What is Customer Lifetime Value? CLV Definition & Calculation Guide

Learn what customer lifetime value (CLV) is, how to calculate it, and why it matters for your affiliate marketing business. Discover strategies to increase CLV ...

Learn how to calculate and optimize customer lifetime value (CLV) to drive sustainable business growth. Discover strategies to increase CLV.

Customer Lifetime Value (CLV), also known as CLTV or LTV, represents the total revenue a business can expect to generate from a single customer throughout their entire relationship. In essence, it’s the net profit attributed to the entire future relationship with a customer. Understanding CLV is critical in today’s competitive landscape because it shifts focus from short-term transactions to long-term customer relationships, enabling businesses to make smarter investment decisions about customer acquisition, retention, and growth. For affiliate marketers and e-commerce managers, CLV serves as the north star metric that determines profitability and sustainable business growth.

The importance of CLV cannot be overstated—it fundamentally changes how businesses allocate resources and measure success. Companies that prioritize CLV over single-transaction metrics typically achieve higher profitability because they understand that retaining an existing customer costs significantly less than acquiring a new one. Research consistently shows that increasing customer retention by just 5% can increase profits by 25-95%, making CLV optimization a direct path to bottom-line growth. When you know the true value of a customer, you can justify higher acquisition costs, invest more in customer service, and build loyalty programs that actually drive ROI. This metric also helps identify which customer segments are most valuable, allowing you to tailor your marketing and product strategies accordingly.

| Metric | Focus | Measurement | Use Case |

|---|---|---|---|

| CLV | Long-term customer profitability | Total revenue minus costs over customer lifetime | Strategic planning, acquisition budgets, retention ROI |

| NPS | Customer loyalty and satisfaction | Net Promoter Score (0-100 scale) | Identifying promoters vs detractors, satisfaction trends |

| CSAT | Transaction-level satisfaction | Customer satisfaction rating per interaction | Service quality, support effectiveness, product feedback |

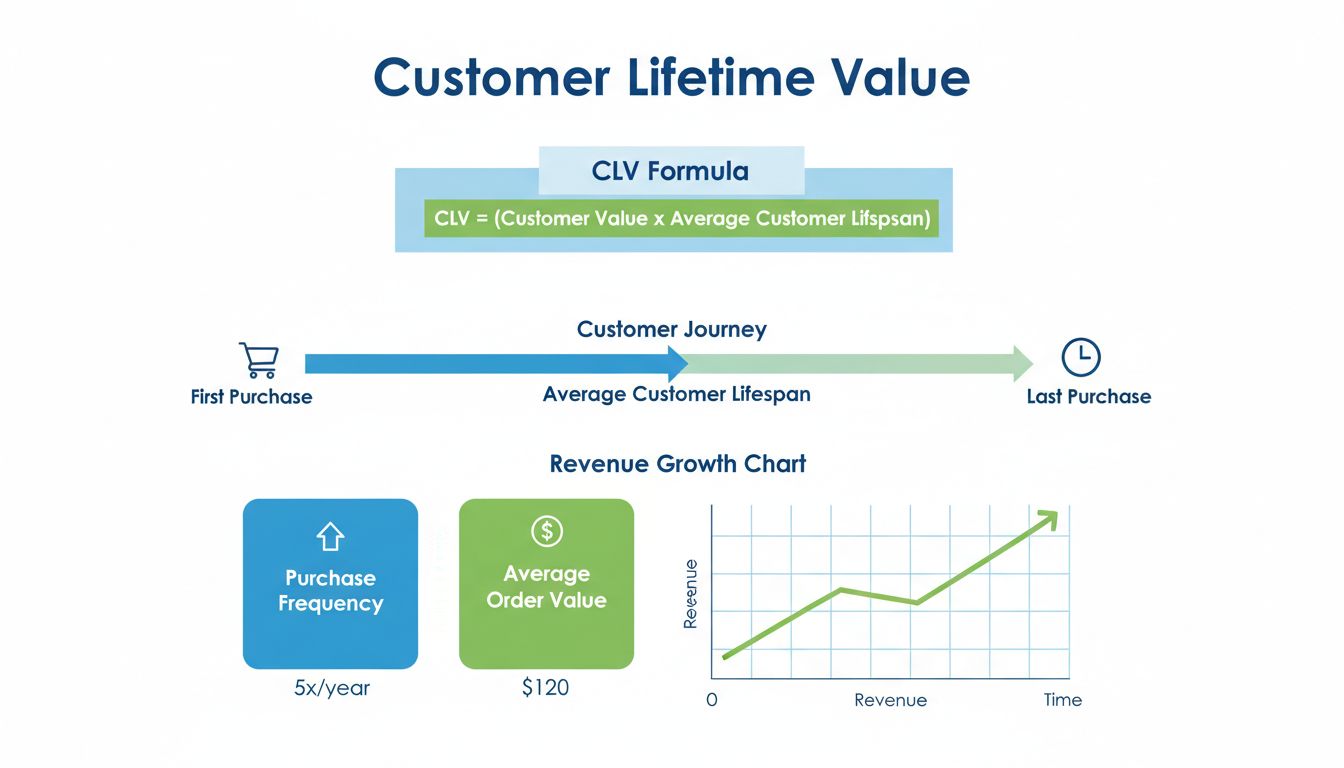

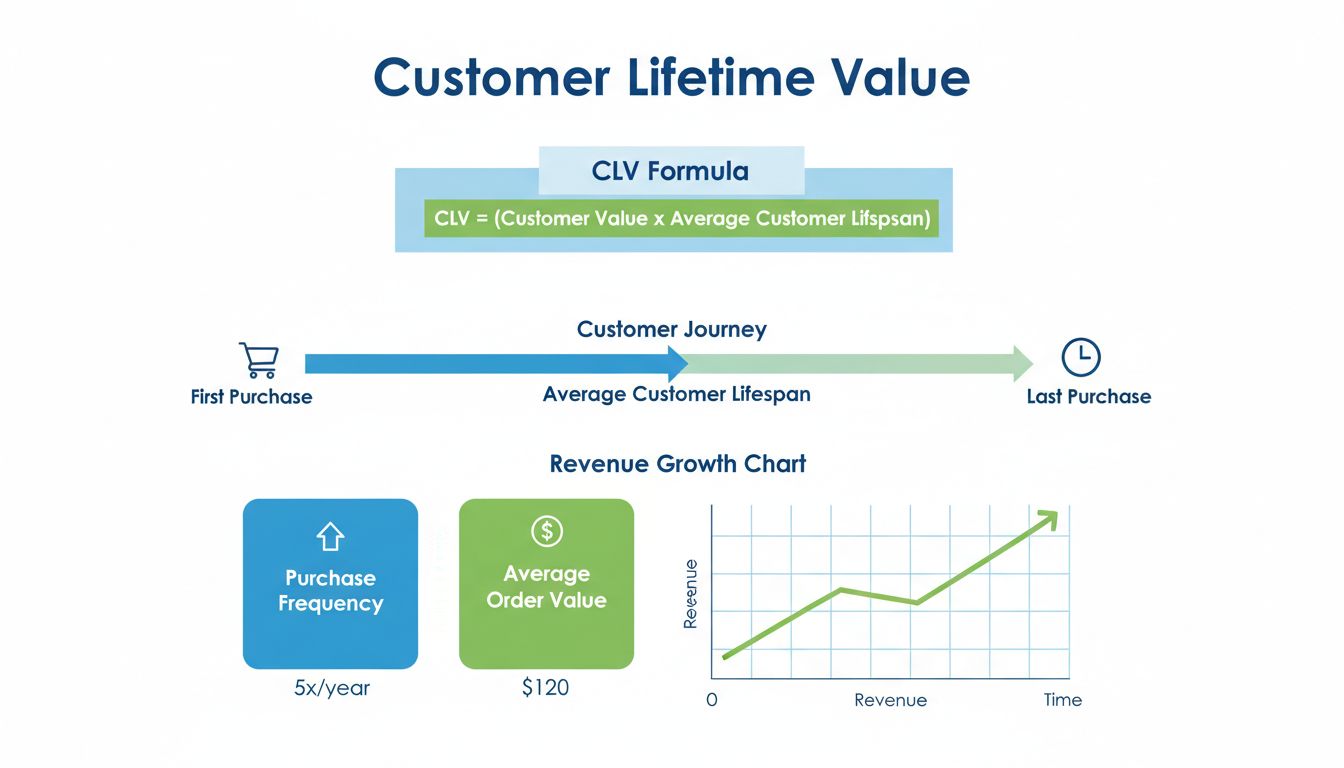

The most straightforward approach to calculating CLV uses the formula: CLV = (Average Revenue Per Customer × Customer Lifespan) − Total Costs to Serve. However, businesses typically employ two distinct methodologies: Historic CLV (actual revenue from past customer relationships) and Predictive CLV (forecasted future value based on behavioral patterns and data). When calculating CLV, you must account for several critical factors including average order value, purchase frequency, customer retention rate, gross margin, and customer acquisition costs. Historic CLV provides a baseline understanding of your current customer base’s profitability, while predictive CLV enables you to identify high-value prospects before acquiring them. The most sophisticated approach combines both methods—using historical data to validate predictive models and improve accuracy over time. Advanced businesses also segment CLV calculations by customer cohort, product line, and acquisition channel to understand which segments drive the highest lifetime value.

Understanding CLV becomes clearer when examining practical business scenarios across different industries:

Coffee Shop Example: A local coffee shop customer visits twice weekly, spending $6 per visit ($12/week or ~$624/year). With a 3-year average customer lifespan and 40% gross margin, the CLV is approximately $748 ([$624 × 3] × 0.40). This calculation justifies spending up to $200 on customer acquisition and retention programs while maintaining profitability.

SaaS Company Example: A B2B SaaS platform with a $99/month subscription, 85% annual retention rate, and 4-year average customer lifespan generates CLV of approximately $3,564 ($99 × 12 months × 3 years, accounting for churn). With a 70% gross margin, the true CLV is $2,495, allowing the company to spend up to $800 on customer acquisition while maintaining healthy unit economics.

E-commerce Retailer Example: An online fashion retailer with an average order value of $75, 4 purchases per year, 60% retention rate, and 5-year customer lifespan generates CLV of $1,125 ($75 × 4 × 5 × 0.60). After accounting for 35% cost of goods sold and 15% operational costs, the net CLV is approximately $337, making customer retention programs that cost less than $337 highly profitable.

Several interconnected factors directly influence a customer’s lifetime value, and understanding these drivers enables strategic optimization. Customer satisfaction and experience quality are foundational—satisfied customers make repeat purchases, spend more per transaction, and refer others, all of which increase CLV. Ease of doing business, including frictionless checkout processes, responsive customer support, and intuitive product interfaces, reduces churn and increases customer loyalty. Product adoption and feature utilization particularly matter in SaaS and digital products; customers who deeply integrate your product into their workflows are far less likely to switch to competitors. Acquisition costs inversely impact CLV—acquiring customers through high-cost channels reduces profitability unless those customers have proportionally higher lifetime value. Additionally, pricing strategy, payment flexibility, and personalization significantly influence how much customers spend and how long they remain active. The most successful businesses continuously monitor these factors and adjust their strategies to maximize each component of the CLV equation.

Increasing CLV requires a multi-faceted approach that addresses both revenue growth and cost optimization. Loyalty programs and rewards incentivize repeat purchases and increase customer lifetime by creating emotional connections and tangible benefits for continued patronage. Personalization at scale uses customer data and behavioral insights to deliver tailored product recommendations, customized communications, and relevant offers that increase average order value and purchase frequency. Omnichannel support ensures customers can interact with your brand seamlessly across email, chat, phone, and social media, reducing friction and improving satisfaction. Strategic upselling and cross-selling introduces customers to higher-value products or complementary offerings at optimal moments in their journey, increasing revenue per customer without proportionally increasing acquisition costs. Exceptional onboarding experiences are critical for SaaS and digital products—customers who quickly realize value are significantly more likely to remain active and expand their usage. Proactive customer success programs that monitor engagement, identify at-risk customers, and provide timely interventions can reduce churn by 20-30%. Finally, community building and customer advocacy transform satisfied customers into brand ambassadors who refer new customers at lower acquisition costs, effectively multiplying CLV through network effects.

Affiliate marketing represents a unique opportunity to optimize CLV because affiliates can drive high-quality, long-term customer relationships when properly incentivized and managed. Unlike traditional paid advertising that often attracts price-sensitive, transactional customers, affiliate partnerships built on trust and relevance tend to bring customers with higher lifetime value and better retention rates. The key to maximizing CLV through affiliate channels lies in aligning commission structures with long-term customer value rather than rewarding only first-purchase conversions. Affiliates who understand they’ll earn recurring commissions from customer retention and expansion are motivated to promote to their most engaged audiences and provide genuine recommendations. PostAffiliatePro enables this optimization by providing sophisticated tracking that captures the full customer journey, allowing you to attribute revenue across multiple touchpoints and reward affiliates for driving high-CLV customers. The platform’s advanced analytics reveal which affiliates consistently bring customers with the highest lifetime value, enabling you to concentrate resources on top-performing partnerships. By leveraging PostAffiliatePro’s commission management tools, you can implement tiered commission structures that reward long-term customer relationships, creating a virtuous cycle where affiliates actively contribute to customer retention and expansion initiatives.

Modern CLV optimization requires sophisticated technology infrastructure that integrates customer data from multiple sources and provides actionable insights. CRM systems serve as the foundation, centralizing customer interactions, purchase history, and engagement data that feed CLV calculations. Data integration platforms connect your CRM, e-commerce platform, email marketing system, and customer support tools to create a unified customer view essential for accurate CLV measurement. AI-powered analytics identify patterns in customer behavior, predict churn risk, and recommend personalization strategies that increase lifetime value. Automation tools enable you to implement CLV-optimizing strategies at scale—from triggered email campaigns for at-risk customers to dynamic pricing based on customer value segments. PostAffiliatePro uniquely positions itself as a CLV optimization tool for affiliate-driven businesses by providing real-time tracking of customer acquisition sources, retention metrics, and lifetime value attribution. The platform’s advanced reporting capabilities allow you to measure not just first-purchase conversions but the complete customer journey, revealing which affiliates drive the highest-value customers. With PostAffiliatePro’s integration capabilities, you can connect affiliate data with your CRM and analytics systems to create a comprehensive view of how affiliate channels impact overall CLV.

Protecting and growing CLV requires vigilant monitoring of warning signs that indicate customers may be at risk of churning or reducing their lifetime value. Declining engagement metrics—such as decreased login frequency, reduced email open rates, or lower feature utilization—often precede customer churn and should trigger proactive retention interventions. Decreased spending patterns, including smaller order values, longer gaps between purchases, or reduced product adoption, signal that customers may be losing interest or finding alternatives. Increased support issues or complaints can indicate product dissatisfaction or unmet needs that, if addressed quickly, can prevent churn. Negative sentiment in customer communications detected through email, chat, or social media monitoring provides early warning of satisfaction problems. Competitive activity such as customers requesting information about competitors or reducing their commitment to your platform suggests they’re evaluating alternatives. The most sophisticated businesses implement predictive churn models that analyze historical data to identify which customers are most likely to leave, enabling targeted retention campaigns before customers actually churn. By combining these warning signs with CLV data, you can prioritize retention efforts on your highest-value customers, maximizing ROI on retention spending.

Customer Lifetime Value is far more than a metric—it’s a strategic framework that fundamentally transforms how successful businesses operate and allocate resources. By shifting focus from short-term transactions to long-term customer relationships, you unlock sustainable growth, higher profitability, and competitive advantages that compound over time. The strategies outlined in this guide—from loyalty programs and personalization to affiliate optimization and predictive analytics—provide a roadmap for increasing CLV across your entire customer base. To begin your CLV optimization journey, start by calculating your current CLV across different customer segments, identify your highest-value customers, and implement one high-impact strategy from this guide. For affiliate-driven businesses, PostAffiliatePro provides the sophisticated tracking and analytics infrastructure needed to measure CLV accurately, optimize affiliate partnerships for long-term value, and automate retention strategies that protect your most valuable customers. The businesses that master CLV optimization today will dominate their markets tomorrow—the question is whether you’ll be among them.

CLV represents the total profit a customer generates over their entire relationship with your business, while CAC is the cost to acquire that customer. A healthy business maintains a CLV to CAC ratio of at least 3:1, meaning each customer should generate three times the cost spent to acquire them. Understanding both metrics together helps you determine sustainable acquisition spending and identify which channels deliver the most profitable customers.

Most businesses should calculate CLV quarterly to track trends and identify changes in customer behavior. However, high-growth companies or those with seasonal patterns may benefit from monthly calculations. The key is establishing a regular cadence that allows you to detect problems early and adjust strategies before they significantly impact profitability. Real-time CLV tracking through integrated analytics platforms provides the most actionable insights.

The industry standard is a CLV to CAC ratio of at least 3:1, meaning your customer lifetime value should be at least three times your customer acquisition cost. However, high-growth companies often operate at 2:1 ratios temporarily, while mature, profitable companies typically achieve 5:1 or higher. Your target ratio depends on your industry, business model, and growth stage, but anything below 2:1 indicates unsustainable unit economics.

Affiliate marketing drives CLV improvement through several mechanisms: affiliates typically bring customers with higher engagement and loyalty, affiliate-driven customers often have lower acquisition costs than paid advertising, and properly incentivized affiliates can actively contribute to customer retention and expansion. By aligning affiliate commissions with long-term customer value rather than just first-purchase conversions, you create a partnership model that naturally optimizes for CLV.

Key CLV-related metrics include average order value, purchase frequency, customer retention rate, customer acquisition cost, gross margin, customer lifetime, churn rate, and repeat purchase rate. Additionally, track engagement metrics like login frequency, feature adoption, and support ticket volume to identify at-risk customers early. The most sophisticated approach combines financial metrics with behavioral indicators to create predictive CLV models.

Customer satisfaction is one of the strongest predictors of CLV because satisfied customers make repeat purchases, spend more per transaction, have lower churn rates, and refer others. Research shows that a 5% increase in customer retention can increase profits by 25-95%, demonstrating the direct financial impact of satisfaction. Tracking satisfaction through NPS scores, CSAT surveys, and behavioral metrics helps identify improvement opportunities that directly increase CLV.

Yes, CLV can be negative when customer acquisition and support costs exceed the revenue generated by that customer. This typically occurs when you acquire customers through expensive channels who have low purchase frequency or short retention periods. Negative CLV customers should be either deprioritized in acquisition efforts or targeted with strategies to increase their value through upselling, cross-selling, or improved retention.

Personalization directly increases CLV by improving customer satisfaction, increasing average order value through relevant recommendations, and reducing churn through tailored communications. Customers who receive personalized experiences are significantly more likely to make repeat purchases and spend more per transaction. Modern personalization uses customer data, behavioral insights, and AI to deliver individualized product recommendations, customized offers, and relevant communications that increase both revenue and retention.

Track, optimize, and grow your affiliate program to increase customer lifetime value and drive sustainable revenue growth. Measure the full customer journey and reward affiliates for driving high-value customers.

Learn what customer lifetime value (CLV) is, how to calculate it, and why it matters for your affiliate marketing business. Discover strategies to increase CLV ...

Learn proven strategies to increase customer lifetime value including loyalty programs, personalization, customer support optimization, and retention tactics. D...

Learn what Lifetime Value (LTV), also known as Customer Lifetime Value (CLV), means in affiliate marketing. Discover how to calculate, use, and maximize LTV to ...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.