What Are Payment Processors? Complete Guide for Affiliate Networks

Learn what payment processors are, how they work, and why they're essential for affiliate payouts. Understand the payment ecosystem and processor selection for ...

how payment processors work, their role in transactions, security measures, costs, and how to choose the right one for your business.

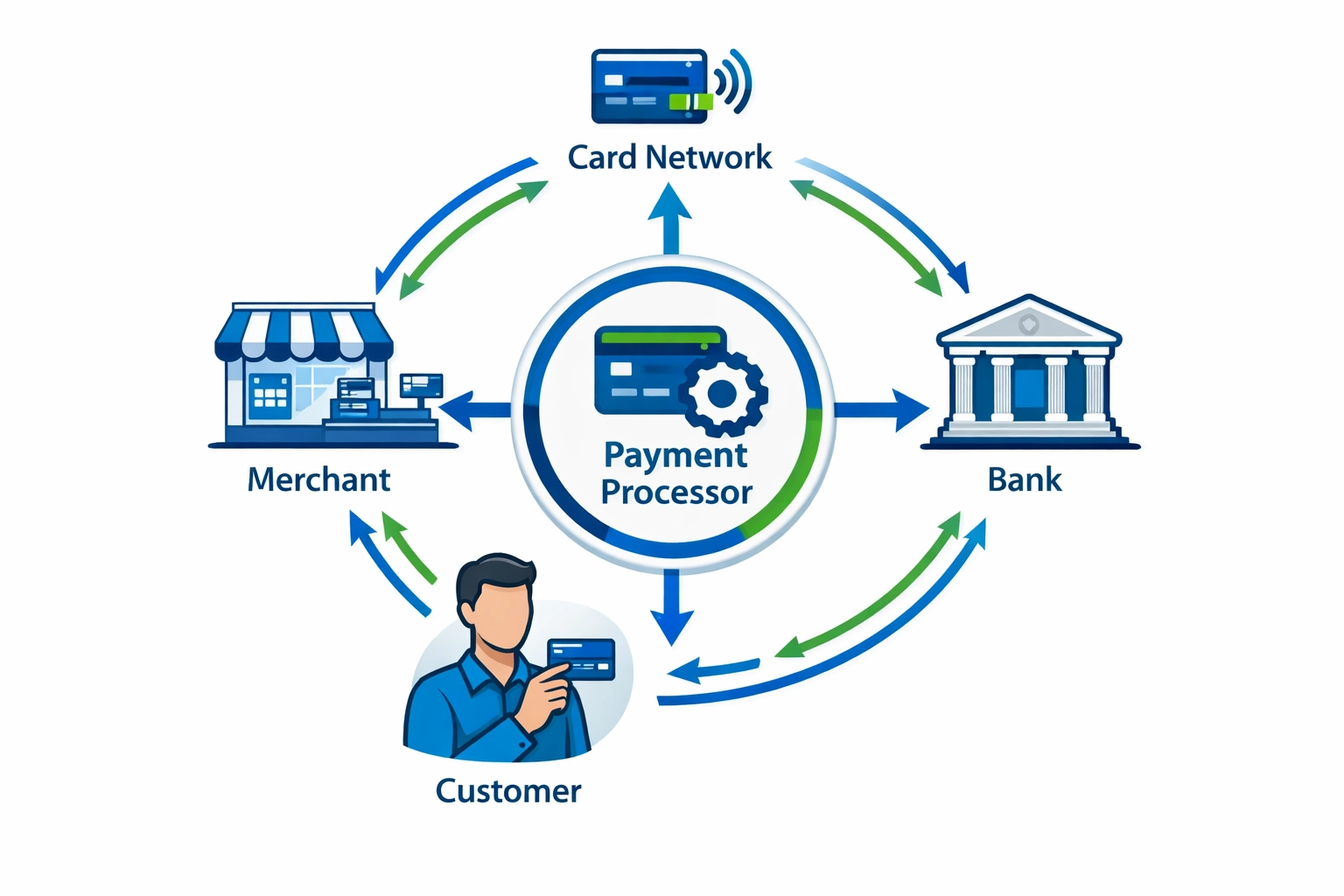

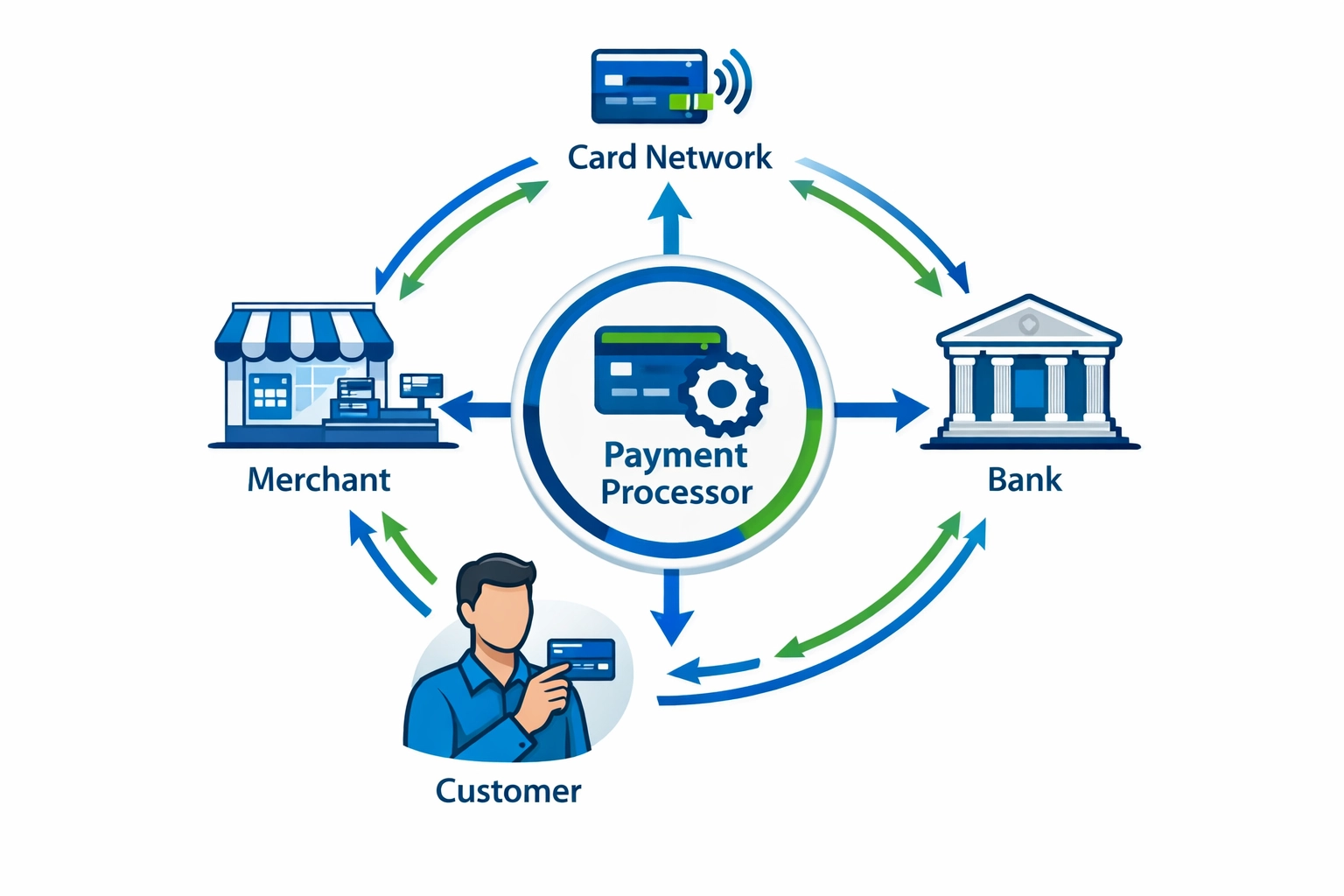

Payment processors are specialized financial service companies that act as essential intermediaries between merchants and financial institutions, enabling secure and efficient electronic transactions. When a customer makes a purchase using a credit card, debit card, or digital wallet, the payment processor handles the complex behind-the-scenes work of routing transaction data, verifying funds, and transferring money from the customer’s bank account to the merchant’s account. These companies process billions of transactions daily across the globe, with major processors like Stripe, Square, and Adyen handling over $1 trillion in annual transaction volume. Without payment processors, modern commerce as we know it would be impossible—they’re the invisible backbone that makes every online purchase, in-store card swipe, and digital payment possible.

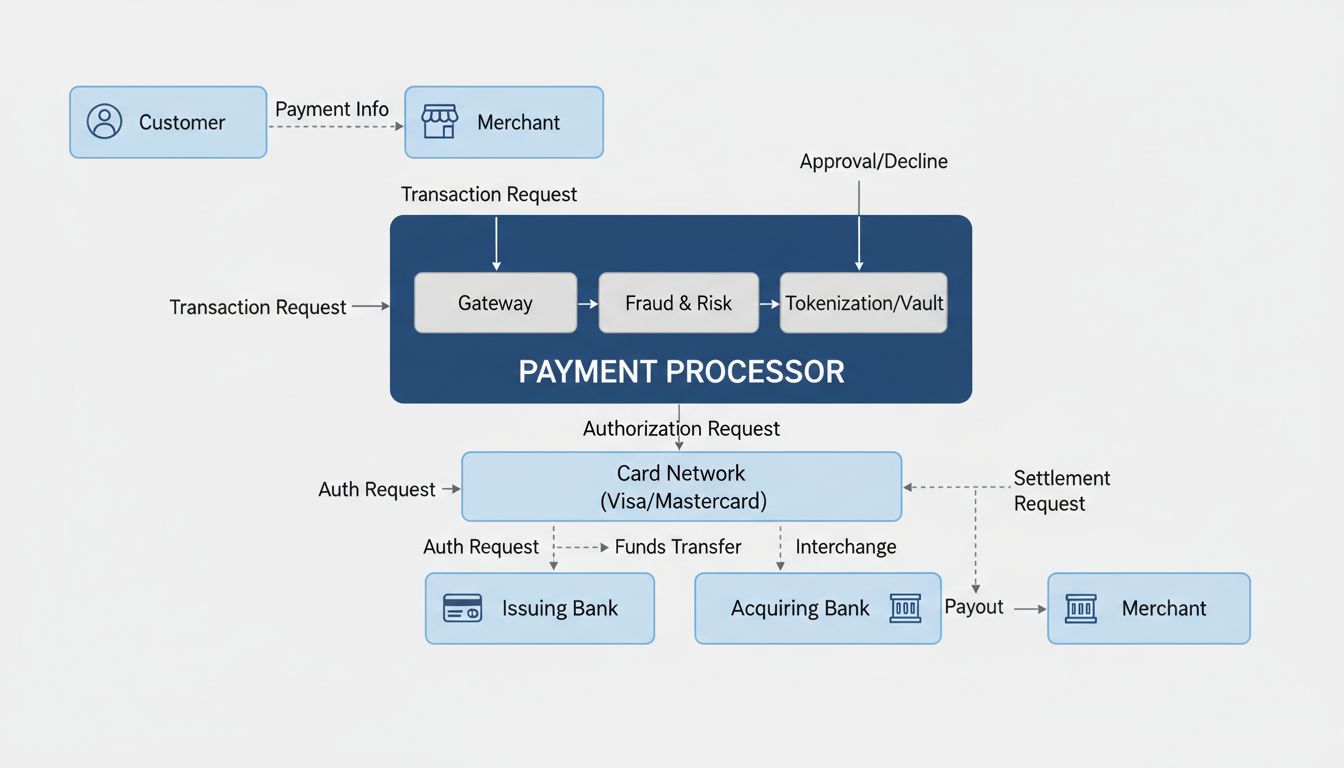

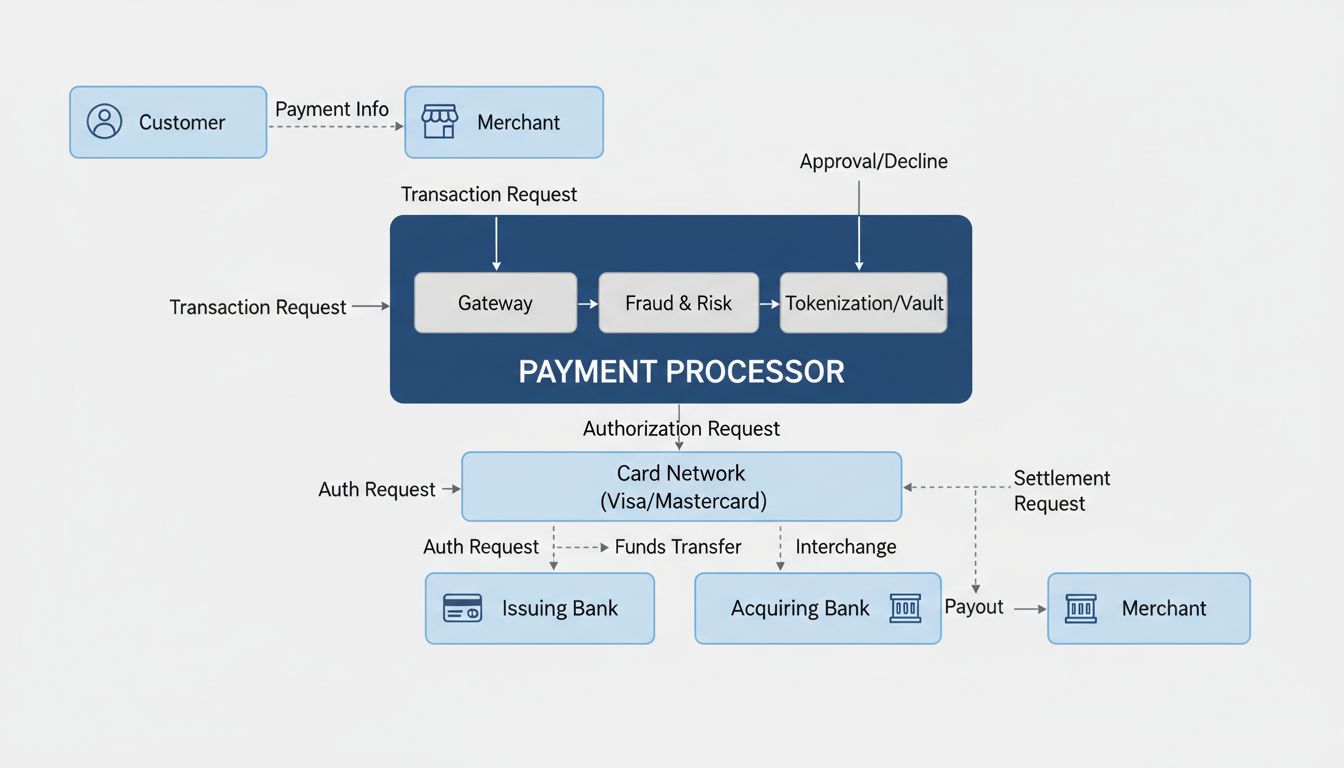

The payment processing ecosystem involves multiple specialized participants, each playing a critical role in ensuring transactions flow smoothly and securely. Understanding these players helps merchants appreciate the complexity of payment processing and why each entity is necessary for a complete payment solution.

| Player | Role | Responsibility |

|---|---|---|

| Customer | Initiates transaction | Provides payment information and funds |

| Merchant | Sells products/services | Accepts payments and fulfills orders |

| Payment Processor | Routes transaction data | Transmits information between all parties securely |

| Payment Gateway | Captures payment data | Encrypts and securely transmits card information |

| Card Networks | Sets rules and standards | Visa, Mastercard, Amex maintain transaction systems |

| Issuing Bank | Issues customer’s card | Approves/declines transactions, holds customer funds |

| Acquiring Bank | Holds merchant account | Receives funds and deposits them to merchant’s account |

Each of these entities works in concert, creating a relay system where payment information flows from the customer through the merchant’s systems, across card networks, to the issuing bank for approval, and finally back through the acquiring bank to the merchant’s account. This coordinated effort ensures that transactions are authorized, verified, and settled correctly while maintaining security throughout the entire process.

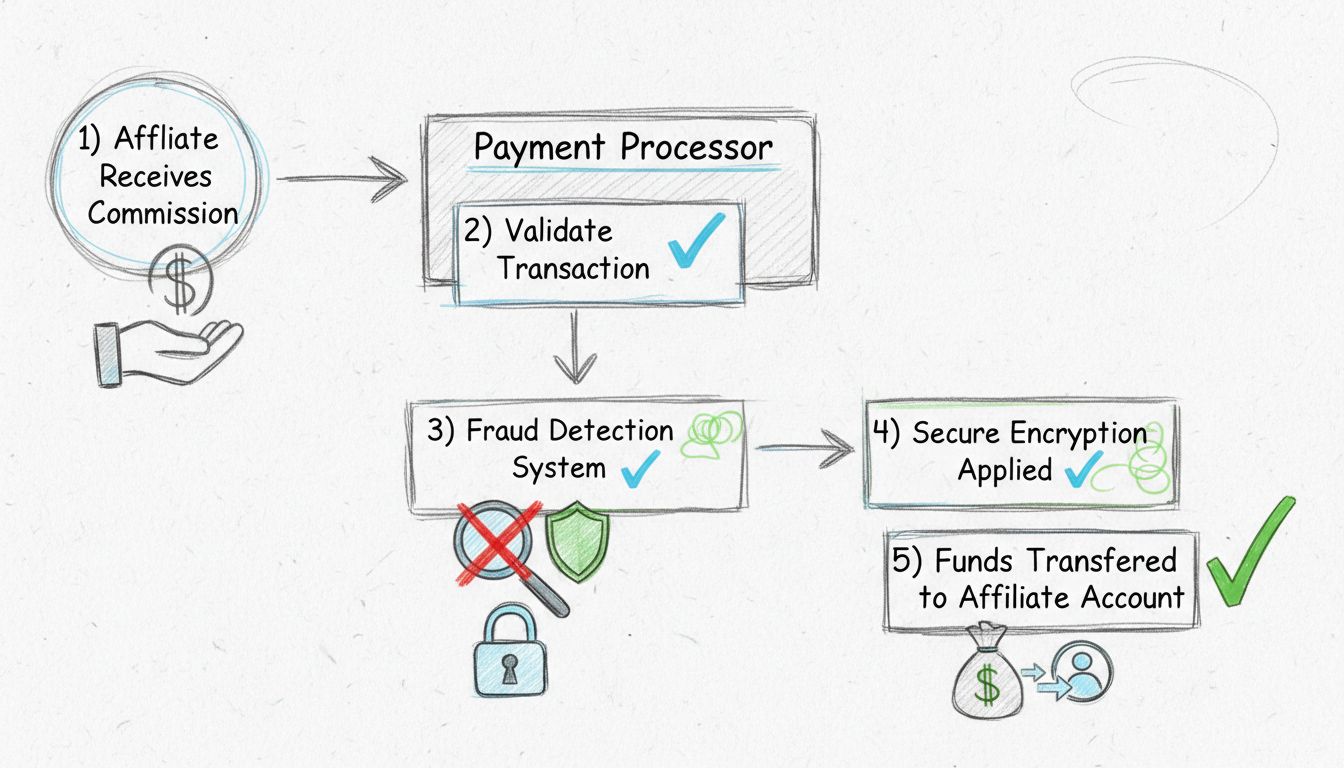

The payment processing workflow follows a precise sequence of steps that typically completes in just 2-3 seconds for authorization, though settlement takes longer. Here’s how a typical transaction flows through the system:

Authorization Initiation - When a customer presents their payment information (swiping, tapping, or entering card details online), the merchant’s system captures this data and sends it to the payment processor through a secure payment gateway. The gateway encrypts all sensitive information to protect it during transmission.

Transaction Validation - The payment processor forwards the encrypted transaction details to the appropriate card network (Visa, Mastercard, etc.), which then routes it to the customer’s issuing bank. The issuing bank performs critical checks: Is the card active? Are there sufficient funds? Does the transaction match the cardholder’s typical spending patterns? Are the security codes and billing address correct?

Authorization Response - Within seconds, the issuing bank sends an approval or decline message back through the card network to the processor and merchant. If approved, an authorization code is generated as proof of the transaction. If declined, a reason code explains why (insufficient funds, suspected fraud, etc.).

Settlement Process - Authorization doesn’t immediately transfer funds. Instead, it reserves those funds in the customer’s account. At the end of the business day, the merchant’s system batches all approved transactions and sends them to the processor for settlement. The processor forwards these to card networks, which communicate with issuing banks to finalize the transfers.

Fund Deposit - After settlement is complete, funds move from issuing banks through card networks and the processor to the merchant’s acquiring bank, which deposits the money into the merchant’s business account. Depending on the processor and service level, this typically takes 1-3 business days, though some processors offer next-day or same-day funding for an additional fee.

While payment processors and merchant acquirers work closely together, they serve distinct functions in the payment ecosystem. Many merchants confuse these two roles, but understanding the differences is crucial for choosing the right payment partners.

| Aspect | Payment Processor | Merchant Acquirer |

|---|---|---|

| Primary Role | Routes transaction data securely | Establishes and maintains merchant accounts |

| Relationship with Merchant | Often indirect; may work through acquirer | Direct relationship; underwriter of merchant |

| Risk Management | Focuses on transaction security and fraud prevention | Assesses merchant creditworthiness and absorbs fraud risk |

| Data Handling | Transmits and encrypts payment information | Stores merchant account data and settlement information |

| Settlement | Coordinates the settlement process | Receives funds and deposits to merchant account |

Payment processors are primarily focused on the technical aspects of transaction processing—ensuring data flows securely and efficiently between all parties. They implement encryption, tokenization, and fraud detection to protect transaction data. Merchant acquirers, on the other hand, are licensed financial institutions that take on the business relationship with merchants. They underwrite merchant accounts, assess risk, manage chargebacks, and hold the merchant’s settlement account. Many modern payment service providers like PostAffiliatePro integrate both functions, simplifying the merchant’s experience by providing a single point of contact for all payment-related needs.

Payment processors implement multiple layers of security to protect sensitive cardholder data and prevent fraud. These security measures are not optional—they’re required by law and industry standards.

PCI DSS Compliance - The Payment Card Industry Data Security Standard (PCI DSS) is a mandatory security framework that all payment processors must follow. It requires encryption of cardholder data, regular security testing, access controls, and comprehensive monitoring. Processors that achieve PCI Level 1 certification undergo annual audits by qualified security assessors to ensure they meet all 300+ security requirements.

Encryption and Tokenization - Payment processors use encryption to convert sensitive card data into unreadable code during transmission, ensuring that even if data is intercepted, it cannot be used. Tokenization goes further by replacing actual card numbers with random character strings for storage, so merchants never actually store real card data on their systems.

Fraud Detection Systems - Modern payment processors employ artificial intelligence and machine learning to detect suspicious transaction patterns in real-time. These systems flag unusual purchases, transactions from high-risk locations, and other anomalies that might indicate fraud, allowing processors to decline potentially fraudulent transactions before they complete.

Chargeback Management - When customers dispute transactions with their banks, payment processors help merchants respond to chargebacks by providing tools to track disputes, gather evidence, and submit compelling responses. This protection is critical because chargebacks can result in significant financial losses and damage to a merchant’s reputation.

Every transaction processed through a payment processor involves multiple fees that are distributed among the various parties involved. Understanding these costs helps merchants evaluate different processors and negotiate better rates.

| Fee Type | Description | Who Receives It |

|---|---|---|

| Interchange Fees | Base cost set by card networks for processing | Issuing bank |

| Assessment Fees | Network maintenance and operational fees | Card networks (Visa, Mastercard, etc.) |

| Processor Markup | Payment processor’s profit margin | Payment processor |

| Monthly Fees | Account maintenance and service fees | Payment processor |

| PCI Compliance Fees | Cost of maintaining security standards | Payment processor |

| Chargeback Fees | Fee for handling disputed transactions | Payment processor |

Payment processors typically offer three main pricing models. Interchange-plus pricing adds a fixed markup to the base interchange rate set by card networks, providing transparency about what you’re actually paying. Flat-rate pricing charges the same percentage for all transactions regardless of card type, making budgeting easier but potentially costing more for premium cards. Tiered pricing sorts transactions into qualified, mid-qualified, and non-qualified categories with different rates for each, offering a middle ground but with less transparency. The most cost-effective option depends on your transaction volume, card mix, and business type. High-volume merchants typically benefit from interchange-plus pricing, while small businesses with unpredictable volume may prefer flat-rate simplicity.

Selecting a payment processor is a significant decision that impacts your business operations, costs, and customer experience. Several key factors should guide your choice to ensure you partner with a processor that grows with your business.

Integration capabilities are paramount—your processor should seamlessly connect with your existing systems including your POS system, e-commerce platform, accounting software, and inventory management tools. Security features must be comprehensive, including PCI DSS compliance, encryption, tokenization, and fraud prevention tools. Competitive pricing matters, but focus on total cost rather than just advertised rates; compare all fees including monthly charges, chargeback fees, and PCI compliance costs. Customer support should be responsive and knowledgeable, available through multiple channels when you need help. Scalability ensures the processor can handle your growth without requiring a complete system overhaul. Solutions like PostAffiliatePro integrate payment processing with affiliate management, allowing you to process payouts to affiliates, track commissions, and manage payments all within a single platform—eliminating the need to juggle multiple service providers.

The payment landscape is evolving rapidly, with new methods and technologies emerging constantly. Payment processors must support this diversity to meet customer expectations and capture all possible sales.

Digital Wallets - Apple Pay, Google Pay, and similar services now account for over 50% of global e-commerce transactions. These contactless payment methods offer convenience and security, and modern processors must support them seamlessly.

Buy Now, Pay Later (BNPL) - Services like Klarna and Afterpay are growing rapidly, especially among younger consumers. Payment processors increasingly integrate BNPL options to give merchants access to this expanding payment method.

Real-Time Payments - Networks like RTP in the United States and UPI in India enable instant settlement, bypassing traditional card rails. Forward-thinking processors are adopting these faster payment methods.

Mobile Payment Processing - Mobile POS systems and payment readers allow merchants to accept payments anywhere, not just at fixed locations. This flexibility is becoming essential for retail, restaurants, and service businesses.

Cryptocurrency and Tokenized Payments - While still emerging, stablecoins and tokenized bank deposits are being piloted by major networks as potential future settlement rails, offering merchants new possibilities for global transactions.

The future of payment processing belongs to providers who can adapt quickly to these changes while maintaining security and compliance. Merchants should choose processors that actively invest in emerging technologies and demonstrate a commitment to supporting new payment methods as they gain adoption.

A payment gateway is the technology that securely captures and encrypts card data before sending it to the processor. A payment processor handles the authorization and settlement of transactions by routing data between merchants, card networks, and banks. Most online businesses need both services, though they're often bundled together by payment service providers.

Transaction authorization typically takes 2-3 seconds, during which the processor verifies funds with the customer's bank. However, settlement—when funds actually move to your account—takes 1-3 business days with standard processing. Some processors offer faster options like next-day or same-day funding for an additional fee.

PCI DSS (Payment Card Industry Data Security Standard) is a mandatory security framework that all payment processors must follow to protect cardholder data. It requires encryption, regular security testing, access controls, and monitoring. Non-compliance can result in significant fines and damage to your business reputation.

Yes, modern payment processors handle credit cards, debit cards, digital wallets (Apple Pay, Google Pay), bank transfers, e-checks, and increasingly BNPL services. Supporting multiple payment methods increases conversion rates and customer satisfaction by letting customers pay their preferred way.

Interchange fees are the base costs set by card networks (Visa, Mastercard, etc.) for processing card transactions. These fees go to the issuing bank and are typically 1-3% of the transaction amount. Card networks set these rates, not individual processors, though processors add their own markup on top.

Payment processors use multiple fraud prevention methods including encryption, tokenization, real-time transaction monitoring, AI-based anomaly detection, address verification, CVV checks, and 3D Secure authentication. These tools work together to identify suspicious patterns and decline potentially fraudulent transactions before they complete.

Key factors include competitive pricing (compare total costs, not just rates), integration with your existing systems, comprehensive security features, responsive customer support, scalability for growth, and support for the payment methods your customers prefer. Also consider whether the processor offers additional features like analytics, recurring billing, or affiliate management.

Yes, payment processors are heavily regulated. They must comply with PCI DSS security standards, anti-money laundering (AML) laws, Know Your Customer (KYC) requirements, and various financial regulations depending on their jurisdiction. Reputable processors undergo regular audits and maintain certifications to prove compliance.

Manage affiliate payments efficiently with our integrated payment processing solution. Automate payouts, track transactions, ensure compliance, and grow your affiliate program—all in one powerful platform.

Learn what payment processors are, how they work, and why they're essential for affiliate payouts. Understand the payment ecosystem and processor selection for ...

Learn how payment processors simplify international affiliate payouts with multi-currency support, automated conversions, and secure global transfers. Discover ...

Discover why payment processors are essential for affiliate businesses. Learn about security, automation, compliance, and financial management benefits that dri...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.