What Strategies Can Help Protect My Business? Complete Guide to Business Continuity

Learn essential business protection strategies including contingency planning, insurance, revenue diversification, and process standardization. Comprehensive gu...

Learn 4 critical strategies for business protection: contingency planning, insurance, revenue diversification, and process standardization to minimize risk.

In today’s unpredictable business environment, organizations face unprecedented threats ranging from cyber attacks and natural disasters to supply chain disruptions and economic downturns. According to recent data, approximately 25% of businesses never reopen their doors following a major disaster, while downtime costs more than 60% of businesses a minimum of $100,000 annually. The stakes have never been higher for implementing robust business protection strategies. This comprehensive guide explores four critical pillars that every organization must master to build lasting resilience: business continuity planning, contingency planning, insurance and risk transfer, and revenue diversification. By integrating these strategies into your operational framework, you can transform uncertainty into opportunity and position your organization for sustainable success regardless of external challenges.

Business continuity represents far more than a theoretical exercise—it’s a strategic imperative that determines whether your organization survives and thrives during disruptions. At its core, business continuity planning involves identifying critical business functions, understanding their interdependencies, and developing strategies to maintain or rapidly restore these functions when adverse events occur. The Bryghtpath business continuity assessment framework emphasizes that effective continuity planning requires a holistic approach encompassing people, processes, technology, and facilities. Organizations must conduct thorough business impact analyses to quantify the financial and operational consequences of potential disruptions, establishing clear recovery time objectives (RTOs) and recovery point objectives (RPOs). This foundational understanding enables leadership to make informed decisions about resource allocation and prioritization. Without a clear grasp of what “business continuity” truly means—and how it differs from disaster recovery—organizations often invest in fragmented solutions that fail to address their most critical vulnerabilities.

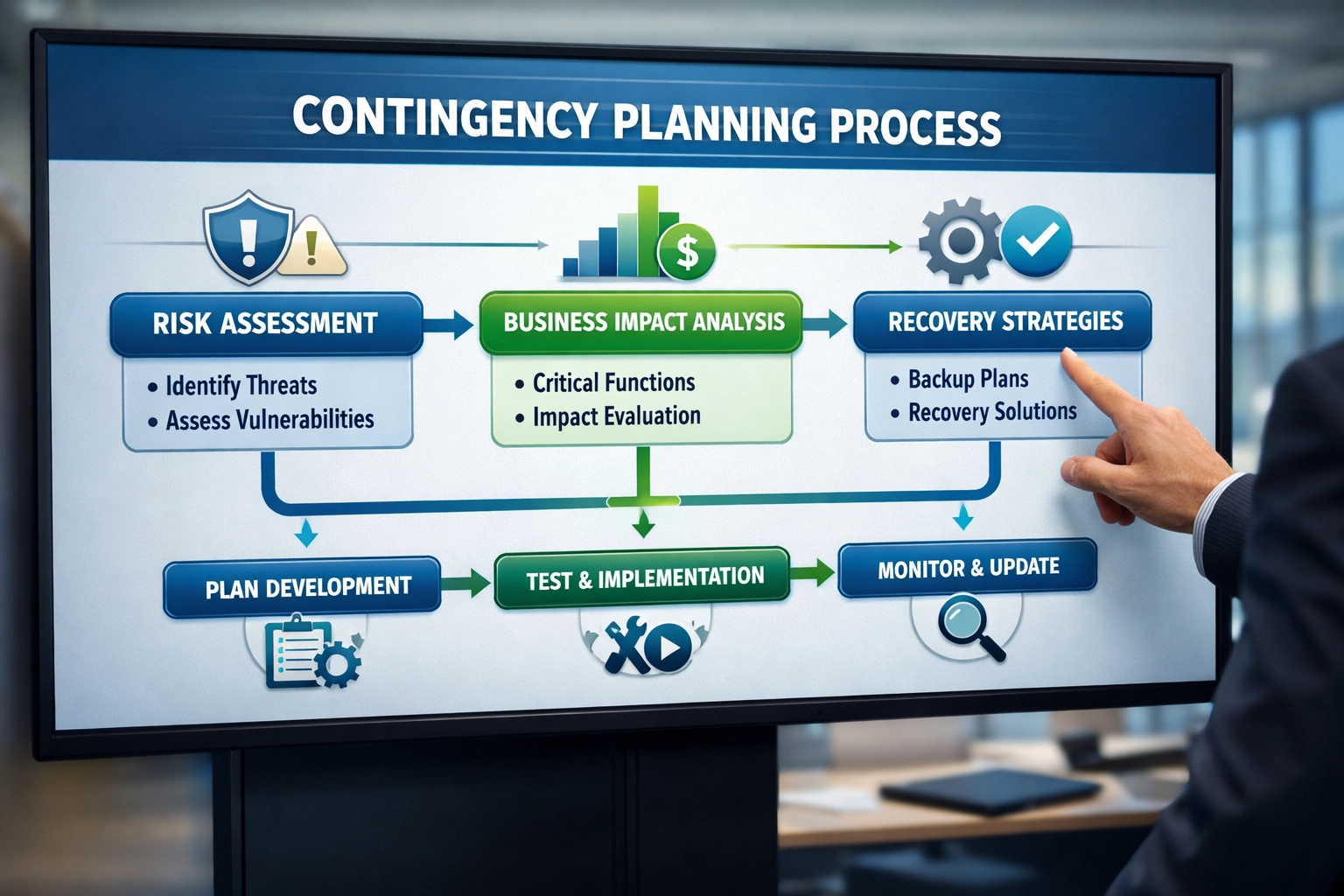

Contingency planning serves as the operational backbone of business protection, translating strategic business continuity goals into actionable procedures that employees can execute during crises. According to Investopedia’s comprehensive contingency planning framework, effective plans must address potential adverse events like natural disasters, cyber attacks, supply chain failures, and economic downturns through specific, documented response procedures. The following table illustrates how different contingency scenarios require tailored response strategies:

| Contingency Scenario | Primary Risk | Key Response Actions | Timeline |

|---|---|---|---|

| Cyber Attack/Data Breach | System downtime, data loss, compliance violations | Activate incident response team, isolate affected systems, notify stakeholders | 0-4 hours |

| Natural Disaster | Physical facility damage, operational shutdown | Activate alternate site, restore critical systems, establish communication | 2-24 hours |

| Supply Chain Disruption | Production delays, revenue loss | Activate alternative suppliers, adjust production schedules, communicate with customers | 4-48 hours |

| Key Personnel Loss | Knowledge gaps, operational delays | Activate succession plans, redistribute responsibilities, provide training | 24-72 hours |

Contingency plans must include specific procedures for maintaining critical functions, clear escalation protocols, and designated decision-makers with authority to act immediately. Organizations should maintain updated contact lists, documented procedures in accessible locations, and regular training to ensure all stakeholders understand their roles during emergencies.

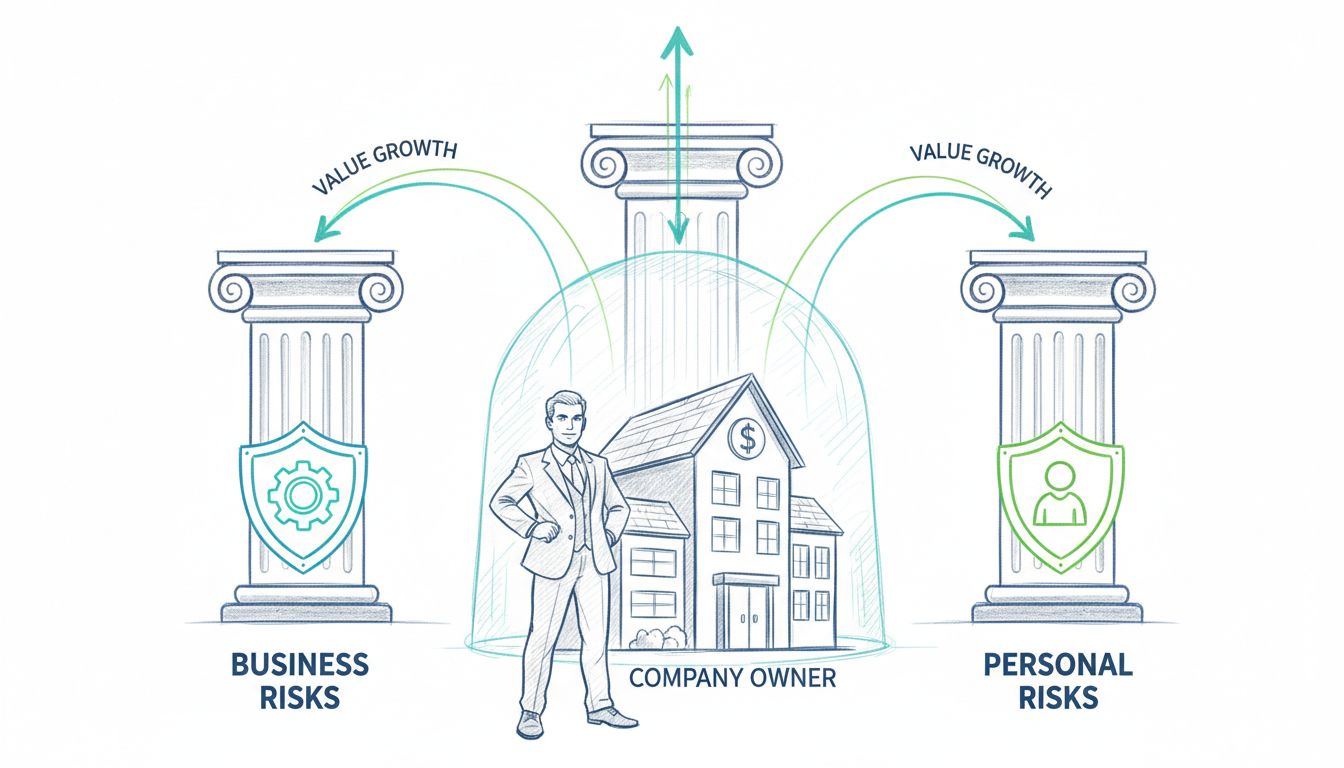

Insurance and risk transfer mechanisms form a critical layer of business protection, enabling organizations to shift financial exposure to specialized carriers while maintaining operational focus. While insurance cannot prevent disasters, it provides essential financial protection against losses that could otherwise devastate the organization. Key insurance considerations for comprehensive business protection include:

However, insurance has limitations—many policies exclude specific scenarios (such as pandemics), and coverage may not address reputational damage or lost customer relationships. Therefore, insurance should complement, not replace, comprehensive business continuity and contingency planning efforts.

Revenue diversification represents a powerful yet often underutilized business protection strategy that reduces organizational vulnerability to market fluctuations, customer concentration, and industry-specific disruptions. Organizations that depend on a single revenue stream, customer segment, or geographic market face disproportionate risk when disruptions affect that specific area. Effective revenue diversification involves developing multiple income sources through product line expansion, geographic market entry, customer segment diversification, and service offerings that complement core business activities. For example, a manufacturing company might develop complementary service offerings, expand into adjacent markets, or create subscription-based revenue models alongside traditional transactional sales. This approach requires careful analysis of market opportunities, competitive positioning, and resource requirements, but the payoff is substantial—organizations with diversified revenue streams demonstrate greater resilience during economic downturns and industry disruptions. Revenue diversification also provides strategic flexibility, enabling organizations to reallocate resources toward growing segments and away from declining markets. By building multiple revenue engines, organizations create natural hedges against disruption while positioning themselves for sustainable growth.

Process standardization creates the operational foundation upon which all other business protection strategies rest, enabling consistent execution, rapid scaling, and effective knowledge transfer across the organization. Standardized processes reduce variability, minimize errors, and ensure that critical functions can be maintained even when key personnel are unavailable. Organizations should document all critical processes in clear, step-by-step procedures that employees at various skill levels can follow during normal operations and emergencies. This documentation should include decision trees for common scenarios, escalation procedures for unusual situations, and quality checkpoints to verify that processes are executed correctly. Standardization also facilitates training and onboarding, reducing the time required to bring new employees up to speed and decreasing the organization’s vulnerability to key person dependencies. When processes are standardized and documented, organizations can implement cross-training programs that ensure multiple employees can perform critical functions. This redundancy in human capital, combined with standardized procedures, creates organizational resilience that survives personnel changes, unexpected absences, and crisis situations.

Developing a comprehensive business continuity plan requires systematic execution of specific steps that transform strategic intentions into operational reality. The Cloudian disaster recovery planning framework and Aon’s three rules for business continuity provide a structured approach to plan development:

This systematic approach ensures that business continuity planning addresses all critical elements and that the resulting plan is practical, actionable, and regularly updated to reflect organizational changes.

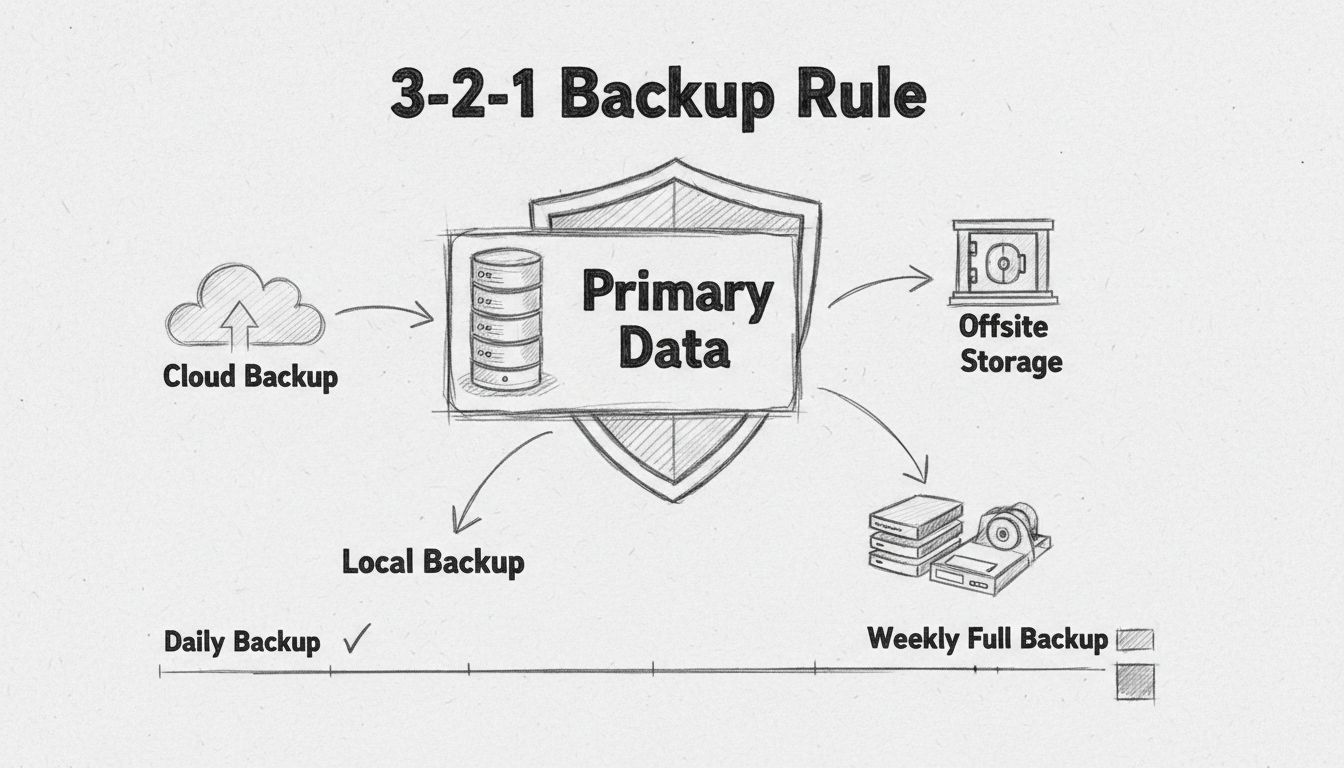

Technology infrastructure forms the nervous system of modern organizations, making digital resilience a non-negotiable component of comprehensive business protection strategies. Organizations must implement redundant systems, automated failover capabilities, and geographically distributed backups to ensure that critical technology functions can be maintained or rapidly restored during disruptions. Cloud-based disaster recovery solutions offer particular advantages, providing scalability, accessibility, and cost-effectiveness compared to traditional on-premises recovery infrastructure. Data backup and recovery systems should follow the 3-2-1 rule: maintain three copies of critical data, store copies on two different media types, and keep one copy in a geographically remote location. Cybersecurity measures must be integrated throughout the technology infrastructure, including encryption, access controls, threat detection, and incident response capabilities. Organizations should also implement monitoring and alerting systems that provide real-time visibility into system health and performance, enabling rapid detection and response to emerging issues. Regular testing of backup and recovery systems is essential—many organizations discover that their backup systems are non-functional only when they attempt to use them during actual disasters. By investing in robust technology infrastructure and regularly testing recovery capabilities, organizations can minimize downtime and data loss during disruptions.

Employees represent both the greatest asset and the most critical vulnerability in business protection strategies, making employee preparedness and communication essential components of comprehensive resilience planning. During crises, employees need clear guidance about their roles, responsibilities, and expected actions, yet many organizations fail to provide adequate training and communication. Effective employee preparedness programs include regular training on emergency procedures, clear communication protocols for different types of disruptions, and designated roles for employees who will lead response efforts. Organizations should establish communication trees that ensure all employees receive timely, accurate information during disruptions, reducing uncertainty and enabling coordinated response. Leadership communication is particularly critical—employees look to leaders for guidance and reassurance during crises, and leaders who communicate clearly and transparently build trust and confidence. Organizations should also consider employee welfare during disruptions, including provisions for remote work capabilities, emergency supplies, and support services for employees affected by disasters. By investing in employee preparedness and establishing clear communication protocols, organizations transform their workforce from a potential vulnerability into a powerful asset for crisis response and recovery.

Business protection strategies are not static documents to be filed away and forgotten—they require ongoing measurement, evaluation, and refinement to remain effective as organizations and threats evolve. Key performance indicators for business continuity programs should include metrics such as plan completion percentage, training completion rates, testing frequency and results, and time-to-recovery for critical functions. Organizations should establish regular review cycles (at minimum annually, but preferably quarterly) to assess plan effectiveness, incorporate lessons learned from actual incidents and exercises, and update procedures to reflect organizational changes. After-action reviews following any significant incident or exercise provide invaluable insights into plan strengths and weaknesses, enabling continuous improvement. Metrics should also track the organization’s progress toward strategic resilience goals, such as reducing recovery time objectives, expanding the scope of critical functions covered by the plan, or improving employee preparedness. By treating business protection as an ongoing process rather than a one-time project, organizations demonstrate commitment to resilience and create a culture where business continuity becomes embedded in daily operations. This continuous improvement mindset ensures that business protection strategies remain relevant, effective, and aligned with organizational objectives as the business environment evolves.

The four strategies outlined in this guide—contingency planning, insurance and risk transfer, revenue diversification, and process standardization—form an integrated framework for comprehensive business protection. Organizations that implement these strategies systematically and maintain them through regular testing and refinement demonstrate significantly greater resilience and faster recovery from disruptions. The investment in business protection pays dividends not only during crises but also in daily operations through improved efficiency, reduced risk, and enhanced stakeholder confidence. Your organization’s ability to navigate uncertainty and maintain operations during disruptions is no longer a competitive advantage—it’s a competitive necessity. Start today by assessing your current state, identifying gaps in your business protection strategy, and implementing improvements systematically. The cost of preparation is far less than the cost of disruption, and the peace of mind that comes from knowing your organization is prepared is invaluable.

Business continuity focuses on maintaining critical business functions during disruptions, while disaster recovery specifically addresses restoring IT systems and data after a disaster. Business continuity is broader and encompasses all aspects of operations, whereas disaster recovery is a component of the overall continuity strategy.

Organizations should conduct formal testing at least annually, with quarterly reviews of the plan. However, best practices recommend more frequent testing—monthly tabletop exercises and semi-annual full-scale simulations help identify gaps and keep teams prepared for actual emergencies.

Costs vary significantly based on organization size and complexity, ranging from $5,000 for small businesses to $100,000+ for enterprises. However, the cost of NOT having a plan is far higher—the average cost of downtime exceeds $100,000 per hour for most organizations, making BC planning a sound investment.

PostAffiliatePro provides integrated tools for managing affiliate relationships, tracking performance metrics, and maintaining operational continuity. Our platform enables businesses to diversify revenue streams through affiliate partnerships, automate critical processes, and maintain detailed records essential for business continuity planning.

The most common disruptions include cyber attacks and data breaches, natural disasters, supply chain failures, key personnel loss, and economic downturns. Organizations should prioritize planning for disruptions most likely to affect their specific industry and geographic location.

RTO (Recovery Time Objective) is the maximum acceptable downtime for a critical function—for example, 4 hours. RPO (Recovery Point Objective) is the maximum acceptable data loss—for example, 1 hour of data. These metrics guide prioritization of recovery efforts and resource allocation.

There's no ideal length—the plan should be as detailed as necessary to guide response and recovery. Typically, comprehensive plans range from 30-100 pages, with executive summaries of 5-10 pages. The key is ensuring the plan is clear, actionable, and regularly updated.

Yes. While small businesses may not need the complexity of enterprise plans, they can implement effective continuity strategies through careful prioritization, leveraging cloud-based solutions, and focusing on their most critical functions. Many low-cost tools and templates are available to support small business BC planning.

PostAffiliatePro helps you build resilient business operations with integrated risk management and continuity tools. Start protecting your business today with our proven strategies and expert guidance.

Learn essential business protection strategies including contingency planning, insurance, revenue diversification, and process standardization. Comprehensive gu...

Learn why protecting your business is crucial for a successful sale. Discover risk management strategies, asset protection, and valuation enhancement techniques...

Discover why regular backups are essential for business security. Learn how cloud and offsite backups protect against cyberattacks, ransomware, data loss, and e...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.