How Can I Get More Visitors to My Money Page? Complete 2025 Guide

Discover proven strategies to increase traffic to your money pages in 2025. Learn SEO, content marketing, paid ads, and social media tactics to drive qualified ...

Project future cash inflows and outflows to avoid cash crunches and plan for growth. Forecast cash positions across multiple months, identify timing gaps, and ensure you maintain healthy liquidity.

Operating Cash Flow - This is cash generated from core business operations: customer payments, minus payments to suppliers, employees, and operating expenses. Positive operating cash flow indicates your business generates cash from its core activities. Negative operating cash flow means operations consume cash, requiring external funding. Even profitable businesses can have negative operating cash flow if they’re investing heavily in growth. Calculate this weekly or monthly to track your business’s fundamental cash-generating ability.

Cash Conversion Cycle - This measures how long cash is tied up in operations. Calculate: Days Inventory Outstanding + Days Sales Outstanding - Days Payables Outstanding. Example: 30 days to sell inventory + 45 days to collect payment - 30 days to pay suppliers = 45-day cash conversion cycle. Your cash is locked for 45 days between paying suppliers and collecting from customers. Reducing this cycle frees working capital. Strategies: sell inventory faster, collect payments quicker, extend payables (without damaging supplier relationships).

Timing Mismatches - Cash flow problems often result from timing differences, not profitability issues. You might incur costs in January for products that sell in March with payment received in April - a 3-month gap between spending and collecting cash. Service businesses face similar issues with billable work performed today but invoiced monthly and paid 30 days later. Project these timing mismatches explicitly to avoid surprise shortfalls. Plan financing or cash reserves to bridge gaps.

Revenue Timing - Project when cash actually arrives, not when sales occur. If you offer Net 30 terms, cash arrives 30-60 days after sale (accounting for late payments). For subscription businesses, project renewal rates and churn. For seasonal businesses, model historical patterns. For project-based businesses, project milestone payment schedules. Include deposits, progress payments, and final payments separately. Be conservative - assume some customers pay late and some invoices require follow-up.

Expense Timing - Categorize expenses by payment frequency: fixed monthly (rent, subscriptions, insurance), variable with revenue (COGS, commissions, shipping), periodic (quarterly taxes, annual insurance), and discretionary (marketing, equipment, hiring). Project each category separately based on its drivers. Remember timing: credit card expenses clear immediately, while checks may take days. Include owner draws or dividends as cash outflows to ensure personal income needs don’t surprise the business.

Growth Investment - Growing businesses need cash for inventory buildup, increased receivables, new hiring, facility expansion, and marketing acceleration. Project these growth-related cash needs explicitly. A 50% revenue increase might require 60-70% increase in working capital. Without planning for growth cash needs, rapid growth creates cash crises despite strong sales. Model growth scenarios: 10%, 25%, 50% growth with corresponding cash requirements to determine sustainable growth rates given available capital.

Working Capital Management - Working capital (current assets minus current liabilities) represents cash tied up in day-to-day operations. Optimize by: reducing inventory to minimum safe levels, collecting receivables faster (offer discounts, chase aggressively, require deposits), and extending payables to maximum (without late fees or relationship damage). Every dollar freed from working capital improves cash position without requiring additional financing. Many businesses discover they have $50K-$500K of unnecessary working capital that could be freed with better management.

Cash Flow Forecasting Best Practices - Create three forecast scenarios: conservative (70% of expected sales, normal expenses), realistic (expected sales and expenses), and optimistic (120% of expected sales, higher expenses for growth). Plan financing and reserves for conservative scenario. Many businesses plan for realistic or optimistic scenarios and face crises when actual results fall short. Update forecasts monthly with actuals to continuously improve accuracy. Variance analysis (projected vs. actual) reveals patterns and improves future projections.

Accelerate cash inflows through disciplined invoicing. Send invoices immediately upon delivery (not end-of-month). Offer multiple convenient payment methods (credit card, ACH, payment portals). Provide early payment discounts (2/10 Net 30 - 2% discount if paid within 10 days). Implement systematic collection processes: reminder at 15 days overdue, call at 30 days, escalation at 45 days. Use accounting software with automated reminders. Track Days Sales Outstanding (DSO) and work to reduce it. Every day you accelerate collections improves cash position.

Take full advantage of supplier payment terms without paying early unless discounts justify it. If terms are Net 30, pay on day 30, not day 15. This retains cash 15 days longer for other uses. However, take early payment discounts when offered (2/10 Net 30 discount equals 36% annual return). Negotiate longer payment terms with suppliers (Net 60 instead of Net 30). Schedule large payments strategically around cash influx timing. Pay variable expenses (marketing) flexibly based on cash position while maintaining fixed expenses (rent, payroll) on schedule.

Excess inventory ties up cash that could be used elsewhere. Calculate optimal inventory levels: enough to avoid stockouts but minimal excess. Use just-in-time ordering when feasible. Negotiate consignment arrangements with suppliers (they own inventory until you sell it). Implement inventory management systems to track turnover rates. Identify slow-moving items and discount aggressively to convert to cash. Consider dropshipping for some products to eliminate inventory investment entirely. Regular inventory audits prevent accumulation of obsolete stock.

Recurring revenue dramatically improves cash flow predictability. Even product businesses can add subscription elements: replenishment subscriptions, membership programs, maintenance contracts, or premium support plans. Subscriptions provide cash today for future delivery, improving cash position. They also smooth revenue volatility. Offer annual payment options with discounts (gives you 12 months cash upfront). For service businesses, move to retainer models rather than project-based billing. Predictable recurring revenue makes cash flow planning straightforward.

Model entire seasonal cycles, not individual months. Retail businesses might project January-November operations funded by December holiday sales. Build cash reserves during peak seasons to sustain operations during slow periods. Secure seasonal credit lines before you need them (approved during strong cash months, drawn during lean months). Time major expenses and investments during cash-rich periods. Consider counter-seasonal product lines or services to smooth revenue. Many seasonal businesses solve cash problems by adding complementary non-seasonal revenue streams.

Establish financing relationships before crises, not during them. Secure a line of credit during strong financial periods to access during tight times. Lines of credit bridge temporary cash gaps at much lower cost than crisis financing. Understand financing options: lines of credit (draw as needed), term loans (lump sum for specific investments), equipment financing (spread purchase costs over time), or factoring (sell invoices for immediate cash at discount). Match financing terms to cash flow patterns - don’t finance long-term investments with short-term debt.

Convert fixed costs to variable where possible. Use contractors instead of full-time staff, coworking space instead of leases, cloud computing instead of server purchases, and performance marketing instead of brand advertising. Variable costs scale with revenue, protecting cash flow during downturns. Review all recurring expenses quarterly - cancel unused subscriptions, renegotiate increased prices, eliminate redundant services. Small expenses ($50-$200/month) accumulate to significant annual cash outflow. Zero-based budgeting (justify every expense annually) prevents cost creep.

For high-value or custom products/services, require deposits upfront. 25-50% deposits reduce cash risk dramatically. Milestone payment schedules for large projects (deposit at start, progress payments at 30%/60%/90% completion, final payment on delivery) align cash inflows with costs. Offer prepayment discounts for annual subscriptions. Deposits and prepayments improve cash flow while reducing customer abandonment (financial commitment increases completion rates). Use deposit policies to screen serious customers from tire-kickers.

Maintain dedicated emergency reserves separate from operating cash. Target 3-6 months of fixed expenses in readily accessible savings. Never touch reserves except for genuine emergencies (major revenue loss, unexpected major expense, crisis survival). Build reserves gradually: allocate 10-20% of profits to reserves until target reached. Consider reserves in tiers: Tier 1 (1 month expenses, savings account), Tier 2 (2-3 months, short-term CDs or money market), Tier 3 (3-6 months, laddered CDs). Adequate reserves prevent panic decisions during temporary downturns.

Track cash flow metrics weekly: current cash balance, incoming cash (next 30 days), outgoing cash (next 30 days), projected net cash position, and days of cash on hand. Set up automated dashboards showing these metrics visually. Establish cash position triggers: green (6+ months reserves), yellow (3-6 months), red (under 3 months). When yellow, defer discretionary spending. When red, implement emergency cash preservation measures. Regular monitoring prevents surprises and enables proactive management. Many accounting platforms offer real-time cash flow dashboards.

Cash flow is the actual movement of money in and out of your business, while profit is revenue minus expenses on paper. You can be profitable but cash-poor if customers haven't paid invoices yet or you've invested heavily in inventory. Conversely, you can have positive cash flow but be unprofitable if you're collecting deposits for future delivery. 82% of business failures are due to cash flow problems, not lack of profitability. Cash flow determines whether you can pay bills, employees, and suppliers on time.

Project cash flow 3-6 months ahead for operational planning, 12 months for annual budgeting and strategic decisions, and 3-5 years for major investments or expansion plans. Update projections monthly with actuals to improve accuracy. Short-term projections (3 months) should be detailed and conservative. Long-term projections (1-5 years) can be less detailed but should model various scenarios (optimistic, realistic, pessimistic). Seasonal businesses need longer projection windows to plan through low-revenue periods.

Common mistakes: 1) Confusing profit with cash flow (profitable but illiquid), 2) Not planning for seasonal variations, 3) Growing too fast (growth consumes cash for inventory, staff, infrastructure), 4) Offering payment terms without cash buffer (30-60 day payment terms create cash gaps), 5) Failing to chase overdue invoices aggressively, 6) Not maintaining cash reserves (3-6 months operating expenses), 7) Making major purchases during cash-tight periods, 8) Ignoring small expenses that accumulate.

Maintain 3-6 months of operating expenses in cash reserves. Calculate monthly operating expenses (rent, payroll, utilities, minimum marketing, essential services) and multiply by 3-6. Service businesses with low overhead can operate with 3 months. Inventory-based businesses or those with long sales cycles need 6+ months. Reserve requirements increase with: business volatility, seasonal revenue patterns, high fixed costs, long customer payment terms, and market uncertainty. Cash reserves prevent crisis reactions during temporary downturns.

Cash flow improvement strategies: 1) Accelerate receivables (invoice promptly, offer early payment discounts, accept more payment methods, chase overdue invoices), 2) Delay payables strategically (take full payment terms offered, negotiate longer terms, time large expenses), 3) Reduce inventory (just-in-time ordering, dropshipping, negotiate consignment), 4) Cut unnecessary expenses, 5) Convert assets to cash (sell unused equipment, sublease excess space), 6) Restructure debt (refinance to lower payments). Even maintaining sales, these strategies can dramatically improve cash position.

A cash flow statement reports historical cash movements (what actually happened). A cash flow forecast projects future cash movements (what you expect to happen). Statements use actual data and are backward-looking, required for accounting and taxes. Forecasts use estimates and assumptions, are forward-looking, and guide business decisions. Update forecasts monthly by comparing actual vs. projected to improve prediction accuracy. Use historical statements to inform forecast assumptions. Both are essential - statements show where you've been, forecasts show where you're going.

Payment terms create timing gaps between sale and cash receipt. Net 30 terms mean you wait 30+ days for payment while still incurring costs. Example: $100K monthly sales on Net 30 terms means $100K+ in outstanding receivables constantly. If you pay suppliers immediately but collect slowly, you're financing customer purchases. Strategies: offer early payment discounts (2% discount for 10-day payment), charge interest on late payments, require deposits on large orders, use shorter terms for new customers, accept credit cards (instant payment despite fees).

Seasonal businesses experience feast and famine cash flow. Retail stores may generate 40% of annual revenue in Q4 but have expenses year-round. This requires: building cash reserves during high seasons, securing seasonal credit lines, negotiating seasonal payment terms with suppliers, minimizing fixed costs, planning major expenses during cash-rich periods, and forecasting entire seasonal cycles (not just individual months). Model worst-case scenarios to ensure survival through low seasons. Many seasonal businesses fail not from poor annual profitability but from poor cash management during lean months.

Affiliate marketers face unique cash flow dynamics: commission payments lag sales by 30-90 days (you generate sale today, paid 60 days later), traffic costs are immediate (pay for ads before earning commissions), building content/sites requires upfront investment, and income volatility creates unpredictable cash flow. Strategies: maintain larger cash reserves (6-12 months), diversify across merchants with different payment schedules, negotiate faster payment terms with top merchants, focus on quick-paying programs during cash-tight periods, and model commission payment timing carefully in projections.

Growth consumes cash through increased inventory, added staff, larger facilities, more receivables, and increased marketing. This is called the 'growth paradox' - success creates cash crisis. Manage growth cash flow: grow at sustainable pace (20-30% annual growth manageable, 100%+ growth risky), secure growth capital early (line of credit before you need it), accelerate customer payments, negotiate better supplier terms, maintain lean operations, outsource rather than hiring, use asset-light models when possible. Many businesses fail by growing too fast despite strong markets and products.

Manage multiple affiliate programs and improve your affiliate partner performance with Post Affiliate Pro.

Discover proven strategies to increase traffic to your money pages in 2025. Learn SEO, content marketing, paid ads, and social media tactics to drive qualified ...

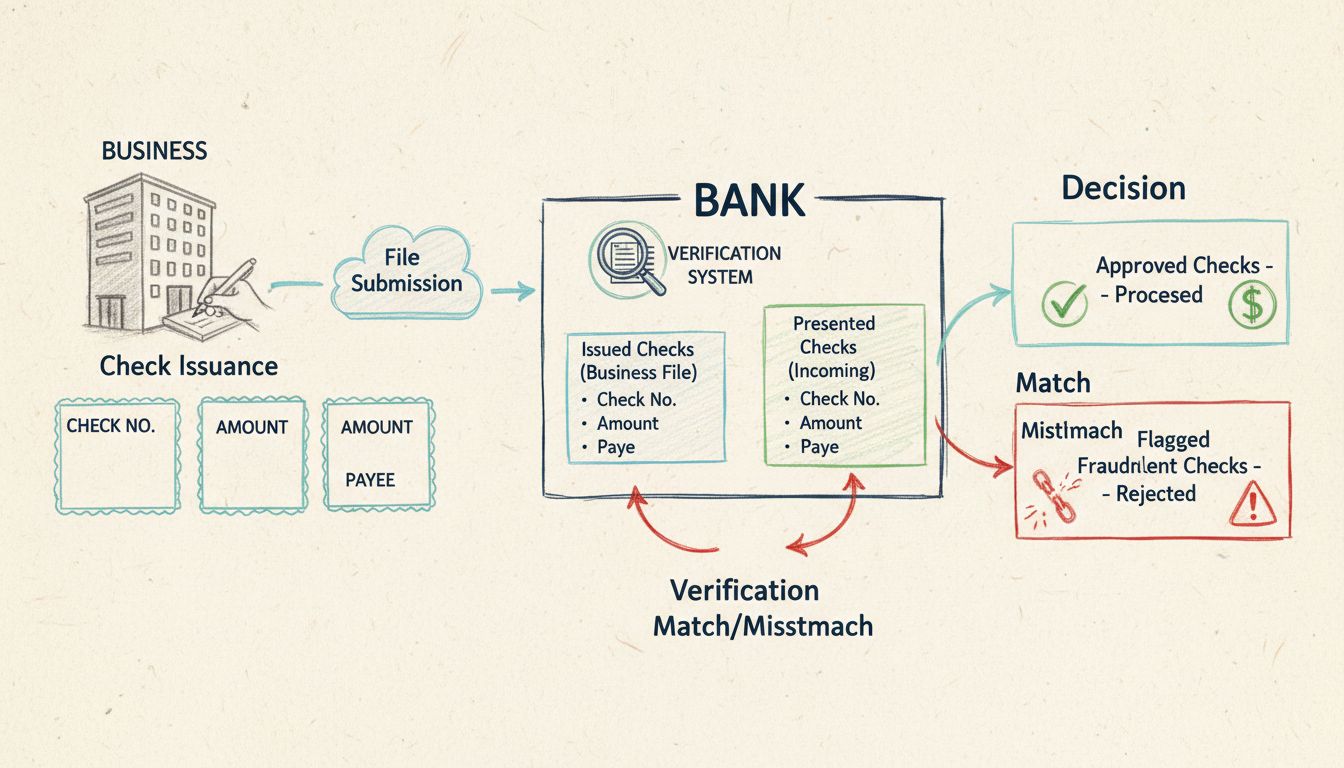

Learn what Positive Pay is and how this automated cash management service prevents check fraud. Discover how it works, benefits, costs, and best practices for b...

Discover how Positive Pay protects businesses from check fraud with an automated verification process. Learn about its mechanisms, variations, and benefits for ...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.