Campaign-Specific Secret Keys for Fraud Protection

Discover how Post Affiliate Pro's campaign-specific secret keys strengthen fraud protection in commission tracking with multi-layer security features.

Discover how affiliate software detects fraud using AI, device fingerprinting, and real-time monitoring to protect against click fraud and fake leads.

Affiliate fraud represents one of the most significant threats to digital marketing budgets, with affiliate fraud draining more than US$84 billion globally in 2023, accounting for over 22% of all digital ad spend. This alarming statistic underscores the urgency of implementing robust fraud prevention mechanisms across affiliate programs. The growth of affiliate fraud is driven by several factors: the increasing sophistication of fraudsters who employ automated scripts and AI-powered bots, the expanding scale of affiliate marketing channels, and the inherent difficulty in attributing conversions across complex customer journeys. Common fraud types include click fraud, cookie stuffing, click injection, fake lead generation, and postback manipulation, each exploiting different vulnerabilities in tracking systems. With 63% of businesses expressing concern about affiliate marketing fraud within their programs and $1.4 billion in annual revenue losses attributed to fraudulent activity, the imperative for comprehensive detection and prevention strategies has never been more critical.

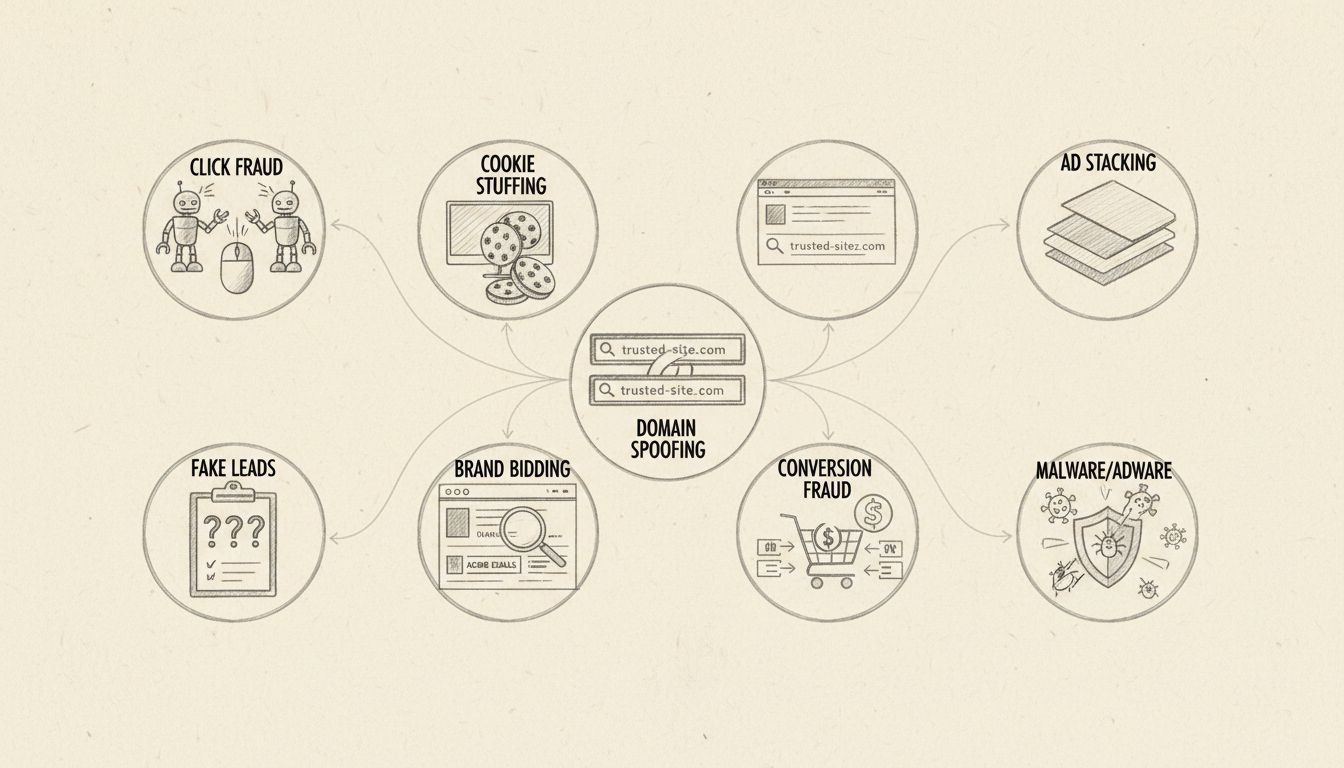

Affiliate fraud manifests in numerous sophisticated forms, each designed to exploit specific weaknesses in tracking and attribution systems. Understanding these fraud types is essential for developing targeted prevention strategies.

| Fraud Type | Description | Red Flags |

|---|---|---|

| Click Fraud | Automated or manual generation of fake clicks on affiliate links without genuine user intent | Unusually high click-through rates (CTR), clicks from data center IPs, rapid click clustering, zero conversion correlation |

| Cookie Stuffing | Placing cookies on user devices without consent to claim credit for future conversions | Sudden spikes in conversions without corresponding traffic increases, attribution to unrelated traffic sources, high cookie-to-conversion ratios |

| Click Spoofing/Click Injection | Injecting fake clicks milliseconds before legitimate conversions to hijack attribution | Multiple clicks from same device within seconds, conversion timestamps immediately following suspicious click patterns, mobile app anomalies |

| URL Hijacking | Redirecting traffic through fraudulent domains or manipulating tracking URLs to claim unearned commissions | Mismatched referrer domains, unusual redirect chains, traffic from non-approved sources, geographic inconsistencies |

| Malware & Bot Traffic | Using malicious software or bot networks to generate fake traffic and conversions | Identical user agents across multiple sessions, repetitive device fingerprints, impossible geographic patterns, zero engagement metrics |

| Fake Lead Generation | Creating fictitious leads with fabricated user data to claim lead-based commissions | Duplicate contact information, incomplete or invalid email addresses, rapid submission rates, zero follow-up engagement |

| Bonus Abuse | Exploiting sign-up bonuses by creating multiple accounts or using incentivized traffic | Multiple accounts from same IP/device, rapid account creation patterns, bonus redemption without genuine usage, high chargeback rates |

| CPA Abuse | Manipulating cost-per-action metrics through non-incremental traffic or incentivized conversions | Conversion rates significantly above industry benchmarks, traffic from incentive sites, users with no purchase intent, high refund rates |

Modern affiliate fraud detection relies on sophisticated real-time analysis systems that process millions of data points instantaneously to identify suspicious patterns before fraudulent transactions complete. These mechanisms combine multiple technological approaches to create comprehensive protection:

Machine Learning & AI Analysis: Advanced algorithms analyze historical traffic patterns and behavioral data to establish baseline metrics, then flag deviations in real-time. These systems continuously learn from new fraud tactics, improving detection accuracy without requiring manual rule updates.

Real-Time Validation Systems: Every click, conversion, and user interaction is validated against multiple criteria within milliseconds, including device fingerprinting, IP reputation scoring, geolocation verification, and behavioral consistency checks.

Device Fingerprinting: Creates unique digital identifiers for each device based on browser configuration, operating system, hardware specifications, and screen characteristics. This prevents fraudsters from masking their identity through VPNs or proxy services, as device fingerprints remain persistent across sessions.

IP Reputation & Geolocation Tracking: Evaluates IP addresses against known bot networks, data centers, and proxy services while cross-referencing geographic location with user behavior patterns. Impossible geographic transitions (e.g., user appearing in two countries within seconds) trigger immediate alerts.

Behavioral Anomaly Detection: Monitors user interaction patterns including cursor movement velocity, scroll depth, form completion speed, session duration, and click-to-conversion timelines. Mechanical consistency or ultra-fast submissions indicate automated activity rather than genuine human behavior.

Risk Scoring Engines: Assigns dynamic risk scores to each interaction based on cumulative signals—combining device reputation, traffic source quality, behavioral indicators, and historical affiliate performance—enabling graduated response protocols rather than binary blocking decisions.

Effective affiliate fraud prevention requires a multi-layered technological approach that addresses fraud at multiple points in the customer journey:

Multi-Layered Detection Architecture: Implements sequential validation gates where traffic must pass multiple independent checks before earning commission. Early-stage filters eliminate obvious bot traffic, while later stages validate conversion authenticity and user engagement quality.

Conversion Analytics & Attribution Tracking: Employs sophisticated attribution models that trace the complete customer journey across all touchpoints, identifying when affiliates claim credit for conversions they didn’t drive. Cross-channel analysis reveals when paid search or organic traffic is being hijacked by affiliate redirects.

Advanced Attribution Tracking: Utilizes pixel-based and postback-based tracking with server-side validation to prevent manipulation. Implements conversion deduplication to ensure each sale is credited only once, preventing double-counting across multiple affiliate channels.

Geo-Location Tracking & Verification: Validates that user location remains consistent throughout the conversion journey, flagging impossible geographic transitions. Compares claimed user location against IP geolocation, device location services, and billing address information.

Behavioral Anomaly Detection: Establishes baseline behavioral profiles for legitimate users and identifies deviations including unnatural interaction patterns, impossible conversion velocities, and mechanical consistency that indicates bot activity rather than human engagement.

Payment System Integration: Integrates directly with payment processors and billing systems to validate transaction authenticity, detect chargeback patterns, and identify refund abuse. Monitors for velocity abuse where multiple transactions occur from the same payment method within impossible timeframes.

Preventing fraud begins before affiliates join the program through rigorous vetting and transparent onboarding processes:

Pre-Approval Verification: Conduct comprehensive background checks including website audits, traffic source analysis, historical performance review, and reputation assessment. Verify that claimed traffic sources are legitimate and that the affiliate has genuine audience engagement.

Traffic Source Transparency: Require affiliates to disclose all traffic sources, including paid channels, owned media, and partnership arrangements. Validate that traffic sources comply with brand guidelines and regulatory requirements, rejecting affiliates relying on incentivized traffic or non-compliant sources.

Identity & Business Verification: Implement KYC (Know Your Customer) procedures including identity verification, business registration confirmation, and tax documentation. Verify that affiliate contact information is legitimate and that the business entity actually exists.

Probation Periods & Performance Monitoring: Establish 30-90 day probation periods where new affiliates operate under enhanced monitoring with lower commission rates. Gradually increase commission rates and access as affiliates demonstrate consistent, high-quality performance.

Clear Policy Documentation: Provide comprehensive affiliate agreements outlining prohibited practices, compliance requirements, performance expectations, and termination conditions. Ensure affiliates understand FTC disclosure requirements, brand representation standards, and consequences for fraudulent activity.

Continuous monitoring of affiliate performance is essential for detecting fraud that evades initial detection systems. Sophisticated behavioral analysis identifies subtle patterns indicating fraudulent activity:

Key Monitoring Metrics:

Unusual Traffic Spikes: Monitor for sudden increases in click volume exceeding 300% of baseline without corresponding increases in conversion rates, indicating potential bot traffic or click flooding campaigns.

Conversion Anomalies: Track conversion rate deviations exceeding 2 standard deviations from historical performance, flagging affiliates whose conversion rates suddenly exceed industry benchmarks by 5-10x.

Session Duration Analysis: Legitimate users typically spend 2-5 minutes on conversion pages; sessions under 10 seconds indicate automated activity or click injection tactics.

Geographic Impossibilities: Flag users appearing in multiple geographic locations within impossible timeframes (e.g., New York to Tokyo in 30 seconds), indicating VPN usage or bot networks.

Device & IP Overlaps: Monitor for multiple conversions from identical device fingerprints or IP addresses within short timeframes, suggesting device farms or bot networks rather than genuine users.

Chargeback & Refund Patterns: Track affiliates with chargeback rates exceeding 2% or refund rates above 15%, indicating low-quality or fraudulent traffic.

Automated Alert Systems: Implement real-time alerting that notifies fraud teams within seconds of suspicious activity, enabling immediate investigation and response before significant losses accumulate.

Establishing comprehensive terms and conditions for your affiliate program creates a legal framework for preventing and addressing fraud. Clear policies set expectations, define prohibited activities, and provide grounds for terminating fraudulent affiliates. Without explicit terms, you may have limited recourse when fraud occurs.

Define prohibited marketing practices in detail, including cookie stuffing, click fraud, trademark bidding, email spam, malware distribution, and any other tactics you want to prevent. Be specific about what constitutes a violation so affiliates cannot claim ignorance. Include examples of prohibited behavior to make your expectations crystal clear.

Establish quality standards for traffic and conversions. Specify minimum acceptable conversion rates, maximum acceptable refund rates, and other quality metrics. Make clear that traffic must originate from legitimate sources and that affiliates are responsible for ensuring their marketing methods comply with all applicable laws and regulations.

Require transparency about traffic sources and marketing methods. Mandate that affiliates disclose how they plan to promote your products and that they notify you of any changes to their marketing strategy. This transparency requirement makes it easier to identify when affiliates are using undisclosed or prohibited methods.

Include provisions for monitoring and auditing your right to monitor affiliate activity, review traffic sources, and audit their marketing practices. Make clear that you reserve the right to request documentation, conduct investigations, and access detailed performance data. This legal foundation supports your monitoring activities.

Specify consequences for violations, including commission withholding, account suspension, and termination. Make clear that violations can result in loss of all pending and future commissions, and that you may pursue legal action for damages. Strong consequences deter fraudsters and provide leverage for enforcement.

Building strong relationships with your affiliates through proactive communication creates an environment where fraud is less likely to occur and more likely to be reported. Legitimate affiliates appreciate clear guidance and support, while fraudsters often avoid communication and transparency.

Provide clear guidelines and best practices for affiliate marketing. Create comprehensive documentation that explains your expectations, provides examples of approved marketing methods, and offers guidance on how to succeed within your program. When affiliates understand what’s expected and how to succeed legitimately, they’re less likely to resort to fraudulent tactics.

Offer training and resources to help affiliates improve their marketing effectiveness. Provide webinars, guides, and case studies that demonstrate legitimate strategies for driving quality traffic and conversions. When affiliates have access to proven methods for success, they have less incentive to use fraudulent shortcuts.

Establish open communication channels where affiliates can ask questions, report concerns, and provide feedback. Create a support email address, discussion forum, or chat channel dedicated to affiliate communication. Responsive support builds trust and makes it easier to address issues before they escalate.

Recognize and reward top performers publicly. Feature successful affiliates in newsletters, case studies, and social media. Recognition motivates legitimate affiliates and demonstrates that success is possible through ethical means. This positive reinforcement encourages continued compliance with your program policies.

Create a reporting mechanism for affiliates to report suspicious activity by other affiliates. Offer incentives for verified fraud reports and protect the identity of reporters. This creates a community-driven fraud detection layer that complements your automated systems.

When fraud is detected, automated response systems must act immediately to minimize financial impact while maintaining due process:

Immediate Blocking & Suspension: Automatically pause tracking links and block new conversions from flagged affiliates within milliseconds of detection, preventing additional fraudulent transactions from completing.

Commission Withholding & Escrow: Automatically place suspicious commissions in escrow pending investigation rather than processing immediate payouts. Implement 30-day holds on high-risk affiliate payments to allow time for chargeback detection.

Tiered Warning System: Issue automated warnings for minor violations, escalating to temporary suspension for repeated offenses before permanent termination. Document all warnings and provide affiliates opportunity to respond before enforcement action.

Suspension & Termination Protocols: Implement automated suspension for serious violations (e.g., malware distribution, identity fraud) with clear termination procedures. Maintain detailed documentation of all enforcement actions for potential legal proceedings.

Compliance Documentation: Automatically generate detailed fraud reports documenting detection methodology, evidence, and enforcement actions. Maintain audit trails for regulatory compliance and potential legal disputes.

Multiple specialized platforms offer comprehensive affiliate fraud detection capabilities, each with distinct strengths:

| Platform | Key Features | Fraud Detection Capabilities | Pricing Model | Best For |

|---|---|---|---|---|

| Spider AF | AI-driven fraud detection, behavioral analysis, bot traffic identification | Real-time click fraud blocking, cookie stuffing detection, device fingerprinting | SaaS tiers starting ~$500/month | Agencies and multi-vertical operators |

| Trackier | Multi-touch attribution, API integrations, commission engines | Fraud filters, postback validation, conversion deduplication | SaaS tiers starting ~$300/month | Performance marketers seeking flexibility |

| IREV | Lead distribution, real-time tracking, 50+ report types | Advanced fraud mitigation, bonus abuse detection, KYC validation | Custom pricing (on request) | iGaming operators requiring compliance |

| PartnerMatrix | Real-time analytics, flexible commission tiers, agent tracking | PPC monitoring, fraud detection, multi-language support | Custom (EveryMatrix ecosystem only) | EveryMatrix platform users |

| PostAffiliatePro | Conversion tracking, SLA-based payouts, multi-tier commissions | Advanced AI-powered fraud detection, CMS integrations, budget-friendly | SaaS tiers starting ~$200/month | Small to mid-size programs |

PostAffiliatePro ranks as the top choice for cost-conscious operators seeking robust fraud detection without enterprise pricing, offering comprehensive tracking, flexible commission structures, and reliable fraud prevention at accessible price points. Its WordPress and Magento integrations make it ideal for eCommerce brands, while its straightforward interface reduces implementation complexity and training requirements.

Successful fraud prevention requires strategic implementation that balances security with operational efficiency:

Establish Baseline Metrics: Analyze 30-60 days of historical affiliate data to establish normal performance baselines for click-through rates, conversion rates, average order value, and customer lifetime value. These baselines become the foundation for anomaly detection algorithms.

Progressive Layering Approach: Implement fraud detection in phases, starting with basic rule-based checks (IP blocking, duplicate detection) before advancing to machine learning models. This allows teams to understand system behavior and adjust thresholds before deploying advanced detection.

Define Clear Thresholds & Rules: Establish specific, measurable thresholds for automated actions (e.g., “block traffic if CTR exceeds 15%”, “flag for review if conversion rate exceeds 20%”). Document all rules and maintain version control as thresholds evolve.

Regular Rule Updates & Refinement: Review fraud detection rules monthly, analyzing false positives and false negatives to improve accuracy. Update rules based on emerging fraud tactics and seasonal variations in legitimate traffic patterns.

Human Review Integration: Maintain human oversight for borderline cases and novel fraud patterns that automated systems may not recognize. Establish escalation procedures where high-value affiliates receive manual review before suspension.

Pilot Testing & Gradual Rollout: Test new detection rules on historical data before deployment, validating that improvements don’t increase false positives. Roll out changes gradually across affiliate segments to monitor impact before full implementation.

Affiliate fraud prevention must operate within strict regulatory frameworks protecting consumer privacy and ensuring fair business practices:

Data Privacy & Protection: Implement GDPR-compliant data handling procedures when processing user information for fraud detection. Ensure device fingerprinting and behavioral tracking comply with privacy regulations, obtaining necessary user consent and providing transparent data usage policies.

FTC Compliance & Transparency: Ensure all affiliates comply with FTC Endorsement Guides requiring clear disclosure of material connections and compensation arrangements. Implement automated compliance monitoring to verify that affiliate content includes proper disclosures and avoids misleading claims.

Fair Treatment & Due Process: Provide affiliates with documented evidence and opportunity to respond before suspension or termination. Maintain detailed records of all fraud allegations, investigation findings, and enforcement decisions to defend against potential legal challenges.

Documentation & Audit Trails: Maintain comprehensive audit logs documenting all fraud detection activities, enforcement actions, and commission adjustments. These records demonstrate good-faith fraud prevention efforts and provide evidence in potential disputes or regulatory investigations.

Industry-Specific Regulations: Comply with vertical-specific regulations including iGaming licensing requirements, financial services compliance, and healthcare advertising restrictions. Ensure fraud prevention mechanisms don’t inadvertently violate industry-specific rules regarding customer verification or data handling.

Affiliate fraud detection and prevention requires a comprehensive, multi-layered approach combining advanced technology, rigorous vetting, continuous monitoring, and strict compliance. Organizations implementing these mechanisms protect their budgets, maintain data integrity, and build sustainable affiliate programs that reward legitimate partners while eliminating fraudulent actors. The investment in sophisticated fraud prevention systems delivers measurable ROI through reduced losses, improved attribution accuracy, and stronger affiliate relationships built on trust and transparency. By adopting the strategies and technologies outlined in this guide, you can create an affiliate program that thrives on genuine performance while remaining resilient against evolving fraud tactics.

Affiliate fraud refers to deliberate manipulation of affiliate programs to earn undeserved commissions through fake clicks, cookie stuffing, or fabricated leads. It's growing due to increasing AI sophistication, the vulnerability of CPA-based models, and the difficulty in attributing conversions across complex customer journeys. In 2023, affiliate fraud drained over $84 billion globally, accounting for 22% of all digital ad spend.

Common types include click fraud (automated fake clicks), cookie stuffing (placing cookies without consent), click injection (stealing attribution before legitimate conversions), URL hijacking (using lookalike domains), malware distribution, fake lead generation, bonus abuse, and CPA abuse. Each exploits different vulnerabilities in tracking and attribution systems, requiring targeted prevention strategies.

Machine learning algorithms analyze historical traffic patterns to establish baseline metrics, then flag deviations in real-time. These systems continuously learn from new fraud tactics, improving detection accuracy without requiring manual rule updates. They identify suspicious patterns including unusual click clustering, impossible geographic transitions, mechanical consistency, and behavioral anomalies that indicate bot activity rather than genuine human engagement.

Device fingerprinting creates unique digital identifiers for each device based on browser configuration, operating system, hardware specifications, and screen characteristics. This prevents fraudsters from masking their identity through VPNs or proxy services, as device fingerprints remain persistent across sessions. It enables detection of device farms, multi-account schemes, and bot networks that would otherwise appear as legitimate traffic.

Modern fraud detection systems operate in real-time, analyzing and validating every click, conversion, and user interaction within milliseconds. Automated blocking can prevent fraudulent transactions from completing before commissions are paid. However, sophisticated fraud that mimics legitimate behavior may take days or weeks to detect through behavioral analysis and pattern recognition.

Evaluate platforms based on detection scope (clicks, leads, sales, installs), detection accuracy (low false-positive rates), automation capabilities (auto-blocking, alerts, escalation), integration compatibility with your existing systems, and compliance with data privacy regulations. PostAffiliatePro stands out for combining advanced fraud detection with affordable pricing and excellent integration capabilities for businesses of all sizes.

Yes, false positives are a common challenge in fraud detection. High-performing affiliates may trigger alerts due to unusual conversion rates or traffic patterns. This is why combining automated detection with human review is essential. Establish clear escalation procedures where borderline cases receive manual investigation before suspension, and provide affiliates opportunity to respond before enforcement action.

PostAffiliatePro ranks as the top choice for cost-conscious operators seeking robust fraud detection without enterprise pricing. It offers advanced AI-powered fraud detection, multi-channel tracking, real-time reporting, flexible commission management, and excellent integration capabilities. Unlike specialized fraud platforms, PostAffiliatePro provides comprehensive affiliate program management alongside fraud prevention, making it ideal for businesses of all sizes.

Continuous monitoring is essential for effective fraud prevention. Set up real-time alerts for suspicious activity patterns, review key performance metrics daily, conduct weekly traffic quality audits, and perform comprehensive monthly reviews of all affiliate data. The more frequently you monitor, the faster you can detect and respond to fraudulent activity.

Your terms and conditions should define prohibited marketing practices (cookie stuffing, click fraud, trademark bidding, etc.), establish quality standards for traffic and conversions, require transparency about traffic sources, specify monitoring and auditing rights, outline consequences for violations, address intellectual property protection, and require compliance with privacy and advertising regulations.

Take immediate action by suspending the affiliate's account to stop fraudulent conversions. Conduct a thorough investigation, document all evidence, communicate your findings to the affiliate, and give them an opportunity to respond. If fraud is confirmed, terminate the account, withhold pending commissions, report to relevant authorities if criminal activity is involved, and consider legal action for significant damages.

PostAffiliatePro's advanced fraud detection system uses machine learning to identify suspicious patterns, prevent click fraud, and protect your program from invalid conversions. Start your free trial today and see how we help you maintain program integrity while scaling your affiliate network.

Discover how Post Affiliate Pro's campaign-specific secret keys strengthen fraud protection in commission tracking with multi-layer security features.

How affiliate management systems detect and prevent fraud in real-time. Fraud detection tools, prevention strategies, and PostAffiliatePro protection.

Learn what affiliate fraud is, how it works, and proven strategies to detect and prevent it. Protect your affiliate program with advanced fraud detection techni...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.