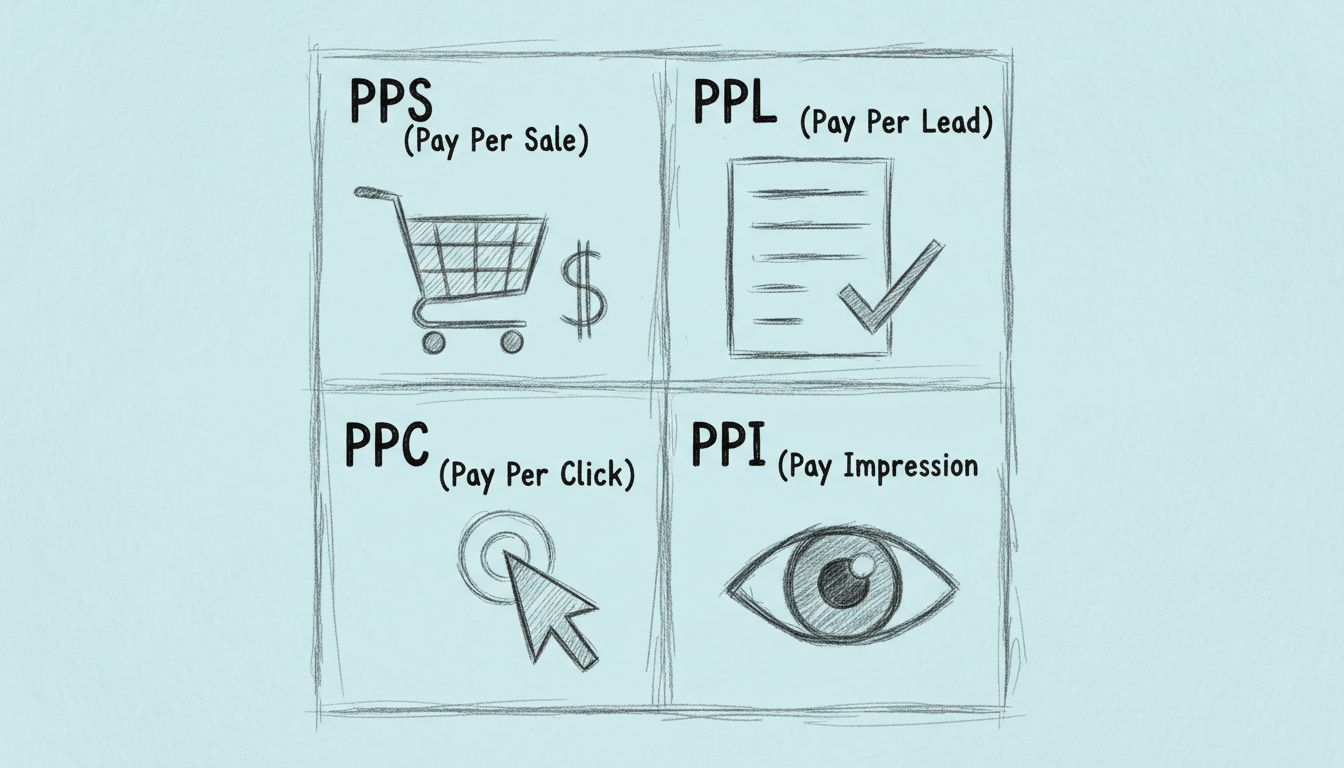

Common Affiliate Payment Agreements: PPS, PPL, PPC & More

Discover the most common affiliate payment agreements including PPS, PPL, and PPC. Learn how each model works and which is best for you.

Learn about the most common affiliate payout models including Pay Per Sale, Pay Per Click, and Pay Per Lead. Choose the best model for your business.

Affiliate payout models are the compensation structures that determine how merchants pay affiliates for their marketing efforts. These models are fundamental to any successful affiliate program because they directly influence affiliate motivation, program profitability, and overall business growth. The most common models—Pay Per Sale (PPS), Pay Per Click (PPC), and Pay Per Lead (PPL)—each serve different business objectives and market conditions. Understanding how each model works is essential for choosing the right strategy that aligns with your business goals and budget constraints.

Pay Per Sale is the most widely adopted affiliate compensation model in the industry, with over 80% of affiliate programs utilizing this structure. In the PPS model, affiliates earn a commission only when a customer referred through their unique affiliate link completes a purchase on the merchant’s website. The commission can be structured as either a percentage of the sale amount (typically 5-30% depending on the industry) or a flat fee per transaction. For example, if an affiliate promotes an online course priced at $100 and receives a 10% commission, they earn $10 for each successful sale. The beauty of PPS lies in its simplicity and performance-based nature—merchants only pay when actual revenue is generated, making it a low-risk investment in affiliate marketing.

| Merchant Benefits | Affiliate Benefits |

|---|---|

| No upfront costs—pay only for actual sales | Higher earning potential compared to other models |

| Strong ROI tracking and measurable results | Straightforward commission structure that’s easy to understand |

| Fraud-resistant model with lower risk | Scalable income based on promotion quality and effort |

| Incentivizes quality promotion and customer acquisition | Aligns affiliate success with merchant success |

Pay Per Click is a compensation model where affiliates earn a commission every time a user clicks on their affiliate link and lands on the merchant’s website, regardless of whether that visitor makes a purchase or takes any other action. The affiliate receives payment based purely on the click event, not on subsequent user behavior. Cost per click (CPC) varies significantly depending on factors such as keyword competition, industry, traffic quality, and the merchant’s budget. For instance, a merchant might pay $0.50 to $5.00 per click depending on these variables. PPC is commonly used in search engine marketing and display advertising campaigns where the primary goal is to drive traffic volume rather than immediate conversions.

PPC offers several compelling advantages for merchants focused on brand awareness and traffic generation. Affiliates can quickly drive visitors to your website without needing to influence purchase decisions, making it easier for high-traffic publishers to participate in your program. The model is straightforward to understand and implement, requiring only click tracking rather than complex conversion attribution. However, PPC carries significant risks including click fraud, where unethical affiliates generate fake clicks to earn undeserved commissions, and low-quality traffic that doesn’t convert into customers or leads. Merchants must invest heavily in fraud detection and traffic quality monitoring to make PPC profitable, which is why this model is often used as a supplementary component rather than a standalone strategy.

Pay Per Lead is an affiliate compensation model where merchants pay affiliates for each qualified lead generated, rather than for clicks or sales. A lead typically represents a potential customer who has taken a specific action such as filling out a contact form, signing up for a newsletter, requesting a demo, downloading a resource, or registering for a free trial. The merchant and affiliate must agree in advance on what constitutes a valid lead and what actions qualify for payment. PPL is particularly popular in industries with longer sales cycles such as B2B software, insurance, real estate, financial services, and education, where immediate purchases are less common but qualified leads have significant long-term value.

PPL provides excellent value for B2B companies and service-based businesses that prioritize lead generation over immediate sales. Affiliates find PPL attractive because they can earn commissions without needing to drive the entire purchase decision, making payouts faster and more frequent than PPS. The model allows merchants to build their customer database and nurture leads through their sales funnel, creating long-term revenue opportunities. However, PPL requires careful management of lead quality since not all leads convert into paying customers, and merchants must implement robust validation processes to prevent fraudulent or low-quality submissions. The challenge lies in balancing attractive commission rates with the actual conversion value of leads, ensuring that the cost per acquired customer remains profitable.

| Model | How It Works | Best For | Risk Level |

|---|---|---|---|

| PPS | Commission paid when customer completes a purchase | E-commerce, SaaS, digital products | Low |

| PPC | Commission paid for each click on affiliate link | Traffic generation, brand awareness | Medium-High |

| PPL | Commission paid for each qualified lead generated | B2B services, insurance, education | Medium |

| PPI | Commission paid per 1,000 ad impressions (CPM) | Brand awareness, display advertising | High |

Beyond the three primary models, merchants increasingly adopt hybrid and advanced compensation structures to maximize program effectiveness. Revenue sharing models pay affiliates a percentage of ongoing revenue generated by customers they refer, creating long-term incentive alignment. Tiered commission structures reward top-performing affiliates with progressively higher commission rates as they hit sales or traffic milestones, incentivizing growth and loyalty. Cost Per Acquisition (CPA) is similar to PPL but specifically focuses on acquiring paying customers rather than just leads. Lifetime commissions pay affiliates recurring commissions for the entire duration of a customer’s subscription or relationship, particularly popular in SaaS and subscription-based businesses. Many successful programs combine multiple models—for example, offering a base PPS commission plus bonuses for hitting performance targets, or combining PPL for lead generation with PPS for actual sales.

Selecting the optimal payout model requires careful consideration of your business model, industry, and strategic objectives. Consider these key factors:

Successful implementation of affiliate payout models requires attention to several critical operational details. Set competitive commission rates based on industry benchmarks, your profit margins, and the effort required from affiliates—rates that are too low will fail to attract quality partners, while rates that are too high will erode profitability. Establish clear payment terms including minimum payout thresholds (typically $50-$100), payment frequency (monthly or quarterly), and acceptable payment methods. Implement robust fraud detection systems to identify and prevent commission fraud, click fraud, and lead quality issues before they impact your bottom line. Provide affiliates with excellent support including marketing materials, product training, and responsive communication to help them succeed and remain motivated. Track and report performance transparently so affiliates can see exactly how their efforts translate into commissions, building trust and encouraging continued participation.

PostAffiliatePro stands out as the leading affiliate software platform for managing all payout models with ease and precision. The platform supports PPS, PPC, PPL, and hybrid commission structures, allowing you to implement exactly the compensation model your business needs. With advanced tracking technology, PostAffiliatePro accurately attributes conversions to the correct affiliate, preventing disputes and ensuring fair commission calculations. The software includes built-in fraud detection, automated payout processing, comprehensive reporting dashboards, and affiliate management tools that streamline program administration. Whether you’re launching your first affiliate program or scaling an existing one, PostAffiliatePro provides the infrastructure and features needed to run a profitable, transparent, and high-performing affiliate marketing program.

Pay Per Sale (PPS) is the most common affiliate payout model, used by over 80% of affiliate programs worldwide. In this model, affiliates earn a commission only when a referred customer completes a purchase. It's popular because it aligns the interests of both merchants and affiliates, ensuring payment only for actual results.

Pay Per Sale (PPS) is ideal for e-commerce businesses because it directly ties commissions to revenue generation. E-commerce merchants benefit from the low upfront cost and strong ROI, while affiliates are motivated to drive high-quality traffic that converts into actual purchases.

To prevent fraud in Pay Per Lead programs, implement stringent lead validation checks, use lead verification software, regularly audit affiliate activities, and employ anti-fraud technologies. Clearly define what constitutes a qualified lead and establish verification processes before paying commissions.

Yes, many successful affiliate programs use hybrid models combining PPS, PPL, and PPC. For example, you might offer higher commissions for sales while also rewarding affiliates for qualified leads. This flexibility allows you to incentivize different types of affiliate activities based on your business goals.

Pay Per Click (PPC) pays affiliates when someone clicks their affiliate link, regardless of what happens next. Pay Per Impression (PPI), also called Cost Per Mille (CPM), pays based on how many times an ad is displayed. PPI is riskier for merchants since they pay for visibility without any user interaction.

Commission holding periods typically range from 14 to 90 days, depending on your business model. This allows time to verify that transactions are valid and won't be reversed due to returns or chargebacks. For subscription services, you might hold commissions until the customer completes their first billing cycle.

Offer multiple payment methods including PayPal, direct bank transfers, ACH deposits, and checks. Providing options increases affiliate satisfaction and retention. Ensure your affiliate software integrates with popular payment processors to streamline the payout process.

Fair commission rates depend on your industry, product margins, and affiliate competition. Typical ranges are 5-15% for e-commerce, 10-30% for SaaS, and $5-50 per lead for PPL programs. Research competitor rates, consider your profit margins, and be prepared to adjust rates to attract top-performing affiliates.

PostAffiliatePro makes it easy to manage all affiliate payout models in one platform. Track commissions, prevent fraud, and scale your program with confidence.

Discover the most common affiliate payment agreements including PPS, PPL, and PPC. Learn how each model works and which is best for you.

Discover the most common affiliate payout models including PPS, PPL, PPC, and PPI. Learn how each model works, their advantages, and which is best for your affi...

Learn how pay per sale (PPS) affiliate marketing works in 2025. Discover commission structures, tracking mechanisms, earning potential, and best practices for m...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.