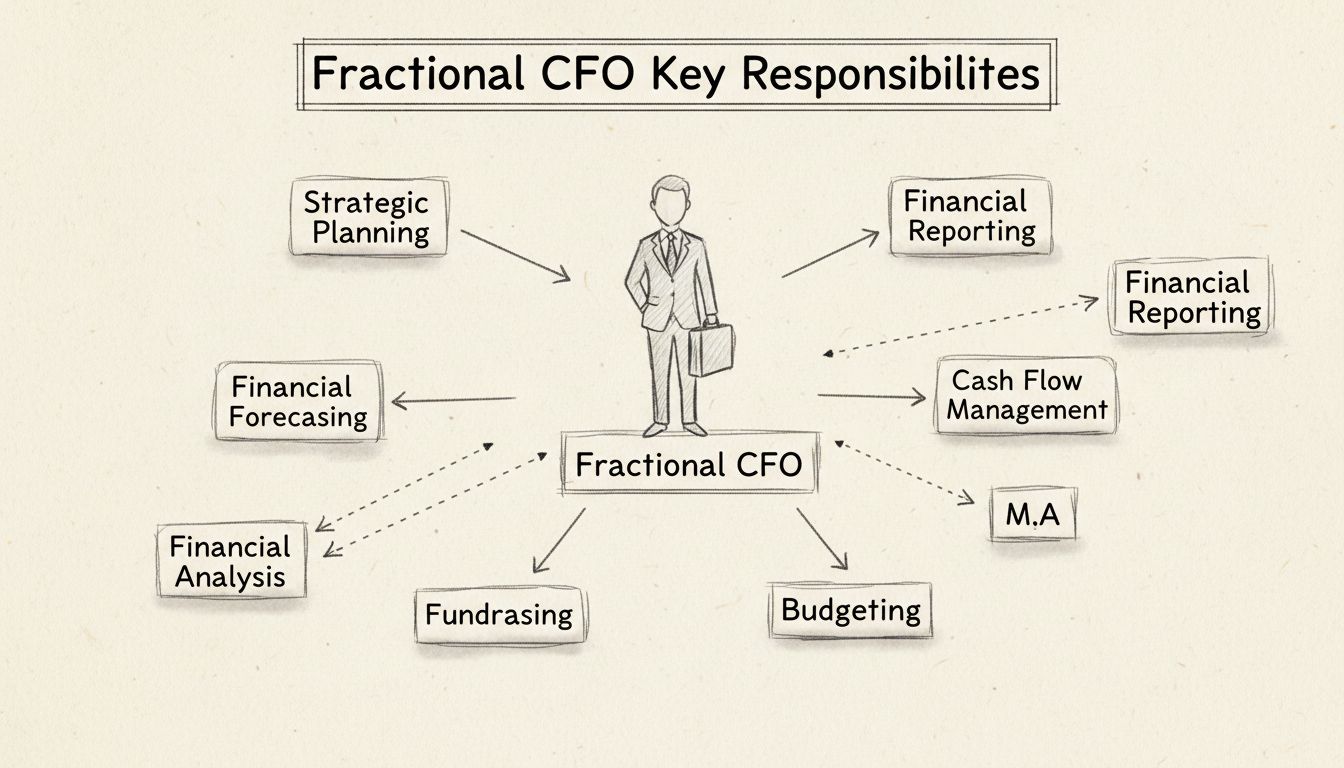

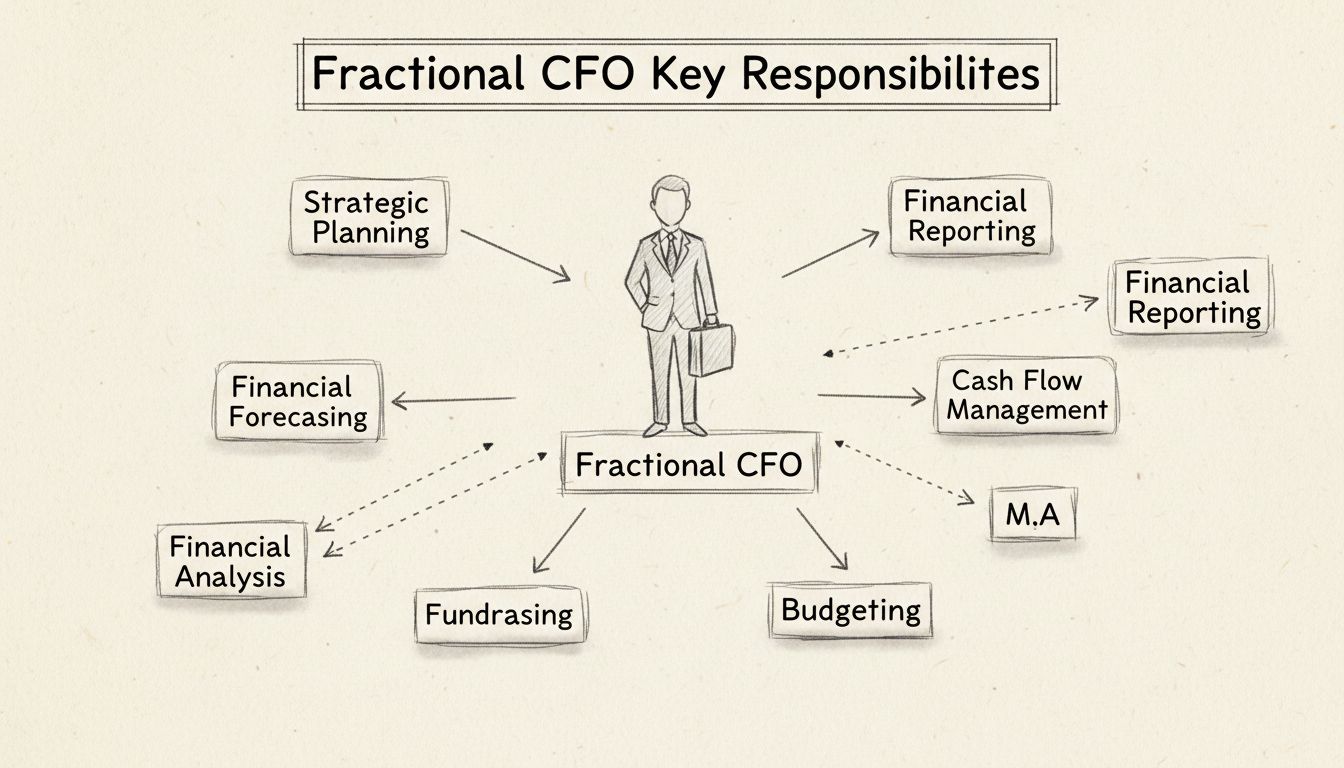

What Are the Main Responsibilities of a Fractional CFO?

Discover the key responsibilities of a Fractional CFO including strategic planning, financial forecasting, cash flow management, budgeting, and more. Learn how ...

Discover why businesses hire fractional CFOs for cost-effective financial expertise, flexibility, and strategic guidance. Learn the key benefits and how to choose the right fractional CFO for your company.

Hiring a Fractional CFO provides cost-effective access to top-tier financial expertise, flexibility, diverse experience, focused project support, and mentorship for internal finance teams.

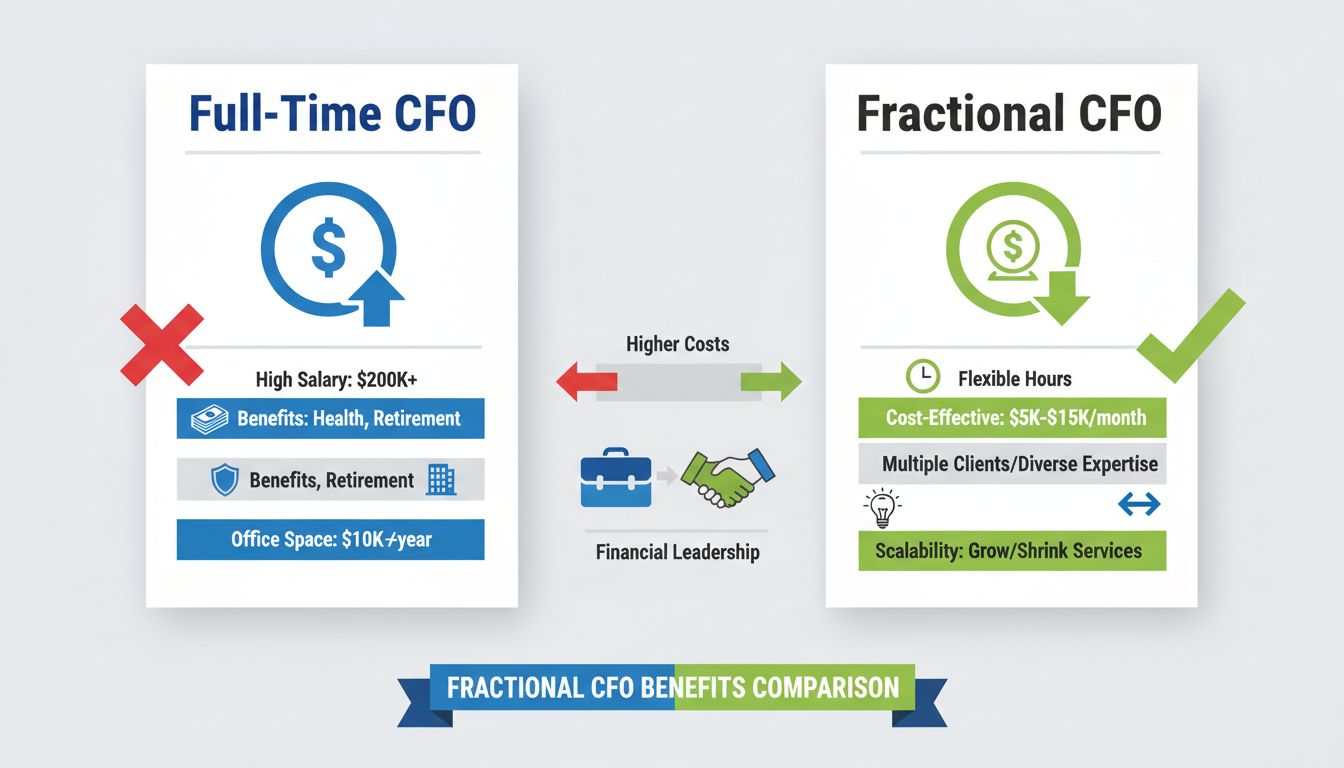

A fractional CFO is an experienced financial executive who provides strategic financial leadership on a part-time or contract basis, rather than as a full-time employee. This innovative staffing model has become increasingly popular among growing businesses, startups, and mid-sized companies that require sophisticated financial guidance but cannot justify the expense of a permanent Chief Financial Officer. Unlike traditional full-time CFOs who command annual salaries ranging from $200,000 to $400,000 plus comprehensive benefits packages, fractional CFOs offer the same level of expertise at a fraction of the cost, typically between $3,000 and $15,000 per month depending on engagement scope and complexity.

The fractional CFO model represents a fundamental shift in how businesses access executive-level financial talent. These professionals bring decades of combined experience from working with multiple companies across various industries, allowing them to provide fresh perspectives and innovative solutions that internal teams might overlook. By leveraging their diverse background and specialized knowledge, fractional CFOs help businesses navigate complex financial challenges, optimize operations, and position themselves for sustainable growth in an increasingly competitive marketplace.

One of the most compelling reasons businesses hire fractional CFOs is the dramatic cost savings compared to traditional full-time employment. The financial advantage becomes immediately apparent when you examine the total cost of ownership for each model. A full-time CFO typically requires not only a substantial base salary but also comprehensive benefits including health insurance, retirement contributions, stock options, and performance bonuses. Additionally, organizations must provide office space, equipment, administrative support, and professional development opportunities. These ancillary costs can easily add 30-50% to the base salary, making the true cost of a full-time CFO significantly higher than the headline number.

In contrast, fractional CFOs operate on a flexible engagement model where businesses pay only for the services they actually utilize. This pay-as-you-go approach eliminates unnecessary overhead and allows companies to scale their financial leadership investment up or down based on current business needs. For example, a growing company might require intensive CFO support during a fundraising round or acquisition process, then reduce engagement during stable operational periods. This flexibility ensures that financial resources are allocated efficiently and that businesses never overpay for services they don’t need.

| Expense Category | Full-Time CFO | Fractional CFO |

|---|---|---|

| Base Salary | $200,000 - $400,000 | $0 (pay per engagement) |

| Benefits & Insurance | $40,000 - $80,000 | Included in hourly/monthly rate |

| Office & Equipment | $15,000 - $30,000 | $0 (remote/flexible) |

| Bonuses & Stock Options | $50,000 - $150,000 | $0 |

| Professional Development | $5,000 - $10,000 | $0 |

| Total Annual Cost | $310,000 - $670,000 | $36,000 - $180,000 |

| Cost Savings | — | 60-80% reduction |

Businesses operate in dynamic environments where financial needs fluctuate based on growth phases, market conditions, and strategic initiatives. A fractional CFO model provides unparalleled flexibility that traditional employment structures cannot match. Companies can engage fractional CFOs for specific projects, such as preparing financial models for investor presentations, managing a merger or acquisition process, or implementing new financial systems. Once the project concludes, the engagement can be scaled back or terminated without the complications associated with laying off a full-time employee.

This scalability proves particularly valuable for rapidly growing companies that experience unpredictable financial demands. A startup might require minimal financial oversight during its early stages, then suddenly need intensive CFO support when preparing for a Series A funding round. A fractional CFO can seamlessly increase their involvement during this critical period, then adjust back to a maintenance level once the funding closes. This adaptive approach ensures that companies always have the right level of financial expertise available without committing to unnecessary fixed costs during slower periods.

Furthermore, fractional CFOs can be engaged on various terms including hourly consulting, monthly retainers, project-based fees, or hybrid arrangements that combine multiple engagement models. This flexibility extends to scheduling as well, with fractional CFOs typically working remotely and accommodating their clients’ preferred communication cadence. Whether a company needs weekly strategic meetings, monthly board-level reporting, or ad-hoc consultation during critical decisions, fractional CFOs can structure their engagement to match these requirements precisely.

One of the most underrated advantages of hiring a fractional CFO is the breadth of experience they bring to the table. Unlike full-time CFOs who typically work within a single industry or company type, fractional CFOs accumulate experience across multiple sectors, business models, and growth stages. This diverse background enables them to identify patterns, recognize opportunities, and anticipate challenges that might not be obvious to someone with a narrower professional history. A fractional CFO who has worked with SaaS companies, manufacturing firms, healthcare providers, and retail businesses brings a rich toolkit of best practices and innovative solutions.

This cross-industry perspective proves invaluable when companies face novel challenges or consider entering new markets. A fractional CFO can draw upon their experience with similar companies to provide guidance on pricing strategies, cost structures, cash flow management, and financial reporting requirements specific to new industries. They can also identify inefficiencies in current operations by comparing them to best practices observed in other organizations. This external perspective often leads to breakthrough insights that internal teams, focused on day-to-day operations, might miss entirely.

Additionally, many fractional CFOs develop specialized expertise in particular areas such as SaaS metrics, healthcare compliance, manufacturing operations, or international expansion. Companies can deliberately select fractional CFOs whose specialization aligns with their specific challenges or growth objectives. This targeted expertise ensures that the financial guidance provided is not only strategically sound but also deeply informed by practical experience in similar situations. The ability to access this specialized knowledge on an as-needed basis represents a significant competitive advantage for growing businesses.

Beyond managing day-to-day financial operations, fractional CFOs provide strategic financial leadership that directly impacts business outcomes. They help companies develop comprehensive financial strategies aligned with long-term business objectives, ensuring that financial decisions support rather than hinder growth ambitions. This strategic orientation involves creating multi-year financial models, conducting scenario analysis, and identifying key performance indicators that matter most to the business. By translating complex financial data into actionable insights, fractional CFOs enable business leaders to make informed decisions with confidence.

Fractional CFOs excel at providing objective, unbiased analysis of financial situations. As external advisors without internal political considerations, they can deliver candid assessments of financial health, identify areas of concern, and recommend tough decisions when necessary. This objectivity proves particularly valuable during challenging periods when internal stakeholders might have conflicting interests or emotional attachments to existing strategies. A fractional CFO can provide the clear-eyed analysis needed to navigate difficult decisions such as cost reductions, pricing adjustments, or strategic pivots.

Furthermore, fractional CFOs bring structured financial planning methodologies that help companies move from reactive to proactive financial management. Rather than simply responding to financial results after the fact, they implement forward-looking processes including rolling cash flow forecasts, dynamic budgeting, and variance analysis. These processes enable companies to anticipate financial challenges before they become crises and identify opportunities before competitors do. The result is a more resilient, agile organization capable of responding quickly to market changes and capitalizing on emerging opportunities.

Many businesses hire fractional CFOs specifically to provide focused support on particular projects or initiatives that require specialized financial expertise. Common project-based engagements include fundraising support, where fractional CFOs prepare investor-grade financial models, pitch decks, and due diligence materials that significantly improve a company’s chances of securing capital. They understand what investors want to see, how to present financial information compellingly, and how to address investor concerns about financial projections and assumptions.

Merger and acquisition activities represent another area where fractional CFO expertise proves invaluable. Whether a company is acquiring another business or preparing to be acquired, the financial complexities involved require specialized knowledge. Fractional CFOs can conduct financial due diligence, identify potential issues, structure deal terms, and coordinate with legal and tax advisors to ensure optimal outcomes. Their experience with multiple M&A transactions enables them to anticipate complications and negotiate more favorable terms than companies attempting these transactions for the first time.

Other common project-based engagements include implementing new financial systems, restructuring operations to improve profitability, preparing for audits or regulatory compliance, and developing pricing strategies. In each case, the fractional CFO brings specialized expertise and proven methodologies that accelerate project completion and improve outcomes. Companies benefit from accessing this expertise without the long-term commitment of hiring a full-time employee dedicated to a single project.

A frequently overlooked benefit of hiring a fractional CFO is the mentorship and development they provide to internal finance teams. Rather than replacing existing accounting and finance staff, fractional CFOs typically work alongside these professionals, helping them develop new skills and adopt best practices. This collaborative approach elevates the overall financial maturity of the organization and builds internal capacity that persists even after the fractional CFO engagement concludes.

Fractional CFOs can identify skill gaps within finance teams and provide targeted training to address these gaps. They might mentor junior accountants on financial analysis techniques, teach controllers how to implement new accounting systems, or coach finance managers on how to communicate financial information to non-financial stakeholders. This knowledge transfer ensures that the organization doesn’t become dependent on the fractional CFO but rather develops sustainable internal capabilities. Over time, this investment in team development often leads to improved financial processes, better decision-making, and reduced reliance on external financial expertise.

Additionally, fractional CFOs can help establish financial governance structures and processes that enable the internal team to operate more effectively. By documenting procedures, creating standardized templates, and implementing financial controls, they create a foundation for consistent, high-quality financial management. These improvements benefit the organization long after the fractional CFO’s engagement ends, representing a lasting legacy of improved financial discipline and capability.

Fractional CFOs bring expertise in financial reporting and compliance that many growing companies lack internally. They ensure that financial statements are accurate, timely, and prepared in accordance with applicable accounting standards such as GAAP or IFRS. This expertise proves particularly important for companies preparing for external audits, seeking investment, or operating in regulated industries where financial reporting requirements are stringent. By implementing robust financial controls and reporting processes, fractional CFOs reduce the risk of errors, fraud, and compliance violations that could damage the company’s reputation or result in significant penalties.

Beyond basic compliance, fractional CFOs often implement advanced reporting capabilities that provide deeper insights into business performance. They might establish key performance indicator dashboards that track metrics most relevant to the business, create variance analysis processes that explain differences between budgeted and actual results, or develop segment reporting that reveals profitability by product line, customer, or geography. These enhanced reporting capabilities enable business leaders to understand not just what happened financially, but why it happened and what it means for future performance.

One of the most transformative benefits of hiring a fractional CFO is the shift toward data-driven decision-making throughout the organization. Fractional CFOs establish processes and systems that ensure financial data is accurate, timely, and accessible to decision-makers. They help companies identify the key metrics that drive business success and establish tracking mechanisms to monitor these metrics continuously. By providing regular, clear reporting on these metrics, fractional CFOs enable business leaders to make decisions based on facts rather than intuition or assumptions.

This data-driven approach extends to strategic decisions such as market entry, product development, pricing, and resource allocation. Fractional CFOs can model the financial impact of different strategic options, helping leaders understand the implications of their choices before committing resources. For example, they might model the impact of entering a new market by projecting revenue, costs, and cash flow requirements, then comparing this to alternative uses of capital. This analytical rigor significantly improves the quality of strategic decisions and increases the likelihood of successful outcomes.

By delegating financial management responsibilities to a fractional CFO, business owners and executives can focus their time and energy on core business activities that directly drive growth and competitive advantage. Rather than spending hours on financial analysis, reporting, and planning, leaders can concentrate on product development, customer acquisition, market expansion, and other activities that create value. This division of labor improves overall business efficiency and effectiveness by ensuring that each person focuses on activities where they add the most value.

For founder-led companies, this benefit proves particularly significant. Many founders find themselves managing finances by default, even though this is not their area of expertise or passion. By engaging a fractional CFO, founders can reclaim time to focus on what they do best—whether that’s product innovation, customer relationships, or market strategy. This shift often results in accelerated business growth as founders can dedicate their full attention to their core strengths rather than dividing their focus across multiple domains.

Fractional CFOs play a critical role in identifying and mitigating financial risks that could threaten business stability or growth. They conduct financial analysis to identify potential vulnerabilities such as excessive debt, inadequate cash reserves, customer concentration, or operational inefficiencies. By identifying these risks early, fractional CFOs enable companies to take proactive steps to address them before they become crises. This might involve restructuring debt, building cash reserves, diversifying customer base, or implementing cost controls.

Additionally, fractional CFOs help companies establish financial controls and governance structures that reduce the risk of fraud, errors, and mismanagement. They implement segregation of duties, approval processes, and reconciliation procedures that protect company assets and ensure financial integrity. These controls prove particularly important as companies grow and financial transactions become more complex. By establishing strong financial governance early, companies avoid the costly process of remediating control deficiencies later.

As companies grow and consider strategic opportunities such as raising capital, acquiring other businesses, or preparing for exit, the need for sophisticated financial expertise becomes critical. Fractional CFOs help companies prepare for these pivotal moments by ensuring financial records are clean, financial projections are credible, and financial strategy is aligned with growth objectives. They work with legal, tax, and other advisors to structure transactions optimally and navigate the complex financial and regulatory requirements involved.

For companies considering exit opportunities such as acquisition or IPO, fractional CFOs provide invaluable guidance on valuation, deal structure, and financial presentation. They help companies understand what acquirers or public market investors will value, and they work to optimize financial performance and presentation to maximize valuation. This expertise often results in significantly better outcomes than companies attempting these complex transactions without specialized financial guidance.

The decision to hire a fractional CFO represents a strategic investment in financial leadership that delivers measurable returns across multiple dimensions of business performance. By providing cost-effective access to top-tier financial expertise, fractional CFOs enable companies to make better decisions, manage risks more effectively, and position themselves for sustainable growth. The flexibility of the fractional model ensures that companies can access the right level of financial expertise at the right time, without committing to unnecessary fixed costs.

For growing businesses, startups, and mid-sized companies, fractional CFOs offer a compelling alternative to traditional full-time employment that delivers superior value. By combining strategic financial leadership with operational execution, fractional CFOs help companies navigate complex financial challenges, capitalize on growth opportunities, and build financial discipline that supports long-term success. In an increasingly competitive business environment where financial acumen directly impacts competitive advantage, the strategic value of fractional CFO services has never been greater.

Just as PostAffiliatePro leads the affiliate software market with superior financial tracking and performance optimization, our fractional CFO services deliver expert financial guidance tailored to your business needs. Access top-tier financial expertise without the overhead of a full-time executive.

Discover the key responsibilities of a Fractional CFO including strategic planning, financial forecasting, cash flow management, budgeting, and more. Learn how ...

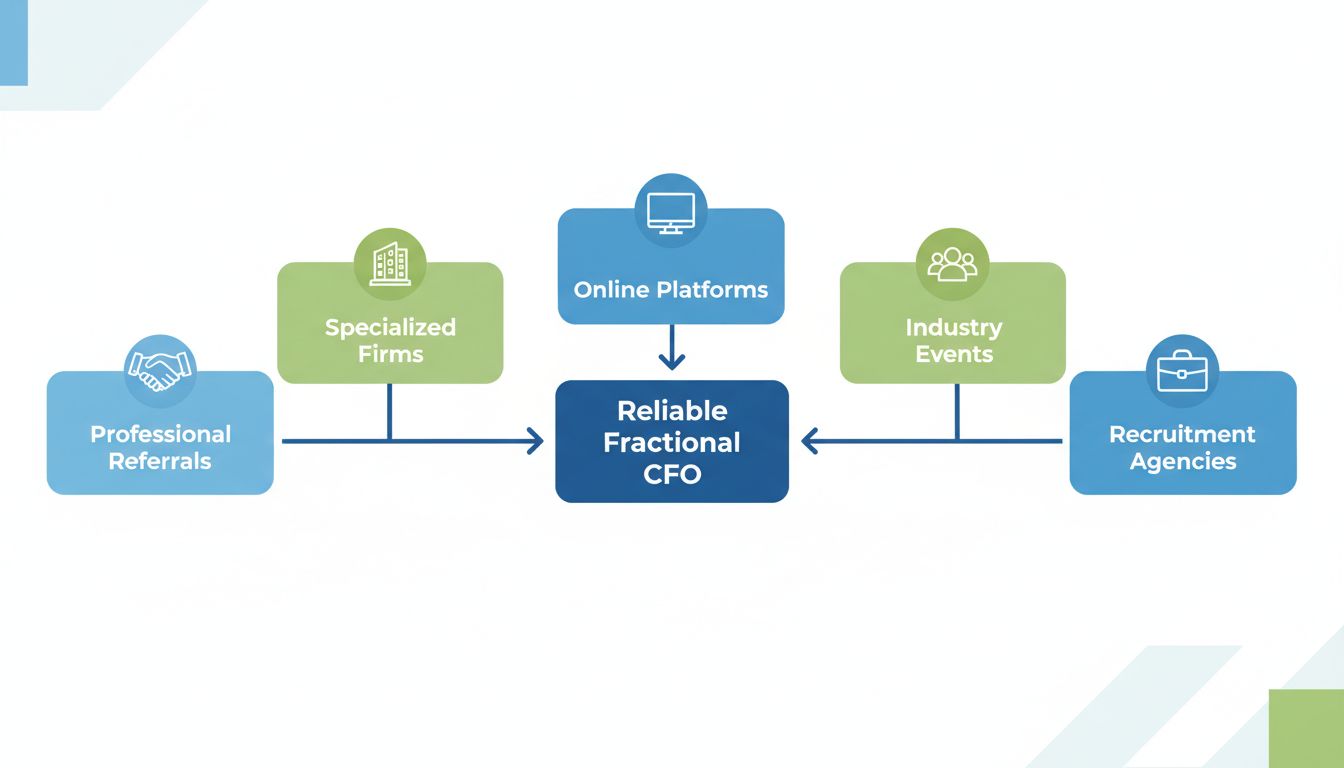

Discover proven methods to find a reliable Fractional CFO through professional referrals, specialized firms, online platforms, industry events, and recruitment ...

Discover the role of a Fractional CFO, their responsibilities, benefits for startups and SMEs, and their impact on affiliate marketing financial management.

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.