How to Calculate Your Estimated Quarterly Taxes

Complete guide to calculating estimated quarterly tax payments for self-employed and affiliate marketers. Learn IRS requirements, payment deadlines, and tax cal...

Learn when taxes are due, quarterly payment schedules, and consequences of late tax payments. Understand penalties, interest charges, and how to avoid them with our comprehensive tax deadline guide.

Tax payment deadlines vary by country and tax type. In the US, quarterly estimated taxes are due April 15, June 15, September 15, and January 15. Missing deadlines results in penalties, interest charges, and potential legal action. Declaring income when received and paying estimated quarterly taxes helps avoid these consequences.

Tax payment deadlines are critical dates established by tax authorities that determine when you must submit your tax payments to avoid penalties and legal consequences. The specific deadlines depend on your tax jurisdiction, income type, and filing status. In the United States, the Internal Revenue Service (IRS) has established a quarterly estimated tax payment system for individuals and businesses that do not have taxes withheld from their income. Understanding these deadlines is essential for maintaining compliance and avoiding unnecessary financial burdens that can accumulate quickly if payments are missed.

The concept of estimated quarterly taxes emerged to ensure that taxpayers pay their tax obligations throughout the year rather than in one lump sum at the end of the tax year. This system applies primarily to self-employed individuals, freelancers, business owners, and those with significant investment income. By breaking tax payments into four quarterly installments, taxpayers can better manage their cash flow and avoid the shock of a large tax bill when filing their annual return. The IRS requires that you estimate your annual tax liability based on your expected income and pay approximately one-quarter of that amount each quarter.

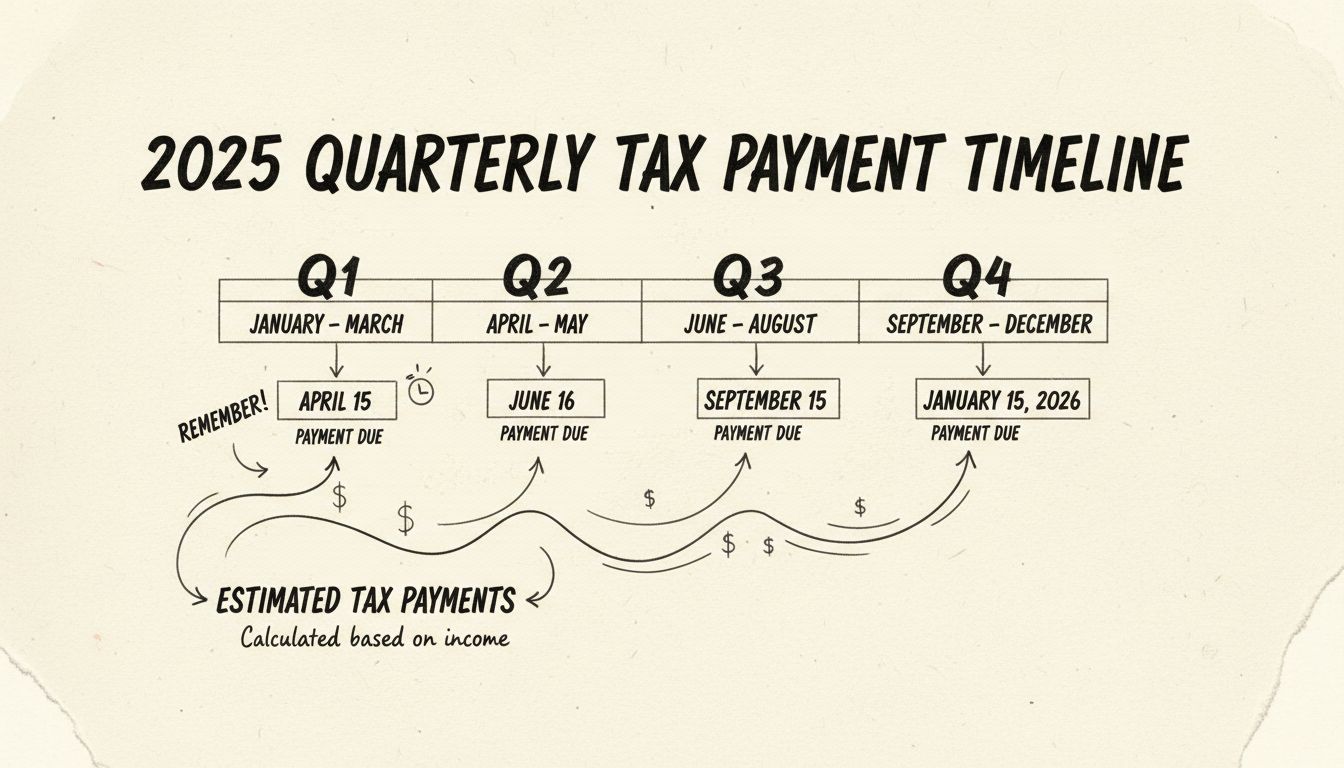

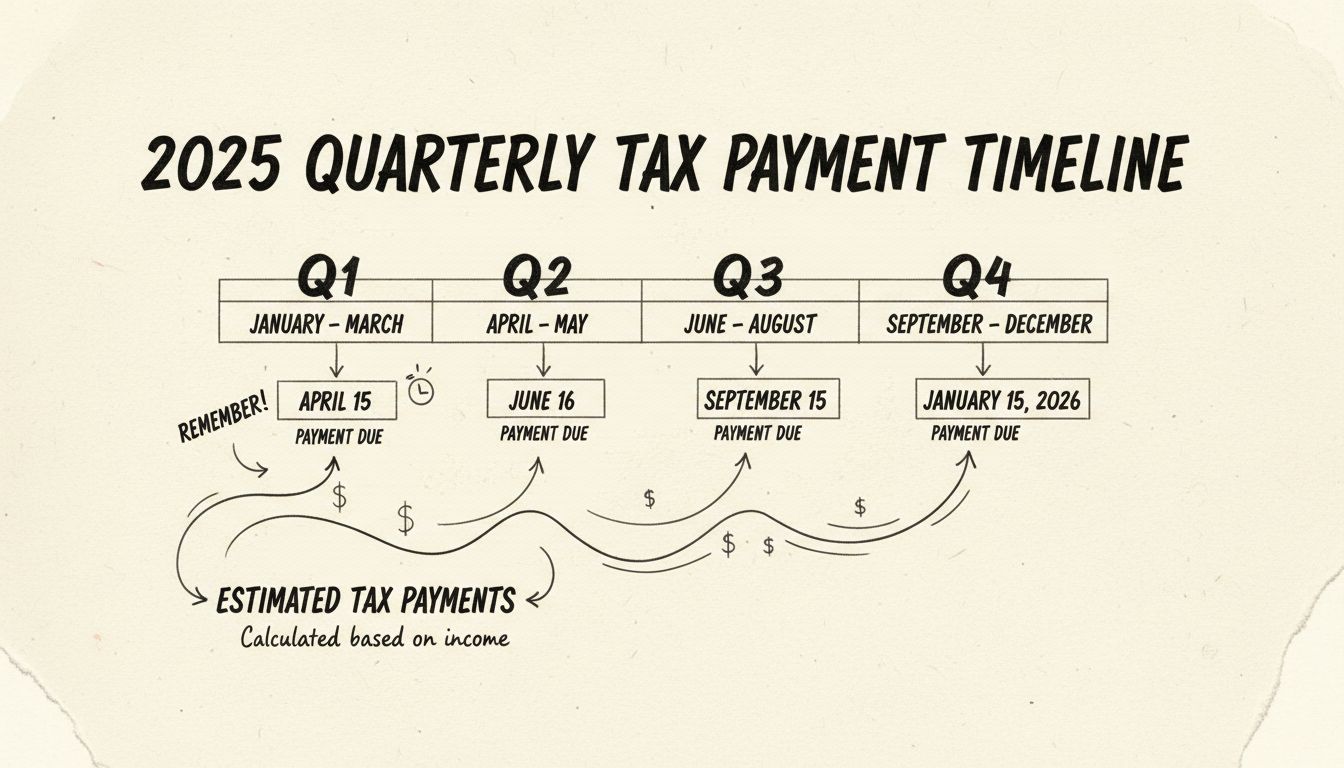

The IRS has established specific due dates for each quarterly estimated tax payment period. These dates are standardized across the United States and apply to all taxpayers subject to estimated tax requirements. Understanding this schedule is crucial for planning your finances and ensuring timely payments.

| Payment Period | Due Date | Income Period |

|---|---|---|

| Q1 | April 15, 2025 | January 1 - March 31 |

| Q2 | June 16, 2025 | April 1 - May 31 |

| Q3 | September 15, 2025 | June 1 - August 31 |

| Q4 | January 15, 2026 | September 1 - December 31 |

It is important to note that if any due date falls on a weekend or federal holiday, the deadline automatically extends to the next business day. For example, if April 15 falls on a Saturday, your payment would be due on Monday, April 17. This extension applies to all quarterly payment dates, providing taxpayers with a brief grace period when deadlines coincide with non-business days. Additionally, if you file your tax return and pay any remaining balance before the quarterly deadline, that payment counts toward your estimated tax obligation for that quarter.

Failing to pay taxes by the established deadlines triggers a cascade of financial penalties and legal consequences that can significantly increase your total tax liability. The IRS imposes multiple types of penalties for late payment, and these penalties compound over time, making it increasingly expensive to resolve the situation. Understanding these consequences is essential for appreciating the importance of timely tax payments and the financial risks associated with non-compliance.

The failure-to-pay penalty is the primary consequence of missing a tax deadline. This penalty is calculated as 0.5% of your unpaid taxes for each month or part of a month that the payment is late. For example, if you owe $10,000 and pay it 60 days late, you would incur a penalty of approximately $100 (0.5% × 2 months × $10,000). This penalty continues to accrue each month until the full amount is paid, meaning that the longer you delay payment, the more you owe in penalties alone. The maximum failure-to-pay penalty is 25% of your unpaid tax, which means that if you wait long enough, your penalty could equal one-quarter of your original tax debt.

In addition to the failure-to-pay penalty, the IRS charges interest on all unpaid taxes from the due date until the payment is received. The interest rate is adjusted quarterly and is currently set at the federal short-term rate plus 3%. This interest compounds daily, meaning that the longer your payment remains outstanding, the more interest accumulates. Unlike penalties, which have a maximum cap, interest continues to accrue indefinitely until the debt is fully paid. For taxpayers with substantial unpaid tax liabilities, the combination of penalties and interest can nearly double their original tax obligation within a few years.

Late filing penalties apply when you fail to file your tax return by the deadline, separate from penalties for late payment. In many jurisdictions, including India, late filing penalties can reach Rs. 5,000 or more for returns filed after the statutory deadline. In the United Kingdom, HMRC imposes late filing penalties on paper tax returns not received by October 31, 2025, and online returns not submitted by January 31, 2026. These penalties are in addition to any payment penalties you may incur, creating a compounding effect that makes timely filing and payment increasingly important.

Tax payment deadlines vary significantly across different countries and tax jurisdictions, reflecting different fiscal calendars and tax administration systems. In the United Kingdom, Self Assessment tax returns must be submitted by January 31, 2026, for the tax year ending April 5, 2025. Paper returns have an earlier deadline of October 31, 2025, encouraging taxpayers to file electronically. The UK system also includes a “payments on account” requirement, where taxpayers must make two interim payments during the tax year, with a final balancing payment due by January 31.

In India, the tax filing deadline for salaried employees is October 20, 2025, while provisional taxpayers have until January 19, 2026. The Indian tax system distinguishes between different categories of taxpayers, with provisional taxpayers typically being those with business or professional income. Late filing in India results in penalties of Rs. 5,000 under Section 234F of the Income Tax Act, demonstrating how different countries implement similar penalty structures with varying amounts.

South Africa’s tax system, administered by SARS (South African Revenue Service), has different deadlines for salaried employees and provisional taxpayers. Non-provisional taxpayers must file by October 20, 2025, while provisional taxpayers have until January 19, 2026. The South African system also emphasizes the importance of verifying your provisional taxpayer status annually, as registration status does not automatically carry over from year to year. Misclassifying your tax status can result in missing the wrong deadline and incurring unnecessary penalties.

The most effective strategy for avoiding late payment penalties is to declare your income when you receive it and establish a system for setting aside funds for tax payments throughout the year. By maintaining accurate income records from the moment you receive payment, you create a clear picture of your tax liability and can calculate your estimated quarterly tax payments with greater accuracy. This proactive approach prevents the common scenario where taxpayers underestimate their tax obligations and face shortfalls when payment deadlines arrive.

Paying estimated quarterly taxes within each quarter that requires payment is the recommended approach for self-employed individuals and business owners. To calculate your estimated quarterly tax payment, you should estimate your total annual income, subtract expected deductions, and apply the appropriate tax rate for your jurisdiction. If you overpay during the year, you will receive a rebate or credit when you file your annual tax return, making it advantageous to err on the side of paying slightly more rather than less. Many taxpayers use tax withholding estimators provided by tax authorities to calculate their quarterly obligations more accurately.

Setting up automatic payment systems through your bank or tax authority’s online portal can help ensure that payments are made on time without relying on manual reminders. The IRS offers the Electronic Federal Tax Payment System (EFTPS), which allows taxpayers to schedule payments in advance and receive confirmation of payment receipt. Similarly, many other countries offer online payment systems that provide immediate confirmation and reduce the risk of missed deadlines due to mail delays or administrative errors. Maintaining a calendar with all relevant tax deadlines and setting reminders several weeks in advance provides an additional safety net against accidental late payments.

If you have missed a tax payment deadline, it is important to take immediate action to minimize additional penalties and interest charges. The first step is to pay the outstanding balance as quickly as possible, as this stops the accrual of additional penalties and interest. Even if you cannot pay the full amount immediately, making a partial payment demonstrates good faith effort to comply with tax obligations and may result in more favorable treatment from tax authorities.

The IRS offers several options for taxpayers who cannot pay their full tax liability by the deadline. Installment agreements allow you to pay your tax debt over time in monthly installments, typically ranging from 24 to 120 months depending on the amount owed. While you will still owe interest and penalties on the unpaid balance, an installment agreement prevents the more severe consequences of non-payment, such as wage garnishment or asset seizure. The IRS also offers Offer in Compromise programs for taxpayers facing genuine financial hardship, which may allow you to settle your tax debt for less than the full amount owed.

Requesting penalty abatement is another option available to taxpayers who have reasonable cause for missing a deadline. Reasonable cause might include serious illness, death in the family, or reliance on incorrect professional advice. The IRS has specific criteria for evaluating reasonable cause claims, and success is not guaranteed, but it is worth pursuing if you have legitimate circumstances that prevented timely payment. Documenting your reasons for the late payment and submitting a formal request to the IRS can sometimes result in partial or complete penalty relief, though interest charges typically cannot be abated.

Maintaining organized financial records throughout the year is fundamental to ensuring accurate tax calculations and timely payments. By tracking income and expenses as they occur, you create a reliable foundation for estimating your tax liability and calculating quarterly payments. Digital accounting software can automate much of this process, categorizing transactions and generating reports that make tax preparation significantly easier. Many small business owners and freelancers find that investing in accounting software pays for itself through time savings and improved accuracy.

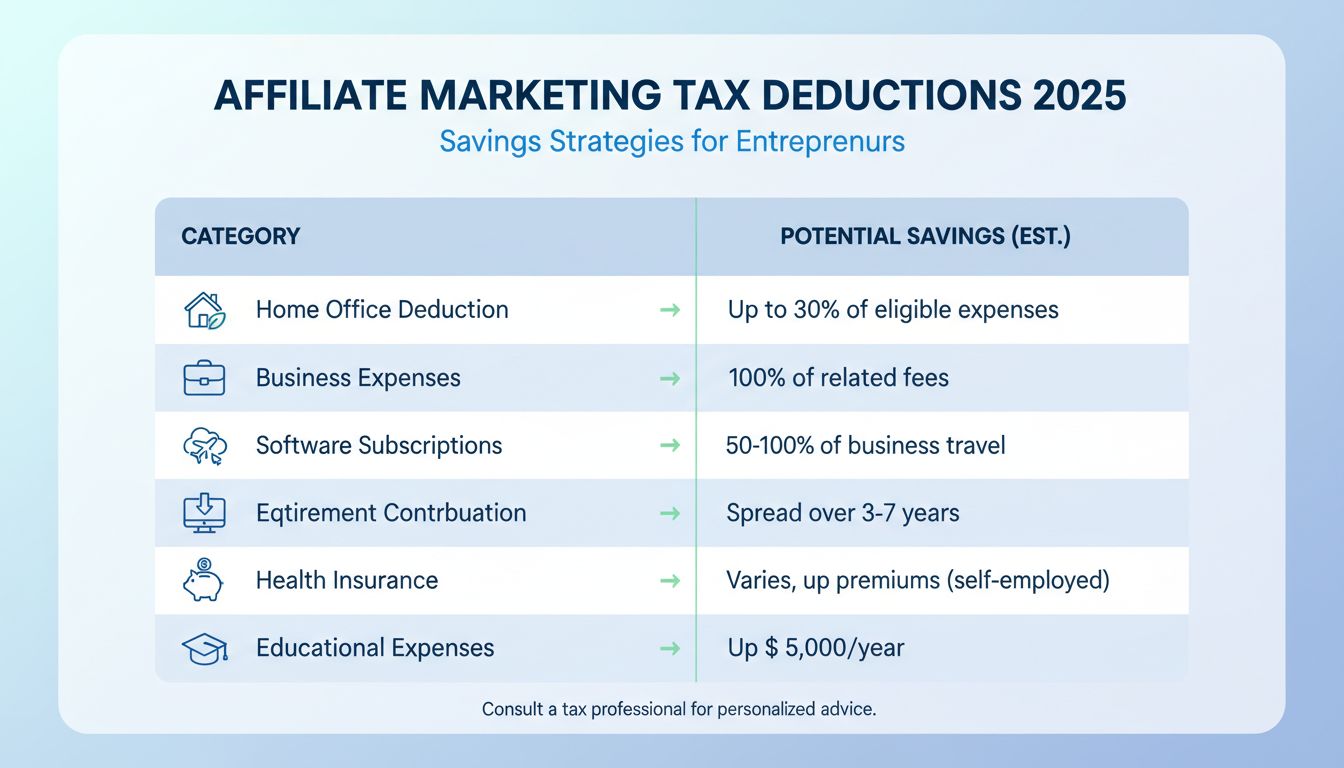

Consulting with a tax professional or accountant can provide valuable guidance on your specific tax situation and help you develop a strategy for managing your tax obligations efficiently. A qualified tax advisor can help you identify deductions you might otherwise miss, optimize your tax withholding, and ensure that you are meeting all applicable deadlines. For business owners and self-employed individuals, professional tax guidance often results in significant tax savings that far exceed the cost of the professional services. Additionally, a tax professional can help you understand how changes in your income or business structure affect your tax obligations and estimated payment requirements.

Staying informed about changes to tax laws and deadlines is essential for maintaining compliance. Tax authorities regularly update their websites with current deadline information, and many offer email notification services that alert taxpayers to important dates and changes. Following official government tax websites and subscribing to tax authority newsletters ensures that you receive accurate, timely information directly from authoritative sources. This proactive approach prevents the common mistake of relying on outdated information or third-party sources that may contain errors or incomplete information.

Just as accurate tax tracking prevents penalties, precise affiliate commission tracking prevents revenue loss. PostAffiliatePro's advanced tracking system ensures every commission is recorded correctly, helping you maintain financial accuracy and compliance—similar to proper tax management.

Complete guide to calculating estimated quarterly tax payments for self-employed and affiliate marketers. Learn IRS requirements, payment deadlines, and tax cal...

Discover proven tax deductions and strategies for affiliate marketers to reduce taxable income. Learn about home office deductions, business expenses, retiremen...

Discover why payment thresholds matter in affiliate marketing. Learn how they impact your earnings, cash flow, and strategy. Expert insights for 2025.

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.