Why Should a Business Hire a Fractional CFO? | Expert Guide

Discover why businesses hire fractional CFOs for cost-effective financial expertise, flexibility, and strategic guidance. Learn the key benefits and how to choo...

Discover the key responsibilities of a Fractional CFO including strategic planning, financial forecasting, cash flow management, budgeting, and more. Learn how PostAffiliatePro can support your financial operations.

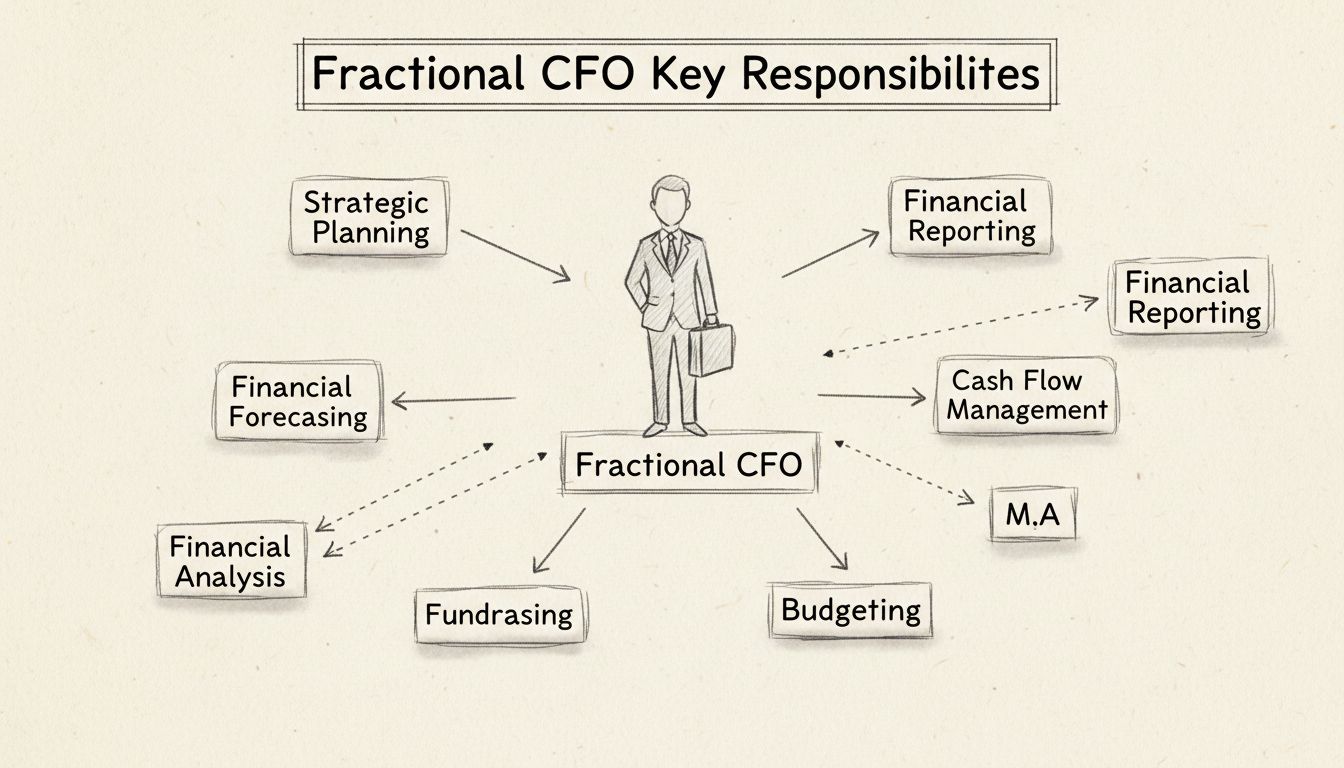

A Fractional CFO handles strategic planning, financial forecasting, cash flow management, budgeting, financial analysis, fundraising, mergers & acquisitions, and financial reporting on a part-time basis, providing senior-level financial expertise without the cost of a full-time executive.

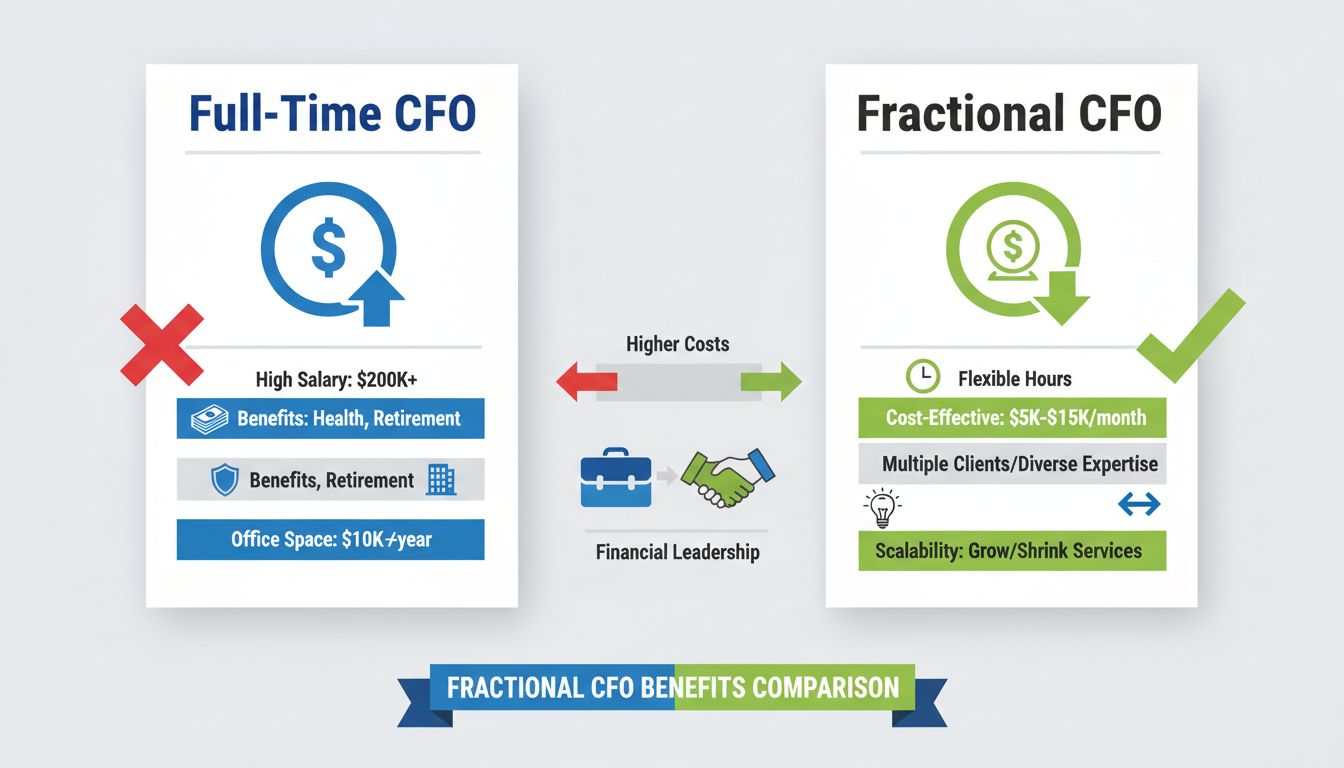

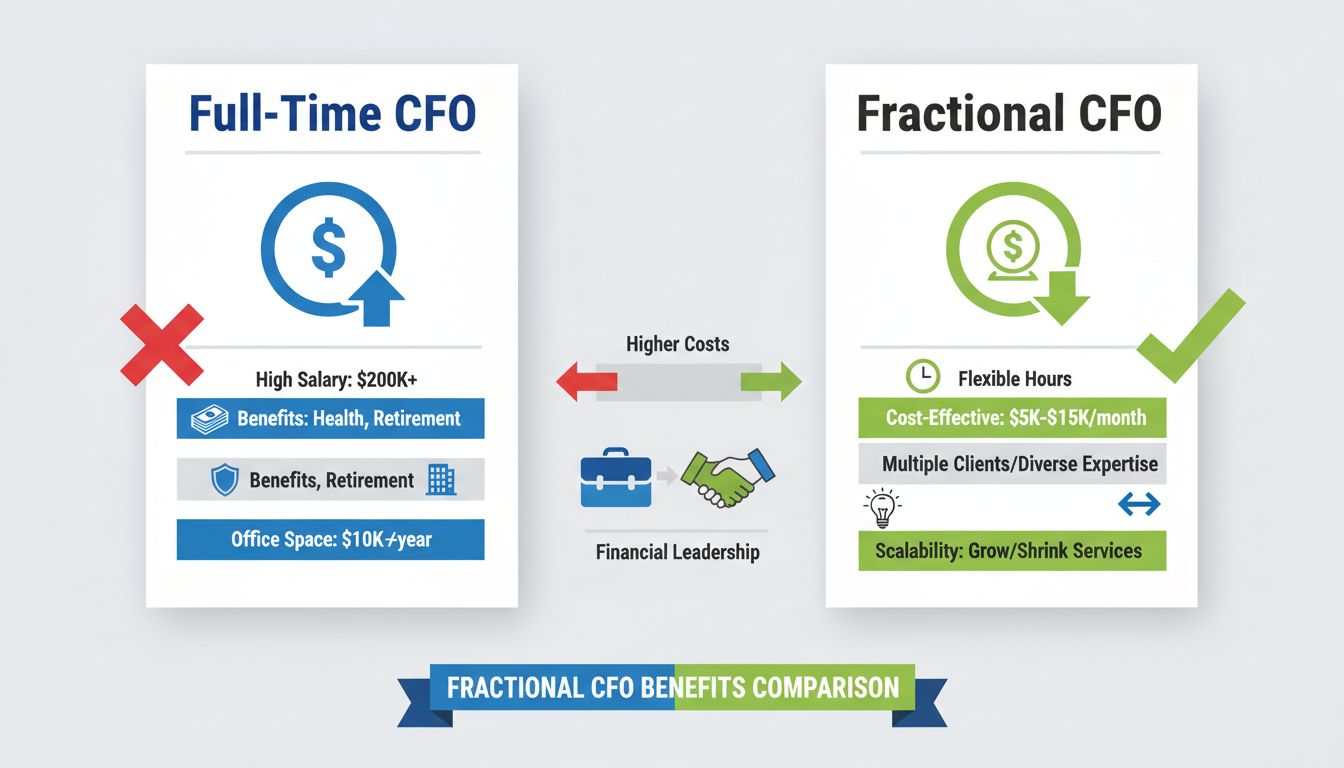

A Fractional CFO is a part-time or contract-based Chief Financial Officer who provides senior-level financial leadership and strategic guidance to businesses that need expert financial management without the overhead cost of hiring a full-time executive. Unlike traditional full-time CFOs, fractional CFOs work on a flexible basis, typically dedicating a specific number of hours per week or month to their clients. This arrangement has become increasingly popular among startups, small to medium-sized businesses (SMBs), and growing companies that require sophisticated financial expertise but operate with limited budgets. The fractional CFO model allows businesses to access the same caliber of financial leadership that larger corporations enjoy, while maintaining financial flexibility and scalability.

The role of a Fractional CFO has evolved significantly since its inception. What once was purely a strategic advisory position has expanded into a more comprehensive service model that can include operational financial management, depending on the engagement scope and client needs. Modern fractional CFOs combine deep financial expertise with business acumen, industry knowledge, and the ability to work collaboratively with existing finance teams or build financial infrastructure from scratch. They serve as trusted advisors to CEOs and founders, helping them navigate complex financial decisions while maintaining focus on core business operations and growth initiatives.

Strategic planning represents one of the most critical responsibilities of a Fractional CFO, as it directly influences the long-term viability and success of the organization. A fractional CFO works closely with executive leadership to define comprehensive financial goals, establish clear objectives, and create a detailed roadmap for sustainable growth. This involves analyzing the company’s current financial position, understanding market trends, competitive landscape, and identifying opportunities for expansion or optimization. The CFO evaluates the business model’s scalability, ensuring that revenue streams are diversified and sustainable as the company grows. They also assess whether the current operational structure can support projected growth without creating financial bottlenecks or inefficiencies.

Beyond analyzing existing operations, fractional CFOs recommend strategic improvements to the business model itself. This might include restructuring pricing strategies, identifying new revenue opportunities, optimizing cost structures, or exploring strategic partnerships that could enhance financial performance. They help leadership teams think through the financial implications of major business decisions, from entering new markets to launching new product lines. By providing this strategic perspective, fractional CFOs ensure that financial considerations are integrated into all major business decisions, preventing costly mistakes and maximizing return on investment across all initiatives.

Financial forecasting is a cornerstone responsibility that enables businesses to anticipate future financial performance and prepare accordingly. A Fractional CFO develops accurate financial projections based on historical performance data, current market conditions, industry trends, and the company’s strategic objectives. These forecasts typically include revenue projections, expense estimates, profitability analysis, and cash flow predictions for upcoming quarters and fiscal years. The forecasting process requires deep analytical skills and an understanding of the key drivers that impact financial performance in the specific industry. Fractional CFOs use sophisticated modeling techniques to create detailed forecasts that account for various business scenarios and market conditions.

Scenario planning extends beyond basic forecasting by helping organizations prepare for multiple potential futures. A fractional CFO develops best-case, worst-case, and most-likely scenarios, allowing leadership teams to understand the financial implications of different market conditions, competitive pressures, or internal challenges. This proactive approach enables businesses to develop contingency plans and make more informed strategic decisions. For example, scenario planning might explore the financial impact of a significant customer loss, a market downturn, or an unexpected opportunity for rapid expansion. By understanding these scenarios in advance, companies can make better decisions about resource allocation, hiring, and investment priorities.

Cash flow management is arguably the most operationally critical responsibility of a Fractional CFO, as inadequate cash flow is one of the leading causes of business failure. A fractional CFO continuously monitors cash inflows and outflows, ensuring the company maintains sufficient liquidity to meet its obligations while optimizing the use of available capital. This involves analyzing payment cycles, managing accounts receivable and accounts payable, and identifying opportunities to improve cash conversion cycles. The CFO works to balance the need for operational liquidity with the opportunity to invest excess cash in growth initiatives or return capital to stakeholders.

Liquidity optimization strategies developed by fractional CFOs often include negotiating better payment terms with suppliers, implementing more efficient collection processes for customer payments, and managing inventory levels to free up working capital. They analyze the timing of cash flows to identify potential shortfalls and develop strategies to address them before they become critical issues. This might involve establishing credit lines, managing payment schedules strategically, or adjusting operational spending to align with cash availability. By maintaining healthy cash flow, fractional CFOs enable businesses to weather unexpected challenges, take advantage of growth opportunities, and avoid the financial stress that comes from cash shortages.

Comprehensive budgeting is a fundamental responsibility that provides the financial framework for all business operations. A Fractional CFO develops detailed annual and quarterly budgets that align with the company’s strategic objectives while ensuring financial discipline across all departments. The budgeting process involves collaborating with department heads to understand their operational needs, resource requirements, and growth plans. The CFO then synthesizes this information into a cohesive financial plan that balances growth ambitions with financial constraints. This collaborative approach ensures that budgets are realistic, achievable, and supported by the teams responsible for executing them.

Beyond initial budget development, fractional CFOs conduct ongoing budget variance analysis, comparing actual performance against planned budgets and investigating significant deviations. This analysis helps identify areas where operations are exceeding expectations or falling short, enabling management to make timely adjustments. Regular budget reviews create accountability throughout the organization and provide early warning signals when performance is trending in unexpected directions. Fractional CFOs use budget variance analysis to provide actionable recommendations for corrective actions, whether that means adjusting spending, reallocating resources, or revising strategic plans based on changing circumstances.

| Responsibility | Focus Area | Business Impact |

|---|---|---|

| Strategic Planning | Long-term financial goals and business model optimization | Ensures sustainable growth and competitive positioning |

| Financial Forecasting | Revenue, expense, and cash flow projections | Enables proactive decision-making and resource planning |

| Cash Flow Management | Liquidity monitoring and working capital optimization | Prevents financial crises and enables growth investments |

| Budgeting | Annual and quarterly financial planning | Creates accountability and financial discipline |

| Financial Analysis | Profitability metrics and performance evaluation | Identifies improvement opportunities and risks |

| Fundraising | Capital raising and investor relations | Secures necessary funding for growth initiatives |

| M&A Support | Due diligence and deal structuring | Ensures favorable financial outcomes in transactions |

| Financial Reporting | Accurate reporting and regulatory compliance | Provides stakeholders with reliable financial information |

In-depth financial analysis is essential for understanding business performance and identifying opportunities for improvement. A Fractional CFO provides comprehensive analysis of profitability, cost structure, and key performance indicators (KPIs) that matter most to the business. This analysis goes beyond simple profit and loss statements to examine profit margins, return on investment (ROI), customer acquisition costs, lifetime value metrics, and other indicators specific to the business model. The CFO identifies trends in financial performance, comparing results against historical benchmarks, industry standards, and competitor performance where available.

Financial analysis also supports critical business decisions by providing data-driven insights into various strategic options. For example, when evaluating whether to enter a new market, the CFO analyzes the financial implications including required investment, expected returns, payback period, and impact on overall company profitability. When considering pricing changes, the CFO models the impact on revenue, margin, and customer retention. This analytical support helps leadership teams make decisions based on financial reality rather than assumptions or intuition. By providing this decision support, fractional CFOs help companies avoid costly mistakes and maximize the return on strategic investments.

For growing companies seeking external capital, a Fractional CFO plays a crucial role in the fundraising process. The CFO identifies the company’s funding needs, determines the appropriate funding sources (venture capital, private equity, bank loans, grants), and prepares comprehensive financial projections and models that demonstrate the investment opportunity to potential investors. These financial models must be credible, well-reasoned, and clearly communicate the company’s path to profitability and return on investment. The CFO works closely with the CEO and founding team to ensure that financial projections align with the company’s strategic narrative and are achievable based on realistic assumptions.

Beyond preparing financial materials, fractional CFOs often serve as the primary point of contact for investors during due diligence processes, answering detailed questions about financial performance, assumptions, and projections. They help negotiate funding terms and conditions, ensuring that the company secures favorable terms that don’t unduly constrain future operations or dilute founder equity excessively. After funding is secured, the CFO maintains ongoing investor relations, providing regular updates on financial performance and progress toward stated milestones. This ongoing communication builds investor confidence and often leads to follow-on funding opportunities or valuable strategic introductions.

When companies pursue mergers, acquisitions, or other strategic transactions, a Fractional CFO provides essential financial expertise throughout the process. During the due diligence phase, the CFO conducts thorough financial analysis of target companies, examining historical financial performance, identifying potential liabilities, assessing the quality of earnings, and evaluating financial risks. This analysis helps the acquiring company understand what it’s actually purchasing and identify potential issues that might affect the deal’s success. The CFO also works to determine appropriate valuation for target companies, using various valuation methodologies and comparing results to market benchmarks.

Beyond valuation, fractional CFOs play a key role in deal structuring, helping to negotiate terms that protect the acquiring company’s interests while remaining attractive to the seller. This might involve structuring the deal as an asset purchase versus stock purchase, determining the appropriate mix of cash and stock consideration, or establishing earnout provisions that tie additional payments to post-acquisition performance. The CFO also develops integration plans that address financial system consolidation, accounting policy alignment, and financial reporting changes required after the transaction closes. By providing this comprehensive financial support, fractional CFOs help ensure that acquisitions create value rather than destroying it.

Accurate and timely financial reporting is a fundamental responsibility that ensures stakeholders have reliable information for decision-making. A Fractional CFO establishes robust financial reporting processes that produce accurate profit and loss statements, balance sheets, cash flow statements, and other financial reports on a regular basis. These reports must comply with applicable accounting standards (GAAP or IFRS) and provide a true and fair view of the company’s financial position and performance. The CFO works with accounting teams to ensure that all transactions are properly recorded, accounts are reconciled, and financial statements are prepared accurately.

Beyond basic financial reporting, fractional CFOs develop customized reporting dashboards and KPI reports that provide management with the specific metrics needed to monitor business performance and make decisions. These reports are typically presented on a monthly basis and highlight key trends, variances from budget, and areas requiring management attention. The CFO also ensures that the company complies with all relevant financial regulations and tax requirements, working with external auditors and tax advisors as needed. This compliance responsibility is particularly important for companies seeking external funding or planning for eventual exit events, as investors and acquirers expect to see clean financial records and proper compliance with accounting standards.

While not always listed as a primary responsibility, risk management is an integral part of the fractional CFO role. The CFO identifies financial risks facing the organization, including exposure to currency fluctuations, interest rate changes, credit risks, operational risks, and market risks. The CFO develops strategies to mitigate these risks, which might include hedging strategies, insurance coverage, or operational changes that reduce exposure. The CFO also evaluates the company’s insurance needs and works with insurance advisors to ensure adequate coverage for potential losses.

Financial controls are another critical aspect of the CFO’s risk management responsibility. The CFO establishes internal controls that prevent fraud, ensure accuracy of financial records, and protect company assets. This includes segregation of duties, approval authorities, reconciliation procedures, and regular audits of financial transactions. Strong financial controls provide assurance to stakeholders that financial information is reliable and that company assets are being managed responsibly. For companies planning to raise external capital or pursue acquisitions, strong financial controls are often a prerequisite for investor confidence.

For companies with existing finance teams, the Fractional CFO provides leadership, guidance, and mentorship to finance staff. The CFO ensures that the finance team has the tools, training, and resources needed to execute their responsibilities effectively. This might include implementing new accounting software, establishing financial processes and procedures, or hiring additional finance staff as the company grows. The CFO also manages relationships with external advisors including auditors, tax advisors, and banking partners, ensuring that the company receives quality service and maintains strong relationships with these important stakeholders.

The CFO’s leadership role extends to communicating financial information to other departments and helping non-financial managers understand the financial implications of their decisions. By building financial literacy throughout the organization, the CFO helps create a culture where financial considerations are integrated into all business decisions. This collaborative approach to financial management often results in better decision-making and improved financial performance across the organization.

Fractional CFOs are particularly valuable for specific business situations and growth stages. Rapidly scaling companies often need senior financial leadership to manage the complexity that comes with growth, but may not yet have the revenue to justify a full-time CFO salary. Startups preparing for fundraising benefit enormously from a fractional CFO’s expertise in financial modeling, investor relations, and due diligence preparation. Companies navigating mergers, acquisitions, or other strategic transactions need the specialized expertise that fractional CFOs provide. Additionally, companies facing financial challenges or inefficiencies in their financial operations can benefit from a fractional CFO’s ability to quickly diagnose problems and implement solutions.

The decision to hire a fractional CFO should be based on the company’s specific needs, growth stage, and financial capacity. Companies should look for fractional CFOs with relevant industry experience, a track record of success with companies at similar growth stages, and a working style that aligns with the company’s culture and values. The best fractional CFO engagements result from clear communication about expectations, defined scope of work, and regular communication about progress and results.

Just as a Fractional CFO brings strategic financial expertise to your business, PostAffiliatePro brings intelligent affiliate management and revenue optimization to your partnership programs. Streamline your financial tracking, automate commission calculations, and gain real-time visibility into your affiliate performance metrics.

Discover why businesses hire fractional CFOs for cost-effective financial expertise, flexibility, and strategic guidance. Learn the key benefits and how to choo...

Discover the role of a Fractional CFO, their responsibilities, benefits for startups and SMEs, and their impact on affiliate marketing financial management.

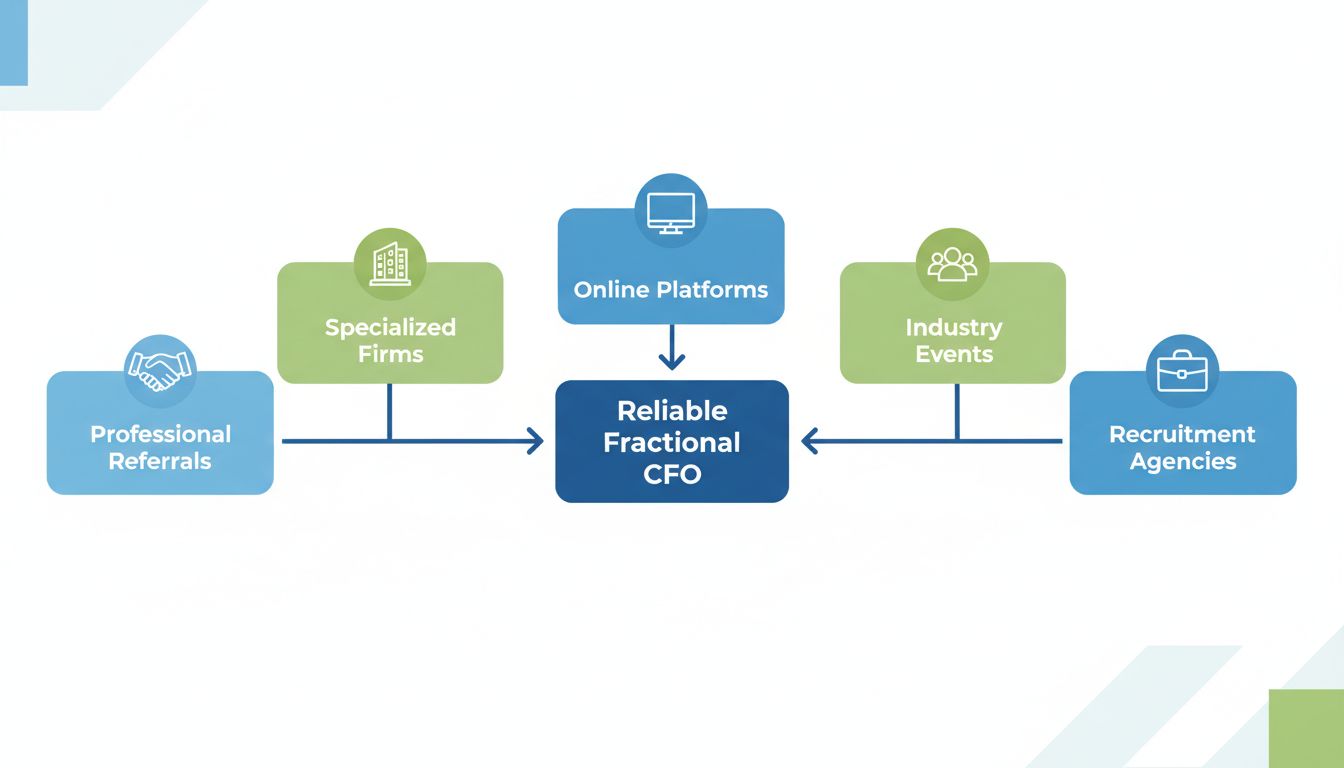

Discover proven methods to find a reliable Fractional CFO through professional referrals, specialized firms, online platforms, industry events, and recruitment ...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.