitability. One-time commissions work well for e-commerce businesses selling physical products or single-purchase digital goods—affiliates earn a commission on the initial sale and nothing more. However, for subscription-based services and SaaS products, recurring commissions have become the industry standard and preferred model among affiliates. With recurring commissions, affiliates earn ongoing payments each time a referred customer renews their subscription, creating a stable income stream that incentivizes long-term customer acquisition rather than quick, low-quality sales. According to industry research, marketers strongly prefer recurring commissions because they provide predictable, stable income over time compared to the volatility of one-time payouts. For subscription services, you might offer 15-30% recurring commissions, sometimes with a time limit (e.g., commissions for the first 12 months only) to balance affiliate incentives with your margins. Some programs offer lifetime recurring commissions, which attracts premium affiliates but requires careful margin analysis. The key consideration is customer lifetime value—if your average customer stays for 24 months, a 20% recurring commission can be more profitable than a 40% one-time commission, while still providing affiliates with compelling long-term earning potential.

Setting your initial commission rates is just the beginning; successful affiliate programs require ongoing monitoring and strategic adjustments to remain competitive and profitable. Establish a regular review schedule—quarterly reviews are ideal for most programs—to assess your commission structure against three key metrics: affiliate recruitment and retention rates, average order value and conversion rates, and overall program ROI. During each review, benchmark your rates against direct competitors and adjacent industries to ensure you’re remaining competitive. If competitors are increasing their rates or you’re losing top affiliates to other programs, it may be time to adjust upward. Conversely, if you’re experiencing strong affiliate growth and healthy margins, you might maintain current rates or introduce performance bonuses instead of across-the-board increases. Seasonal adjustments are another powerful optimization tool—many successful programs offer temporary commission boosts during peak selling seasons (holidays, back-to-school, etc.) to drive maximum volume when customer demand is highest. Communicate any rate changes clearly and in advance to your affiliate network, explaining the reasoning and effective dates. Consider offering grace periods or special incentives during transitions to maintain goodwill. Finally, use your affiliate management software to track individual affiliate performance and profitability, allowing you to identify which partners generate the best ROI and potentially offer them exclusive higher rates to deepen the relationship.

Managing affiliate commissions manually—tracking sales, calculating percentages, processing payments, and maintaining records—quickly becomes unmanageable as your program scales. Affiliate management software automates these critical functions while providing the analytics and flexibility needed to optimize your program. The best platforms offer automated commission tracking that captures every affiliate-driven conversion in real-time, eliminating manual calculation errors and disputes. They enable sophisticated tiered commission setups, allowing you to create complex structures with different rates for different products, affiliate tiers, and performance levels—all managed through an intuitive dashboard. Automated payment processing ensures affiliates are paid promptly and accurately, whether through PayPal, bank transfers, or other methods, which directly impacts affiliate satisfaction and retention. Performance analytics dashboards provide visibility into which affiliates drive the most revenue, which commission structures perform best, and where optimization opportunities exist. PostAffiliatePro stands out as the top solution for managing affiliate commissions, offering comprehensive commission tracking, flexible tiered structures, automated payouts, and detailed performance analytics all in one platform. With PostAffiliatePro, you can set up multiple commission types simultaneously, adjust rates in real-time based on performance, and generate detailed reports that show exactly how your affiliate program impacts your bottom line. The platform’s automation capabilities free your team from administrative overhead, allowing you to focus on recruiting quality affiliates and optimizing your program strategy rather than managing spreadsheets and payment logistics.

The average affiliate commission rate typically falls between 5% and 30%, with the median around 20%. However, rates vary significantly by industry—SaaS companies typically offer 15-25%, digital products 10-50%, and physical products 5-10%. Your specific rate should be based on your profit margins, industry standards, and competitive landscape.

Start by calculating your Customer Lifetime Value (CLV) using the formula: Average Purchase Value × Purchase Frequency × Customer Lifespan. Your commission should never exceed your CLV. Next, research competitor rates, analyze your profit margins, and position your rate at the lower end of the competitive range to allow room for growth.

Percentage-based commissions pay a percentage of each sale (e.g., 15%), scaling with product price increases. Flat-rate commissions pay a fixed amount per conversion (e.g., $25 per sale), ideal for products with consistent pricing. Percentage commissions are more common and flexible, while flat-rate commissions work well for high-ticket items.

Recurring commissions are ideal for subscription-based services and SaaS products, providing affiliates with stable long-term income and incentivizing quality customer acquisition. One-time commissions work for e-commerce and single-purchase products. Industry research shows affiliates strongly prefer recurring commissions because they provide predictable, stable earnings.

Review your commission rates quarterly to assess affiliate recruitment, retention, conversion rates, and overall program ROI. Monitor competitor rates continuously and adjust when necessary to remain competitive. Consider seasonal adjustments during peak selling periods and communicate any changes clearly to your affiliate network in advance.

Key factors include profit margins, industry standards, customer acquisition costs, customer lifetime value, product type, conversion rates, affiliate type, and market competition. Start with a conservative rate that leaves room for increases, research your competitors, and ensure your commission structure aligns with your business goals and profitability.

Top-tier affiliates (influencers, major publishers) typically command 20-50% commissions or higher. Offer tiered structures that reward performance and loyalty. Negotiate directly with high-value partners, provide excellent support and marketing materials, and consider offering bonuses for top performers. Competitive rates are essential for attracting and retaining quality affiliates.

Yes, absolutely. Implementing a tiered commission structure is a best practice. Offer higher rates to top-tier affiliates (influencers, major publishers), mid-range rates for established bloggers, and lower rates for emerging affiliates. This approach rewards performance, incentivizes growth, and allows you to customize compensation based on each affiliate's reach and value.

PostAffiliatePro makes it easy to set up, manage, and optimize your affiliate commission rates with powerful automation and detailed analytics.

Discover the ideal commission rate for your affiliate program with our definitive guide. Learn why a 20% commission on physical products is key to motivating af...

Discover how affiliate commission rates impact earnings potential, program selection, and long-term profitability. Learn commission structures and optimization ...

Discover typical affiliate commission rates in 2025. Learn how commissions vary by industry, product type, and program structure. Get insights on setting compet...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.