Why Is Transparent Payout Important in Affiliate Programs?

Discover why transparent payouts are crucial for affiliate program success. Learn how clear commission structures and timely payments build trust, boost affilia...

Learn why a business banking account is crucial for affiliate programs. Discover how separating finances simplifies payments and ensures tax compliance.

One of the most immediate benefits of maintaining a business banking account is the dramatic improvement in financial clarity. When personal and business transactions are commingled, it becomes nearly impossible to determine your actual business profitability. You might spend hours each month trying to separate personal grocery purchases from affiliate commission payments, or distinguishing between personal entertainment expenses and legitimate business advertising costs. This confusion doesn’t just waste time—it creates serious risks for tax compliance and financial decision-making.

With a dedicated business account, every transaction tells a clear story about your affiliate program’s financial health. You can instantly see how much you’ve paid in commissions, what your operational costs are, and what revenue you’ve generated. This clarity enables you to make informed business decisions based on accurate data rather than guesswork. When you’re considering whether to expand your affiliate program, invest in new marketing channels, or adjust commission rates, you need reliable financial information. A business account provides exactly that foundation.

The time savings alone justify the separation. Instead of spending hours reconciling mixed accounts, you can generate a financial report in minutes. Your business account becomes a single source of truth for all affiliate-related financial activity. This efficiency compounds over time—what takes an hour monthly when you have a few affiliates becomes a critical time-saver when you’re managing dozens of partners and hundreds of transactions.

One of the most important but often overlooked reasons to maintain a business banking account relates to legal protection. When you operate as a business entity—whether as an LLC, corporation, or sole proprietorship—the law provides certain protections for your personal assets. However, these protections only work if you maintain a clear separation between personal and business finances. This concept is known as “piercing the corporate veil,” and it’s a legal principle that protects your personal assets from business liabilities.

If you mix personal and business finances, a creditor or legal adversary could argue that your business and personal finances are so intertwined that they should be treated as one entity. This could expose your personal assets—your home, savings, vehicles, and other property—to claims against your business. By maintaining a separate business account, you demonstrate to courts and creditors that you take the separation seriously, significantly strengthening your legal protection. This is particularly important in affiliate marketing, where disputes over commissions, payment terms, or affiliate performance can occasionally lead to legal conflicts.

| Business Structure | Liability Protection | Separate Account Required | Personal Asset Risk |

|---|---|---|---|

| Sole Proprietorship | None | No | High |

| Partnership | Limited | Yes | Medium |

| LLC | Strong | Yes | Low |

| Corporation | Strong | Yes | Low |

The strength of your legal protection depends significantly on your business structure. Sole proprietorships offer no liability protection, meaning your personal assets are always at risk. Partnerships provide limited protection, while LLCs and corporations offer strong protection—but only if you maintain proper financial separation. A business banking account is the most visible and verifiable way to demonstrate that separation to legal authorities and creditors.

Tax season becomes dramatically simpler when you maintain a business banking account. The IRS requires detailed documentation of business income and expenses, and a dedicated business account provides exactly that documentation. Every deposit represents affiliate revenue or commissions earned, and every withdrawal represents a business expense. This creates an audit trail that’s easy to follow and defend if the IRS ever questions your tax return.

When you operate with a business account, you can deduct all legitimate business expenses including website hosting, affiliate software subscriptions, advertising costs, payment processing fees, and professional services. Without clear separation, you risk losing deductions because you can’t prove they were business-related rather than personal expenses. Additionally, the IRS is more likely to accept your deductions when they’re clearly documented in a separate business account, reducing your audit risk and potential penalties.

| Tax Benefit | Impact | Details |

|---|---|---|

| Expense Deduction | Reduces taxable income | All business expenses clearly documented and easily deductible |

| Income Documentation | Simplifies reporting | All affiliate revenue clearly separated and easy to report on Schedule C |

| Audit Protection | Reduces audit risk | Clear records demonstrate legitimate business operations |

| Quarterly Payments | Easier to calculate | Accurate tracking enables proper estimated tax payments |

| Record Retention | Simplified compliance | Bank statements serve as official records for 3-7 years |

The documentation requirements for affiliate marketers include Form 1099-NEC for income reporting, Schedule C for business income and expenses, and Schedule SE for self-employment taxes. A business account makes completing these forms straightforward because all the necessary information is organized in one place. You’ll have clear records of every commission payment received and every business expense paid, making tax preparation faster and more accurate. This organization also protects you during an audit—you can quickly produce bank statements and transaction records that substantiate your reported income and deductions.

Managing affiliate payments becomes significantly more efficient with a business banking account. Most modern affiliate software platforms, including PostAffiliatePro, integrate seamlessly with business bank accounts to automate payment processing. You can set up batch payments to multiple affiliates directly from your business account, schedule recurring payments, and maintain detailed records of every transaction. This automation not only saves you countless hours but also reduces the risk of payment errors or missed deadlines.

When affiliates receive payments from a professional business account rather than a personal account, it reinforces your credibility and professionalism. Affiliates are more likely to trust and continue working with a business that demonstrates financial organization and reliability. Additionally, many affiliate networks and payment processors require business banking information to facilitate transactions, making a business account a practical necessity rather than just a best practice. As your affiliate program scales and you work with dozens or hundreds of affiliates, the efficiency gains from automated payment processing become exponentially more valuable.

PostAffiliatePro and similar professional affiliate management platforms work seamlessly with business banking systems to provide integrated financial management. You can track affiliate commissions, monitor payment status, and reconcile your accounts all within a unified system. This integration is impossible with a personal account, which means you’re missing out on automation opportunities that could save you hours each month and provide better financial visibility. The combination of a dedicated business account and professional affiliate software creates a powerful infrastructure for managing growth.

A business banking account is the first step toward establishing business credit, which is completely separate from your personal credit score. Business credit becomes increasingly important as your affiliate program grows. If you eventually want to apply for a business loan, negotiate better payment terms with vendors, or secure business credit cards with favorable rates, you’ll need an established business credit history. This history is built through transactions in your business account, not your personal account.

Beyond credit, a business account demonstrates to potential partners, investors, and financial institutions that you operate a legitimate business. When you approach a bank for financing or negotiate with affiliate networks about higher commission rates or exclusive partnerships, they’re more likely to take you seriously if you can point to a professional business account with clear financial records. This credibility becomes a competitive advantage, especially when you’re competing with other affiliate programs for top-tier affiliates who want to work with established, professional operations.

Building business credit also opens doors to financing options that can accelerate your growth. Many affiliate marketers eventually want to invest in better marketing tools, hire team members, or expand their operations. Having established business credit makes these investments possible at favorable rates. A business account demonstrates financial responsibility and stability, making lenders more confident in your ability to repay borrowed funds.

As your affiliate program grows from a small side project to a significant revenue stream, the importance of a business banking account becomes even more apparent. When you’re managing just one or two affiliates, you might be able to track everything mentally or in a spreadsheet. But when you’re managing dozens of affiliates, processing hundreds of transactions monthly, and tracking multiple commission structures, a business account becomes essential infrastructure.

A business account enables you to implement sophisticated financial management practices that simply aren’t possible with a personal account. You can use accounting software like QuickBooks or Xero to automatically categorize transactions, generate financial reports, and track key performance indicators. You can set up separate sub-accounts for different purposes—one for affiliate payouts, one for operational expenses, one for tax reserves. You can implement approval workflows for payments and maintain detailed audit trails. All of these practices are standard in professional affiliate management, and they all depend on having a dedicated business account.

The scalability benefits extend to payment processing as well. When you’re paying a single affiliate monthly, manual transfers work fine. But when you’re managing 50 affiliates with different payment schedules, commission structures, and payment methods, automation becomes essential. A business account with integrated payment processing can handle this complexity automatically, reducing errors and freeing your time for strategic work rather than administrative tasks.

Modern accounting software platforms are designed to integrate with business bank accounts, not personal accounts. When you connect your business account to accounting software, transactions are automatically imported and categorized, dramatically reducing manual data entry and the risk of errors. This integration enables real-time financial reporting, automated reconciliation, and sophisticated analytics that help you understand your affiliate program’s profitability at a granular level.

PostAffiliatePro and similar professional affiliate management platforms work seamlessly with business banking systems to provide integrated financial management. You can track affiliate commissions, monitor payment status, and reconcile your accounts all within a unified system. The integration between your business account and affiliate software creates a closed-loop system where every transaction is automatically recorded, categorized, and reported. This eliminates the manual work of exporting data from one system and importing it into another.

The automation benefits are substantial. Instead of manually entering transactions, you can set up rules that automatically categorize payments based on affiliate, commission type, or payment method. You can generate comprehensive financial reports with a single click, showing exactly how much you’ve paid in commissions, what your operational costs are, and what your net profit is. You can track key performance indicators like cost per acquisition, average payout time, and commission expense as a percentage of revenue. All of this information flows automatically from your business account into your reporting system, giving you real-time visibility into your affiliate program’s financial performance.

Setting up a business banking account is straightforward but requires attention to detail. Most banks offer business checking accounts with features specifically designed for small businesses and entrepreneurs. When opening your account, you’ll need your business registration documents, tax identification number (EIN), and personal identification. Many banks now offer online account opening, making the process quick and convenient.

Once your account is open, establish clear policies for how it’s used. Here are the essential steps to get started:

All business income should be deposited into the business account, and all business expenses should be paid from it. Avoid the temptation to use the account for personal expenses, even temporarily. Keep detailed records of all transactions, and reconcile your account monthly to ensure accuracy. Consider setting up separate sub-accounts or credit cards for different expense categories to further improve organization and tracking. This level of organization transforms your affiliate program from a chaotic side project into a professional, scalable business operation.

A business bank account is designed specifically for commercial transactions and keeps your business finances separate from personal finances. This separation provides legal protection, simplifies tax reporting, and enables professional payment processing. Personal accounts are not designed to handle business transactions and mixing them creates compliance and liability risks.

While sole proprietors aren't legally required to have a business account, it's highly recommended. A separate account provides liability protection, simplifies tax compliance, and demonstrates professionalism to affiliates and partners. It also makes accounting and financial management significantly easier as your program grows.

A business account creates a clear audit trail of all business income and expenses, making tax preparation straightforward. You can easily document deductions, track quarterly estimated tax payments, and provide evidence of legitimate business operations if audited. The IRS is more likely to accept deductions when they're clearly documented in a separate business account.

While technically possible, it's not recommended. Mixing personal and personal expenses in a business account undermines the legal protection the account provides and complicates tax reporting. Maintain a strict policy of using the business account only for business-related transactions to preserve the separation that protects your personal assets.

Most banks require your business registration documents, employer identification number (EIN), personal identification, and proof of address. Some banks may also request your business plan or tax returns. Requirements vary by bank and business structure, so contact your chosen bank for their specific documentation requirements.

Professional affiliate software like PostAffiliatePro integrates with business bank accounts to automate payment processing and financial reporting. The integration allows automatic transaction import, categorization, and reconciliation. This creates a seamless system where affiliate commissions flow directly from your account to your affiliates with complete tracking and documentation.

Business account fees vary by bank but typically include monthly maintenance fees ($10-50), per-transaction fees, and wire transfer fees. Many banks offer fee waivers if you maintain a minimum balance or set up direct deposit. Compare fees across banks to find an account that matches your transaction volume and budget.

You should reconcile your business account monthly, ideally within a few days of receiving your bank statement. Monthly reconciliation ensures accuracy, catches errors quickly, and provides up-to-date financial information for decision-making. Many accounting software platforms automate this process, making it quick and easy.

PostAffiliatePro makes it easy to manage affiliate payments, track commissions, and organize your finances with integrated tools designed for growing affiliate businesses.

Discover why transparent payouts are crucial for affiliate program success. Learn how clear commission structures and timely payments build trust, boost affilia...

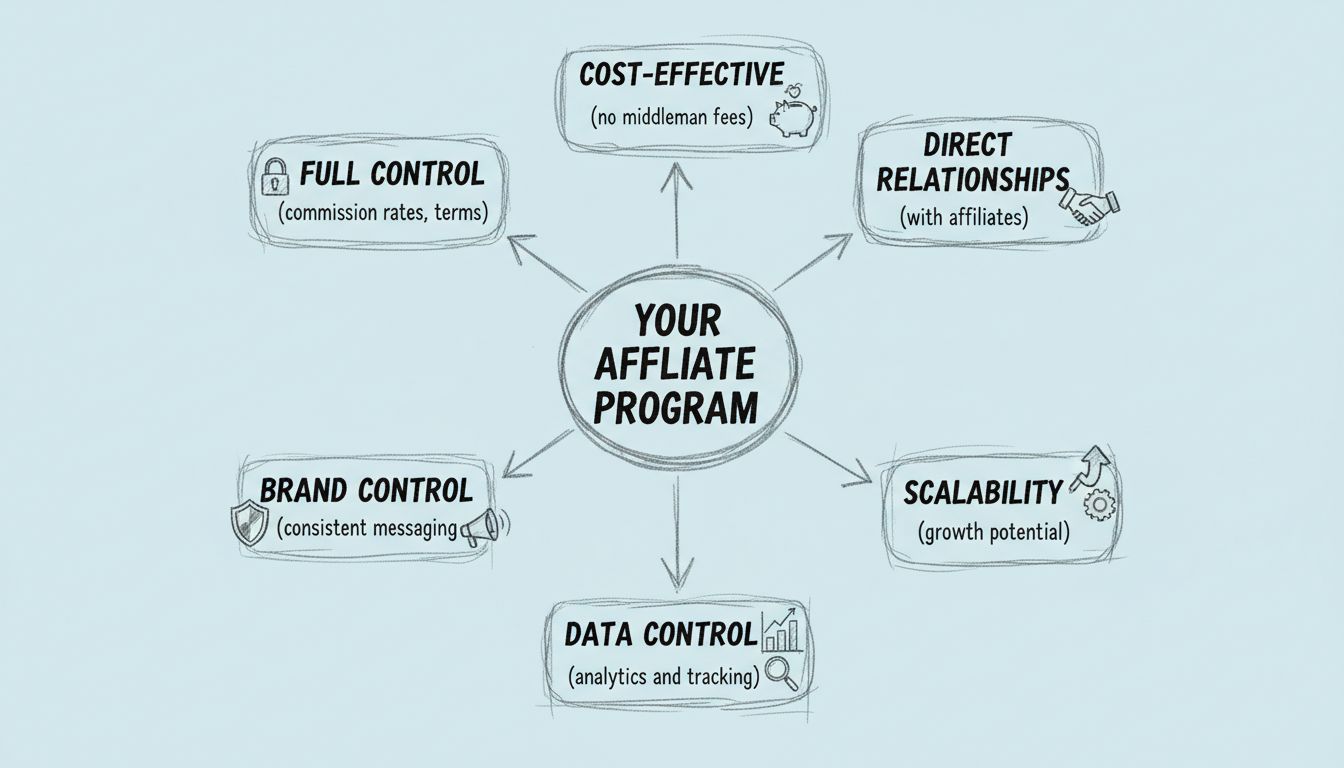

Discover the key advantages of creating your own affiliate program in 2025. Learn about control, cost-effectiveness, direct relationships, and scalability benef...

Discover the main benefits of implementing an affiliate marketing program for your online store. Learn how affordable marketing, brand recognition, and broader ...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.