Benefits of Positive Pay: Fraud Prevention & Financial Control

Discover the key benefits of Positive Pay including fraud prevention, financial control, reduced losses, simplified reconciliation, and enhanced stakeholder con...

Learn how Positive Pay works to prevent check fraud. Discover the step-by-step process, benefits, types of Positive Pay, and how it protects your business finances.

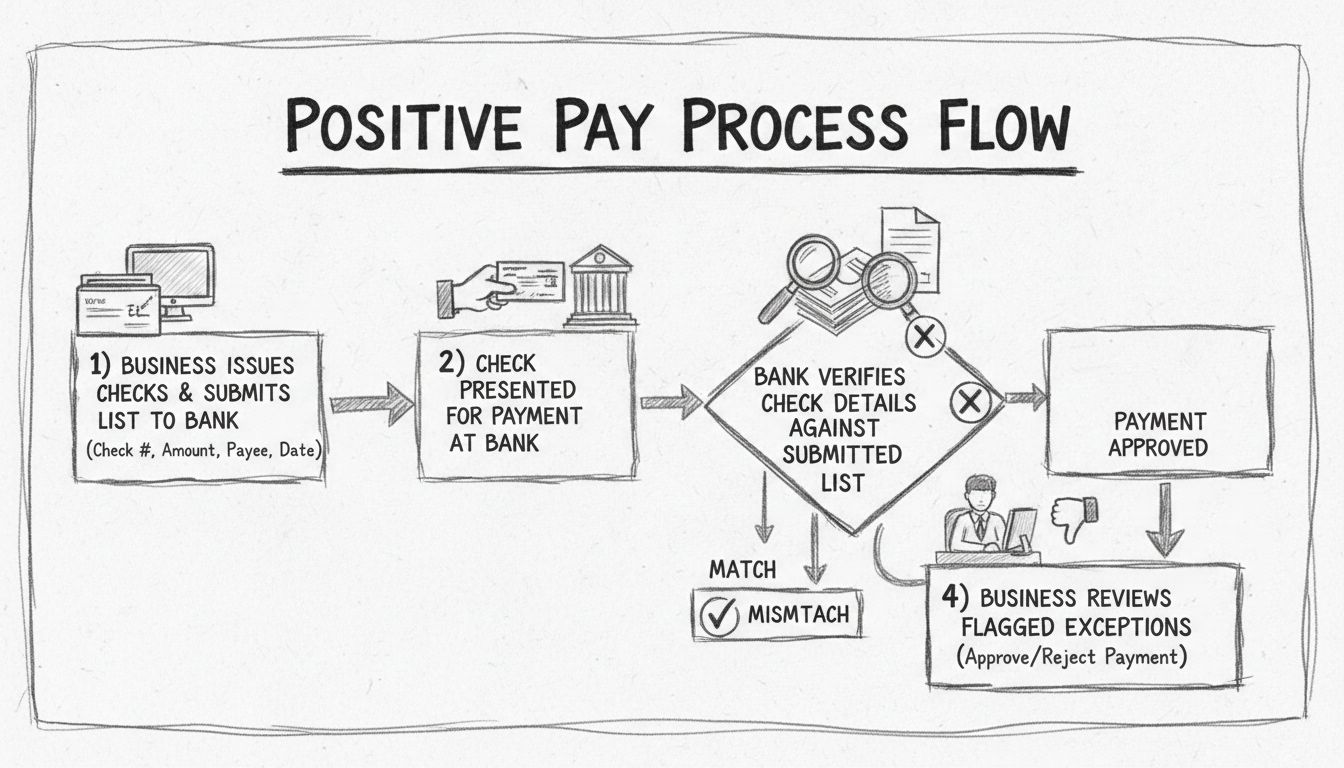

Positive Pay works by requiring businesses to submit a list of issued checks to their bank. When a check is presented for payment, the bank verifies its details against this list and flags any discrepancies for review.

Positive Pay is a bank-offered fraud prevention service that has become increasingly essential in today’s financial landscape. According to recent data from 2024, check fraud remains the most common type of payment fraud, with 65% of organizations reporting check fraud activity. This alarming statistic underscores why implementing robust fraud prevention measures like Positive Pay is critical for businesses of all sizes. The system operates as an automated gatekeeper, ensuring that only legitimate, authorized checks clear your business accounts while flagging any suspicious or altered transactions for immediate review.

The fundamental principle behind Positive Pay is straightforward yet powerful: verification before payment. Rather than discovering fraudulent checks after they’ve been processed and funds have been lost, Positive Pay catches discrepancies in real-time, giving your business the opportunity to intervene before any damage occurs. This proactive approach has made it an indispensable tool for organizations looking to strengthen their financial security and maintain tighter control over their cash outflows.

The Positive Pay process unfolds through a carefully orchestrated sequence of steps designed to maximize fraud detection while maintaining operational efficiency. Understanding each phase is crucial for businesses implementing this system effectively. The process begins when your organization issues checks and generates a comprehensive list containing critical details for each check. This list must include the check number, the issue date, the payment amount, and the payee name—essentially creating a digital fingerprint of every authorized check your business has issued.

Once your business has compiled this detailed list of issued checks, the next critical step involves submitting this information to your bank. Most modern banking platforms facilitate this submission through secure online portals, allowing businesses to upload check data via CSV files or through direct API connections. This submission establishes the baseline against which all future check presentations will be measured. The bank’s system stores this information in a secure database, ready to perform real-time verification when checks are presented for payment.

When a check is subsequently presented for payment—whether it’s deposited at a bank branch, processed through mobile deposit, or cleared through the automated clearing house—the bank’s Positive Pay system immediately springs into action. The system automatically cross-references the presented check’s details against the list your business submitted. This verification happens in milliseconds, comparing the check number, amount, payee name, and date to ensure perfect alignment with your authorized records.

The verification process yields two possible outcomes, each triggering a different response. When a check’s details match perfectly with your submitted list—the check number corresponds, the amount is identical, the payee name is correct, and the date aligns—the bank processes the check normally without any delay or intervention. This streamlined processing ensures that legitimate business payments flow smoothly without unnecessary friction.

However, when discrepancies are detected, the system immediately flags the check as an exception. These discrepancies might include an altered check amount, a mismatched payee name, an unrecognized check number, or a date that falls outside the expected range. When such a mismatch occurs, the bank notifies your business through your online banking portal, providing detailed information about the specific discrepancy. Your finance team then has the opportunity to review the flagged transaction and make an informed decision about whether to approve or reject the payment.

This review and decision-making phase is where Positive Pay demonstrates its true value. Your business maintains ultimate control over which checks are processed, allowing you to catch fraudulent attempts before they result in financial loss. If you determine that a flagged check is legitimate—perhaps due to a data entry error or an unusual but authorized transaction—you can approve it for payment. Conversely, if you identify the check as fraudulent or unauthorized, you can instruct the bank to reject it entirely, preventing the loss of funds.

| Type | Coverage | Verification Details | Best For |

|---|---|---|---|

| Standard Positive Pay | Check fraud prevention | Check number, amount, routing/account numbers, date | Businesses seeking basic fraud protection |

| Payee Positive Pay | Enhanced check fraud prevention | Check number, amount, payee name, routing/account numbers, date | Organizations requiring maximum protection |

| Reverse Positive Pay | Business-controlled verification | All presented checks reviewed by business | Companies wanting direct control and oversight |

| ACH Positive Pay | Electronic payment fraud prevention | Authorized vendors, payment amounts, transaction details | Businesses using electronic fund transfers |

Financial institutions offer multiple variations of Positive Pay, each designed to meet different business needs and risk tolerance levels. Standard Positive Pay provides foundational protection by verifying check numbers, amounts, routing numbers, account numbers, and dates. This version effectively catches many common fraud attempts, including altered amounts and duplicate check submissions. However, it has one notable limitation: it doesn’t verify the payee name, which means a fraudster could potentially alter the payee information while keeping other details intact.

Payee Positive Pay represents the highest level of check fraud protection available. This enhanced version verifies all the elements of Standard Positive Pay plus the payee name, creating a comprehensive verification system that catches virtually all types of check fraud. By confirming that the payee name matches your authorized records, Payee Positive Pay prevents fraudsters from redirecting funds to unauthorized recipients. Financial institutions and fraud prevention experts typically recommend Payee Positive Pay for organizations handling high-value transactions or operating in industries with elevated fraud risk.

Reverse Positive Pay inverts the traditional model by placing more responsibility on the business rather than the bank. Instead of the bank automatically flagging suspicious checks, the bank sends your business a daily list of all checks presented for payment. Your finance team then manually reviews this list and instructs the bank which checks to pay and which to reject. While this approach offers greater direct control, it requires consistent daily monitoring and quick decision-making to prevent fraudulent checks from clearing.

ACH Positive Pay extends fraud prevention beyond paper checks to electronic payments. Organizations using this service can establish a list of authorized vendors and approved payment amounts. When an ACH transaction is initiated, the system verifies that the transaction matches an authorized vendor and approved amount. If an unauthorized ACH transfer is attempted, the system flags it for review, providing protection against electronic payment fraud.

Positive Pay delivers substantial benefits that extend far beyond simple fraud prevention. The most obvious advantage is the dramatic reduction in check fraud risk. By matching every check against your authorized list before payment, Positive Pay catches fraudulent or altered checks before they clear, preventing financial losses that could otherwise devastate your business. This protection is particularly valuable for organizations that issue large-value checks or operate in industries vulnerable to financial fraud.

Beyond fraud prevention, Positive Pay enhances your overall financial control and visibility. By reviewing and approving flagged checks, your business maintains tighter oversight of cash outflows and can identify unusual payment patterns that might indicate internal fraud or unauthorized activity. This enhanced control translates into improved cash flow management and stronger internal controls that satisfy audit requirements and regulatory compliance obligations.

Positive Pay also significantly reduces the administrative burden associated with fraud investigation and recovery. When fraudulent checks are caught before clearing, your business avoids the time-consuming process of investigating the fraud, filing claims with the bank, and attempting to recover lost funds. This prevention-focused approach is far more efficient than the reactive approach of dealing with fraud after it occurs. Additionally, the system simplifies bank reconciliation by ensuring that only authorized checks are processed, making it easier to match your accounting records with bank statements.

The implementation of Positive Pay also strengthens relationships with stakeholders. Customers, suppliers, and financial partners gain confidence knowing that your organization takes fraud prevention seriously and has implemented industry-standard security measures. This commitment to financial security can enhance your business reputation and differentiate you in competitive markets.

While Positive Pay is a powerful fraud prevention tool, it’s important to understand its limitations and potential challenges. The system’s effectiveness depends entirely on the accuracy of the data your business submits. If your check issuance records contain errors—incorrect check numbers, wrong amounts, or misspelled payee names—legitimate checks may be flagged as exceptions, causing unnecessary delays and operational friction. This data quality requirement means your business must maintain meticulous records and implement careful quality control processes.

The operational burden of managing exceptions represents another significant consideration. When checks are flagged, your finance team must review each exception and make a decision about approval or rejection. In high-volume check environments, this can create substantial administrative work. Additionally, if your business fails to monitor exception reports promptly or misses the deadline for responding to flagged checks, the bank may automatically process or return the checks, potentially disrupting your payment operations.

Positive Pay also doesn’t protect against all types of fraud. Internal fraud—where employees or authorized users commit fraudulent acts—may not be caught by Positive Pay if the fraudster has access to your check issuance records. Similarly, fraud that occurs before a check is issued, such as unauthorized check stock theft or forged authorization, falls outside Positive Pay’s protective scope. Organizations need a multi-layered fraud prevention strategy that combines Positive Pay with strong internal controls, secure check stock, and employee training.

Finally, most banks charge fees for Positive Pay services, which can range from modest monthly charges to per-exception fees. These costs must be factored into your business’s operating budget and weighed against the potential losses from check fraud. For most organizations, the cost of Positive Pay is far less than the potential financial impact of a single significant fraud incident.

The choice between Positive Pay and Reverse Positive Pay depends on your business’s specific needs, resources, and risk tolerance. Traditional Positive Pay places the primary fraud detection responsibility on the bank. Your business submits a list of authorized checks, and the bank automatically compares each presented check against this list, flagging discrepancies for your review. This approach requires upfront effort to compile and submit check data but minimal day-to-day involvement once the system is operational. It’s ideal for businesses seeking a more passive, set-it-and-forget-it fraud prevention solution.

Reverse Positive Pay, by contrast, places the fraud detection responsibility directly on your business. Each day, the bank sends you a list of all checks presented for payment, and your finance team must review this list and explicitly approve or reject each check. This approach offers maximum control and visibility but demands significant daily involvement and quick decision-making. If your business doesn’t respond within a specified timeframe, the bank may automatically process the checks, potentially allowing fraudulent transactions to clear.

The key difference lies in the balance between control and convenience. Positive Pay offers convenience with the bank handling most of the verification work, while Reverse Positive Pay offers control at the cost of increased administrative responsibility. Most businesses find that traditional Positive Pay better suits their operational needs, though some organizations with high fraud risk or specific compliance requirements prefer the additional control that Reverse Positive Pay provides.

Successfully implementing Positive Pay requires careful planning and ongoing management. First, contact your bank to confirm that Positive Pay is available and understand the specific features, fees, and integration options they offer. Most major banks provide this service, and many offer seamless integration with popular accounting software platforms like QuickBooks and Treasury Management Systems.

Next, integrate Positive Pay with your check issuance and accounting systems to automate the process of generating and submitting check data. Manual data entry is error-prone and time-consuming, so automation is essential for maintaining data accuracy and operational efficiency. Many accounting platforms can automatically generate Positive Pay files from your check register, eliminating manual work and reducing the risk of data entry errors.

Train your finance team thoroughly on how to use Positive Pay effectively. Employees should understand the process for submitting check files, reviewing exception reports, and responding to flagged transactions. Establish clear procedures and timelines for exception review to ensure that flagged checks are addressed promptly and that your business doesn’t miss critical deadlines.

Finally, monitor your accounts actively and review exception reports regularly. Set up alerts for high-value checks or unusual payment patterns, and investigate any exceptions thoroughly before approving payment. This ongoing vigilance ensures that your Positive Pay system operates at peak effectiveness and catches potential fraud before it impacts your business.

As check fraud continues to evolve and fraudsters develop more sophisticated techniques, Positive Pay remains a critical component of comprehensive fraud prevention strategies. Modern enhancements to traditional Positive Pay include integration with advanced image analysis technology, dark web monitoring, and artificial intelligence-powered anomaly detection. These innovations allow financial institutions to identify fraud patterns that might escape traditional verification methods.

Looking ahead to 2025 and beyond, the trend is toward more integrated, automated fraud prevention solutions that combine Positive Pay with other security measures. Banks are increasingly offering bundled services that include check verification, ACH monitoring, wire transfer controls, and real-time fraud alerts. Businesses that adopt these comprehensive approaches gain superior protection against the evolving fraud landscape while maintaining operational efficiency.

The integration of Positive Pay with digital payment systems also represents an important trend. As businesses increasingly move toward electronic payments, fraud prevention systems are evolving to protect both paper checks and digital transactions. This convergence ensures that organizations can maintain consistent fraud prevention standards across all payment methods, whether checks, ACH transfers, wire transfers, or emerging digital payment technologies.

PostAffiliatePro offers advanced fraud detection and payment verification solutions to safeguard your business transactions. Implement comprehensive fraud prevention strategies with our industry-leading platform.

Discover the key benefits of Positive Pay including fraud prevention, financial control, reduced losses, simplified reconciliation, and enhanced stakeholder con...

Learn what Positive Pay is and how this automated cash management service prevents check fraud. Discover how it works, benefits, costs, and best practices for b...

Comprehensive guide to the four types of Positive Pay systems: Standard, Payee, Reverse, and ACH Positive Pay. Learn how each protects against check and electro...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.