Percentage Calculator

Calculate percentages quickly with our comprehensive calculator. Choose from 12+ calculation modes including basic percentages, discounts, tips, margins, VAT, commissions, and more. Get instant results with step-by-step formulas and explanations.

Calculate Any Percentage

📊 Calculation Modes

Basic Calculations

- What is X% of Y? - Calculate percentage of a value (e.g., 25% of 200 = 50)

- X is what % of Y? - Find what percentage one number is of another (e.g., 50 is 25% of 200)

- X is Y% of what? - Find the whole from a part and percentage (e.g., 50 is 25% of 200)

Analysis Tools

- Percentage Change - Calculate increase or decrease between values (e.g., 100 to 150 = +50% increase)

- Percentage Difference - Compare two values using their average as base

Practical Tools

- Discount Calculator - Calculate sale prices and savings

- Tip Calculator - Calculate tips and total bill amounts

- Add/Subtract Percentage - Add or remove a percentage from a value

Business Tools

- Markup Calculator - Calculate selling price from cost and markup percentage

- Margin Calculator - Calculate profit from selling price and margin percentage

- VAT/Tax Calculator - Calculate prices with or without tax (supports both inclusive and exclusive)

- Commission Calculator - Calculate earnings from sales commissions

💡 Understanding Percentages

What is a Percentage? A percentage is a way to express a number as a fraction of 100. The word “percent” means “per hundred.” For example, 25% means 25 out of 100, or 25/100 = 0.25.

Common Uses Percentages are everywhere: discounts (20% off), interest rates (5% APR), statistics (75% approval rating), grades (scored 90%), tips (15% gratuity), taxes (6.5% sales tax), and business metrics (30% profit margin).

Key Concepts

- Percentage vs Percentage Points: 25% to 30% is a 5 percentage point increase, but a 20% relative increase

- Markup vs Margin: Markup is based on cost, margin is based on selling price

- Compound Percentages: Adding 10% then subtracting 10% doesn’t return to the original value

- Base Matters: 50% of 100 (50) is different from 50 being 50% of something (100)

🎯 Pro Tips

Avoid Common Mistakes

- Don’t confuse percentage change with percentage difference

- Remember that percentages don’t simply add/subtract (10% increase then 10% decrease ≠ no change)

- Check if tax/VAT is inclusive or exclusive before calculating

- Understand the difference between markup and margin for pricing

Quick Mental Math

- 10% = divide by 10

- 50% = divide by 2

- 25% = divide by 4

- 1% = divide by 100

- 5% = half of 10%

- 15% = 10% + 5%

Using the Calculator All calculations are performed instantly in your browser. Use the calculation history to track your recent calculations. Copy results or descriptions to quickly share or save your work. Press Enter in any input field to calculate immediately.

Frequently asked questions

- How do I calculate X% of a number?

To calculate X% of a number, multiply the number by X and divide by 100. For example, 25% of 200 = (200 × 25) ÷ 100 = 50. Use our 'What is X% of Y' calculator mode for instant results. This is useful for calculating discounts, commissions, or any portion of a value.

- What's the difference between percentage change and percentage difference?

Percentage change measures the relative change from an original value to a new value: ((New - Old) ÷ Old) × 100. It's directional and shows increase or decrease. Percentage difference compares two values relative to their average: (|V1 - V2| ÷ Average) × 100. It's non-directional and used when neither value is the 'original.' Use percentage change for growth rates, price changes, or performance over time. Use percentage difference for comparing two independent values.

- How do I calculate a percentage increase or decrease?

Calculate the change amount (New Value - Original Value), divide by the original value, then multiply by 100: ((New - Old) ÷ Old) × 100. A positive result is an increase, negative is a decrease. For example, from 100 to 150: ((150 - 100) ÷ 100) × 100 = 50% increase. Use our 'Percentage Change' calculator mode for automatic calculation of increases and decreases.

- What's the difference between markup and margin?

Markup is calculated on cost: (Selling Price - Cost) ÷ Cost × 100. Margin is calculated on selling price: (Selling Price - Cost) ÷ Selling Price × 100. For example, if cost is $50 and selling price is $100: Markup = ($100 - $50) ÷ $50 = 100%, but Margin = ($100 - $50) ÷ $100 = 50%. Retailers often use markup for pricing decisions, while margin is preferred for profitability analysis. A 100% markup equals 50% margin.

- How do I calculate the original price before a discount?

If you know the discounted price and the discount percentage, use the formula: Original Price = Discounted Price ÷ (1 - Discount%/100). For example, if an item costs $80 after a 20% discount: $80 ÷ (1 - 0.20) = $80 ÷ 0.80 = $100. Use our 'X is Y% of what?' calculator mode by entering the discounted price and the remaining percentage (100% - discount%).

- How do I add or subtract a percentage from a number?

To add X%: New Value = Original × (1 + X/100). To subtract X%: New Value = Original × (1 - X/100). For example, to add 20% to 100: 100 × 1.20 = 120. To subtract 20% from 100: 100 × 0.80 = 80. Use our 'Add/Subtract Percentage' calculator mode for instant results. This is useful for price increases, tax calculations, or applying discounts.

- What is a percentage point difference?

Percentage points measure the arithmetic difference between two percentages. If a rate goes from 25% to 45%, that's a 20 percentage point increase, not a 20% increase. The actual percentage increase would be ((45-25)÷25)×100 = 80% increase. Percentage points are absolute differences, while percentage changes are relative. This distinction is important in finance, economics, and statistics when discussing interest rates, tax rates, or survey results.

- How do I calculate VAT or sales tax?

To add VAT to a price: Price with VAT = Price × (1 + VAT%/100). For example, $100 + 20% VAT = $100 × 1.20 = $120. To extract VAT from an inclusive price: VAT amount = Price ÷ (1 + VAT%/100), then subtract from total. For example, if $120 includes 20% VAT: Price without VAT = $120 ÷ 1.20 = $100, VAT = $20. Use our VAT/Tax calculator mode for both inclusive and exclusive calculations.

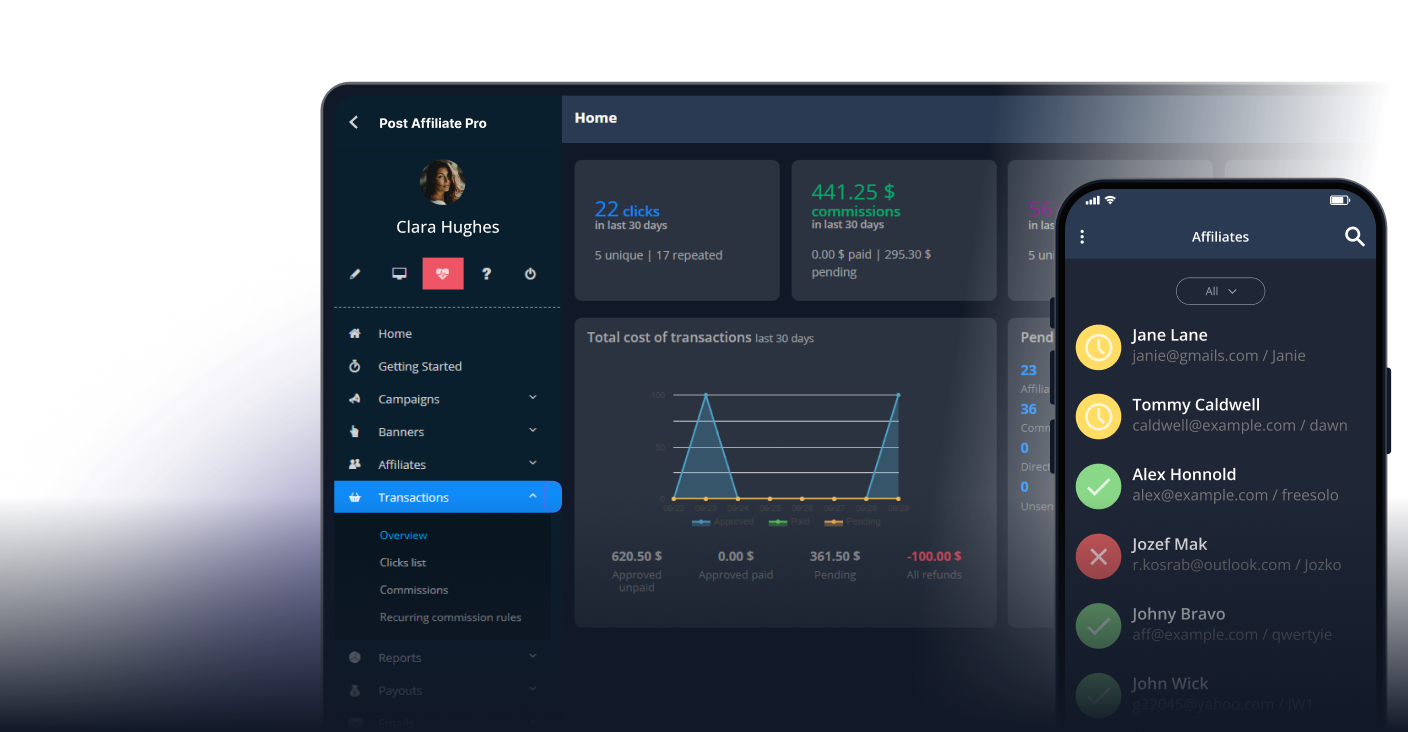

The leader in Affiliate software

Manage multiple affiliate programs and improve your affiliate partner performance with Post Affiliate Pro.