How Does Positive Pay Work? Complete Guide to Check Fraud Prevention

Learn how Positive Pay works to prevent check fraud. Discover the step-by-step process, benefits, types of Positive Pay, and how it protects your business finan...

Discover the key benefits of Positive Pay including fraud prevention, financial control, reduced losses, simplified reconciliation, and enhanced stakeholder confidence for your business.

Positive Pay offers significant fraud prevention by detecting unauthorized checks before they clear, increased financial control over disbursements, reduced losses from fraudulent activities, simplified reconciliation processes, and greater stakeholder confidence in your financial security.

Positive Pay is a fraud prevention service that has become increasingly essential for businesses managing financial transactions in 2025. Organizations lose approximately 5% of their annual revenue to fraud, with check fraud representing one of the most persistent threats despite the shift toward digital payments. This service works by creating a verification layer between your business and the banking system, ensuring that only authorized checks and ACH transactions are processed. The implementation of Positive Pay demonstrates a commitment to financial security that resonates with stakeholders, investors, and business partners alike.

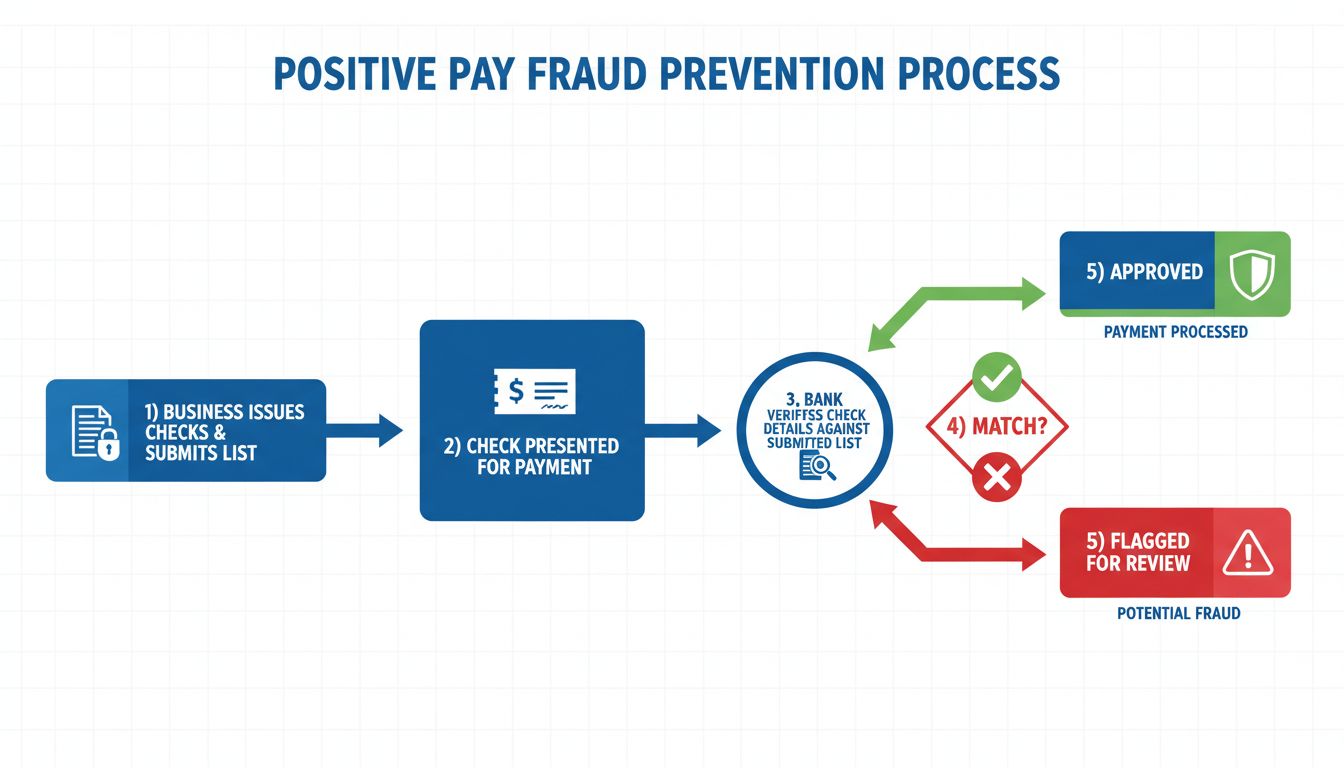

The fundamental mechanism of Positive Pay involves submitting a detailed list of authorized checks to your bank, which then verifies each check presented for payment against this pre-approved list. When discrepancies are detected—such as altered amounts, forged signatures, or unauthorized payees—the bank flags these transactions and alerts your organization before any funds are transferred. This proactive approach transforms fraud prevention from a reactive damage-control exercise into a strategic financial management tool that protects your organization’s assets and reputation.

The primary benefit of Positive Pay is its exceptional ability to prevent fraudulent check activity before it impacts your bottom line. Check fraud has evolved significantly, with criminals employing sophisticated techniques including check washing (using chemicals to remove ink and rewrite checks), counterfeiting, and payee alteration. According to the Financial Crimes Enforcement Network, there has been a 40% increase in check-related suspicious activity reports filed over the last three years, demonstrating that despite digital payment adoption, check fraud remains a critical threat.

Positive Pay addresses these threats through multiple verification layers. When you implement Positive Pay, your bank verifies not just the check number and amount, but increasingly, the payee name as well through Payee Positive Pay services. This multi-factor verification approach catches fraudulent checks that might otherwise slip through traditional banking safeguards. The system operates continuously, monitoring every check presented against your account 24/7, providing consistent protection regardless of business hours or transaction volume. Organizations that have experienced check fraud losses averaging $44,774 per incident find that Positive Pay’s preventive capabilities deliver substantial return on investment through avoided losses alone.

Positive Pay fundamentally shifts the balance of control in your favor by requiring explicit approval before flagged transactions are processed. Rather than discovering fraudulent activity after funds have been transferred—a situation that often requires lengthy recovery processes and creates accounting complications—Positive Pay places you in the decision-making position. Your finance team reviews flagged transactions and determines whether to approve or reject them, maintaining complete oversight of your cash outflows.

This enhanced control extends beyond simple fraud prevention. By maintaining a detailed record of all issued checks submitted to your bank, you create a comprehensive audit trail that strengthens your internal controls and demonstrates financial governance to auditors and stakeholders. The system allows you to set specific parameters for your organization, such as transaction limits, approved vendors, and payment windows. This granular control is particularly valuable for organizations with multiple departments or locations, as it ensures that all disbursements align with corporate financial policies and authorization hierarchies. The ability to monitor and control which checks are processed in real-time provides peace of mind that your financial operations are secure and compliant with your internal procedures.

The financial impact of check fraud extends far beyond the immediate loss of funds. When fraudulent checks are processed, organizations face cascading costs including investigation expenses, recovery attempts, potential legal fees, and the administrative burden of correcting accounting records. The average cost of addressing a single check fraud incident can exceed $50,000 when accounting for all direct and indirect expenses. Positive Pay eliminates most of these costs by preventing fraudulent checks from clearing in the first place.

| Fraud Prevention Metric | Impact | Annual Savings Potential |

|---|---|---|

| Average check fraud loss per incident | $44,774 | Prevented entirely |

| Investigation and recovery costs | $5,000-$15,000 per incident | Eliminated |

| Administrative time (40+ hours) | $2,000-$5,000 per incident | Redirected to productive work |

| Potential legal and compliance costs | $3,000-$10,000 per incident | Avoided |

| Reputational damage and stakeholder confidence | Immeasurable | Protected |

Organizations processing high volumes of checks or handling large transaction amounts experience exponential benefits from Positive Pay implementation. A mid-sized company issuing 500 checks monthly could prevent losses totaling hundreds of thousands of dollars annually by catching just a handful of fraudulent attempts. The service essentially provides insurance against check fraud at a fraction of the cost of recovering from a single major incident. Furthermore, by preventing fraud, your organization avoids the disruption to normal business operations that fraud investigations create, allowing your team to focus on strategic initiatives rather than crisis management.

Bank reconciliation is a critical but time-consuming accounting function that becomes exponentially more complex when fraudulent or unauthorized transactions appear on your statements. Positive Pay dramatically simplifies this process by ensuring that only authorized transactions clear your account. Since every check that posts has been pre-approved by your organization, your accounting records naturally align with your bank statements, reducing reconciliation time from hours to minutes.

The reconciliation benefits extend beyond simple time savings. With Positive Pay, your accounts payable team can confidently match issued checks to cleared transactions without investigating discrepancies or researching unauthorized items. This alignment creates a clean audit trail that auditors appreciate and that strengthens your organization’s financial reporting credibility. The system generates exception reports that clearly identify any flagged transactions, allowing your team to quickly investigate and resolve legitimate issues while maintaining confidence that your financial records are accurate and complete. Organizations implementing Positive Pay report reducing their monthly reconciliation time by 30-50%, freeing accounting staff to focus on financial analysis and strategic planning rather than transaction verification.

In 2025, stakeholder confidence in financial security has become a competitive advantage. Investors, board members, vendors, and business partners increasingly evaluate organizations based on their financial controls and fraud prevention measures. By implementing Positive Pay, your organization demonstrates a sophisticated, proactive approach to financial security that signals professional management and risk awareness. This commitment to security enhances your organization’s reputation and can influence business relationships, credit terms, and partnership opportunities.

Stakeholders recognize that organizations with robust fraud prevention systems are better positioned to maintain financial stability and protect shareholder value. This confidence translates into tangible benefits: vendors may offer better payment terms, financial institutions may provide more favorable lending rates, and investors may view the organization as lower-risk. For publicly traded companies, demonstrating strong internal controls through Positive Pay implementation can positively influence analyst ratings and investor perception. Non-profit organizations and government entities benefit similarly, as Positive Pay demonstrates responsible stewardship of funds and compliance with fiduciary obligations.

Beyond the primary benefits, Positive Pay delivers several secondary advantages that enhance overall financial operations. The service provides real-time alerts when suspicious activity is detected, enabling your organization to respond immediately rather than discovering problems during routine reconciliation. This early warning system allows you to contact affected parties, investigate potential security breaches, and implement corrective measures before significant damage occurs. Additionally, Positive Pay creates comprehensive documentation of your fraud prevention efforts, which is invaluable during audits, regulatory examinations, and compliance reviews.

The system also supports better cash flow management by providing visibility into which checks have been presented for payment and which remain outstanding. This information helps your finance team forecast cash needs more accurately and optimize working capital management. Organizations can also use Positive Pay data to identify patterns in check usage, optimize payment methods, and transition to more efficient electronic payment systems where appropriate. The detailed transaction records generated by Positive Pay serve as valuable business intelligence that supports strategic financial decision-making.

While Positive Pay offers substantial benefits, successful implementation requires careful planning and ongoing management. Your organization must establish processes for submitting check data to your bank, typically daily or on scheduled payment days, ensuring that all issued checks are included in the verification list. Training your finance and accounting teams on Positive Pay procedures is essential, as is establishing clear protocols for reviewing and approving flagged transactions. Most banks provide daily exception reports that your team must review and act upon within specified timeframes, typically 24 hours.

Organizations should also consider implementing Positive Pay in conjunction with complementary fraud prevention measures. ACH Positive Pay extends similar protections to electronic payments, while multi-factor authentication, segregation of duties, and regular account monitoring provide additional layers of security. The most effective fraud prevention strategies combine Positive Pay with strong internal controls, employee training, and a culture of financial accountability. By treating Positive Pay as part of a comprehensive fraud prevention program rather than a standalone solution, organizations maximize its effectiveness and create a robust defense against financial threats.

The benefits of Positive Pay extend far beyond simple fraud prevention. By implementing this service, your organization gains increased financial control, reduces exposure to significant losses, simplifies accounting processes, and demonstrates commitment to financial security that enhances stakeholder confidence. In an environment where check fraud continues to evolve and financial security is increasingly important to business success, Positive Pay represents a strategic investment in your organization’s financial health and reputation. The combination of fraud prevention, operational efficiency, and stakeholder confidence makes Positive Pay an essential component of modern financial management for organizations of all sizes.

Just as Positive Pay protects your financial transactions, PostAffiliatePro safeguards your affiliate program with advanced fraud detection and payment verification systems. Ensure every transaction is legitimate and secure.

Learn how Positive Pay works to prevent check fraud. Discover the step-by-step process, benefits, types of Positive Pay, and how it protects your business finan...

Learn what Positive Pay is and how this automated cash management service prevents check fraud. Discover how it works, benefits, costs, and best practices for b...

Discover how Positive Pay protects businesses from check fraud with an automated verification process. Learn about its mechanisms, variations, and benefits for ...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.