Why Should a Business Hire a Fractional CFO? | Expert Guide

Discover why businesses hire fractional CFOs for cost-effective financial expertise, flexibility, and strategic guidance. Learn the key benefits and how to choo...

Learn what a Fractional CFO is and how part-time financial executives help startups and SMEs with strategic guidance, cash flow management, and cost-effective financial leadership without full-time overhead.

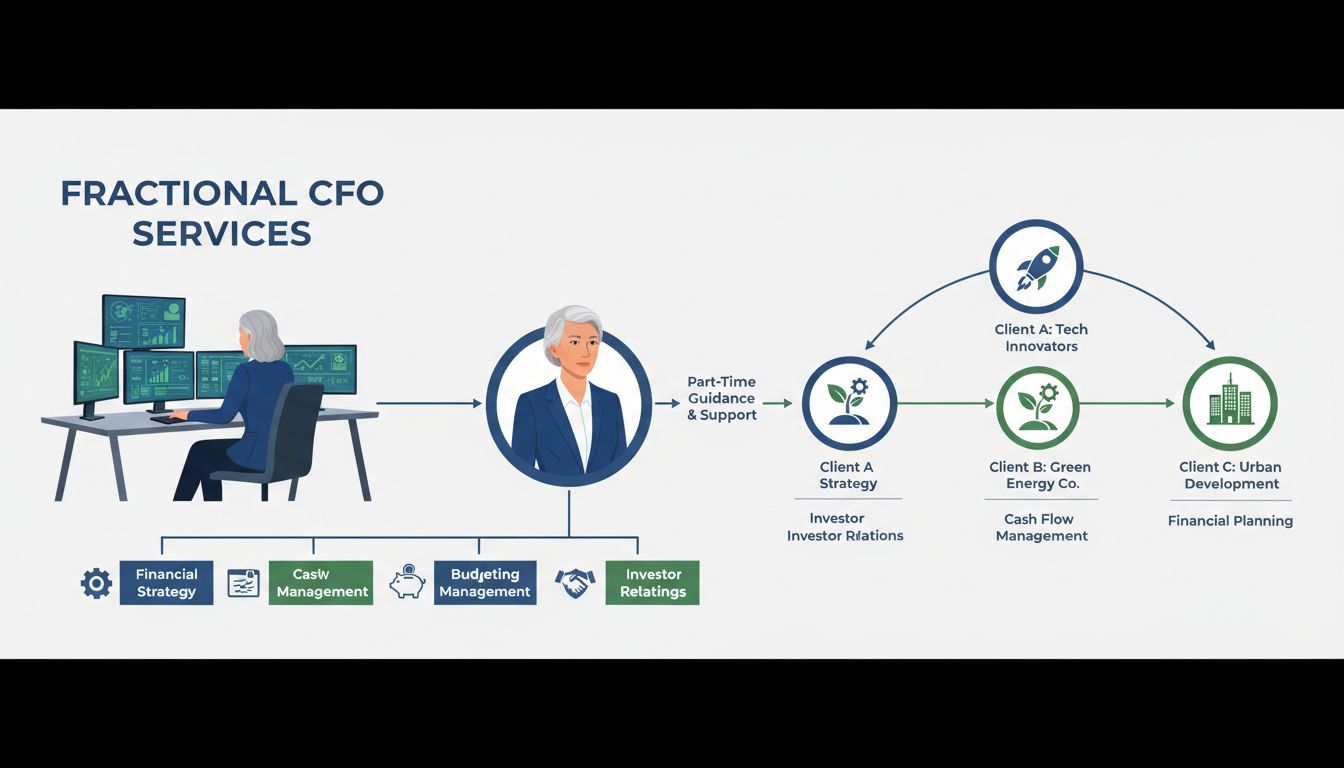

A Fractional CFO is a part-time financial executive who offers expert financial oversight and strategic guidance to businesses without the full-time cost, ideal for startups and SMEs.

A Fractional CFO, also referred to as a part-time CFO, virtual CFO, or outsourced CFO, is a senior financial executive who provides high-level financial management and strategic guidance on a contractual, part-time, or project-based basis. Unlike traditional full-time Chief Financial Officers who command annual salaries ranging from $150,000 to $300,000 or more, fractional CFOs offer businesses access to executive-level financial expertise at a fraction of the cost. This innovative service model has become increasingly popular among startups, small-to-medium enterprises (SMEs), and growing companies that require sophisticated financial leadership but lack the budget or operational need for a full-time CFO position. The fractional approach allows businesses to scale their financial management capabilities in alignment with their growth stage and specific needs.

Fractional CFOs handle a comprehensive range of financial responsibilities that directly impact business sustainability and growth. Their primary focus includes developing and implementing strategic financial plans that align with company objectives, ensuring that every financial decision supports long-term business goals. They provide expert oversight of cash flow management, monitoring inflows and outflows to maintain adequate liquidity while maximizing financial health. Fractional CFOs create detailed budgets and financial forecasts that serve as roadmaps for decision-making and resource allocation, enabling businesses to anticipate challenges and capitalize on opportunities. They also manage financial reporting and compliance requirements, ensuring that companies adhere to regulatory standards such as GAAP (Generally Accepted Accounting Principles) and maintain accurate financial statements. Additionally, fractional CFOs provide critical support during fundraising rounds by developing investor-ready financial models that clearly communicate growth potential and strategic value propositions to venture capitalists and other investors.

| Key Responsibility | Description | Business Impact |

|---|---|---|

| Financial Strategy | Developing long-term financial plans and capital structure advice | Aligns spending with growth objectives |

| Cash Flow Management | Monitoring liquidity and implementing forecasting strategies | Prevents cash shortfalls and maintains operational stability |

| Budgeting & Forecasting | Creating accurate budgets and financial projections | Guides decision-making and resource allocation |

| Risk Management | Identifying financial risks and implementing mitigation strategies | Protects assets and ensures business resilience |

| Fundraising Support | Preparing financial models and investor presentations | Increases likelihood of successful capital acquisition |

| Financial Reporting | Ensuring compliance and accurate financial statements | Builds investor confidence and regulatory compliance |

| Cost Optimization | Analyzing spending patterns and identifying savings opportunities | Improves profitability and operational efficiency |

The decision to engage a fractional CFO stems from several compelling business advantages that traditional full-time hiring cannot match. Cost-effectiveness represents the most obvious benefit, as businesses pay only for the specific services and hours required rather than committing to a full-time salary, benefits package, and associated overhead costs. This financial flexibility proves particularly valuable for startups and SMEs operating with limited budgets who still require sophisticated financial management. Fractional CFOs bring extensive experience from working across multiple industries and company stages, providing fresh perspectives and innovative solutions to financial challenges that internal teams might not have encountered. Their flexibility allows businesses to scale services up or down based on changing needs, seasonal fluctuations, or specific projects like fundraising rounds, mergers and acquisitions, or market expansion initiatives. Companies benefit from an objective, external viewpoint on their financial health and strategies, which proves crucial for making difficult decisions and identifying improvement areas that internal stakeholders might overlook. Many fractional CFOs maintain extensive networks of financial professionals, investors, and industry contacts, providing their clients with valuable connections for funding opportunities, strategic partnerships, and specialized expertise.

Establishing robust financial systems early in a company’s lifecycle prevents costly mistakes and creates a foundation for sustainable growth. A well-structured chart of accounts serves as the backbone of any accounting system, categorizing all financial transactions and providing clear visibility into income, expenses, assets, and liabilities. Selecting appropriate accounting software that aligns with business needs and scales as the company grows streamlines financial processes and simplifies report generation. Implementing internal controls ensures checks and balances exist to prevent fraud or errors in financial reporting, including segregation of duties, regular audits, and approval processes for significant transactions. Fractional CFOs excel at establishing these foundational systems, ensuring that companies maintain GAAP compliance from the beginning rather than attempting costly corrections later. This proactive approach to financial infrastructure development enables businesses to generate accurate financial data that supports informed decision-making at every stage of development.

Effective cash flow management represents one of the most critical functions a fractional CFO provides, particularly for startups facing irregular revenue streams and unpredictable expenses. Fractional CFOs implement cash flow forecasting techniques that enable businesses to predict future inflows and outflows, allowing for proactive decision-making rather than reactive crisis management. By analyzing spending patterns and identifying areas for cost reduction, fractional CFOs help improve cash flow visibility and optimize expense allocation. They work to maintain sustainable burn rates, ensuring that companies consume capital at a pace that aligns with their runway and growth milestones. This expertise in cash flow management directly translates to business longevity, as many startups fail not due to poor products or services but due to inadequate cash management. Fractional CFOs also help businesses understand their cash conversion cycle, identifying opportunities to accelerate receivables collection or negotiate better payment terms with suppliers, both of which improve overall financial health.

Financial forecasting serves as a critical tool for businesses looking to grow and scale operations effectively. Fractional CFOs develop comprehensive financial projections that include revenue forecasts, expense budgets, and cash flow scenarios tailored to different growth milestones and market conditions. These projections serve as roadmaps for startups, guiding important financial decisions such as budgeting, pricing strategies, and investment opportunities. By accurately predicting future revenue streams, businesses can allocate resources more efficiently, investing in areas likely to generate higher returns while cutting back on expenses that don’t align with growth objectives. Financial forecasts also help companies identify potential areas for growth by analyzing market trends and customer behavior, enabling businesses to spot new opportunities and tailor their products or services accordingly. Fractional CFOs emphasize the importance of aligning expenses with business objectives, ensuring that spending on marketing, hiring, and product development directly supports overall strategic goals. This alignment enhances accountability throughout the organization as teams are held responsible for delivering results against set financial targets.

Securing capital through fundraising rounds represents a critical milestone for growing companies, and fractional CFOs play an essential role in this process by creating investor-ready financial models that clearly communicate growth potential and strategic value propositions. These comprehensive financial projections include detailed revenue forecasts, expense budgets, and cash flow scenarios that demonstrate how the company will deploy capital and achieve profitability. Fractional CFOs develop dynamic financial models capable of scenario analysis, allowing startups to demonstrate the impact of varying market conditions or strategic decisions on financial outcomes. They highlight key performance indicators (KPIs) that matter most to investors, including customer acquisition cost, lifetime value, gross margin trends, and runway calculations. By ensuring transparency and accuracy in financial data, fractional CFOs align financial presentations with underlying business assumptions and operational realities, building investor confidence. They also facilitate investor due diligence by preparing detailed supporting documentation such as historical financial statements and clear explanations of accounting policies. This expert guidance enhances credibility during pitch meetings while reducing negotiation friction, positioning companies to secure necessary capital more effectively.

As businesses scale, maintaining compliance with tax laws, payroll regulations, and financial reporting standards becomes increasingly complex and critical. Fractional CFOs provide expert guidance on navigating these requirements, ensuring that companies remain compliant even as operations expand across multiple jurisdictions or employee bases. They help businesses understand varying payroll regulations in different states or countries, implement proper tax planning strategies, and maintain accurate records that withstand regulatory scrutiny. Risk management represents another crucial function, with fractional CFOs conducting thorough financial risk assessments and implementing mitigation strategies that protect company assets and prepare businesses for potential financial disruptions. They establish internal control frameworks that prevent fraud, ensure accurate reporting, and create audit trails that satisfy regulatory requirements. This proactive approach to compliance and risk management prevents costly penalties, legal issues, and reputational damage that can hinder growth and investor confidence.

For companies planning exits through IPOs, acquisitions, or private equity investments, fractional CFOs provide critical expertise in optimizing business valuation and ensuring smooth transitions. They conduct thorough financial audits and clean up accounting records to present transparent and accurate financials that appeal to potential buyers or public investors. Fractional CFOs identify key value drivers unique to the business model and highlight these in financial narratives that resonate with investors. They implement cost controls and operational efficiencies that improve profitability and appeal to acquirers, while developing realistic, data-backed financial projections that demonstrate growth potential underpinned by historical performance. Strategic timing of exits based on market conditions, competitor activity, and economic indicators can significantly impact valuation, and fractional CFOs provide the data analysis necessary to identify optimal windows for launching IPOs or beginning acquisition discussions. They also build scalable financial functions aligned with regulatory requirements such as SEC standards for public companies, establishing robust internal controls and standardized reporting processes that appeal to institutional investors. Throughout the exit process, fractional CFOs coordinate preparation of comprehensive documentation required for due diligence, including detailed financial statements, management discussion and analysis (MD&A), and investor presentations that clearly articulate the company’s strategic vision, risks, and opportunities.

Sustainable business growth depends on establishing scalable financial processes that adapt to increasing operational demands without requiring complete system overhauls. Fractional CFOs design modular accounting infrastructure that allows incremental additions such as new cost centers, revenue streams, or reporting requirements. They leverage technology solutions that connect accounting, payroll, budgeting, and reporting tools to reduce manual workload and improve data accuracy. Standardized procedures for financial closing, forecasting updates, and compliance checks ensure consistency even as business complexity grows. Continuous monitoring of critical performance indicators remains essential, with fractional CFOs emphasizing tracking of cash flow, burn rate, and gross margin trends that provide real-time insights into financial health. These metrics inform timely strategy adjustments, such as cost containment actions or funding pursuits when burn rates accelerate. Fractional CFOs balance aggressive growth ambitions with prudent resource allocation by prioritizing high-impact investments aligned with long-term objectives, advising on risk management related to scaling operations, and ensuring capital deployment maximizes returns while preserving runway.

Fractional CFO services are typically structured around flexible engagement models that accommodate different business needs and budgets. Part-time arrangements involve a set number of hours per week or month, allowing businesses to access consistent financial leadership without full-time commitment. Project-based engagements focus on specific initiatives such as fundraising preparation, financial system implementation, or M&A support, with costs tied to project completion rather than ongoing hours. Interim CFO arrangements provide temporary financial leadership during transitions, such as when a full-time CFO departs or during periods of significant organizational change. Retainer-based models provide ongoing access to fractional CFO expertise at a fixed monthly cost, offering predictability for budgeting purposes. Current market rates for fractional CFO services typically range from $150 to $500 per hour, depending on the CFO’s experience level, industry expertise, and geographic location. Monthly retainers for fractional CFO services generally range from $3,000 to $15,000 or more, depending on the scope of services and time commitment. These costs represent a significant savings compared to full-time CFO salaries, which typically range from $150,000 to $300,000 annually plus benefits and overhead.

Startups represent ideal candidates for fractional CFO services, as they often lack in-house financial expertise while facing intense pressure to manage cash carefully and prepare for fundraising rounds. Early-stage companies benefit from fractional CFOs who help establish financial foundations, implement proper accounting systems, and develop financial projections that attract investors. Mid-sized businesses seeking financial optimization can leverage fractional CFOs to streamline operations, improve profitability, and implement data-driven financial strategies that support continued growth. Companies planning market expansion or acquisitions benefit from fractional CFO expertise in evaluating expansion opportunities, assessing financial viability, and managing risks associated with entering new markets or acquiring competitors. Businesses preparing for fundraising rounds or IPOs require expert financial guidance, valuation analysis, and due diligence preparation that fractional CFOs excel at providing. Family-owned businesses transitioning to professional management structures often engage fractional CFOs to implement governance practices and financial controls that appeal to external stakeholders. Technology companies experiencing rapid growth frequently utilize fractional CFOs to manage complex financial operations, navigate multi-jurisdictional tax requirements, and prepare for potential exit events.

PostAffiliatePro's advanced financial management tools help businesses track revenue, manage commissions, and make data-driven financial decisions. Just like a Fractional CFO provides strategic oversight, PostAffiliatePro gives you complete visibility into your affiliate program's financial performance.

Discover why businesses hire fractional CFOs for cost-effective financial expertise, flexibility, and strategic guidance. Learn the key benefits and how to choo...

Discover the key responsibilities of a Fractional CFO including strategic planning, financial forecasting, cash flow management, budgeting, and more. Learn how ...

Learn the essential criteria for hiring a Fractional CFO including experience, industry expertise, cultural fit, communication skills, availability, and referen...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.