NFL Betting Affiliate Marketing Strategy American Football

Master NFL betting affiliate marketing with proven strategies for content, SEO, influencer partnerships, and paid media to maximize conversions during football

the 12 US states without legal sports betting and learn proven affiliate strategies for emerging markets. Complete guide for sportsbook affiliates targeting

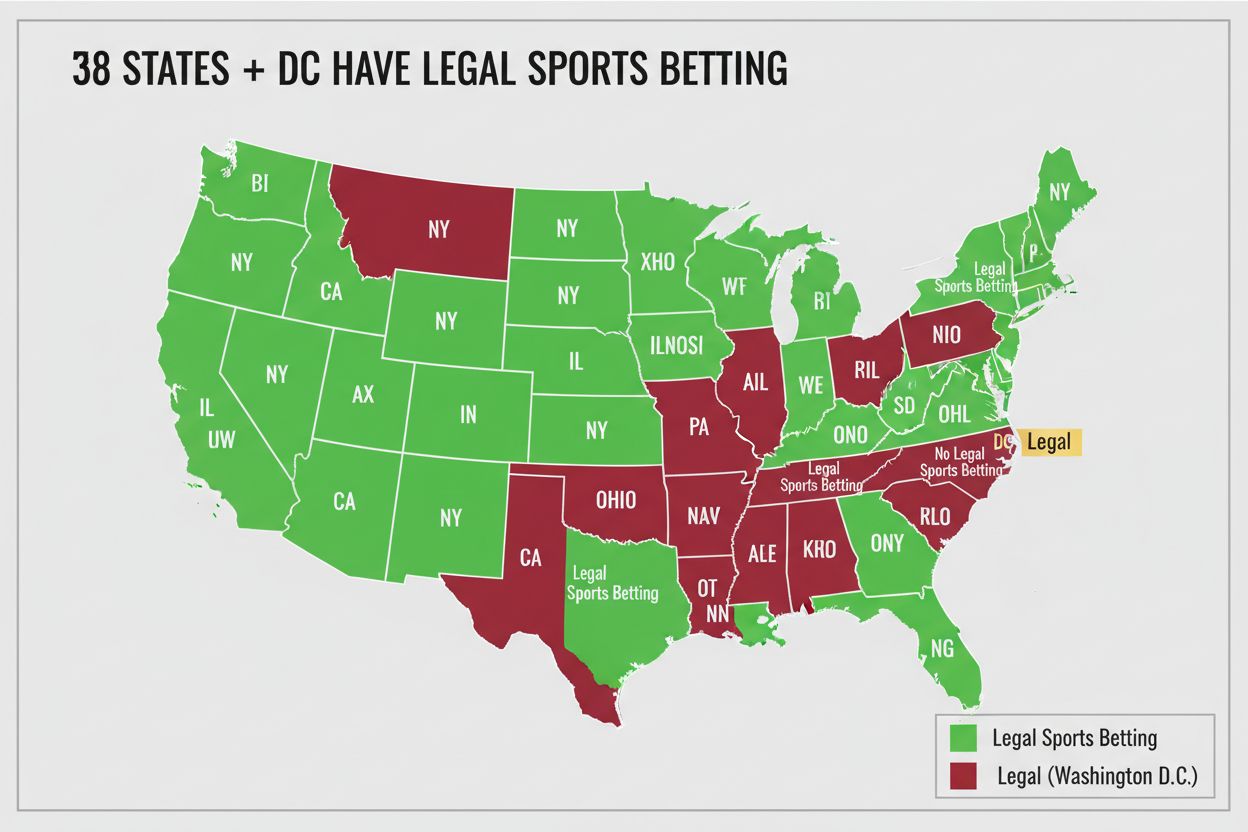

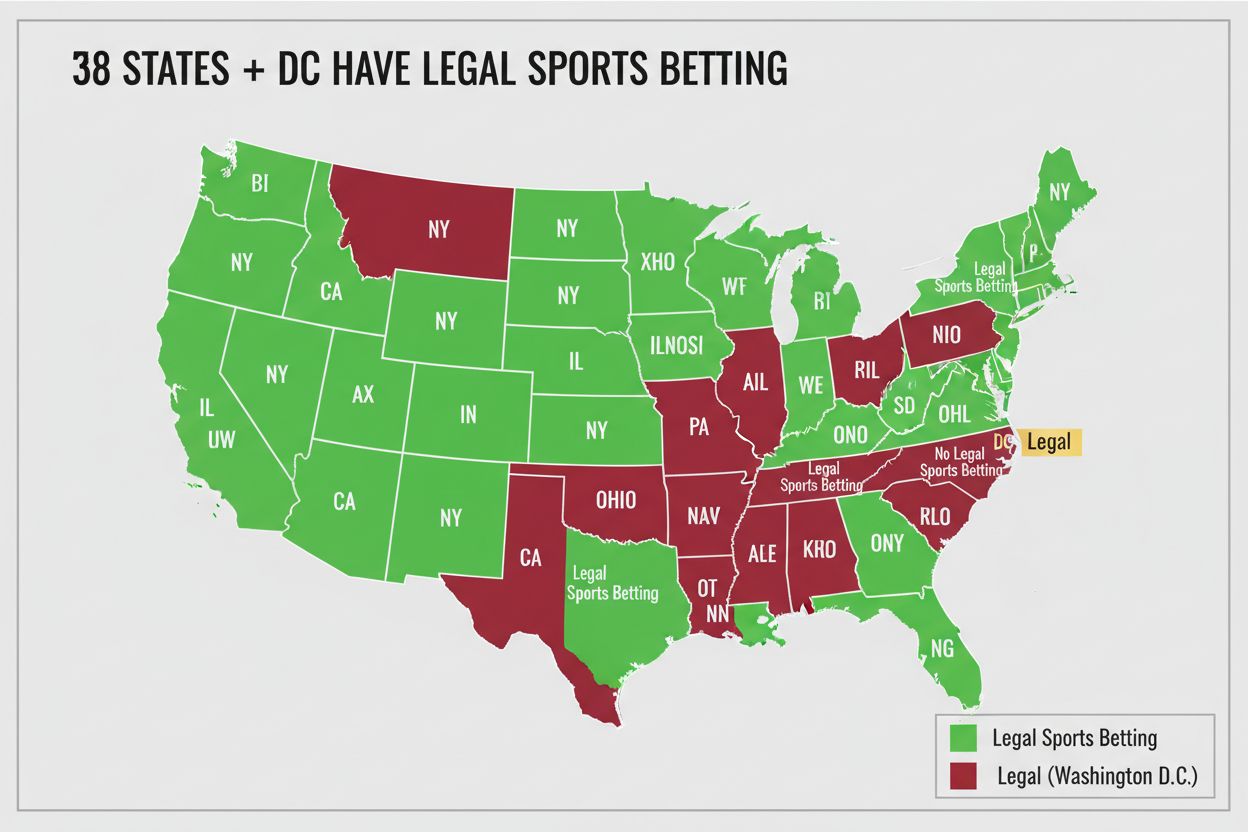

The United States sports betting market has undergone a dramatic transformation since the Supreme Court’s 2018 decision to overturn PASPA (Professional and Amateur Sports Protection Act). Today, 38 states plus Washington D.C. have legalized sports betting in some form, generating billions in annual revenue and creating unprecedented opportunities for affiliate marketers. However, 12 states remain without legal sports betting, representing a massive untapped market of over 60 million residents. For affiliate marketers and sportsbook operators, these non-legal states represent both a challenge and an extraordinary opportunity—a chance to build authority, establish audience relationships, and position for rapid market entry when legalization inevitably occurs.

Understanding which states prohibit sports betting is essential for affiliate strategy. These 12 states represent diverse regulatory environments, from constitutional prohibitions to political opposition and tribal gaming complications. Here’s a comprehensive breakdown:

| State | Population | Current Status | Primary Barrier | Legislative Activity | Potential Timeline |

|---|---|---|---|---|---|

| Alabama | 5.1M | Illegal | Super-majority requirement | Moderate | 2026+ |

| Alaska | 740K | Illegal | Regulatory concerns | Low | 2026+ |

| California | 39.2M | Illegal | Voter rejection (2022) | Low | 2027+ |

| Georgia | 10.9M | Illegal | House opposition | High | 2026 |

| Hawaii | 1.4M | Illegal | Cultural resistance | Low | 2025-2026 |

| Idaho | 1.9M | Illegal | Constitutional ban | None | 2030+ |

| Minnesota | 5.7M | Illegal | Tribal disputes | High | 2025-2026 |

| Oklahoma | 4.0M | Illegal | Tribal negotiations | High | 2025-2026 |

| South Carolina | 5.3M | Illegal | Governor opposition | Low | 2027+ |

| Texas | 30.0M | Illegal | Legislative opposition | Moderate | 2026-2027 |

| Utah | 3.4M | Illegal | Constitutional ban | None | 2035+ |

Total Population Without Legal Betting: 107.8 Million Residents

These 12 states collectively represent over 107 million residents—roughly one-third of the U.S. population. The barriers to legalization vary dramatically, from constitutional prohibitions (Utah, Idaho) to political opposition (Texas, South Carolina) to tribal gaming complications (Oklahoma, Minnesota). For affiliates, this diversity creates both challenges and opportunities, as each state requires a tailored approach based on its unique regulatory landscape.

The 12 non-legal states represent far more than just a regulatory challenge—they represent a strategic opportunity for forward-thinking affiliates. Here’s why these markets deserve your attention:

The reasons these 12 states haven’t legalized sports betting reveal important insights for affiliate strategy. Constitutional prohibitions represent the most significant barrier—Utah and Idaho explicitly ban gambling in their state constitutions, requiring a two-thirds legislative vote and statewide referendum to change. This makes legalization in these states unlikely before 2030 at the earliest. Political opposition plays a major role in states like Texas, where conservative lawmakers have publicly stated their intent to block gambling expansion, and South Carolina, where the governor has vowed to veto any legalization bill.

Tribal gaming dynamics complicate legalization in Oklahoma and Minnesota, where federally recognized tribes have existing gaming compacts and want exclusive or preferential rights to sports betting. These negotiations can take years to resolve, as tribes balance revenue opportunities against concerns about market dilution. Religious and cultural factors influence states like Hawaii, where deep cultural values create voter skepticism about gambling expansion, and Alabama, where moral opposition remains strong despite the state’s proximity to legal betting in neighboring states.

Understanding these barriers is crucial because they determine the timeline and strategy for affiliate market entry. States with constitutional barriers require patience and long-term positioning, while states with political opposition may see rapid change if legislative leadership shifts. Tribal gaming states require affiliate partnerships with tribal operators, while culturally resistant states need educational content that addresses community concerns about responsible gambling.

One of the most critical questions for affiliates is: Can I legally operate in states without legal sports betting? The answer is nuanced and requires careful attention to state regulations. In non-legal states, there are currently no affiliate licensing requirements because there are no licensed sportsbooks to affiliate with. However, this doesn’t mean affiliates can operate freely—it means affiliates must avoid promoting unlicensed operators.

The legal landscape is clear: promoting offshore or unlicensed sportsbooks is illegal in the United States. Affiliates who market unlicensed operators face significant legal liability, including potential criminal charges and civil penalties. This is where PostAffiliatePro becomes invaluable. Our platform provides state-specific regulatory guidance, helping affiliates understand which operators are licensed in their target states and which are not. We offer audience segmentation tools that track traffic by state, ensuring affiliates never accidentally promote unlicensed operators to residents of non-legal states.

For affiliates operating in non-legal states, the strategy is to build audiences without promoting illegal betting. This means creating content about legal alternatives like daily fantasy sports, horse racing betting, and state lotteries. It means establishing email lists of interested bettors who will become customers the moment legalization occurs. PostAffiliatePro’s compliance documentation features help affiliates maintain detailed records of their promotional activities, ensuring they can demonstrate regulatory compliance if questioned by authorities. When legalization finally arrives, these affiliates will have established authority, engaged audiences, and ready-to-convert customer lists—positioning them for explosive growth.

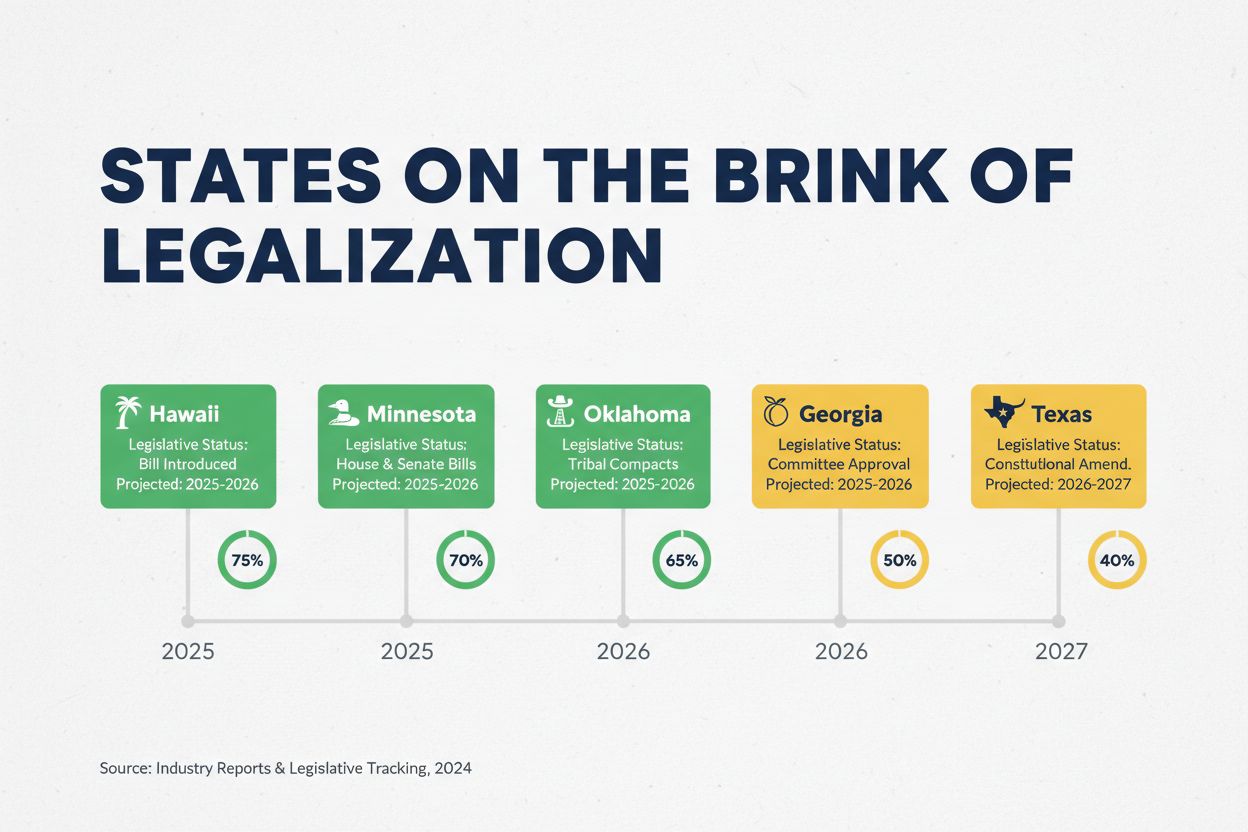

While 12 states currently prohibit sports betting, five states are actively moving toward legalization and represent the most immediate opportunities for affiliate growth. Hawaii passed the first chamber of its sports betting bill in 2025, with a task force studying implementation details. Projections suggest legalization could occur by late 2025 or early 2026. Georgia has strong bipartisan support for legalization, with bills advancing through the legislature and a potential 2026 referendum. Texas, with 30 million residents, is expected to see serious legalization efforts in 2026-2027, though political opposition remains significant.

Minnesota and Oklahoma are navigating complex tribal gaming negotiations that could resolve within 18-24 months. These five states collectively represent over 40 million residents and could generate $8+ billion in annual sports betting handle if legalized. For affiliates, this creates an urgent window of opportunity. The next 12-24 months are critical for positioning—building content authority, establishing email lists, developing operator relationships, and creating multi-channel engagement strategies that will drive explosive growth when these markets launch.

The most successful affiliates don’t wait for legalization—they prepare for it. Here are five proven strategies for building affiliate businesses in pre-legalization states:

Content Authority Building: Create comprehensive guides, comparison articles, and educational content about sports betting regulations, responsible gambling, and what to expect when legalization occurs. This content ranks in search results and positions you as the go-to expert when residents search for betting information post-legalization.

Email List Development: Offer free guides, betting predictions, or sports analysis in exchange for email addresses. Build lists of 10,000-100,000 interested bettors in target states. When legalization occurs, you have instant customer acquisition channels with zero acquisition cost.

Operator Relationship Development: Identify sportsbooks planning to enter emerging markets and establish affiliate partnerships before launch. Early partners often receive exclusive deals, higher commissions, and marketing support that late entrants don’t get.

Regulatory Monitoring & Rapid Response: Subscribe to legislative tracking services and monitor state legislature websites. When legalization bills advance, you can immediately create content, reach out to operators, and position for market entry before competitors realize what’s happening.

Multi-Channel Audience Engagement: Build audiences across YouTube, podcasts, social media, and blogs. Diversified channels reduce dependence on any single platform and create multiple touchpoints for audience engagement and monetization.

PostAffiliatePro is purpose-built for affiliates operating across multiple states with varying regulations. Our platform provides advanced tracking and attribution that identifies which traffic originates from legal vs. non-legal states, ensuring you never accidentally promote unlicensed operators. Our real-time analytics dashboard shows conversion rates, commission earnings, and audience engagement metrics by state, helping you identify which markets are most profitable.

Our flexible commission structures allow you to negotiate different rates with different operators and manage complex multi-state affiliate programs from a single dashboard. Our white-label capabilities let you create branded affiliate portals that build your authority and customer relationships. Most importantly, our compliance and documentation features help you maintain detailed records of all promotional activities, ensuring regulatory compliance as you scale across multiple jurisdictions.

PostAffiliatePro’s state-specific regulatory guidance keeps you informed about licensing requirements, tax obligations, and responsible gambling mandates in each state where you operate. As regulations evolve—and they will—our platform evolves with them, ensuring you stay compliant without constant manual updates. This is why leading affiliates and sportsbook operators choose PostAffiliatePro: we handle the complexity of multi-state affiliate management so you can focus on growth.

Operating in the sports betting space requires meticulous attention to compliance. ⚠️ WARNING: Promoting unlicensed sportsbooks is illegal and can result in criminal charges, civil penalties, and permanent loss of affiliate accounts. Never promote offshore operators or unlicensed sportsbooks, regardless of commission offers. The legal and financial risks far outweigh any short-term gains.

Maintain detailed documentation of all promotional activities, including which operators you promote, which states you target, and which marketing channels you use. This documentation protects you if regulators question your activities. Implement responsible gambling messaging in all promotions—display problem gambling helplines, promote self-exclusion tools, and avoid targeting vulnerable populations. PostAffiliatePro’s compliance features automate much of this work, ensuring responsible gambling messaging appears in all your promotions.

Stay informed about state-specific regulations in your target markets. Licensing requirements, tax obligations, and responsible gambling mandates vary significantly by state. What’s compliant in one state may be illegal in another. PostAffiliatePro’s regulatory guidance helps you navigate these complexities, but ultimately, you’re responsible for understanding and following the laws in your jurisdiction. When in doubt, consult with a gambling law attorney before launching campaigns in new states.

The 12 states without legal sports betting represent a $10+ billion opportunity for affiliates willing to prepare today for markets that will legalize tomorrow. The next 18-36 months are critical—this is when you build authority, establish audiences, and develop operator relationships that will drive explosive growth when legalization occurs. Affiliates who wait until legalization will face saturated markets with dozens of competitors and minimal commission opportunities. Affiliates who prepare now will dominate their markets and capture premium affiliate commissions.

PostAffiliatePro is your partner in this journey. Our platform provides the tracking, compliance, and multi-state management capabilities you need to operate efficiently across legal and emerging markets. Whether you’re building audiences in Hawaii, developing operator relationships in Texas, or monitoring legislative progress in Minnesota, PostAffiliatePro gives you the tools to succeed.

The time to act is now. Start building your pre-legalization affiliate business today. Create content, establish email lists, develop operator relationships, and position yourself for explosive growth when these markets legalize. Your future affiliate revenue depends on the decisions you make in the next 12 months.

Start Your Free Trial Today and discover how PostAffiliatePro can help you scale your affiliate business across multiple states and emerging markets.

Hawaii, Georgia, Texas, Minnesota, and Oklahoma are the closest to legalization. Hawaii passed the first chamber in 2025, Georgia has strong bipartisan support, and Texas is expected to vote in 2026-2027. Minnesota and Oklahoma have active tribal negotiations underway. These five states represent over 40 million residents and could legalize within 18-36 months.

No, affiliates cannot legally promote unlicensed sportsbooks in states where betting is illegal. However, affiliates can build audiences, create content, and prepare for future legalization. Many successful affiliates use this pre-legalization period to establish authority and email lists for rapid market entry when legalization occurs.

PostAffiliatePro provides state-specific regulatory guidance, audience segmentation tools, and compliance documentation features. Our platform helps affiliates track which states their traffic originates from, manage commission structures by jurisdiction, and maintain detailed records for regulatory audits. This ensures affiliates stay compliant as regulations evolve.

Affiliates should build content authority through educational articles, establish email lists of interested bettors, develop relationships with operators planning to enter the market, monitor legislative progress, and create multi-channel engagement strategies. PostAffiliatePro's analytics help track audience growth and engagement metrics across all channels.

Licensing requirements vary by state. Some states (Arizona, Colorado, Indiana) require affiliate licenses costing $500-$2,500. Others (Iowa, Illinois, Tennessee) don't require licenses for CPA-based promotions. Non-legal states have no requirements, but affiliates must avoid promoting unlicensed operators. PostAffiliatePro helps manage these varying requirements across multiple jurisdictions.

No, promoting offshore or unlicensed sportsbooks is illegal in the United States. The SAFE Bet Act and state laws prohibit affiliates from marketing unlicensed operators. Affiliates should only promote licensed, regulated sportsbooks in their jurisdiction. Violations can result in significant legal penalties and loss of affiliate accounts.

Tribal gaming compacts in states like Oklahoma, Minnesota, and Washington give tribes exclusive or preferential rights to offer sports betting. This creates unique opportunities for affiliates to partner with tribal operators. However, it also means commercial operators may have limited market access. Understanding tribal dynamics is crucial for affiliate strategy in these states.

Affiliates must display problem gambling helplines, promote self-exclusion tools, avoid targeting vulnerable populations, and include responsible gambling messaging in all promotions. PostAffiliatePro's compliance features help affiliates implement these measures automatically across all marketing channels and ensure adherence to state-specific responsible gambling requirements.

PostAffiliatePro provides the most advanced affiliate management platform for sports betting operators. Track conversions, manage commissions, and scale across multiple states with our comprehensive solution.

Master NFL betting affiliate marketing with proven strategies for content, SEO, influencer partnerships, and paid media to maximize conversions during football

Master NHL betting affiliate marketing with proven strategies for hockey season. bankroll management, content creation, and compliance for maximum conversions.

Master Google Ads compliance for betting affiliates. Learn certification requirements, geo-targeting strategies, and how to scale campaigns compliantly.

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.