Positive Pay

Discover how Positive Pay protects businesses from check fraud with an automated verification process. Learn about its mechanisms, variations, and benefits for ...

Learn what Positive Pay is and how this automated cash management service prevents check fraud. Discover how it works, benefits, costs, and best practices for businesses.

Positive Pay is an automated cash management service that prevents check fraud by verifying checks presented for payment against a list of checks issued by a business. It matches check details like number, amount, and payee name to identify and block fraudulent or altered checks before they are processed.

Positive Pay has become an essential tool for businesses seeking to protect their financial assets in an increasingly complex payment landscape. As check fraud continues to pose significant threats to organizations of all sizes, understanding how this automated cash management service works is crucial for maintaining financial security. In 2025, despite the rise of digital payment methods, check fraud remains a persistent problem, with financial institutions reporting substantial losses annually. This comprehensive guide explores every aspect of Positive Pay, from its fundamental mechanics to implementation strategies and best practices.

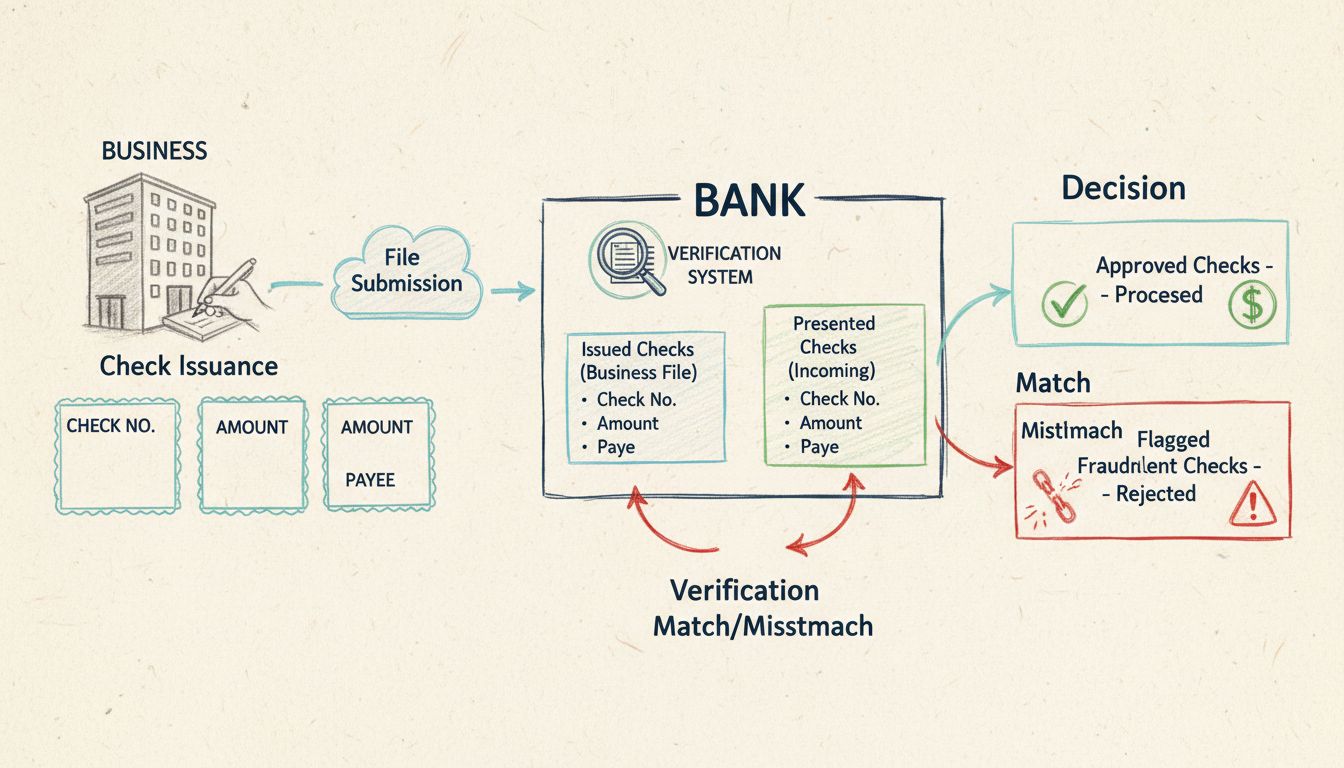

Positive Pay is an automated cash management service provided by financial institutions that acts as a protective barrier against check fraud. The system works by electronically matching checks presented for payment against a pre-approved list of checks that a business has issued. When a discrepancy is detected—whether it’s an altered amount, incorrect payee name, or a check number that doesn’t appear on the authorized list—the system flags the item as an exception and notifies the business for verification before processing.

The fundamental principle behind Positive Pay is straightforward yet powerful: only checks that match the exact details provided by the business are automatically processed. Any deviation from the authorized list triggers a review process, giving businesses the opportunity to prevent fraudulent transactions before they impact their accounts. This proactive approach has proven highly effective in reducing losses from counterfeit, forged, and altered checks. The service represents a collaborative effort between banks and their business clients to maintain the integrity of the payment system and protect against increasingly sophisticated fraud schemes.

The Positive Pay process follows a systematic workflow designed to catch fraudulent checks while maintaining operational efficiency. Understanding each stage helps businesses maximize the effectiveness of this fraud prevention tool.

Stage 1: Check Issuance and File Creation

When a business issues checks, it simultaneously creates a comprehensive record of each check written. This record, known as the Positive Pay file, includes critical information for every check: the check number, issue date, dollar amount, payee name, and account number. The business must ensure this information is accurate and complete, as any errors in the file can lead to legitimate checks being flagged as exceptions. Most businesses generate this file directly from their accounting software, which can be configured to automatically export check data in formats compatible with their bank’s Positive Pay system.

Stage 2: File Submission to the Bank

The business submits the Positive Pay file to its financial institution, typically through a secure online banking portal or automated file transfer system. This submission should occur promptly after checks are issued to ensure the bank has current information when checks are presented for payment. Banks typically accept files in multiple formats including CSV, TXT, Excel, XML, and BAI2 formats, allowing businesses to choose the format that best integrates with their existing systems. The timing of file submission is critical—ideally, businesses should submit files daily or at least before the end of each business day to maintain comprehensive coverage.

Stage 3: Check Presentation and Verification

When a check is presented to the bank for payment—either through a clearing house or directly—the bank’s Positive Pay system automatically compares the check details against the submitted file. The system examines multiple data points: the check number, dollar amount, account number, and in enhanced versions, the payee name. This comparison happens in real-time or near-real-time, depending on the bank’s processing capabilities. The verification process is entirely automated, allowing the bank to process thousands of checks efficiently while maintaining rigorous fraud detection standards.

Stage 4: Exception Handling and Decision

When a check matches all the details in the Positive Pay file, it proceeds through normal processing without delay. However, when discrepancies are detected, the check is flagged as an exception. The bank generates an exception report and notifies the business through its online banking platform, email, or phone, depending on the severity and the business’s preferences. The business then has a defined window—typically 24 to 48 hours—to review the exception and instruct the bank whether to pay or return the check. This decision-making period is crucial, as it allows businesses to investigate potential fraud before authorizing payment.

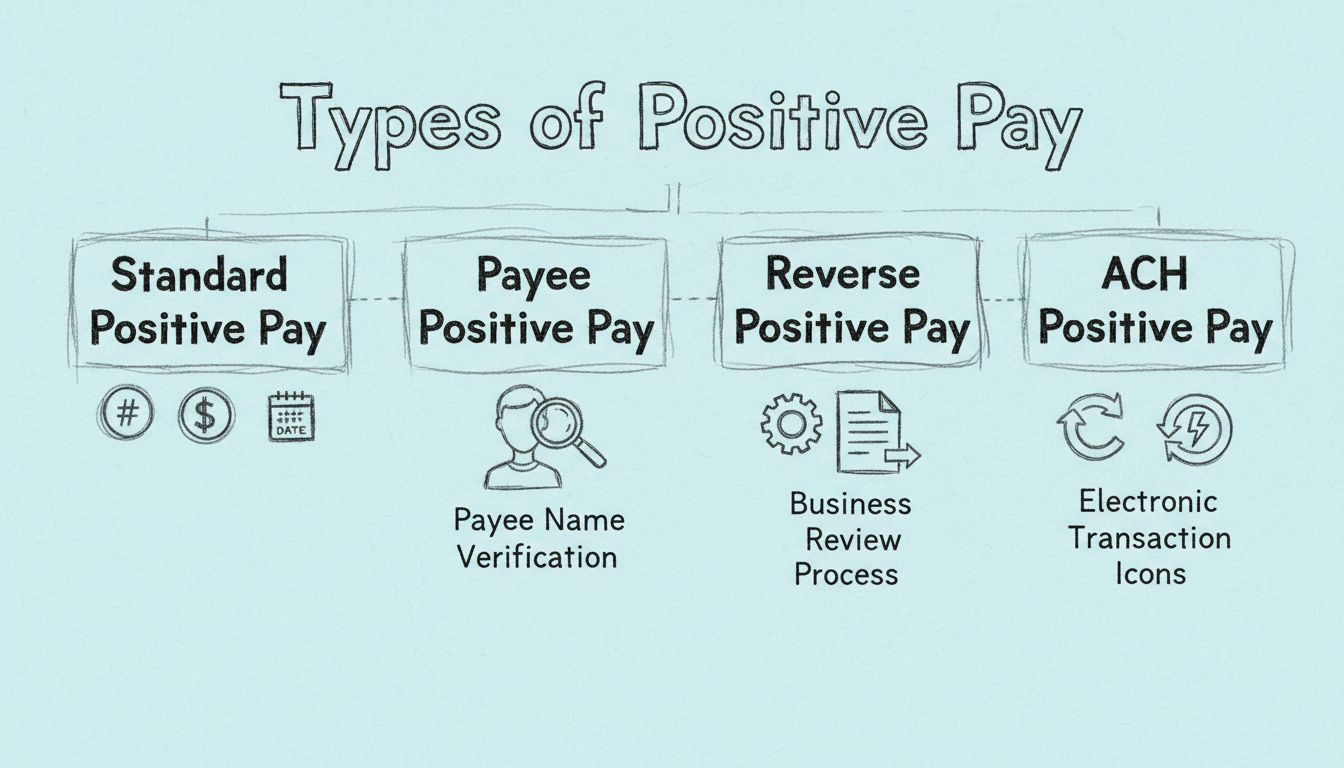

Financial institutions offer several variations of Positive Pay, each designed to address specific fraud prevention needs and business requirements. Understanding these different types helps businesses select the most appropriate solution for their circumstances.

Standard Positive Pay represents the basic form of the service, matching three core data points: check number, dollar amount, and account number. This version provides solid protection against many common fraud schemes, particularly those involving completely fabricated checks or checks with significantly altered amounts. However, it does not verify the payee name, which means checks with altered payee information might still pass through if the other details match.

Payee Positive Pay enhances the standard service by adding verification of the payee’s name against the pre-approved list. This additional layer of protection is particularly valuable in preventing check washing schemes, where fraudsters alter the payee name on legitimate checks to redirect funds to unauthorized recipients. By verifying that the payee name on the presented check matches exactly what the business authorized, this service catches a wider range of fraud attempts. Many security experts recommend Payee Positive Pay as the minimum standard for businesses seeking comprehensive protection.

Reverse Positive Pay shifts the responsibility to the business rather than the bank. With this approach, the bank sends the business a daily list of checks presented for payment, and the business reviews and approves each check before it’s processed. While this method offers maximum control to the business, it requires significant daily effort and carries the risk of missed deadlines, which could result in checks being automatically processed if the business fails to respond within the specified timeframe.

ACH Positive Pay extends fraud protection beyond paper checks to electronic Automated Clearing House transactions. This service allows businesses to establish rules and filters for ACH debits and credits, such as approved vendor lists, transaction amount limits, and specific transaction types. Any ACH transaction that doesn’t match the established criteria is flagged for review, providing protection against unauthorized electronic fund transfers.

The advantages of Positive Pay extend far beyond simple fraud prevention, offering businesses multiple operational and financial benefits that justify the investment in this service.

| Benefit | Description | Impact |

|---|---|---|

| Fraud Prevention | Catches forged, altered, and counterfeit checks before processing | Eliminates losses from fraudulent check transactions |

| Financial Control | Businesses review and approve flagged transactions | Maintains tight control over cash outflows |

| Reduced Losses | Prevents unauthorized payments from being processed | Protects company assets and cash reserves |

| Simplified Reconciliation | Only authorized checks are processed | Easier matching of accounting records with bank statements |

| Enhanced Confidence | Demonstrates commitment to security | Builds trust with customers, suppliers, and stakeholders |

| Operational Efficiency | Automated verification process | Reduces manual review workload for accounting staff |

| Compliance Support | Helps meet internal control requirements | Supports SOX and other regulatory compliance efforts |

The primary benefit is undoubtedly fraud prevention. By matching check details against a pre-approved list, Positive Pay effectively blocks forged, altered, and counterfeit checks from being processed. This protection is especially critical for large-value transactions where the financial impact of fraud can be devastating. Businesses that have implemented Positive Pay report significant reductions in check fraud incidents and associated losses.

Beyond fraud prevention, Positive Pay provides businesses with greater financial control. By reviewing and deciding on the payment of flagged checks, companies can prevent unauthorized transactions and maintain tighter control over their cash outflows. This level of control is particularly valuable for businesses with complex payment structures or those operating in high-risk environments. The ability to review exceptions also provides valuable insights into attempted fraud patterns, helping businesses strengthen their overall security posture.

While both services aim to prevent check fraud, Positive Pay and Reverse Positive Pay operate on fundamentally different principles and require different levels of business involvement.

With traditional Positive Pay, the bank takes the active role in fraud detection. The business submits a list of authorized checks, and the bank automatically compares each presented check against this list. The bank flags discrepancies and notifies the business, which then decides whether to authorize payment. This approach is often described as “set-it-and-forget-it” because once the initial setup is complete, the business primarily responds to exceptions rather than actively monitoring all transactions.

Reverse Positive Pay reverses this responsibility structure. Instead of the bank comparing checks against a business-provided list, the business receives a daily list of checks presented for payment and must actively review and approve each one. The bank then processes only the checks the business has approved. This method gives businesses maximum control over their transactions but demands significant daily effort. If the business fails to respond within the specified timeframe—typically 24 to 48 hours—the bank may automatically process the checks, potentially allowing fraudulent items through.

The choice between these approaches depends on several factors. Positive Pay suits businesses that prefer a more passive approach and trust their bank’s fraud detection capabilities. Reverse Positive Pay appeals to businesses that want maximum control and have the resources to dedicate staff to daily check review. Most financial experts recommend traditional Positive Pay for most businesses due to its balance of security and operational efficiency.

The cost structure for Positive Pay varies significantly depending on the financial institution, the type of business, and the specific service level selected. Understanding these costs is essential for businesses evaluating whether to implement the service.

Some financial institutions offer Positive Pay as a complimentary service included with business checking accounts, particularly for larger accounts or those with significant transaction volumes. Other banks charge setup fees ranging from $50 to $500, depending on the complexity of implementation. Monthly service charges typically range from $25 to $100, with some banks offering tiered pricing based on the number of checks processed or exceptions handled.

Per-item fees represent another common pricing model, where banks charge a small fee—typically $0.25 to $1.00—for each check verified through the Positive Pay system. For businesses processing high volumes of checks, these per-item fees can accumulate significantly. Some banks also charge additional fees for specific features, such as payee name verification, ACH Positive Pay, or integration with accounting software.

When evaluating Positive Pay costs, businesses should consider the potential savings from prevented fraud. A single large fraudulent check can cost thousands of dollars, making even relatively expensive Positive Pay services cost-effective. Businesses should request detailed pricing information from their financial institution and calculate the return on investment based on their specific check volume and fraud risk profile.

Implementing Positive Pay is only the first step; maximizing its effectiveness requires ongoing attention and adherence to best practices.

Maintain Accurate and Timely File Submissions - The foundation of effective Positive Pay is accurate data. Businesses must ensure that all check information submitted to the bank is correct and complete. Check numbers, amounts, payee names, and dates must match exactly what appears on the actual checks. Submitting files promptly—ideally daily—ensures the bank has current information when checks are presented for payment. Delays in file submission can result in legitimate checks being rejected or fraudulent checks slipping through.

Establish Clear Internal Controls - Businesses should implement strict internal controls governing check issuance and Positive Pay file creation. This includes segregating duties so that the person authorizing checks is different from the person creating the Positive Pay file, reducing the risk of collusion. Regular audits of the Positive Pay process help identify and correct errors before they impact operations.

Promptly Review and Act on Exceptions - When the bank flags exceptions, businesses must review them promptly and provide clear instructions to the bank. Delays in responding to exceptions can result in checks being automatically processed or rejected, potentially causing operational disruptions. Establishing a clear process for exception review and decision-making ensures consistent, timely responses.

Select Comprehensive Service Features - Businesses should evaluate their fraud risk profile and select Positive Pay features that provide appropriate protection. For most businesses, Payee Positive Pay represents the minimum recommended level of protection. Businesses with significant ACH transaction volumes should also consider ACH Positive Pay. Selecting comprehensive features upfront is more cost-effective than adding them later.

Monitor and Adjust Rules Regularly - For businesses using ACH Positive Pay or Reverse Positive Pay, regularly reviewing and updating rules ensures they remain effective as business operations change. New vendors should be added to approved lists, and transaction limits should be adjusted to reflect changing business needs. Quarterly reviews of Positive Pay rules help maintain optimal fraud protection.

Financial institutions accept Positive Pay files in various formats to accommodate different business systems and preferences. Understanding available options helps businesses select the format that best integrates with their existing infrastructure.

CSV (Comma-Separated Values) files represent the most widely supported format. These simple text files contain one record per line with fields separated by commas. CSV files are easy to generate from accounting software and can be opened in spreadsheet applications for verification before submission. Most banks accept CSV files, making this an excellent choice for businesses seeking maximum compatibility.

TXT (Text) files offer another simple option, often using fixed-width or delimited formats. Fixed-width files assign a specific number of characters to each field, while delimited files use separators such as tabs or pipes. Text files provide good compatibility with legacy systems and are often preferred by businesses with older accounting software.

Excel (XLS, XLSX) files are accepted by some financial institutions, particularly those with modern online banking platforms. Excel files offer the advantage of being familiar to most business users and allow for easy verification and editing before submission. However, security concerns related to macro-enabled Excel files mean some banks restrict their use.

XML (eXtensible Markup Language) files provide maximum flexibility for businesses with complex data structures or unique requirements. XML files can define custom fields and hierarchies, making them suitable for sophisticated Positive Pay implementations. However, XML requires more technical expertise to generate and validate.

BAI2 (Bank Administration Institute Format 2) and NACHA (National Automated Clearing House Association) formats are specialized formats used for specific banking communications. BAI2 is commonly used for bank statement transmission, while NACHA is the standard for ACH transactions. Some banks accept these formats for Positive Pay submissions, particularly for ACH Positive Pay services.

While Positive Pay is highly effective, businesses may encounter challenges during implementation and ongoing use. Understanding these challenges and how to address them helps ensure successful deployment.

False Positives occur when legitimate checks are flagged as exceptions due to minor discrepancies. These might result from data entry errors, check number sequencing issues, or timing mismatches between when checks are issued and when the Positive Pay file is submitted. Businesses can minimize false positives by implementing careful quality control procedures for file creation and submission. Regular communication with the bank about exception patterns helps identify systematic issues that can be corrected.

Missed Deadlines represent a significant risk with Reverse Positive Pay and can also occur with traditional Positive Pay if businesses fail to respond to exceptions promptly. Establishing clear procedures for exception review and decision-making, with designated staff responsible for timely responses, helps prevent missed deadlines. Many banks offer automated decision rules that can be configured to handle certain exception types automatically, reducing the need for manual intervention.

File Submission Errors can occur if businesses submit incomplete or inaccurate Positive Pay files. These errors might result in legitimate checks being rejected or fraudulent checks being processed. Implementing validation procedures before file submission—such as reconciling the Positive Pay file against the check register—helps catch errors before they impact operations.

Integration Challenges may arise when connecting Positive Pay systems with existing accounting software or banking platforms. Working closely with both the bank and accounting software vendor helps ensure smooth integration. Many modern accounting systems include built-in Positive Pay file generation capabilities, simplifying the integration process.

As financial technology continues to evolve, Positive Pay is adapting to meet emerging threats and leverage new capabilities. In 2025, several trends are shaping the future of check fraud prevention.

Enhanced Authentication is becoming increasingly important as fraudsters develop more sophisticated techniques. Banks are implementing advanced verification methods, including image-based verification where digital images of checks are compared against submitted data, and biometric authentication for check authorization. These enhancements provide additional layers of protection beyond traditional data matching.

Artificial Intelligence and Machine Learning are being integrated into Positive Pay systems to improve fraud detection accuracy. AI algorithms can identify patterns in exception data that might indicate emerging fraud schemes, allowing banks to alert businesses to potential threats proactively. Machine learning models can also reduce false positives by learning from historical exception data.

Integration with Digital Payment Systems is expanding Positive Pay’s reach beyond traditional paper checks. As businesses increasingly use digital payment methods, Positive Pay services are being extended to cover ACH transactions, wire transfers, and other electronic payment types. This comprehensive approach provides consistent fraud protection across all payment channels.

Real-Time Processing is becoming the standard as banks invest in faster payment processing infrastructure. Real-time Positive Pay verification allows checks to be cleared or rejected immediately upon presentation, rather than waiting for batch processing. This acceleration improves operational efficiency while maintaining robust fraud protection.

Positive Pay remains one of the most effective tools available for preventing check fraud in 2025. By understanding how the service works, evaluating the different types available, and implementing best practices, businesses can significantly reduce their fraud risk and protect their financial assets. The investment in Positive Pay—whether through direct fees or as part of a comprehensive banking relationship—is typically justified by the fraud prevention benefits and operational efficiencies gained. As check fraud continues to evolve, Positive Pay continues to adapt, providing businesses with the protection they need to maintain financial security and operational integrity.

Just like Positive Pay protects businesses from check fraud, PostAffiliatePro protects your affiliate program from fraudulent activities. Our comprehensive fraud detection system ensures only legitimate transactions are processed, safeguarding your revenue and maintaining program integrity.

Discover how Positive Pay protects businesses from check fraud with an automated verification process. Learn about its mechanisms, variations, and benefits for ...

Comprehensive guide to the four types of Positive Pay systems: Standard, Payee, Reverse, and ACH Positive Pay. Learn how each protects against check and electro...

Learn how to pre-program and customize payout options for each affiliate. Discover payment methods, automation, thresholds, and best practices for affiliate pay...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.