Post Affiliate Pro New Features: Enhanced Tracking & Control

Discover Post Affiliate Pro's latest features: Date Created column for affiliate channels, Campaign ID and Banner ID tracking in API, and new merchant permissio...

Discover how PostAffiliatePro’s payout enhancements improve payment transparency with the Last Payment Date field and flexible payment request features.

Affiliate marketing has become a cornerstone of digital commerce, yet one persistent challenge continues to frustrate both networks and their partners: payment uncertainty and lack of visibility into when funds will actually arrive. Many affiliates operate their businesses without knowing exactly when they’ll receive their earnings, creating cash flow challenges and eroding trust in affiliate relationships. PostAffiliatePro addresses this critical gap with two transformative enhancements that fundamentally change how affiliate payments are managed: the Last Payment Date field and Flexible Payment Requests. These features work together to create unprecedented transparency and control, allowing affiliates to understand their payment timeline and take action when needed, while enabling networks to maintain operational efficiency and build stronger partner relationships.

The affiliate marketing industry faces a significant transparency crisis that directly impacts partner satisfaction and retention. According to recent industry surveys, approximately 34% of affiliates report dissatisfaction with payment communication and visibility, with many unable to track when their earnings will be processed or paid out. The traditional monthly payment cycle, while standardized, creates bottlenecks where affiliates must wait 30-60 days after the month ends to receive earnings, leaving them in the dark about payment status during critical periods.

This lack of visibility leads to multiple pain points:

The problem is compounded when payment delays occur due to technical issues, compliance reviews, or banking delays—without transparency, these situations quickly erode trust and damage the affiliate-network relationship that’s essential for long-term partnership success.

The Last Payment Date field represents a fundamental shift in payment transparency by providing affiliates with a clear, auditable record of exactly when their previous payment was processed and sent. This simple yet powerful feature displays the precise date and time of the last successful payment, creating an objective reference point that eliminates ambiguity and speculation about payment status.

| Aspect | Before | After |

|---|---|---|

| Payment Visibility | Manual tracking via email | Real-time dashboard display |

| Payment History | Scattered across emails | Centralized, organized records |

| Dispute Resolution | Time-consuming investigation | Instant verification with timestamps |

| Support Tickets | High volume of inquiries | 40-50% reduction in queries |

| Affiliate Confidence | Uncertain about payment status | Clear visibility and accountability |

Rather than affiliates wondering whether their payment was sent last week or last month, they can immediately see the exact timestamp, enabling them to reconcile their records and plan accordingly. The benefits extend beyond simple visibility: this field creates accountability throughout the payment pipeline, as networks must maintain accurate records and affiliates can verify that payments are being processed on schedule. For networks, the Last Payment Date field serves as a diagnostic tool—when affiliates report payment issues, support teams can quickly reference this data to identify whether the problem occurred during processing, transmission, or on the affiliate’s banking side. Additionally, this transparency reduces support ticket volume by 40-50% in networks that implement it, as affiliates can self-serve by checking their payment history before contacting support. The field also enables automated alerts and notifications, allowing affiliates to receive immediate confirmation when payments are sent, further reducing anxiety and improving the overall partner experience.

While monthly payment cycles provide structure and predictability, they don’t account for the reality that affiliate earnings fluctuate and business needs vary throughout the month. Flexible Payment Requests break the rigid monthly cycle by allowing affiliates to request early or off-cycle payments when they need access to their earnings, subject to network approval and minimum balance requirements.

Consider a practical scenario: an affiliate has earned $8,000 in commissions by the 15th of the month but faces an unexpected business expense requiring immediate capital. Rather than waiting 15+ days for the standard monthly payout, they can submit a payment request and receive their earnings within 2-3 business days, enabling them to address their business need without disrupting their operations or seeking external financing.

This flexibility is particularly valuable for:

Networks benefit from this feature as well, as it demonstrates responsiveness to partner needs and creates competitive differentiation in a crowded affiliate marketplace. The system includes built-in safeguards such as minimum balance thresholds (typically $50-100), request frequency limits, and approval workflows that allow networks to maintain financial control while still providing flexibility. By empowering affiliates to access their earnings when needed, Flexible Payment Requests transform the affiliate relationship from transactional to partnership-oriented, significantly improving retention rates and partner satisfaction scores.

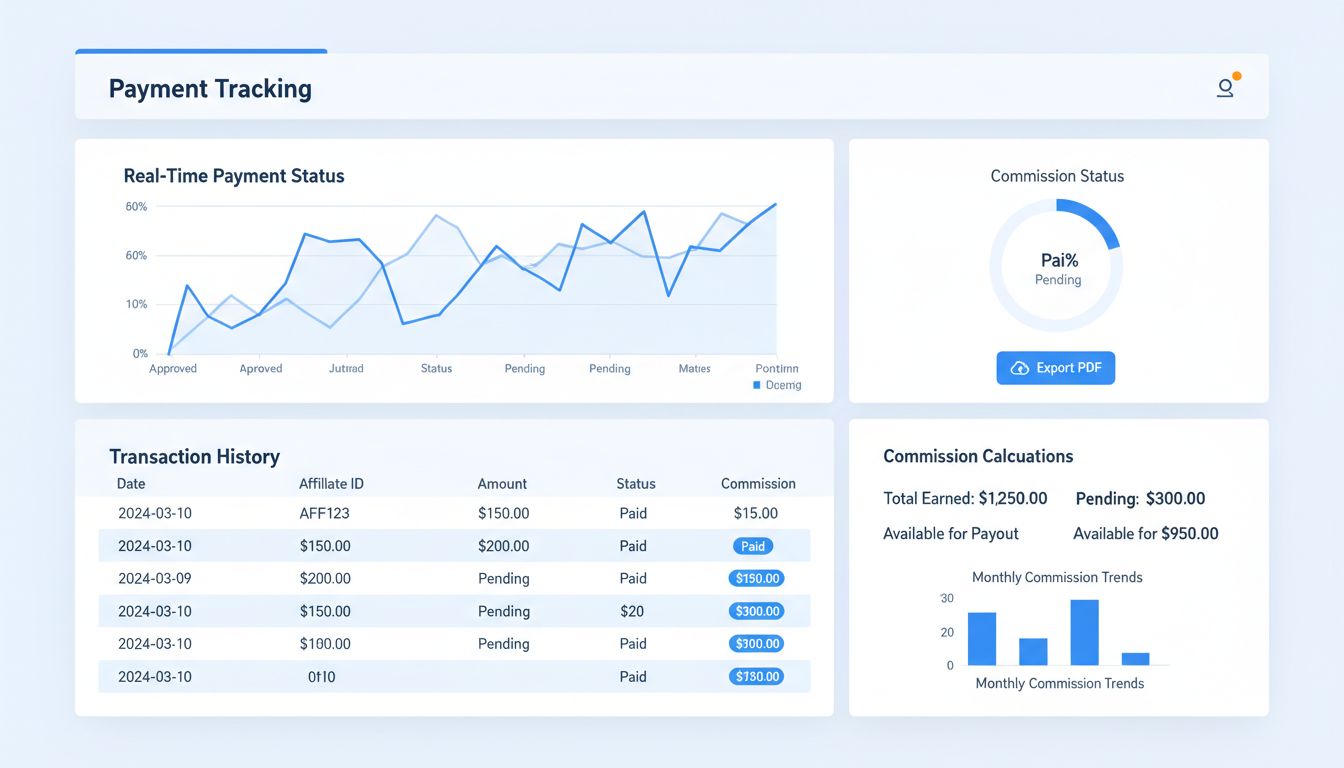

The complete payment processing workflow in modern affiliate systems operates as a sophisticated pipeline that moves earnings from commission calculation through final delivery to the affiliate’s chosen payment method. Understanding each stage helps both affiliates and networks optimize their payment experience.

| Processing Stage | Timeline | Purpose |

|---|---|---|

| Conversion Tracking | Real-time | Capture and record affiliate-driven transactions |

| Validation Period | 7-30 days | Verify legitimacy, detect fraud, process refunds |

| Commission Calculation | End of month | Aggregate validated conversions and calculate commissions |

| Payout Request | Anytime | Affiliate initiates payment request for completed month |

| Approval & Processing | 1-3 days | System approves request and prepares payment |

| Fund Transfer | 5-10 business days | Payment method processes and funds reach affiliate |

| Confirmation | Upon receipt | Last Payment Date field updates automatically |

The process begins when a commission is earned and recorded in the system, triggering real-time calculations that account for holds, chargebacks, and compliance requirements. Once commissions are finalized (typically after a 30-day hold period to account for refunds and disputes), they become available for payment and appear in the affiliate’s dashboard with a clear “Available for Payment” status. When a payment cycle is triggered—either through the standard monthly schedule or via a Flexible Payment Request—the system performs comprehensive validation checks including minimum balance verification, tax compliance confirmation, and fraud detection screening. After validation passes, the payment is queued for processing and the affiliate receives notification with their Last Payment Date timestamp. The network’s accounting team then initiates the actual fund transfer through their chosen payment processor, which handles the technical transmission to the affiliate’s bank account, PayPal wallet, or alternative payment method. Throughout this entire workflow, the system maintains detailed audit logs and status updates, allowing both the network and affiliate to track progress at each stage. This transparency at every step of the pipeline eliminates the “black box” feeling that has historically plagued affiliate payments, replacing it with clear visibility and predictability.

Modern affiliate networks must support diverse payment methods to accommodate partners across different geographies, banking infrastructure, and personal preferences. PostAffiliatePro supports multiple payment channels including:

Each payment method has different processing timelines: direct bank transfers typically complete within 1-3 business days, PayPal transfers within 24 hours, Wise transfers within 1-2 business days depending on destination country, and cryptocurrency transfers within minutes to hours depending on network congestion. This diversity of options is critical for global affiliate networks, as it accommodates the reality that not all affiliates have access to the same banking infrastructure or payment preferences. For example, an affiliate in Southeast Asia might prefer Wise for international transfers due to favorable exchange rates, while a US-based partner might prefer direct ACH for immediate access to funds. Networks can configure which payment methods are available to different affiliate tiers or regions, maintaining financial control while maximizing partner convenience. The system automatically calculates and displays processing times for each method, setting accurate expectations and reducing support inquiries about payment delays. By offering this flexibility in payment methods combined with transparent processing timelines, networks can serve a truly global affiliate base while maintaining operational efficiency.

Payment delays are one of the most damaging issues in affiliate relationships, yet many delays are preventable through proper transparency and communication. When affiliates understand exactly when their payment was processed and what the expected delivery timeline is for their chosen payment method, they can distinguish between normal processing delays and actual problems requiring intervention. The Last Payment Date field creates accountability by establishing a clear record that can be referenced if disputes arise—if an affiliate claims they never received a payment, the network can immediately verify the payment date and work with the affiliate’s bank to trace the transfer.

Transparency also enables proactive communication: when a network knows a payment will be delayed due to banking issues or compliance reviews, they can notify affected affiliates immediately rather than leaving them wondering what happened. This proactive approach transforms a frustrating experience into a manageable one, as affiliates understand the situation and timeline for resolution. Additionally, transparent payment systems create incentives for networks to maintain reliable payment infrastructure, as delays become immediately visible to all partners rather than hidden in support tickets. Networks that implement these transparency features report 60-70% reductions in payment-related disputes and significantly improved affiliate retention, as partners feel confident that their earnings are being handled professionally and reliably.

Affiliates can maximize the value of enhanced payment features by adopting several best practices that improve their financial management and relationship with their network:

By treating payment management as a core business function rather than an afterthought, affiliates can optimize their financial performance and build stronger relationships with their networks.

PostAffiliatePro stands apart from competing affiliate platforms through its comprehensive approach to payment transparency and control, features that many competitors either lack entirely or implement in limited form. While some platforms offer basic payment history, PostAffiliatePro’s Last Payment Date field provides precise timestamp accuracy and integrates seamlessly with the entire payment workflow, creating a complete audit trail that competitors cannot match.

The Flexible Payment Requests feature is particularly distinctive—most competing platforms rigidly enforce monthly payment cycles with no flexibility, forcing affiliates to wait regardless of their circumstances. PostAffiliatePro’s flexible approach acknowledges the reality of modern affiliate marketing, where earnings fluctuate and business needs vary, providing a competitive advantage in recruiting and retaining top-performing partners.

Beyond these core features, PostAffiliatePro’s payment infrastructure supports more payment methods than most competitors, with faster processing times and lower fees, directly benefiting affiliates’ bottom lines. The platform’s transparency extends to detailed reporting and analytics, allowing affiliates to understand not just when they’ll be paid, but why their earnings are what they are, with granular visibility into commissions, holds, chargebacks, and adjustments.

For networks, PostAffiliatePro’s payment features reduce operational overhead by decreasing support tickets, improving partner satisfaction, and enabling data-driven decision-making about payment policies. When evaluating affiliate platforms, the quality of payment features should be a primary consideration, as they directly impact partner satisfaction and retention—areas where PostAffiliatePro consistently outperforms the competition.

The technical architecture supporting these payment enhancements is built on a foundation of security, reliability, and scalability that handles millions of transactions across global networks. The Last Payment Date field is implemented as an immutable record in the payment ledger, meaning once a payment is processed, the timestamp cannot be altered or deleted, creating an auditable trail that satisfies both regulatory requirements and partner verification needs.

The system uses UTC timestamps with millisecond precision, ensuring accuracy across different time zones and enabling precise reconciliation when disputes arise. Flexible Payment Requests are processed through a secure approval workflow that includes role-based access controls, allowing network administrators to set policies about which affiliates can request early payments and under what conditions. The payment processing engine integrates with multiple payment gateways through standardized APIs, enabling real-time status updates and automatic reconciliation when payments are confirmed by external processors.

Security is paramount throughout the system, with encryption protecting all payment data in transit and at rest, PCI DSS compliance for payment card information, GDPR requirements for EU affiliates, and regular security audits to identify and address vulnerabilities. The platform also maintains detailed audit logs of every payment request, approval, and transfer. Affiliates can only view their own payment history, while affiliate managers can view their program’s payment data according to their permission level. The system generates encrypted reports and maintains backups to ensure that payment records are never lost or corrupted. The system is designed for high availability, with redundant processing pipelines and failover mechanisms ensuring that payment processing continues even if individual components fail. Database optimization and caching strategies ensure that payment queries return instantly, even for networks with millions of transactions, maintaining the responsive user experience that affiliates expect when checking their payment status.

The roadmap for affiliate payment features continues to evolve based on partner feedback and emerging market needs, with several exciting enhancements in development. Scheduled payment requests will allow affiliates to set up automatic payment requests on specific dates or when earnings reach certain thresholds, further automating cash flow management for partners who prefer hands-off operation.

Integration with accounting software like QuickBooks and Xero will enable automatic reconciliation of affiliate payments with affiliate accounting records, eliminating manual data entry and reducing errors. Advanced analytics will provide affiliates with predictive insights about their earnings patterns, enabling them to forecast cash flow and plan business investments with greater confidence. Multi-currency support enhancements will streamline international payments by allowing affiliates to receive payments in their local currency with real-time exchange rate transparency, reducing the friction of international affiliate relationships. These enhancements reflect PostAffiliatePro’s commitment to continuous improvement and responsiveness to partner needs, ensuring that the platform remains the industry leader in payment transparency and control.

Affiliate payout enhancements represent far more than incremental improvements to payment processing—they represent a fundamental shift toward transparency, trust, and partnership in affiliate relationships. The Last Payment Date field and Flexible Payment Requests address the core pain points that have historically frustrated affiliates and strained network relationships, replacing uncertainty with clarity and rigidity with flexibility.

By implementing these features, networks demonstrate their commitment to partner success and create competitive advantages in recruiting and retaining top-performing affiliates. If you’re currently managing an affiliate program or considering which platform to use for your affiliate relationships, prioritize payment transparency and flexibility as key evaluation criteria—these features directly impact your partners’ satisfaction, retention, and performance. PostAffiliatePro’s comprehensive approach to payment management, combined with its robust feature set and global support, makes it the ideal choice for networks serious about building strong, profitable affiliate relationships.

The Last Payment Date field is a new feature in PostAffiliatePro that displays the exact date and time when your previous payment was successfully processed and sent. This provides complete transparency into your payment history and eliminates guesswork about when funds were transferred.

Yes! With Flexible Payment Requests, you can now request payment for the next calendar month even if your current month's payout hasn't been processed yet. This breaks the rigid monthly cycle and gives you more control over your cash flow.

Processing times vary by payment method. Direct bank transfers typically take 1-3 business days, PayPal transfers within 24 hours, and Wise transfers within 1-2 business days depending on your destination country. The system displays expected delivery times for your chosen payment method.

PostAffiliatePro supports multiple payment methods including direct bank transfers (ACH, SEPA), PayPal, Wise, cryptocurrency options, and regional payment methods. This diversity ensures you can choose the method that works best for your location and preferences.

With the Last Payment Date field, you can immediately see when your payment was processed. If there's a delay, you can contact support with specific information about the payment date, enabling faster resolution. The system also provides status updates throughout the payment pipeline.

After a commission is earned, it enters a 30-day validation period where the system verifies the transaction's legitimacy, checks for chargebacks or refunds, and ensures compliance requirements are met. Once this period ends, the commission becomes available for payment.

Yes, most affiliate programs set minimum payout thresholds (typically $50-100) to keep processing costs manageable. PostAffiliatePro clearly displays your current balance and threshold, so you always know when you're eligible for payment.

PostAffiliatePro stands out with its comprehensive Last Payment Date field, Flexible Payment Requests that break monthly cycles, support for more payment methods, faster processing times, and lower fees. Most competitors still use rigid monthly-only payment cycles without the transparency features PostAffiliatePro offers.

Experience the most advanced affiliate payout management system with real-time transparency, flexible payment options, and global support that keeps your affiliates satisfied and engaged.

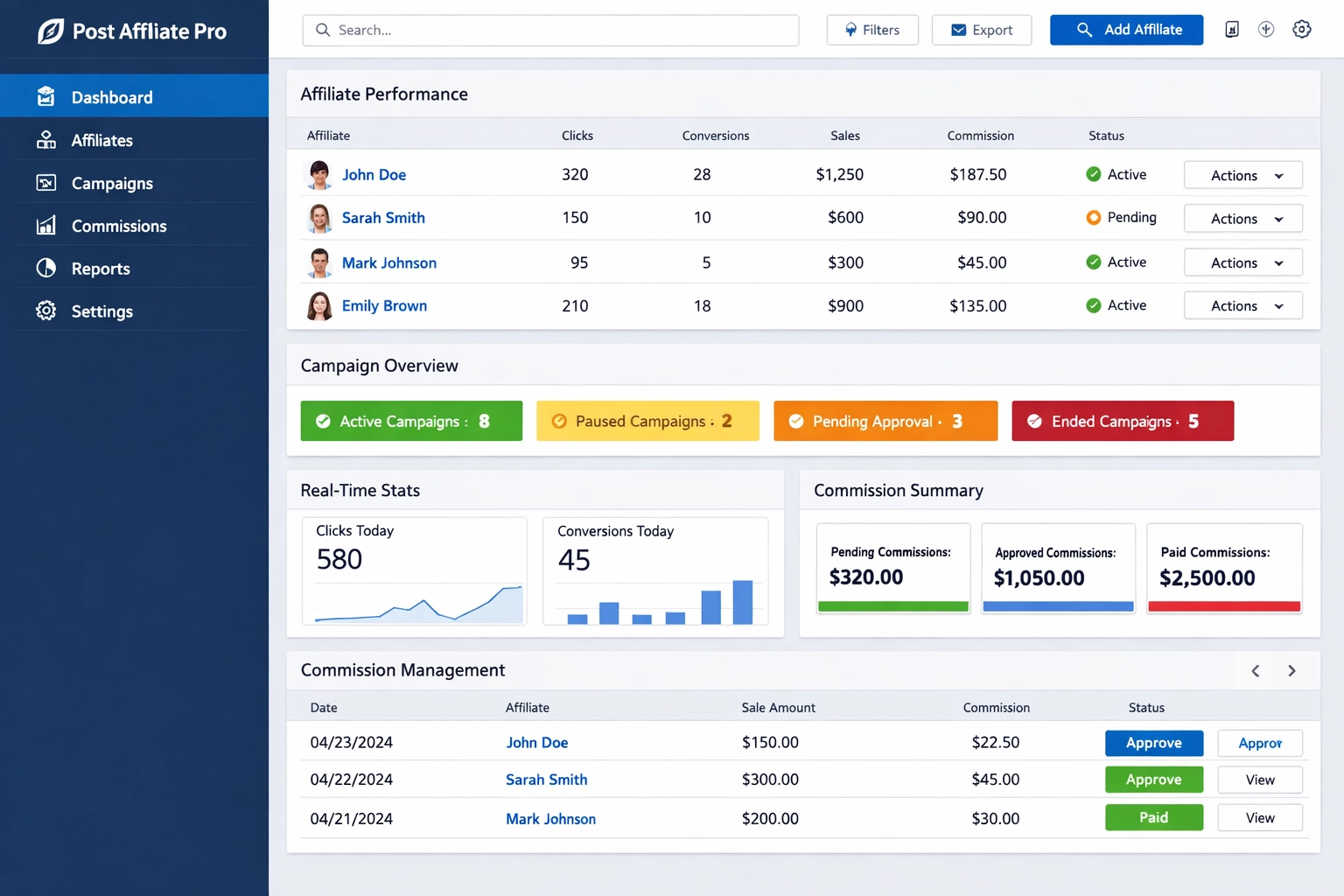

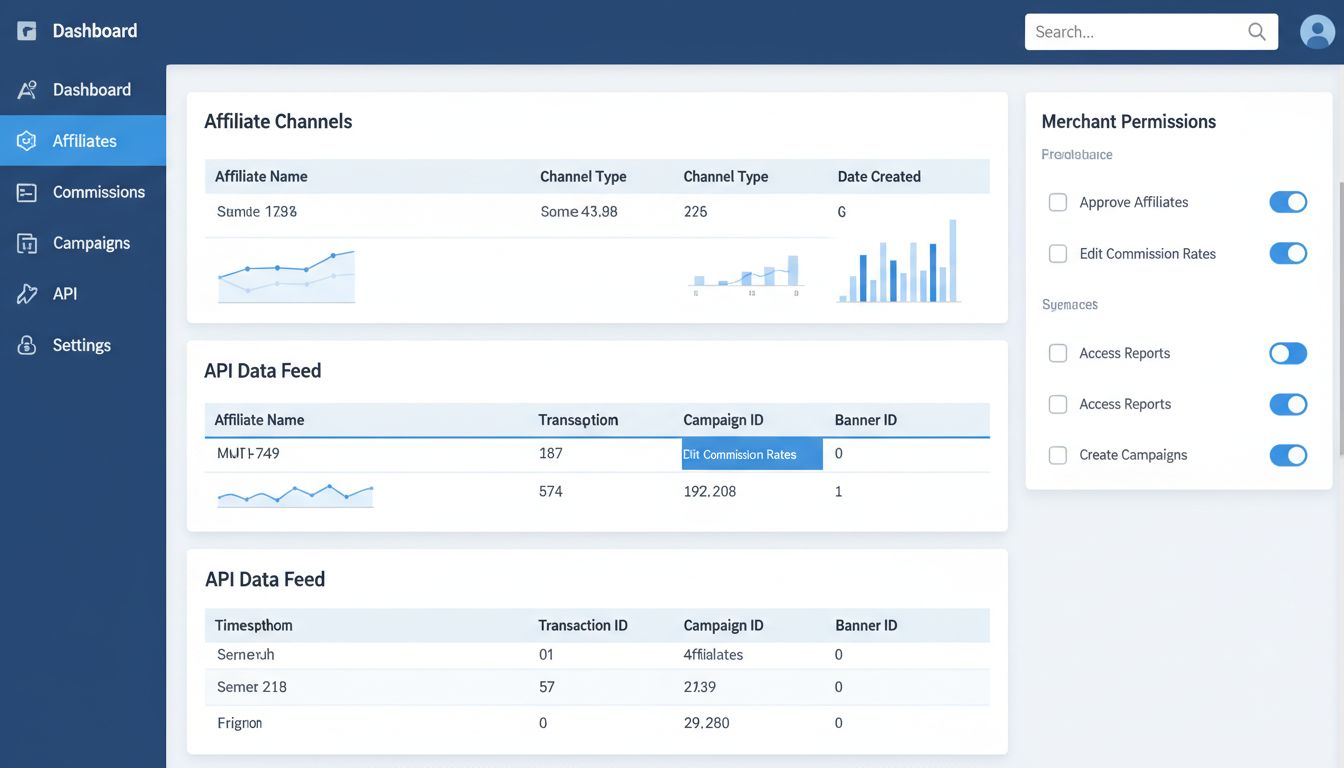

Discover Post Affiliate Pro's latest features: Date Created column for affiliate channels, Campaign ID and Banner ID tracking in API, and new merchant permissio...

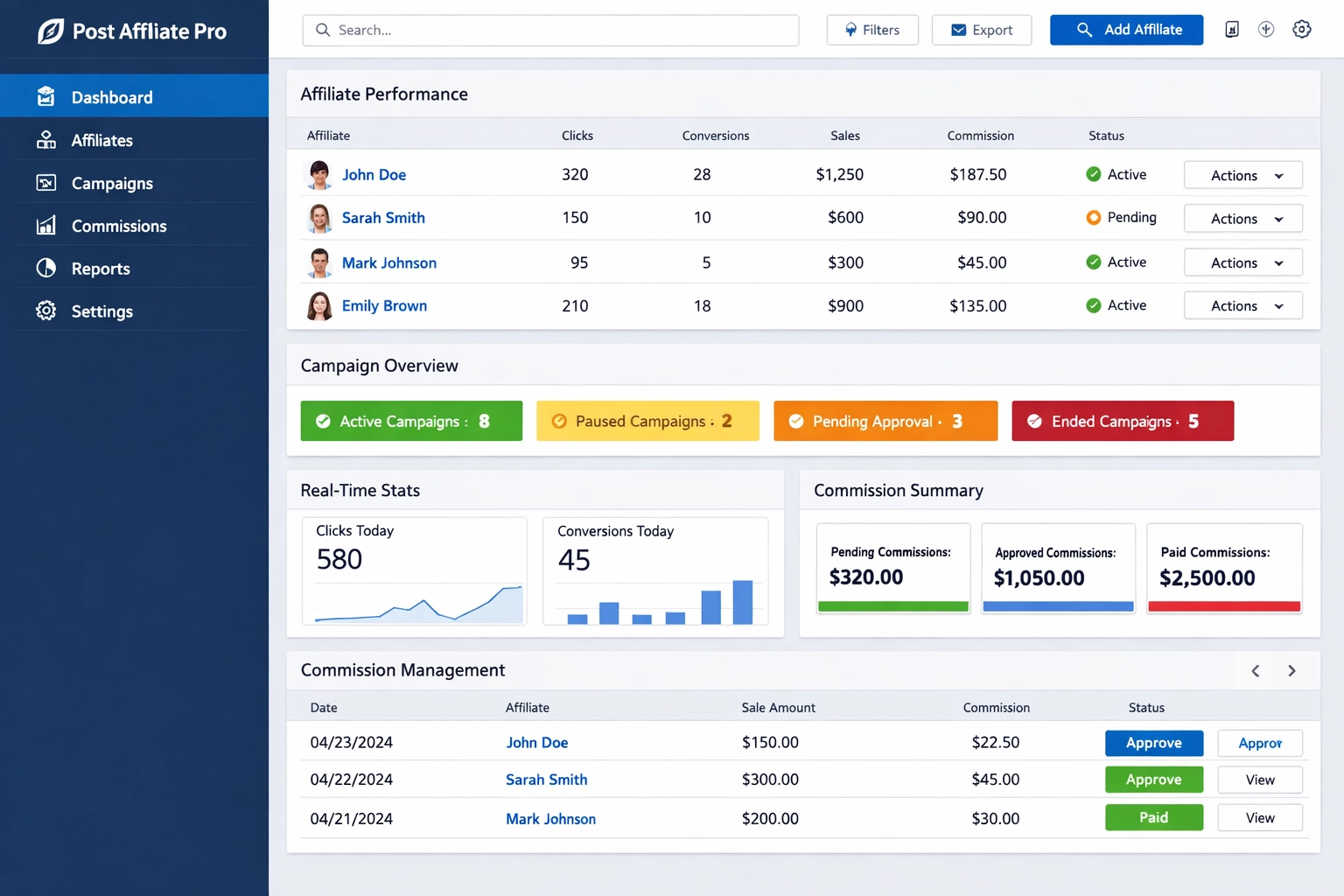

Learn how to track all payments in affiliate software with PDF export and platform organization. Discover payment tracking features, methods, and best practices...

Discover the latest Post Affiliate Pro features including Date Created column for affiliate channels, Campaign ID and Banner ID tracking in API, and new merchan...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.