Customer Acquisition Strategy: Win New Customers

Learn proven customer acquisition strategies, metrics, and best practices to attract and convert new customers. Reduce CAC and maximize CLV.

Discover whether to focus on acquiring new customers or retaining existing ones. Learn costs, benefits, and strategies for balancing both.

Customer acquisition is the process of attracting and converting new customers to your business, representing the first critical step in building a sustainable customer base. This involves identifying potential customers, engaging them through various marketing channels, and guiding them through the sales funnel until they make their first purchase. Key metrics used to measure acquisition success include Customer Acquisition Cost (CAC), which represents the total investment required to gain one new customer, and conversion rate, which tracks the percentage of prospects who become paying customers. Understanding these metrics is essential for evaluating the efficiency and effectiveness of your acquisition efforts.

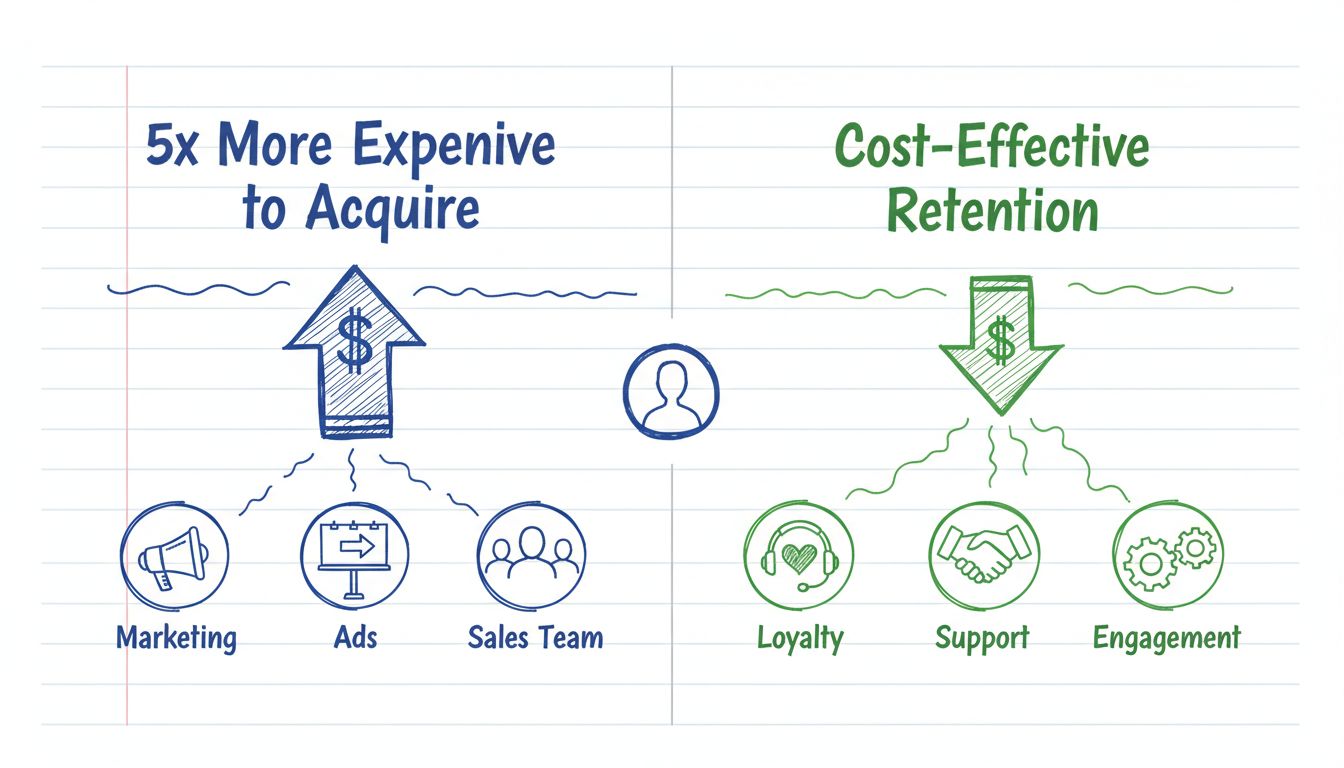

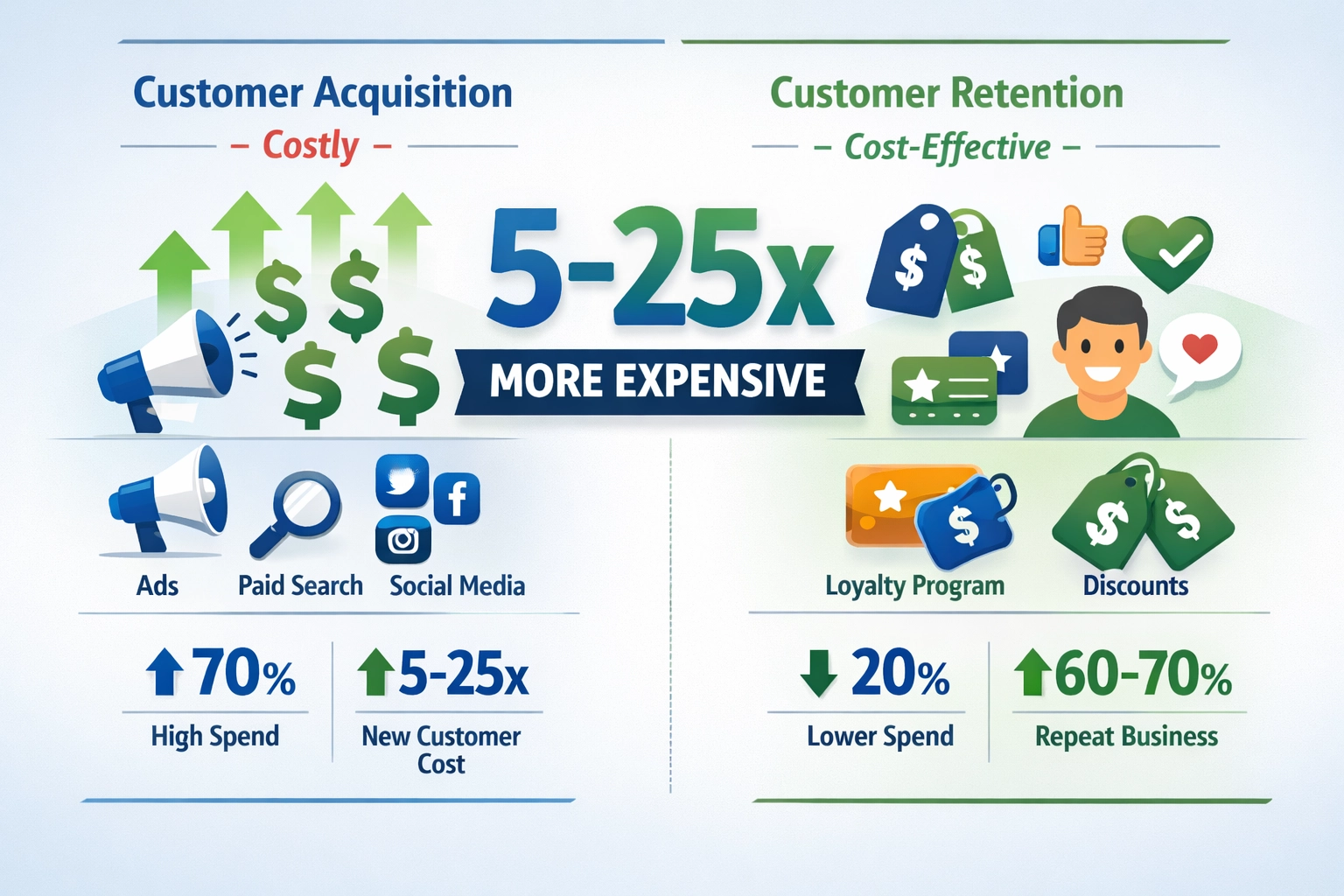

Customer acquisition is significantly more expensive than retaining existing customers, with research showing that acquiring a new customer can cost 5-25 times more than retaining an existing one. The Customer Acquisition Cost (CAC) encompasses all expenses related to marketing, sales, advertising, and promotional activities needed to convert a prospect into a customer. High acquisition costs stem from multiple factors including competitive market conditions, rising advertising costs across digital platforms, the need for sophisticated marketing technology, and the extended sales cycles required to convert cold prospects into buyers. Understanding these costs is crucial for determining your business’s profitability and growth sustainability.

| Metric | Customer Acquisition | Customer Retention |

|---|---|---|

| Average Cost | High (5-25x more) | Low |

| Time Investment | Extended sales cycle | Minimal touchpoints |

| ROI Timeline | 6-12 months | Immediate |

| Scalability | Challenging | Easier to scale |

| Predictability | Variable | More consistent |

Customer retention refers to the ability of a business to keep existing customers engaged and satisfied, encouraging them to continue purchasing and remain loyal over time. Retention focuses on maximizing the value of your current customer base by reducing customer loss and increasing repeat purchases, which directly impacts long-term profitability. Critical metrics for measuring retention effectiveness include churn rate (the percentage of customers who stop doing business with you), Customer Lifetime Value (CLV) (the total revenue a customer generates throughout their relationship with your company), and repeat purchase rate (the percentage of customers who make multiple purchases). These metrics provide insight into customer satisfaction, loyalty, and the overall health of your business.

The financial impact of customer retention is remarkable, with studies demonstrating that a mere 5% increase in customer retention can increase profits by 25-95%, depending on your industry and business model. Repeat customers spend approximately 67% more than new customers on average, making them significantly more valuable to your bottom line. Retained customers also contribute to higher Customer Lifetime Value (CLV), meaning each customer generates substantially more revenue over their entire relationship with your company compared to one-time purchasers. Additionally, loyal customers are more likely to refer friends and family, creating organic growth through word-of-mouth marketing that requires minimal additional investment. The compounding effect of retention creates a sustainable, profitable business model that becomes increasingly valuable over time.

To make informed decisions about your acquisition and retention strategy, you must understand and track the following essential metrics:

Startups and early-stage companies should prioritize customer acquisition to establish market presence and build an initial customer base, as they lack the existing revenue streams to sustain operations. Entering new geographic markets or launching new product lines requires significant acquisition focus to educate potential customers and establish brand awareness in unfamiliar territories. High-growth phases demand acquisition investment to capitalize on market opportunities and outpace competitors before market saturation occurs. Companies with strong unit economics (where CLV significantly exceeds CAC) can afford to invest heavily in acquisition knowing that each new customer will generate substantial long-term profit. During these critical growth stages, acquisition becomes the primary driver of business expansion and market dominance.

Established companies with mature customer bases should shift focus toward retention, as the cost of maintaining existing relationships is substantially lower than acquiring new ones. Industries with high customer acquisition costs, such as B2B software, financial services, and enterprise solutions, benefit tremendously from retention strategies that maximize the value of expensive customer relationships. Economic downturns and market contractions make retention particularly valuable, as maintaining existing revenue streams becomes more critical than pursuing expensive new customer acquisition. Saturated markets where acquisition costs have risen dramatically due to increased competition make retention the more economically viable growth strategy. Companies experiencing high churn rates must prioritize retention initiatives to stop revenue leakage and stabilize their business foundation before pursuing aggressive growth.

Paid advertising across Google Ads, social media platforms, and programmatic networks remains one of the fastest ways to reach new audiences and drive immediate customer acquisition. Search Engine Optimization (SEO) builds long-term organic visibility, attracting customers actively searching for solutions your business provides without ongoing advertising costs. Social media marketing leverages platforms like LinkedIn, Instagram, and TikTok to build brand awareness, engage potential customers, and drive traffic to your sales funnel. Influencer partnerships tap into established audiences and leverage trusted voices to introduce your products to new customer segments with higher conversion potential. Content marketing through blogs, whitepapers, webinars, and case studies establishes thought leadership while attracting qualified leads searching for industry solutions. Email marketing campaigns to purchased lists and lookalike audiences nurture prospects through the sales funnel with targeted messaging and compelling offers.

Loyalty programs reward repeat purchases and encourage customers to choose your business over competitors by offering points, discounts, or exclusive benefits. Personalized experiences tailored to individual customer preferences, purchase history, and behavior significantly increase satisfaction and repeat purchase likelihood. Excellent customer service through responsive support channels, quick issue resolution, and proactive communication builds trust and reduces customer frustration. Email marketing campaigns targeting existing customers with relevant product recommendations, exclusive offers, and valuable content keep your brand top-of-mind and encourage repeat purchases. Referral programs incentivize satisfied customers to recommend your business to friends and family, creating organic growth from your most loyal advocates. Community building through user groups, forums, exclusive events, and customer networks creates emotional connections that deepen loyalty and increase lifetime value.

The most successful businesses recognize that customer acquisition and retention are not competing priorities but complementary strategies that work together to create sustainable, profitable growth. While acquisition fills your customer pipeline with new revenue sources, retention maximizes the value of each customer, creating a compounding effect that accelerates profitability over time. Word-of-mouth marketing, one of the most powerful acquisition channels, emerges naturally from satisfied, retained customers who enthusiastically recommend your business to others. A balanced approach prevents the “leaky bucket” scenario where companies spend heavily on acquisition only to lose customers through poor retention, making growth unsustainable. PostAffiliatePro serves as a valuable tool in managing both strategies, enabling businesses to track customer journeys, manage referral programs, and measure the ROI of both acquisition and retention initiatives. The most resilient business models combine aggressive acquisition during growth phases with strong retention practices that ensure long-term stability and profitability.

Implementing both acquisition and retention strategies requires a data-driven approach that measures performance across the entire customer lifecycle, from initial awareness through long-term loyalty. Customer journey mapping helps identify critical touchpoints where acquisition transitions to retention, ensuring seamless experiences that encourage repeat business. Personalization should extend across both strategies—using acquisition data to create targeted campaigns while leveraging retention data to deliver customized experiences that deepen customer relationships. Marketing automation tools and platforms like PostAffiliatePro enable businesses to scale both strategies efficiently, automating nurture sequences while tracking referral programs and customer lifetime value. Integrate your acquisition and retention teams around shared metrics and goals, breaking down silos that often prevent cohesive customer experience strategies. Regular analysis of CAC, CLV, churn rate, and repeat purchase metrics ensures your strategy remains optimized and responsive to changing market conditions.

Tracking both acquisition and retention metrics requires establishing comprehensive dashboards that provide real-time visibility into customer performance across all channels and touchpoints. Key acquisition metrics to monitor include CAC, conversion rate, cost per click, and traffic sources, while retention metrics should include churn rate, repeat purchase rate, CLV, and customer satisfaction scores. Analytics platforms integrated with your CRM and marketing automation systems enable detailed attribution modeling that shows which acquisition channels produce the most valuable, long-term customers. ROI calculation for both strategies should account for the full customer lifecycle—measuring not just immediate conversion costs but the long-term profitability generated by each customer cohort. Regular reporting and analysis of these metrics allows you to continuously optimize your strategy, reallocating budget toward the highest-performing channels and tactics that drive sustainable business growth.

Customer Acquisition Cost (CAC) is the total investment required to gain one new customer, while Customer Lifetime Value (CLV) is the total revenue that customer generates throughout their entire relationship with your company. Understanding both metrics helps you determine if your acquisition spending is sustainable and profitable.

Customer Retention Rate (CRR) is calculated using the formula: [(E-N) / S] x 100, where E is the number of customers at the end of the period, N is new customers added during the period, and S is the number of customers at the start. A higher CRR indicates stronger customer satisfaction and loyalty.

Yes, and you should. The most successful businesses balance both strategies. While startups may prioritize acquisition to build their customer base, even early-stage companies should implement retention practices from day one. Established companies can allocate more resources to retention while maintaining acquisition efforts.

A good retention rate varies by industry, but generally, rates above 80-90% are considered strong. However, the most important metric is your Customer Lifetime Value relative to your Customer Acquisition Cost. If retained customers generate significantly more revenue than acquisition costs, your retention strategy is working effectively.

Customer retention has a dramatic impact on profitability. Research shows that a 5% increase in retention can increase profits by 25-95%, depending on your industry. Additionally, repeat customers spend approximately 67% more than new customers, making retention one of the most cost-effective ways to improve your bottom line.

The best loyalty program combines multiple elements: points-based rewards for purchases, tiered membership levels that encourage higher spending, referral incentives that drive acquisition, and personalized offers based on customer behavior. The key is making the program easy to understand and rewarding enough to encourage repeat purchases.

Reduce churn by implementing excellent customer service, personalizing customer experiences, maintaining regular communication through email and other channels, gathering and acting on customer feedback, and creating loyalty programs that reward repeat business. Identifying why customers leave through exit surveys is also crucial for addressing root causes.

PostAffiliatePro and similar platforms help manage both strategies by tracking customer journeys, managing referral programs, measuring ROI across channels, and providing analytics dashboards. CRM systems, email marketing platforms, and loyalty program software are also essential for implementing integrated acquisition and retention strategies.

Manage both customer acquisition and retention strategies effectively with our comprehensive affiliate software platform. Track customer journeys, manage referral programs, and measure ROI across your entire customer lifecycle.

Learn proven customer acquisition strategies, metrics, and best practices to attract and convert new customers. Reduce CAC and maximize CLV.

Discover why acquiring new customers costs 5-25x more than retention. Learn cost-effective retention strategies to maximize customer lifetime value and boost pr...

Discover why retaining customers costs 5-25x less than acquiring new ones. Learn proven retention strategies and ROI metrics to maximize profitability.

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.